Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and poor.

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

===================================================================================================================================================================================================================================================================================

Among the less knowledgeable, a sign of brilliance is the parroting of such phrases as, “There’s no such thing as a free lunch.”

It represents the clever notion that if something is offered to you free, there must be a catch, and that you will pay for it sooner or later. (Never mind that mommy gave you food, clothing and warmth, and asked nothing in exchange).

The same shrewd people who use that phrase often are the first ones to demand that the federal government stop providing free social benefits to the poor — food, housing, education, medical care, etc.

But if there really were no such thing as a free lunch, what’s the problem? The poor will made to pay for their “freebies” sooner or later.

“But ah,” they say. “The poor won’t pay; I will pay with my taxes.” And therein lies the abject ignorance of how federal taxes and federal spending actually work.

Unlike the state, county and city governments, which are monetarily non-sovereign and can run short of dollars, the federal government is Monetarily Sovereign, and never can run short of its own sovereign currency, the dollar. No taxpayers’ money needed.

Many people who claim to understand economics, repeatedly prove they don’t know the difference between Monetary Sovereignty and monetary non-sovereignty. So they talk about spending federal taxpayers’ money, when in fact, your federal taxes are not spent, not needed and cease to exist once they hit the U.S. Treasury.

The latest to demonstrate his ignorance is Ed Krayewski, an associate editor at Reason.com. Before joining Reason, he was an associate producer at Fox Business, a media producer for Fox News and Fox Business, and an assistant producer at NBC News.

Bernie Sanders, the 18 Trillion Dollar Man

Wants taxpayers to “feel the Bern.”

Ed Krayewski|Sep. 15, 2015 2:16 pmSen. Bernie Sanders is actually up by 10 points over Hillary Clinton in New Hampshire and tied with her in Iowa. (In the RealClearPolitics average of polls.)

What is driving support for Sanders’ campaign? The promise of lots of free shit certainly helps.

The Wall Street Journal has analyzed Sanders’ campaign proposals and estimated that his plans for new federal programs would cost $18 trillion over the next ten years.

The bulk of that $15 trillion would be spent on expanding Medicare to include all Americans in an attempt to impose a “single payer” (the government) healthcare system in the United States.

Ed Krayewski dismisses free healthcare, food, housing and education as “shit.” And anyone who gives “shit” and takes “shit” must be full of “shit,” right Ed?

And giving free Medicare to all Americans isn’t really giving. To Ed, it’s “imposing” this free “shit” on America. How very awful to have such imposition.

Ed’s article then repeats “$15 trillion” again, and yet again, to make sure we really, really heard him the first time and are suitably shocked.

Of course, Ed fails to mention a basic detail: That $15 trillion will not cost federal taxpayers one cent. On the contrary, it will put $15 trillion into taxpayers’ pockets and stimulate the economy. (That is the difference between federal government finances vs. state and local government finances — a difference Ed seems not to have learned.

Rather than you and me and the rest of America spending $15 trillion on health care, the federal government would pump $15 trillion worth of stimulus into the economy.

(There, Ed. I’ve now repeated “$15 trillion” five more times, and knowledgeable readers are saying, “Hey, let’s start passing out that ‘shit,’ today.”)

Sanders’s policy director, Warren Gunnells, called the $15 trillion number for a single-payer system alone a fair estimate.

President Obama and supporters of Obamacare insisted Americans were dying in the streets as if it were Victorian England, because there wasn’t enough government intervention in healthcare or whatever.

Sneered like a big-shot who has a well-paying job and who receives free healthcare insurance (i.e. “shit”) from his employer.

No, Ed, this isn’t as dreadful as Victorian England. Must it get to that point before you take notice of the real medical hardships facing the “99%” — the poor, the middle-classes and the elderly? Or whatever.

When Democrats controlled the White House and both houses of Congress, Obama spent most of the political capital he earned from his landslide victory pushing Obamacare, not immigration reform or police reform or rolling back the war on terror.

