Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

Many posts on this blog discuss the fact that the U.S. federal government, unlike you and me, and unlike the cities, counties, states, companies and the euro nations, is Monetarily Sovereign, and so, does not need income. It creates all the dollars it needs for spending by the very act of spending dollars.

When the government pays a bill, it simply sends instructions to the creditor’s bank, telling the bank to increase the balance in the creditor’s checking account. These instructions are in the form of a check or a wire, and when the bank follows the instructions, dollars are created.

Unlike we monetarily non-sovereign entities, the U.S. federal government can send such instructions endlessly. For more background on this, you might wish to read: “I just thought you should know.”

We are left with the obvious question, “Why does a government, that does not need income, levy taxes?” Considering that the U.S. federal tax code is perhaps the most complex, convoluted, inefficient, ever-changing, incomprehensible, economically damaging set of laws ever created in the history of the world, this question is important.

Why indeed, does the government force us to spend millions of unproductive and unpleasant hours calculating taxes, then take dollars from our pockets to pay those taxes, then spend more dollars to investigate, prosecute and even jail those who don’t pay taxes, properly?

One cannot imagine another exercise that costs so much in time and money, causes so much grief, and has so little value (none) as the U.S. federal tax system.

So, again, why do we do this to ourselves?

WHY TAX?

Economic Control Federal taxes are used to control certain details of the economy. By adjusting tax rates among long-term, short-term, real estate, interest, salary and various enterprises (oil drilling, farming, energy saving, etc.) the government encourages and discourages certain activities.

However, the government could accomplish the same things without taxes, by rewarding (paying dollars) rather than by punishing (taxing dollars).

Provide Demand: Years ago, I had this discussion with proponents of Modern Monetary Theory (MMT) a kissin’ cousin to Monetary Sovereignty (MS). It was (and I believe remains) their belief that federal taxes are necessary to provide demand for the dollar. By requiring people to pay their taxes in dollars, the federal government assures that people will want and use dollars.

I suggest this is partly true, but mostly false. The “true” part is that requiring taxes to be paid in dollars does indeed create demand for the dollar.

But, because there are plenty of state, county, city, village, park district, water district, etc., etc. taxes to provide demand for the dollar, federal taxes are not necessary to provide dollar demand.

Control Inflation: A second belief is, the purpose of federal taxes is to control inflation. If dollars were not removed from the economy by federal taxation, there would be too many dollars in the economy, and this would cause inflation.

This is like saying a pail must have holes in the bottom, otherwise it will overfill. Clearly, the solution to overfilling is to pour less water into the pail. To prevent having too many dollars in the economy, the federal government simply could spend (create) fewer dollars.

Further, since 1971, when the U.S. went off the last vestiges of a gold standard, there has been no relationship between federal deficit spending and inflation. In the past 40+ years, inflation has been associated with oil prices, not with federal money creation.

More importantly, our Monetarily Sovereign federal government not only has the unlimited ability to create dollars, but it also has the unlimited ability to set the value of those dollars. It could, if it chose, devalue the dollar relative to other currencies, revalue (upward) the dollar or renominate (introduce a wholly new currency.)

The U.S. federal government being the inventor of the dollar, and having arbitrarily created all the laws that make the existence of the dollar possible, is in effect, the “God of the dollar.” It has unlimited power over all aspects of the dollar.

The Federal Reserve, a government agency, controls inflation to its target rate of 2% – 3%. That target is based on the idea that a small amount of inflation stimulates the economy, by creating the incentive to buy goods and services today, rather than waiting until tomorrow, when prices will be higher.

Redistribute Wealth: A third belief is, federal taxes are necessary to redistribute wealth and to prevent some people and some families from being so rich they, in effect, become sovereign dictators. In theory, it is a protection for the “not-rich.”

But, the United States is loaded with billionaires, and these people have enormous power, verging on dictatorial power. So clearly, federal taxation has not worked to prevent concentration of wealth, and the reason it has not worked is the tax code is a product of the wealthy.

Rather than protecting the middle- and lower-income groups, the tax code, as constructed by the rich, is a far lesser burden on the rich than on the rest.

While the rich pay more in total tax, they still are left with a massive surplus, while the poor and middle-classes struggle to pay their taxes and still save anything for the future.

Consider FICA, the single most regressive tax in American history, and the tax that often exceeds income taxes for many lower-end, salaried people. While it purportedly pays for Social Security and Medicare, in reality its sole purpose is to widen the gap between the rich and the rest.

Thus, federal taxes do not redistribute dollars, but in fact are a kind of “false flag” operation, designed to appear created by a benevolent Congress to benefit lower income groups while, actually having been created by the rich, to benefit the rich.

This is why Congress (having been bribed by the rich, via campaign contributions and promises of lucrative employment), the media (owned by the rich) and mainstream economists (controlled by the rich via contributions to universities and by lucrative employment) all combine to spread the “BIG LIE” that federal taxes are necessary.

“Sin” taxes: Taxes on cigarettes, liquor and other recreational drugs may be the sole appropriate use of federal taxation, though perhaps these might better be the function of state and local governments than of the federal government.

Summary on taxation: Federal taxes do not support federal spending. They are inefficient, unnecessary and having been created by agents of the rich, serve only to widen the gap between the rich and the rest.

Federal taxes can, and should be, eliminated.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

THE RECESSION CLOCK

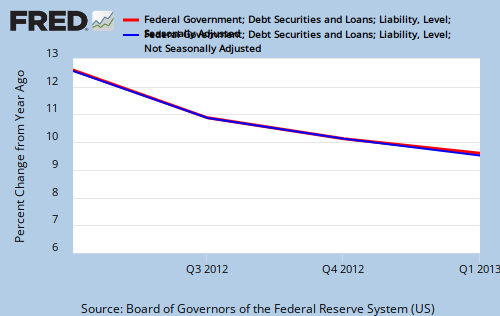

As the lines drop, we approach recession, which will be cured only when the lines rise.

#MONETARY SOVEREIGNTY

“It could, if it chose, devalue the dollar relative to other currencies, revalue (upward) the dollar…”

not sure that’s a 100% accurate–that would require “cooperation” from the country against whose currency you wanted to devalue or revalue.

LikeLike

True, in theory, but in fact, nations often have devalued their currencies (usually to increase exports), and they have done it unilaterally. And currencies are strengthened by raising interest rates.

LikeLike

also, about the fed and their inflation target rate–how does that happen? how can a central bank cause the general price level to go up 2-3% independent of an increase in congressional spending or an increase in the price of an essential commodity like oil?

LikeLike

The value of a dollar is based on risk and reward, for the dollar and for the goods and services it buys.

The reward for owning a dollar is interest, so the Fed controls inflation by controlling interest rates. The higher the rate, the more valuable the dollar and the less the inflation.

Note, of course, that inflation is a complex relationship between money and goods/services, so the Fed needs to do quite a bit of juggling to offset other factors.

LikeLike

http://moslereconomics.com/2011/11/14/it-must-be-impossible-for-the-fed-to-create-inflation/

LikeLike

Warren Mosler @ UMKC 8/30/2013, Why does the govt tax?

1. provision govt (with a tax that creates unemployment)

2. govt spending therefore shifts resources from private to public domain

Rodger, what do you think? Most pertinent portion of video is the first 13 mins or so.

LikeLike

I don’t understand how a tax provisions government.

LikeLike

Mosler also said (in recent “Soft Money” lecture) that the purpose of taxes is to cause unemployment. Eg, this is also code for “reduce inflation”, by which they REALLY mean wage increases, because business really LOVES inflation … asset inflation and price inflation of whatever they are selling.

By causing some unemployment, Govt taxation creates “idle workers” who the Govt can employ for military or roads or other uses, and PAY THEM. The Govt also provisions itself with surplus goods which can’t be otherwise sold on the market. That’s sorta the theory or vision.

Adam Smith argued to tax ONLY un-earned income from asset speculation, mostly about land then, now other ‘fancy’ assets. Mellon of the Coolidge admin also argued that ONLY on the top 2%, at that time the demographic assumed by him to earn gains “in their sleep”, should even have to FILE income tax returns … a messy accounting exercise suitable for financial wizards and speculators, NOT for common workers.

People who earn by “the sweat of one’s brow” who must work or else starve should never pay taxes, according to one of America’s most conservative admins. (But they failed to tax speculative booms of the Roaring 20s.)

For another thing, taxes on common wage & salary income is OBVIOUSLY is a sap on Demand and Consumption. Rich people, by definition, already have the 5000 sq ft house, already have the boat, maybe a plane, already have the big screen TV and fancy fridge. Tax cuts to them might be nice, but do not boost sales (much). Normally, they put tax cuts towards (a) paying down debts (b) savings (c) more asset speculation, all of which further reduces Demand and/or drives up prices.

The tax cuts that you (Roger) proposes is to put more money into the hands of bottom end consumers, the bottom 90%. This is in full agreement with MMT.

That would do a LOT to boost employment, maybe not effective “Full Employment” that MMT wants, via a JG transition program (which mainstream conservative big mouths OUGHT to gladly approve, if they are true to their rhetoric). But even the tax cuts you propose would increase spending and thereby increase velocity and turnover of money … more income, more profits, more jobs.

