Does your neighbor understand the close relationship between federal deficits and economic growth? Do you?

I’m unsure whether to laugh or cry when I read about how the “federal debt” is too high and “unsustainable.” It is amazing how few people seem to understand that Gross Domestic Product growth (economic growth) relies on federal deficit and “debt” growth.

The two are intertwined, with economic growth being the outcome of “federal debt” and deficit growth.

I put “federal debt” in quotes because it isn’t federal, and it isn’t debt. It’s deposits in T-security accounts owned by the depositors, not the federal government.

These accounts resemble bank safe deposit boxes in that the contents remain the property of the depositors, the bank never touches them, and they are not the bank’s debts.

Similarly, the contents of T-security accounts remain the property of depositors; the federal government never touches them, and they are not the federal government’s debts.

The purpose of T-securities is not to provide spending funds to the federal government (which already has infinite spending funds) but to provide a safe, interest-paying storage place for unused dollars. This stabilizes the demand for the dollar.

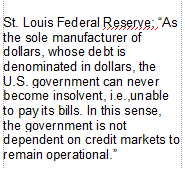

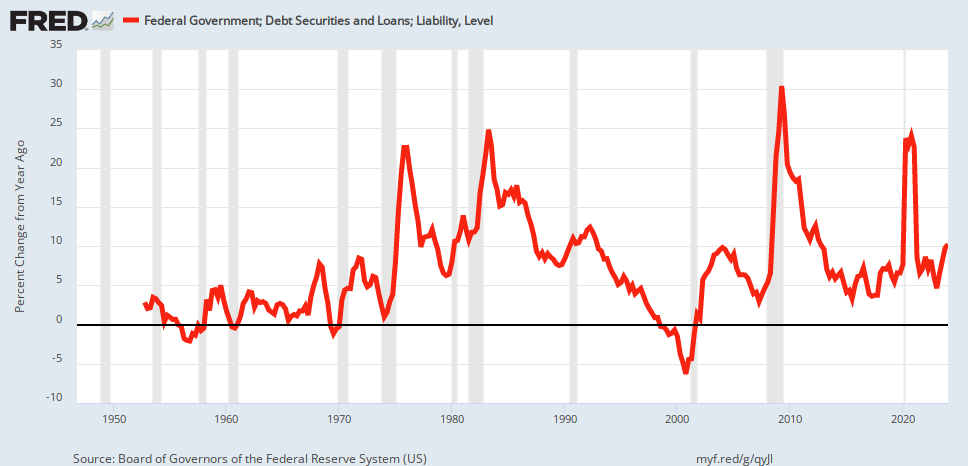

Here is a graph demonstrating the close relationship between deficit spending and economic growth.

The lines parallel because of this formula:

Gross Domestic Product = Federal Spending + Non-federal Spending + Net Exports.

Increases in Federal Spending directly increase economic growth (GDP), but they also increase Non-federal spending by adding dollars to the private sector.

Thus, federal deficit spending is absolutely no-kidding-around necessary for economic growth.

The economy can’t grow without the supply of money growing. The following graph shows the nearly identical tracks of GDP (blue) and both the broad money supply measure (M3) and a narrower money supply measure (purple).

Federal deficit spending grows the supply of money and, thus, the economy.

If you wonder whether economic growth is necessary, consider that the combination of inflation and population growth requires more money just to break even, making a $0 deficit recessionary.

The reality is that even small, insufficient deficit growth has led lead to inflations, which is demonstrated by the following graph:

Even when “federal debt” growth is above zero, it can lead to recessions (vertical gray bars) when the rate of growth declines.

Recessions are cured by increases in the “federal debt” growth rate.

When your neighbor claims the “federal debt” and deficit are too high and demands a reduction, here’s what he unknowingly (perhaps) is asking for:

U.S. depressions come on the heels of federal surpluses.

1804-1812: U. S. Federal Debt reduced 48%. Depression began 1807.

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.

1997-2001: U. S. Federal Debt reduced 15%. Recession began 2001.

Every depression in U.S. history has been caused by federal deficit reductions (“Federal debt” is the net total of federal deficits because that is how “federal debt” is wrongly defined.)