In Krayewski-world, health care is “shit.” What’s really important to Ed is deporting Mexicans and his unspecified “reform” of the police.

Sanders’ spending programs are aimed at offering free things—healthcare and public college, primarily—for everyone.

Sanders has dropped the pretense held by some liberals and progressives that government spending should focus on the needier elements in society. Even as he rails against “income inequality,” Sanders is promising to pay for the healthcare and education of all Americans, even its richest.

Here, Ed does a sneaky pseudo-left turn. After railing against free “shit,” he now complains that the “shit” should go to the “needier elements” — you know, those people whom Ed says are not “dying in the streets as if it were Victorian England.”

The fundamental reasons to provide a simple, straightforward Medicare for everyone, rather than just for the poor are:

1. There would be no need for a bureaucracy to try to separate “needy” from “not needy.” What is needy? Low income? How low? Is “needy” the same in Manhattan as it is in Peoria? The same for a one-person family as for a ten-person family?

And exactly what is income? Salary? Does Social Security count? Does free rent count? College scholarships? Other poverty aids?

How would interest, stock dividends, property sales and all the other little gimmicks in our tax code be counted?

And what about wealth? Does a retired guy having minimal income, but a no-mortgage house in the suburbs, count as “needy”?

2. Unless you are in the hundred million dollar wealth class (and there are comparatively few of those), medical expenses can eat you up.

But the federal government can afford anything.

Ed forgot to mention wealth inequality (the even more important inequality than income inequality). But if he really cares about inequality he can opt for the “Ten Steps to Prosperity (listed at the bottom of this page), and not create yet another million-word tax law.

And while he (Sanders) promises higher taxes on the wealthy to pay for all that free stuff, even setting aside the fact that there are serious diminishing returns on higher tax rates, his tax plans “only” cost taxpayers $6.5 trillion over ten years, far short of what’s needed if Sanders wants to deliver on his promise.

The so-called diminishing returns means the rich have ways to avoid some of those taxes. So?

And then we return to the really, really ignorant part: “His tax plans “only” cost taxpayers $6.5 trillion. . . “

Ed, maybe if I shout, you’ll get it: FEDERAL TAXPAYERS DON’T PAY FOR FEDERAL SPENDING.

The federal government’s finances are different from state and local government finances. While state and local taxes DO pay for state and local spending, federal taxes DO NOT pay for federal spending. Can you understand that? Did shouting help?

Sanders’ proposals show a total lack of priorities, and are divorced from progressives’ self-identification as compassionate people who care for the poor.

Sanders isn’t campaigning to help poor people. He may use that rhetoric, warning of income inequality or how economic conditions hurt the working poor.

But his solutions have nothing to do with helping poor people, and everything to do with getting free stuff to everyone.

As we’re seeing in the polls, that’s a far more popular position.

Hmmm . . . so Medicare for everyone and financial support for education doesn’t help poor people?? Yikes!

Or Ed, do you mean poor people are not part of “everyone”?

And whom do you believe the polls are interviewing: Rich people? No, the polls are interviewing the 99%, the people who would be helped by Medicare for everyone.

It’s difficult to know what nonsense Ed really is spouting. That Medicare for All wouldn’t help the 99%?

That free “shit” from the federal government costs taxpayers money rather than adding dollars to the economy, creating jobs and putting money into taxpayers’ pockets?

That expelling immigrants, Trump-style, is more important than funding health care and education for all Americans?

Or is it that Sanders’s plans don’t help the 99% enough, compared with the right-wing’s generous plans for . . . uh . . . punishing poor people?

