Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes..

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and poor.

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

============================================================================================================================================================================================================================================================

The stated purpose of Medicare and Social Security: To protect seniors from the financial issues associated sickness and retirement.

The real purpose of Medicare and Social Security: To provide the absolute minimum of protection, that will retain voter approvals while continuing to widen the Gap between the rich and the rest.

The method: Keep the populace ignorant of Monetary Sovereignty, by pretending Medicare and Social Security can run short of dollars.

A triple whammy will hit senior citizens in the pocketbook next year, unless Congress can reach a compromise to avoid it.

• They won’t get a yearly raise in Social Security benefits.

• They face a hike in the deductible for Medicare coverage — a cost that comes out of a patient’s pocket.

• Many Medicare recipients will pay far more in monthly premiums.

The costly combination was set off by a near-zero inflation rate over the past year, primarily because of low gas prices.

By law, that means Social Security recipients won’t get a cost-of-living adjustment next year for only the third time in four decades. All three instances have been since 2010.

Prices increased a scant 0.2 percent nationwide.

Individuals who earn less than $85,000 a year and couples who earn less than $170,000 will be spared from an increase in Medicare premiums.

But new enrollees and those who make more than that will be hit with a 52 percent hike in monthly premiums, topping out for the highest earners at $509.80 a month.

On top of that, all patients enrolled in Medicare Part B, which covers doctor fees and other non-hospital care, face a $76 increase in the deductible paid by consumers, jumping from $147 to $223.

All of the above is based on one bit of ignorance: The false belief that the federal government needs and uses federal taxes to pay its bills.

Being Monetarily Sovereign the federal government creates dollars by paying bills. It doesn’t need or use FICA dollars to support Medicare or Social Security benefits. Even if the government stopped collecting FICA, it could continue to fund Medicare and Social Security, forever.

The federal government never can run short of U.S. dollars.

When you are told that Medicare or Social Security benefits must be reduced, you are being lied to. When you are told FICA taxes must be increased, you are being lied to.

The politicians rely on your ignorance of federal financing to squeeze your finances.

Why do they lie? They are paid by the rich, via campaign contributions and promises of lucrative employment later, to widen the Gap between the rich and you.

The wider the Gap, the more power over you the rich have. The Gap, not absolute dollars, is what motivates the rich. The Gap is what makes them rich, and the wider the Gap, the richer they are.

The impending pinch has sparked a backlash. Many senior citizens blame the way the government figures inflation, saying it does not account for rising costs for food, medicine and other essentials.

“As far as seniors are concerned, a lot of us don’t use cars anymore, but everybody has to eat,” said Sam Oser, 89, of West Palm Beach. “At the store, prices seem to go up every week. Seniors have not gotten a break, and I personally think that in many instances a lot of people in Congress don’t give a damn.”

Those (Medicare patients) at higher income levels will pay more on a sliding scale, up to $509.80.

Complaints are pouring into Congress, especially at the office of U.S. Rep. Ted Deutch, a Democrat whose district straddling Palm Beach and Broward counties has one of the nation’s largest clusters of senior citizens.

“We’ve gotten many calls from people who are disappointed and frustrated and don’t understand why this keeps happening,” Deutch said.

Exactly right. They don’t understand because the politicians, the media and the economists (all of whom receive support from the rich) pretend federal finances are like personal finances. They pretend that, like you and me, the federal government can run short of dollars.

It cannot. Ever. Even if every federal tax disappeared tomorrow, the government could continue to spend.

The triple whammy is an unintended consequence of long-standing laws, plus ever-rising health care costs, that neither President Barack Obama nor most members of Congress wanted.

“Unintended??” This Sun-Sentinel writer wants you to believe that the President and Congress are helpless — that they are unable to pass laws funding Medicare and Social Security — that the government has run out of its own sovereign currency, the dollar.

It is a lie. Congress and the President know exactly what they are doing. It’s what they have been paid to do.