Does your neighbor understand that in demanding “debt” cuts, he is demanding a depression? Do you?

If you don’t understand it, I can’t blame you. You’ve received wrong information from all sides, even from trusted sources. Consider this startlingly inaccurate information from Investopedia:

Austerity refers to a set of economic policies a government implements to control public sector debt. Governments put austerity measures in place when their public debt is so large that the risk of default or the inability to service the required payments on its obligations becomes a real possibility.

The U.S. government has the unlimited ability to create U.S. dollars. So, large deficits never have and never will force the U.S. federal government to default.

The only way the government can default is if Congress and the President simply decide not to pay what they owe, for instance, because of the extraordinarily foolish “debt ceiling.”

This misguided event could occur even when deficits are small; the size of deficits is irrelevant to the government’s ability to pay what it owes.

The goal of austerity is to improve a government’s financial health.

Austerity never improves the financial health of a Monetarily Sovereign government, i.e., the U.S. government’s infinite ability to create its sovereign currency.

Austerity always worsens the financial health of an economy. Always.

Default risk can spiral out of control quickly. As an individual, company, or country slips further into debt, lenders will charge a higher rate of return for future loans, making it more difficult for the borrower to raise capital.

Here, Investopedia demonstrates abject ignorance about economics. Individuals and companies are monetarily non-sovereign. The U.S. federal government is Monetarily Sovereign. The two are as different as black and white, and Investopedia doesn’t understand it.

If you and your neighbor are confused, that is the reason. You receive bad information from trusted sources.

Individuals and companies use dollars but do not have the unlimited ability to create dollars. You can run short of dollars. You may need to borrow dollars.

By contrast, the U.S. federal government cannot unintentionally run short of dollars. It has the infinite ability to create dollars. Even if the U.S. government didn’t collect a penny in taxes, it and all its agencies could continue spending forever. Congress and the President merely must vote to make that happen.

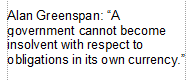

Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency. There is nothing to prevent the federal government from creating as much money as it wants and paying it to somebody. The United States can pay any debt it has because we can always print the money to do that.”

That is why the Supreme Court, Congress, the White House, the Military, Medicare, and Social Security — all federal agencies — cannot run short of dollars unless Congress and the President want them to.

For the above reasons, the federal government never borrows dollars. It creates, ad hoc, all the dollars it ever needs.

While T-bills, T-notes, and T-bonds include the words “bills,” “notes,” and “bonds” — terms often associated with borrowing — T-securities are not borrowing. They are deposits by depositors into their own accounts.

Imagine putting dollars into your bank safe deposit box. The bank has not borrowed those dollars. It only has provided a storage place to deposit things of value. Those things of value are not federal debt. The government does not owe them to you.

When a T-security reaches maturity, the federal government merely returns your dollars to you. It’s a simple transfer of your dollars from one of your accounts to another of your accounts — from your T-security account to your checking account.

If the federal government wished, it could reduce the “federal debt” to $0 simply by returning all your dollars currently residing in your T-security accounts. This would not be a financial burden on the government.

Finally, interest rates on T-securities are not determined by the private sector. They are set by the Federal Reserve in its attempts to control inflation.

Everywhere you turn, some “expert” wrongly conflates “federal debt” with private debt. It’s as wrong as conflating “giving someone the bird” (handing him a parrot) with the same words meaning “showing your middle finger.”

Federal government finances have nothing in common with personal, business, or state/local government finances.

Perhaps you understand this, and maybe even your neighbor does, too. But why do America’s “experts,” the media, the politicians, and the university economists act so gosh darned ignorant about elementary facts?

I suspect the operative word is “act.” Too many of them have been bribed by the rich, who run America, to make you believe the government can’t afford to give you benefits.

You are told that Social Security, Medicare, Medicaid, and all other social benefit programs must be cut, and your taxes must be increased. It’s all a lie, told to widen the income/wealth/power Gap between the rich and you. This is how the rich grow richer.

Did you know all this? If you do, have you complained to your Senator and Representative? It’s not too late. Or you can simply pay the additional FICA and do with less Medicare and Social Security. It’s what the rich hope, sucker.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY