- In the 1780s, the U.S. federal government created the laws that created the U.S. dollar from thin air — as many dollars as it wished – and gave them the value it wished.

- The government’s own laws give it the power to continue creating dollars, infinitely

- The government’s own laws give it the power to continue changing the value of the dollar — a power it has used many times.

- The government can change its laws at will.

- The U.S. federal government never unintentionally can run short of U.S. dollars.

- No agency of the government can run short of dollars unless the government wishes it.

- Federal taxes are not used or needed to fund federal spending.

- By changing the value of the dollar, the government has absolute control over inflation

Here are some of the facts.

Here are some of the facts.

The game is played with multiple players plus a Bank. The Bank pays Monopoly dollars to the players for various benefits. The Bank collects taxes, fines, loans and interest from the players. The Bank “never goes broke.” If the Bank needs money, it may issue as many dollars as needed by printing on scraps of paper or simply by creating a bookkeeping tally.

This lack of a column demonstrates the Bank’s ownership of infinite dollars.

It also demonstrates that all dollars sent to the Monopoly Bank are destroyed upon receipt.

If Tom, for instance, sent $100 to the Bank, his $4,400 would be reduced to $4,300. So, what happened to the $100 Tom paid? They simply disappeared. They no longer exist. Although the Bank can create infinite dollars this creation process does not create Monopoly Bank “debt.” The Monopoly Bank does not borrow dollars nor does it owe any dollars. Thus, taxes are not levied to “pay off” any Monopoly Bank debt. By rule, the Monopoly Bank simply creates all the dollars it needs. Although the Bank is not precluded from keeping track of the dollars it receives from players, that record would not indicate how many dollars the Monopoly Bank “owes” or has. There is no ongoing debt owed by the Monopoly Bank. All of the above is easily understood by you and by virtually anyone else who has played the game. Now, in the above paragraphs, substitute the words, “U.S. federal government” for the word “Bank.” And substitute “members of the public” for “players.” The facts remain essentially the same.There are multiple members of the public plus the federal government.

The federal government pays dollars to the public for various benefits.

The federal government collects taxes, fines, loans, and interest from the public.

The federal government “never goes broke.” If the federal government needs money, the government may issue as much as needed by printing on paper or simply by creating a bookkeeping tally.

[Former Fed Chairman, Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency.”]

Continue reading and substituting until you come to the part that some people have difficulty understanding:The federal government does not borrow dollars nor does it owe any dollars. Taxes are not levied to “pay off” any federal government debt.

[Quote from Ben Bernanke when, as Fed chief, he was on 60 Minutes: Scott Pelley: Is that tax money that the Fed is spending? Former Fed Chair, Ben Bernanke: It’s not tax money… We simply use the computer to mark up the size of the account.]

The Monopoly Bank and the U.S. federal government both are Monetarily Sovereign. They both are issuers of their dollars. Neither of them can run short of dollars. Both the Monopoly Bank and the U.S federal government have infinite dollars.[Former Fed Chair, Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”]

Neither the Monopoly Bank nor the federal government borrows or taxes in order to pay their financial obligations. Spending by the Monopoly Bank or the U.S. federal government does not create future taxpayer obligations. For that reason, Social Security, an agency of the federal government, cannot run short of dollars, unless that is what the government wants. Even if there were no FICA tax (which contrary to popular myth, does not fund Social Security), that agency need not run short of dollars.

……………………………………………………………………..

THE SOLE PURPOSE OF GOVERNMENT IS TO IMPROVE AND PROTECT THE LIVES OF THE PEOPLE.

The most important problems in economics involve:- Monetary Sovereignty describes money creation and destruction.

- Gap Psychology describes the common desire to distance oneself from those “below” in any socio-economic ranking, and to come nearer those “above.” The socio-economic distance is referred to as “The Gap.”

- Eliminate FICA

- Federally funded Medicare — parts A, B & D, plus long-term care — for everyone

- Social Security for all

- Free education (including post-grad) for everyone

- Salary for attending school

- Eliminate federal taxes on business

- Increase the standard income tax deduction, annually.

- Tax the very rich (the “.1%”) more, with higher progressive tax rates on all forms of income.

- Federal ownership of all banks

- Increase federal spending on the myriad initiatives that benefit America’s 99.9%

MONETARY SOVEREIGNTY

Alabama board game show a way to maintain the “gap”: https://www.al.com/news/2022/01/police-in-this-tiny-alabama-town-suck-drivers-into-legal-black-hole.html?utm_source=pocket-newtab

Didn’t you have some posts about this little gem that hides in plain sight?: https://transition.fec.gov/pages/brochures/checkoff_brochure.pdf

LikeLike

Yes, the presidential checkoff thing on your tax return is 100% bullshit. I mentioned it in the post, “The dirty little secret of federal finances is even revealed on your tax return.”

LikeLike

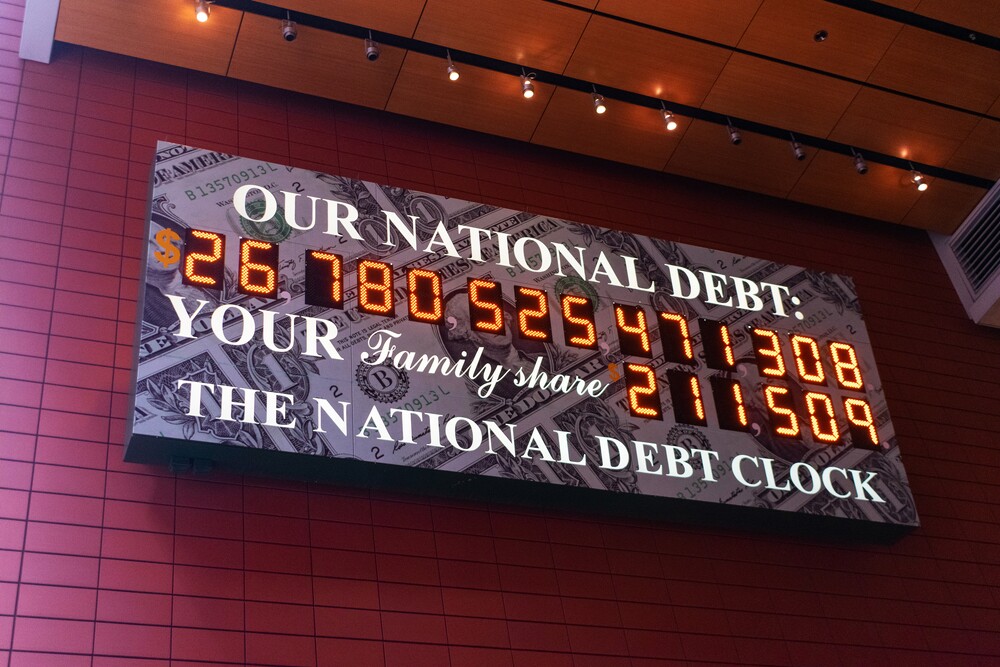

Kook killer Robert Durst’s brother and nephew have made sure the debt clock cancer has metastisized to other monetary sovereigns: https://www.debtclock.ca/

LikeLike