Ed, until you publicly recognize the differences between Monetary Sovereignty and monetary non-sovereignty, you don’t know “shit” about economics.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

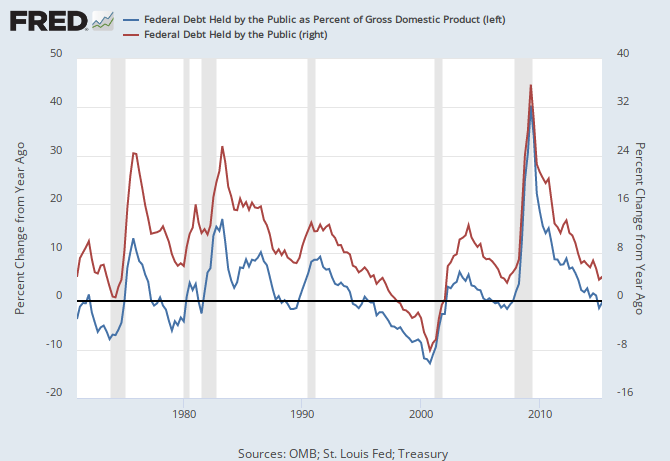

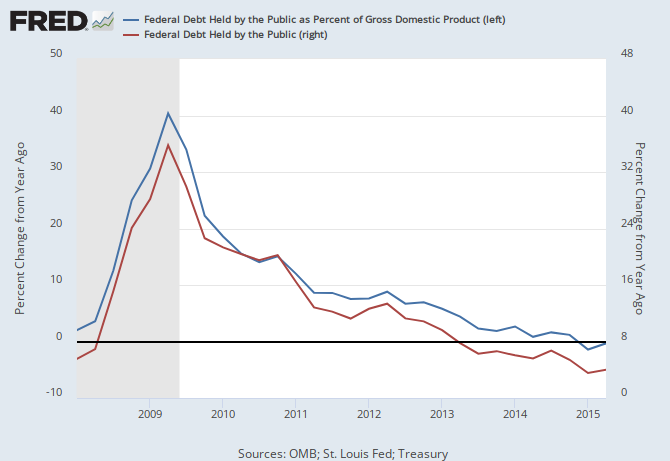

THE RECESSION CLOCK

Recessions come after the blue line drops below zero.

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

Does anybody know if Sanders is aware of and understands MMT? Has he talked with Kelton, Wray, et al. (even you too Rodger)? If so, if Sanders is elected President, America could be at the dawn of a new, exciting and prosperous age with MMT understanding at the highest levels. Also, what about Trump? I think he may be receptive to MMT, if he not already understands MMT. I’ve given up on the rest of the republican and democratic party candidates.

LikeLike

If he knows, he won’t say it. The voters have been trained to believe federal finances are like personal finances. Facts and logic don’t seem to be able to shake that belief.

LikeLike

Get him to mint the coin once in office 😉

LikeLike

If you’re referring to the proposed, $10 trillion platinum coin, I agree.

LikeLike

“A prominent advocate of bigger deficits and unconventional economics will be Sen. Bernie Sanders’ chief economist when he becomes the ranking member of the Senate Budget Committee in January.

Stephanie Kelton, a self-described “deficit owl” and a leading proponent of the alternative economics theory known as modern monetary theory, announced that she would be the chief economist for the minority on the Budget Committee Friday.”

http://www.washingtonexaminer.com/sanders-names-deficit-owl-his-chief-economist/article/2557903

He most definitely has but people would simply freak out at this time.

LikeLike

This is one answer to the Tax issue.

http://www.basicincome.org/news/2015/06/united-states-trust-fund-approach-basic-income-aims-take-edge-off-political-culture-war/

LikeLike

Rich, here is what the plan proposes:

The plan is based on the erroneous belief that federal taxes pay for federal spending.

Not sure what “all transactions” includes. If it’s a form of sales tax or a European-style VAT, it punishes the 99% far more than the upper 1%. It would widen the Gap between the rich and the rest.

If it also includes purchases and sales of stocks and commodity futures, it would wreck those markets.

And if it includes borrowing and debt payments, it would be a financial disaster.

I like the proposal for the federal government to pay a “bonus” to each American (see Step #3 in the Ten Steps to Prosperity — above).