Social Security’s yearly raises since 1975 have been determined by inflation as measured by the consumer price index over 12 months. This year, a plunge in fuel prices has brought the inflation rate to zero.

The measurement of inflation repeatedly has changed over the years, always to reduce the published measure. Even now, the Republicans wish to reduce the measure of inflation (though not inflation itself), by using “chained CPI.”

You’ll still pay the same prices, but because the official measure of inflation would go down, your benefits would be decreased, again.

Because of the usual rise in health-care costs, Medicare premiums and deductibles were bound to increase next year. But the law contains a “hold harmless” provision that protects roughly 70 percent of enrollees from a Medicare premium increase if they are not getting a Social Security raise.

That leaves new enrollees and the higher-earning 30 percent to bear the whole burden of next year’s premium hike. This group also includes some Medicaid patients, whose premiums are paid by the state-run program.

All this action is to give the illusion that “we are working hard to protect you.” It’s all a fake. There is no financial reason why benefits could not be increased and taxes decreased.

Democrats in Congress have introduced legislation to freeze Medicare premiums and deductibles.

If Democrats really wanted to help, they would eliminate deductibles and premiums, while increasing benefits.

Many senior citizens agree. “How can they say there is no inflation? I don’t know what planet they are on, but it’s got nothing to do with what we pay,” said Mae Duke, 88, of West Palm Beach.

“I hate to tell how my drug costs have tripled. I was just managing. There are those in worse shape than me. It’s going to impact us, no question.”

Republicans, preoccupied with a leadership shakeup in the House, have been mostly silent on the Medicare rate increase.

“Preoccupied” makes it sound as though Republicans will take action, as soon as the election is over. Yes, they will take action — to increase taxes and to reduce benefits further.

Many want to contain the rising costs of “entitlement programs” for fear they will eat up the budget and become unsustainable. Some, including Senate Majority Leader Mitch McConnell, have floated proposals to change the way inflation is figured, not to increase future COLAs but to trim them as part of a larger budget deal to reduce deficits.

And there it is, the BIG LIE, all in one short paragraph:

It is the lie that federal spending can become “unsustainable,” together with the lie that federal deficits should be reduced.

The Big Truth: It is financially impossible for any federal spending to become “unsustainable,” and federal deficits are necessary to grow the economy and to narrow the Gap between the rich and the rest.

The cost of ignorance is about to go up, again.

Open your minds, folks, or open your wallets. Your choice.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually Click here

