Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

=====================================================================

The formula for Gross Domestic Product, the most common measure of economic growth and shrinkage, is: Gross Domestic Product (GDP) = Federal Spending (FS) + Private Investment and Consumption (PIC) – Net Imports (NI).

So, it makes sense that reductions in Federal Spending growth, and/or in Private Investment and Consumption growth, would affect GDP growth adversely.

Reductions in Federal Deficit Spending growth reduce both FS and PIC growth. Although recessions have many causes, one would expect to see some relationship between reduced deficit growth and recessions. And so it is.

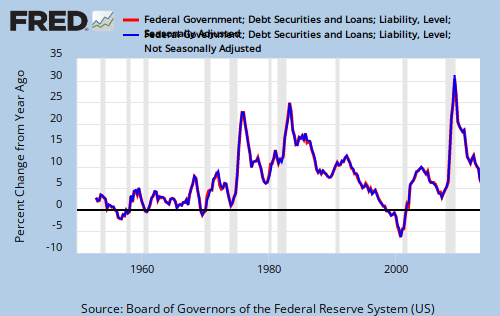

In the blog post, This graph predicts the future. What does it tell you? we looked at the following graph.

The FRED series, Total Credit Market Debt Owed by Domestic Nonfinancial Sectors – Federal Government, is now known as Federal Government; Credit Market Instruments; Liability.

The FRED series, Total Credit Market Debt Owed by Domestic Nonfinancial Sectors – Federal Government, is now known as Federal Government; Credit Market Instruments; Liability.

And we asked the following four questions:

1. What does the federal government do in the years leading up to recessions? (Answer: Cut growth in deficit spending)

2. What does the government do that cures recessions? (Answer: Increase deficit spending growth)

3. What is the government doing now? (For a clearer picture, here is a closeup of the most recent past):

4. Why is the government cutting deficit spending growth, despite overwhelming evidence this causes recessions? (Because of the false premises that the federal government can run short of dollars, or by creating dollars, could cause inflation.)

On many occasions, we have discussed why it is 100% impossible for our Monetarily Sovereign U.S. government involuntarily to run short of dollars, most recently at: I just thought you should know. Lunch really can be free (Saturday, Jul 27 2013).

Even were zero taxes collected, the federal government could not be forced to run short of dollars.

And at: Federal deficit spending doesn’t cause inflation; oil does (Tuesday, Apr 6 2010), we have demonstrated that federal deficits (i.e. increase in money supply) have not been a cause of inflation

In answer to question #4, Why?, we have discussed how federal spending helps the lower income groups more than it does the higher income groups. So, the rich bribe the politicians (via campaign contribution and promises of lucrative employment) to cut federal spending and to increase taxes on the lowest groups. The FICA increase and the push for “broadening the tax base” are but two examples.

The purpose: To widen the gap between the rich and the rest.

To smooth the path to austerity (i.e. deficit cuts), the voting public is brainwashed by the wealthy-owned media, partly via the publication of various “debt clocks.” The purpose of debt clocks is to shock the public into believing, falsely, the U.S. government is burdened by too much debt.

Missing from these “debt clocks” is any evidence that the government really is burdened or that debt has any negative economic effects. Presumably, the use of the word “debt” provides sufficient shock, despite evidence that lack of debt does have negative economic effects.

For those reasons, it might be helpful to publish in every post, from this day forth, a “Recession Clock” from which the public can draw correct conclusions about austerity, the government’s actions and the probability of those actions causing a recession.

THE RECESSION CLOCK

As the lines drop, we approach recession, which will be cured only when the lines rise. This leads to question #5:

5. Why do we allow Congress and the President to make the lines drop?

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

#MONETARY SOVEREIGNTY

Thanks, Mitchell.

I thought this was important enough to create a quicklink to it for our readers at Opednews: http://www.opednews.com/Quicklink/Government-deficit-cuts-le-in-Best_Web_OpEds-130812-726.html

You might want to submit this to Global Economic Intersect, and Seeking Alpha (the last one pays).

LikeLike

1. Scott, RMM’s recent post, ” Why the Economy Grows when the Stimulus Shrinks” appeared on GEI on August, 11, 2013. The highlight though is the stunningly obtuse “responses” to Rodger’s article by some lunatic named “Rob Carter.” A ROTFLMFAO moment to be sure. Carter presents only a jumbled mess of non sequiturs and preposterously indecipherable run-on sentences… an overt sign of genius, I suppose.

2. However, of interest and value is a recent piece on GEI:

“Asset Purchase Programs Like QE2 Have Moderate Effect on Economic Growth At Best”

by Vasco Cúrdia and Andrea Ferrero – FRBSF Economic Letter, Federal Reserve Bank of San Francisco

http://econintersect.com/b2evolution/blog1.php/2013/08/12/asset-purchase-programs-like-qe2-have-moderate-effect-on-economic-growth-at-best

LikeLike

Well, there are 255 more views of Rodger’s article on the OEN post now, and counting, since it is still on the front page. We’ll probably double that before it’s done. I can’t promise any top decision makers are reading it, but Opednews is a top 100 blog, according to Technorati (Huffington Post is #1).

No comments there yet, but no “Rob Carters” either. People like that are usually impervious to reason and practice a theocratic economic perspective.

LikeLike