It takes only two things to keep people in chains:

It takes only two things to keep people in chains:

.

The ignorance of the oppressed

and the treachery of their leaders.

——————————————————————————————————————————————————————————————————————————————————————————–

If this year’s news has you confused about whether or not the federal “debt” was too high, is too high, or soon will be too high, you are not alone. The politicians want you to be confused.

As U.S. budget fight looms, Republicans flip their fiscal script

Reuters December 31, 2017WASHINGTON (Reuters) – The head of a conservative Republican faction in the U.S. Congress, who voted this month for a huge expansion of the national debt to pay for tax cuts, called himself a “fiscal conservative” on Sunday and urged budget restraint in 2018.

In reality, the GOP, “Party of the Rich,” doesn’t have a fundamental objection to a “high” debt.

And in that, they are correct. The “high” federal debt merely is the total of deposits in Treasury security accounts. These deposits can come from foreign investors, domestic investors, or from the Federal Reserve.

If no one wished to invest in federal T-securities, the Federal Reserve could buy them all, or not buy any. The federal government does not need anyone to deposit in T-security accounts.

The deposits in T-securities, the so-called “debt,” have no adverse effect on the U.S. economy.

To some degree, these deposits actually have a positive effect, because they force the federal government to pump additional interest dollars into the economy, and those dollars are economically stimulative.

In keeping with a sharp pivot under way among Republicans, U.S. Representative Mark Meadows, speaking on CBS’ “Face the Nation,” drew a hard line on federal spending, which lawmakers are bracing to do battle over in January.

Meadows was among Republicans who voted in late December for their party’s debt-financed tax overhaul, which is expected to balloon the federal budget deficit and add about $1.5 trillion over 10 years to the $20 trillion national debt.

For years, the GOP has decried the federal “debt” (deposits) as being “unsustainable,” until last year they unanimously voted for a budget that will add $1.5 trillion to the debt.

Suddenly debt became O.K., and now that the bill has passed, just as suddenly the GOP, once again, will find the “debt” a terrible threat

President Donald Trump and his Republicans want a big budget increase in military spending, while Democrats also want proportional increases for non-defense “discretionary” spending on programs that support education, scientific research, infrastructure, public health and environmental protection.

“The (Trump) administration has already been willing to say: ‘We’re going to increase non-defense discretionary spending … by about 7 percent,'” Meadows, chairman of the small but influential House Freedom Caucus, said on the program.

Both parties know the debt is no threat to the economy or to taxpayers, but both want to appear fiscally prudent by claiming to be debt haters.

“Eventually you run out of other people’s money,” Meadow said.

By “other people’s money,” Meadows means “taxpayers’ money.” But that is part of the Big Lie, that federal taxes fund federal spending. They don’t.

Federal taxes do not fund federal spending.

The politicians hide the truth that federal taxes (unlike state and local taxes) pay for nothing.

The politicians hide the truth that federal taxes (unlike state and local taxes) pay for nothing.

The moment the Treasury receives your tax dollars, those dollars disappear from any money supply measure.

They no longer are part of such money measures as M1, M2, M3, L, etc. Thus, those federal tax dollars simply are destroyed.

There are two ways dollars are created and two ways dollars are destroyed:

Dollars Created:

1. All lending

2. Federal deficit spending

Dollars Destroyed

1. Loans repaid

2. Federal taxation

Even if all federal taxes, and all federal borrowing, were reduced to $0, the federal government could continue spending forever. (This isn’t true of state and local governments, which do use tax income to pay their bills.)

Federal finances are different from state/local government finances. It is the difference between Monetary Sovereignty and monetary non-sovereignty.

Meadows was among Republicans who voted in late December for their party’s debt-financed tax overhaul, which is expected to balloon the federal budget deficit and add about $1.5 trillion over 10 years to the $20 trillion national debt.

“It’s interesting to hear Mark talk about fiscal responsibility,” Democratic U.S. Representative Joseph Crowley said on CBS.

Crowley said the Republican tax bill would require the United States to borrow $1.5 trillion, to be paid off by future generations, to finance tax cuts for corporations and the rich.

“This is one of the least … fiscally responsible bills we’ve ever seen passed in the history of the House of Representatives. I think we’re going to be paying for this for many, many years to come,” Crowley said.

Crowley, too, promulgates the Big Lie. The Big Truth is:

- The federal government never is forced to borrow, and indeed, does not borrow. It has the unlimited ability to create dollars, which it does, ad hoc, every time it pays a creditor.