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

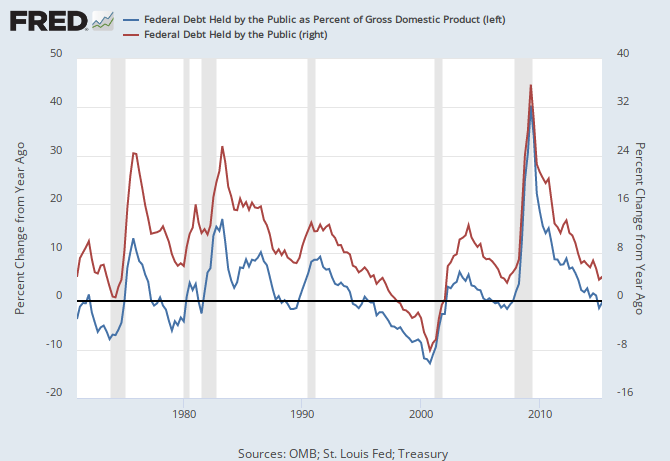

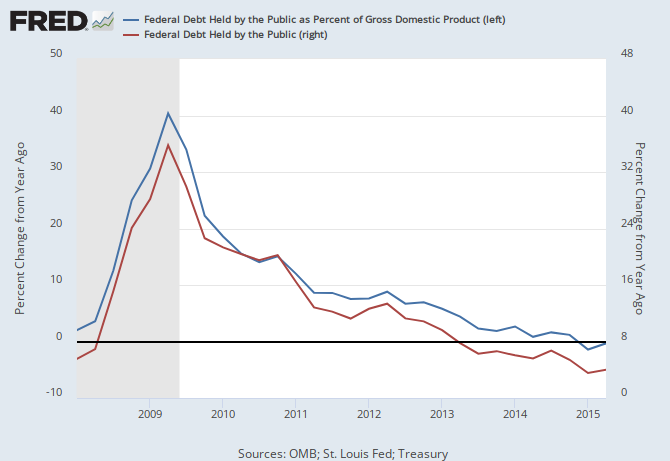

THE RECESSION CLOCK

Recessions come after the blue line drops below zero.

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

The rich win again:

Note to the voting public: Austerity = deficit reduction = recession.

LikeLike

I’m finding, much to my chagrin, that people don’t want to hear it, they won’t bother to believe it, and they don’t want it to be true – that is – monetary sovereignty. Either they are so immersed in their lifelong training that the government is just like their households, or they are too lazy to even question the possibility of anything different. One guy, for example, keeps telling me that the government doesn’t generate money, it only issues worthless, but inflationary, scrip. How could anyone really believe that crap? Geesh!

LikeLike

Tell your friend to give you all his worthless, inflationary scrip.

I’m surprised your friend also didn’t say, “Inflation, Zimbabwe, Weimar Republic.” That is the usual response by those who know nothing about economics.

LikeLike

I also hear, all the time, stuff like “Well, if it were true, why doesn’t the government already do it?” and of course the old “Why don’t they then just give everyone a million dollars and we’d all be rich!” But the biggest common disconnect is the “taxes don’t fund spending” truism. The common response to that is “If taxes don’t fund spending, then the government wouldn’t take them.” Or the even wierder, “I’m proud to pay my part – everyone should pay his fair share.” Keep up the good fight though, Rodger. There are some of us who get it.

LikeLike

And once again, the ugly “Debt Ceiling” rears its ugly head, supported by the far-out right.

And it’s all because Congress has convinced the populace that federal finances are like personal finances, and that the federal government can run short of its own sovereign currency.

The cost of ignorance goes up, again.

LikeLike

This is the kind of stuff (or fluff or disinformation) we are up against in Eastern North Carolina. People here don’t realize they are supporting their own poverty by championing the economic policies of Congressman Walter Jones. Here is an October 24, 2015 editorial by Rep. Jones in the New Bern Sentinel:

http://www.newbernsj.com/article/20151024/OPINION/151029314/15474/OPINION

LikeLike

He said, “Even though Uncle Sam is collecting record amounts from American taxpayers, our annual federal deficit is still over $400 billion simply because of excessive spending.”

Properly stated: “Draining record amounts out of the economy, the government has managed to pump $400 billion stimulus dollars into the economy, which is why the economy has continued to grow. If the annual deficit were $0, the government would pump $0 into the economy, and we would have a recession, followed by a depression.”

LikeLike

rising cost of ignorance:

http://coloradocareyes.co/about/

The beat goes on…Vermont (laid an egg) , soon Colorado?

LikeLike

I have to ask (again) how far can the gulf (BIG LIE) be extended before the system begins tearing down. The ultra wealthy are equally ignorant if they think their behind the scenes conspiracy will only have select consequences that do not include them. All history and philosophy shows we are interconnected. Now we have the web and a great way to counter the 1% selfishness. We can save ourselves not from ourselves, but from those who look down on us and wish to keep it that way.

People are born generally wanting to succeed and help one another; observe any kindergarten class. It’s the invisible powerful few wishing to engage in remote control while living in quiet superiority among themselves. If everyone is equal they can’t have this feeling of superiority. They’ll fight any philosophy that tries to reduce their lovely gulf and bring joy to the poor.

I feel increasingly difficult world circumstances will force the misinformation out of our heads. We’ll either learn fast and move fast or it’s curtains. In the Old West this was referred to as “the quick and the dead.”

LikeLike