A version of this was used at the beginning of the Great Recession, though it was too little and too late to have enough effect.

But no tax increase is necessary or desirable to accomplish this.

LikeLike

Rodger, I think the “all transactions” are about the financial markets which is similar to what some European countries are already doing.

As far as wrecking the markets, they control about 30 to 40 percent of our GDP.

That’s money taking away from producing products , jobs ,research, education, etc.

I was looking at this proposal as a way to open the door for the conversation to change in a more positive direction.

As side note in January Dr. Stephanie Kelton has join Bernie Sanders as Economic Adviser.

LikeLike

It’s NOT free. Federal spending on those things we cannot afford as individuals but can easily do collectively is NOT free.

It requires the use of one’s brain and to have a pair of gonads.

It requires some rational thought processing by one’s cerebral lobes; not that fight-or-flight primitive amygdala that overrides the cerebral lobes of today’s ‘conservatives’ with fears of “the other” and the latest end-of-world scenario.

It requires maturity. It requires faith in the collective strength of your nation, your fellow countrymen, the future.

It’s not rocket science, but it does require having the fortitude to open oneself to the possible, to rational thought, no matter how scary it is to go against your years if not decades long Indoctrination .

The basic problem – too many self-absorbed cowards unwilling to do the work.

Unfortunately, overcoming that is far from free.

LikeLike

Thanks Penny and Rich.

By coincidence, I dropped Stephanie a note yesterday, reminding her of the above graphs.

I’m glad to see she is with Sanders, though I agree with you, Penny. If he starts talking about MS (or MMT), the populace will believe he’s crazy.

Call it the “Galileo” effect.

LikeLike

I think if he beats Hillary in the early primaries the press may force him to explain his position on MMT. Which i think will be good for the public’s awareness but will sink his campaign.

Although if he can emphasize that this will benefit the rich as it obviously will the poor we may witness a major revolution!

LikeLike

The rich will like it because it will put more money in their pockets.

The rich will hate it because it will narrow the Gap between the rich and the rest.

Ah, what a dilemma for the rich!

LikeLike

Maybe what it takes is one or two eccentric and charasmatic legislators to “preach” monetary sovereignty to the voters and other legislators, much like Ron Paul did with his “End the Fed” and cut spending mantras of the previous two presidential campaigns. Millions of people who never heard of the Fed before then now stand ready to shut it, and the rest of government, down for no other reason than Ron Paul says it’s the financially expedient thing to do. I can assure you that many of my friends (much to my dismay) were swayed to Ron Paul-type thinking and still mouth his words mindless of any evidence to the contrary. At least one friend understands MS fully but is convinced that legislators have nothing to gain and their seats to lose if they admit that the federal government is not monetarily constrained.

I would certainly think that the tenets of MS, especially the non-relationship between federal taxes and federal spending, would resonate with voters if only some brave politicians would step forward and tout them. They certainly resonated with me upon first exposure.

LikeLike

Pretty good article. Misses on a few points, but overall informative:

LikeLike

I’m with you on all the substantive issues, but this is a poor analogy:

“mommy gave you food, clothing and warmth, and asked nothing in exchange”

Maybe you were never sent to your room without supper, but in my house, mommy demanded absolute obedience, told me where to go, when to go there, what to wear, what to eat, how to talk etc., etc. Yeah, there was love, even unconditional love, but there was no free lunch.

LikeLike

It probably is silly to argue about analogies.

But yes, in America, we have to obey the laws, just like you had to obey your mommy’s laws.

Obeying the law has nothing to do with paying for your “lunch” in the way the debt-dopes mean.

LikeLike

Yes, you’re right of course. And re-reading my post it is more rude than I intended. I’m sorry.

LikeLike

Wow Jamie, that’s the best you can do?

How about, but MOMMY worked her butt off to “give” me that?

LikeLike

THIS WEEK IN CRAZY

LikeLike

Here’s the Real Reason Donald Trump Is So Rich

LikeLike