- Future generations will not “pay for” federal “borrowing” (i.e. deposits in T-security accounts). Those accounts will be paid off by transferring the dollars already in the accounts back to the checking accounts of the T-security holders.

Republicans insist the tax package, the biggest U.S. tax overhaul in more than 30 years, will boost the economy and job growth.

If the tax package does cause a $1 trillion increase in federal deficit spending, it will stimulate the economy by adding dollars to the economy.

The problem is that though the total economy will grow, the way the tax bill is structured, it will boost the rich at the expense of the rest. It will widen the Gap.

House Speaker Paul Ryan, who also supported the tax bill, recently went further than Meadows, making clear in a radio interview that welfare or “entitlement reform,” as the party often calls it, would be a top Republican priority in 2018.

In Republican parlance, “entitlement” programs mean food stamps, housing assistance, Medicare and Medicaid health insurance for the elderly, poor and disabled, as well as other programs created by Washington to assist the needy.

That is the GOP goal: To help their wealthy backers by widening the Gap between the rich and the rest.

The “Gap” is what makes the rich rich. Without the Gap, no one would be rich. (We all would be the same.) And the wider the Gap, the richer they are. So cutting benefits to the middle- and lower-income groups, make the rich richer.

Democrats seized on Ryan’s early December remarks, saying they showed Republicans would try to pay for their tax overhaul by seeking spending cuts for social programs.

The author means the Republicans would try to “pay for” increased deficits by cutting social programs. But that is not correct. Nothing pays for increased deficits. The government pays for its financial obligations by creating new dollars, not by taxes or spending cuts.

To pay a creditor, the federal government sends instructions (not dollars) to the creditor’s bank, instructing the bank to increase the numbers in the creditor’s checking account. When the bank does as instructed, brand new dollars are created.

In summary:

- Both parties know the federal “debt,” (deposits) are not “unsustainable” or paid for by future generations.

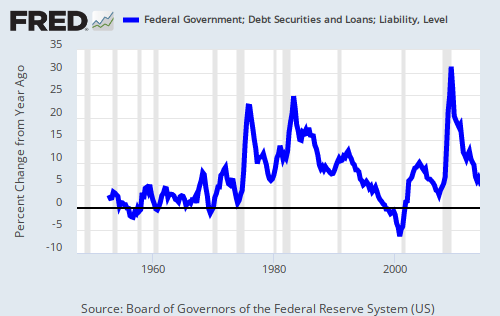

- Both parties also know federal deficit spending stimulates economic growth by adding dollars to the economy.

- And both parties know that deficit reduction leads to recessions, while recessions are cured by increased deficit spending.

- The difference between the parties is the GOP’s desire to make the rich richer, at the expense of the poor, while the Democrats wish to improve the lives of the poor at the expense of the rich.

Both tell the Big Lie (that federal taxes fund federal spending) to further their own political agenda.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

The most important problems in economics involve the excessive income/wealth/power Gaps between the have-mores and the have-less.

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Implementation of The Ten Steps To Prosperity can narrow the Gaps:

Ten Steps To Prosperity:

1. ELIMINATE FICA (Ten Reasons to Eliminate FICA )

Although the article lists 10 reasons to eliminate FICA, there are two fundamental reasons:

*FICA is the most regressive tax in American history, widening the Gap by punishing the low and middle-income groups, while leaving the rich untouched, and

*The federal government, being Monetarily Sovereign, neither needs nor uses FICA to support Social Security and Medicare.

2. FEDERALLY FUNDED MEDICARE — PARTS A, B & D, PLUS LONG TERM CARE — FOR EVERYONE (H.R. 676, Medicare for All )

This article addresses the questions:

*Does the economy benefit when the rich can afford better health care than can the rest of Americans?

*Aside from improved health care, what are the other economic effects of “Medicare for everyone?”

*How much would it cost taxpayers?

*Who opposes it?”

3. PROVIDE A MONTHLY ECONOMIC BONUS TO EVERY MAN, WOMAN AND CHILD IN AMERICA (similar to Social Security for All) (The JG (Jobs Guarantee) vs the GI (Guaranteed Income) vs the EB (Economic Bonus)) Or institute a reverse income tax.

This article is the fifth in a series about direct financial assistance to Americans:

Why Modern Monetary Theory’s Employer of Last Resort is a bad idea. Sunday, Jan 1 2012

MMT’s Job Guarantee (JG) — “Another crazy, rightwing, Austrian nutjob?” Thursday, Jan 12 2012

Why Modern Monetary Theory’s Jobs Guarantee is like the EU’s euro: A beloved solution to the wrong problem. Tuesday, May 29 2012

“You can’t fire me. I’m on JG” Saturday, Jun 2 2012

Economic growth should include the “bottom” 99.9%, not just the .1%, the only question being, how best to accomplish that. Modern Monetary Theory (MMT) favors giving everyone a job. Monetary Sovereignty (MS) favors giving everyone money. The five articles describe the pros and cons of each approach.

4. FREE EDUCATION (INCLUDING POST-GRAD) FOR EVERYONE Five reasons why we should eliminate school loans

Monetarily non-sovereign State and local governments, despite their limited finances, support grades K-12. That level of education may have been sufficient for a largely agrarian economy, but not for our currently more technical economy that demands greater numbers of highly educated workers.

Because state and local funding is so limited, grades K-12 receive short shrift, especially those schools whose populations come from the lowest economic groups. And college is too costly for most families.

An educated populace benefits a nation, and benefitting the nation is the purpose of the federal government, which has the unlimited ability to pay for K-16 and beyond.

5. SALARY FOR ATTENDING SCHOOL

Even were schooling to be completely free, many young people cannot attend, because they and their families cannot afford to support non-workers. In a foundering boat, everyone needs to bail, and no one can take time off for study.

If a young person’s “job” is to learn and be productive, he/she should be paid to do that job, especially since that job is one of America’s most important.

6. ELIMINATE FEDERAL TAXES ON BUSINESS

Businesses are dollar-transferring machines. They transfer dollars from customers to employees, suppliers, shareholders and the federal government (the later having no use for those dollars). Any tax on businesses reduces the amount going to employees, suppliers and shareholders, which diminishes the economy. Ultimately, all business taxes reduce your personal income.

7. INCREASE THE STANDARD INCOME TAX DEDUCTION, ANNUALLY. (Refer to this.) Federal taxes punish taxpayers and harm the economy. The federal government has no need for those punishing and harmful tax dollars. There are several ways to reduce taxes, and we should evaluate and choose the most progressive approaches.

Cutting FICA and business taxes would be a good early step, as both dramatically affect the 99%. Annual increases in the standard income tax deduction, and a reverse income tax also would provide benefits from the bottom up. Both would narrow the Gap.

8. TAX THE VERY RICH (THE “.1%) MORE, WITH HIGHER PROGRESSIVE TAX RATES ON ALL FORMS OF INCOME. (TROPHIC CASCADE)

There was a time when I argued against increasing anyone’s federal taxes. After all, the federal government has no need for tax dollars, and all taxes reduce Gross Domestic Product, thereby negatively affecting the entire economy, including the 99.9%.

But I have come to realize that narrowing the Gap requires trimming the top. It simply would not be possible to provide the 99.9% with enough benefits to narrow the Gap in any meaningful way. Bill Gates reportedly owns $70 billion. To get to that level, he must have been earning $10 billion a year. Pick any acceptable Gap (1000 to 1?), and the lowest paid American would have to receive $10 million a year. Unreasonable.

9. FEDERAL OWNERSHIP OF ALL BANKS (Click The end of private banking and How should America decide “who-gets-money”?)

Banks have created all the dollars that exist. Even dollars created at the direction of the federal government, actually come into being when banks increase the numbers in checking accounts. This gives the banks enormous financial power, and as we all know, power corrupts — especially when multiplied by a profit motive.

Although the federal government also is powerful and corrupted, it does not suffer from a profit motive, the world’s most corrupting influence.

10. INCREASE FEDERAL SPENDING ON THE MYRIAD INITIATIVES THAT BENEFIT AMERICA’S 99.9% (Federal agencies)Browse the agencies. See how many agencies benefit the lower- and middle-income/wealth/ power groups, by adding dollars to the economy and/or by actions more beneficial to the 99.9% than to the .1%.

Save this reference as your primer to current economics. Sadly, much of the material is not being taught in American schools, which is all the more reason for you to use it.

The Ten Steps will grow the economy, and narrow the income/wealth/power Gap between the rich and you.

MONETARY SOVEREIGNTY

LikeLike

Hey, one deficit hawk converted..it’s a start…https://www.nytimes.com/2017/12/30/opinion/confessions-of-a-columnist.html

“But I was wrong in the priority that I gave the deficit relative to other issues, wrong to discern a looming “fiscal precipice,”

LikeLike

OMG!

LikeLike

And now another step backwards — Lew says we are broke…https://www.yahoo.com/finance/news/former-treasury-secretary-lew-says-125300506.html

LikeLike