The precise point at which “full employment” could become true inflationary pressure — more demand for employees than capacity — is impossible to answer, too many variables, but that can be measured in due time.

True enough?

LikeLike

-Why are the rates going up although the Fed has not change their target or their rates?

– What makes higher rates do to suppress inflation?

LikeLike

Higher rates increase the demand for dollars, which strengthens dollars vs. goods and services.

That said, inflation is caused by several factors, the most important of which currently is oil prices.

LikeLike

Sorry,

Perhaps I didn’t ask the questions clearly. In your comments, you stated that the Fed sets a target rate of inflation and sets the interest rates.

The first question is, why are the current market rates (4.5%) way above the Fed (0.75%) target rate? The rates were about 3% not so long ago, essentially, rates have gone up by 50% in a few months.

The second question is not about what inflation is. The question is: what about higher rates makes them effective in combating inflation (although it is caused by other non-controllable factors as you say)?

LikeLike

Error on the above, the Fed funds rate is currently 0.25%. The gap between the Fed funds and the market rate is widening big time.

LikeLike

Since you ignored the questions, let me take a crack!

Q: The first question is, why are the current market rates (4.5%) way above the Fed (0.75%) target rate? The rates were about 3% not so long ago, essentially, rates have gone up by 50% in a few months.

A: Because the Fed can only target the rate, it has little control over what the real market rate will be. In other words, the market will respond to stupid policies, like continuous purchase of 1 trillion/year government debt. The spikes in rates within the last few months are a direct consequence of the Fed’s policies the last few years. Sure, the market doesn’t react immediately, but it sure does and when it does, it’s unstop-able. Just look at India for a peak at what stupid policies bring.

Q: The second question is not about what inflation is. The question is: what about higher rates makes them effective in combating inflation (although it is caused by other non-controllable factors as you say)?

A: Easy, it removes currency from circulation. If it is effective by removing currency from circulation, than isn’t it obvious that It’s adding more currency that causes it? wow that was easy.

And that Sir, that is what you don’t want the readers to read. That you are fully aware that inflation is the complete creation of the Fed/Government actions. That it is a direct consequence of printing and that it is theft.

LikeLike

Danny,

Higher interest rates (paid) ADDS money to the economy, because pensioners and savers earn more income on T-Bill assets and savings and CDs.

BANKS can inflate or deflate the money supply MUCH MORE and MUCH FASTER than the Fed Gov does or is likely to do. The credit bubble — banks create money out of thin air by keystrokes — banks were allowed to guesstimate their own risk, decided that their fraud mortgages & securities were “risk-free” when in reality their assets/capital was guaranteed to fail, and their internal emails proved they knew that — created an unprecedented VOLUME of money. See Steve Keen’s presentations on PRIVATE household debt bubble, which was nearly double that of what the Roaring 20s produced before the Great Depression.

Federal Spending produces a trickle, roughly some 3% of total volume of dollars is NOT from bank credit creation. Otoh, Federal Spending produces 100% of NET financial wealth & NET savings. Bank loans cause economic activity & growth and velocity in circulation, but obviously cannot be a debt and savings at the same time (tho savings for some and debt for others).

The Fed CANNOT boost nor limit the volume of bank created money by manipulating Reserves or requirements, as explained by Allen Holmes (probably in response to early Friedman-monetarist ideology) in 1969. Since banks are not reserve constrained in lending, i.e. creating new assets, QE cannot boost lending. Sharply limiting reserves cannot cut lending and “reduce inflation” as Friedman desired in the 80s, because then banks can’t clear payments without reserves and there’s a freeze of payments system and commercial credit … so Fed was forced by the workings of the system to provide necessary reserves. This occurs 2-4 weeks in ARREARS of loan creation.

No, the Fed does not control what banks charge, except the Interbank Lending rate. We just got an ad in the mail from “Rise” a company that offers short term loans of $800 or so with bi-weekly payments at 450% annual interest. Congress USED to have a cap on such interest, called “usurious” but those caps were removed when Volker decided that the way to combat Oil Spike interest in the 70s was to bump Fed rates to 12% and finally up to 21.8%, in early Reagan. Sure, that cut inflation .. by starvation. People still praise Volker’s “resolve” but 55000 businesses failed and countless Americans were laid off, many PERMANENTLY.

The current conservative mantra is that Americans enjoyed too much prosperity (along with growing productivity and post-war boom) and that made young people immoral. This was due to lack of suffering in World Wars (Korea and Vietnam obviously insufficient suffering), and too much consumption society … consumerism and mass psychology engineering was invented by Big Business in the first place to sell output.

But they wanna make people feel guilty for that now. Schizo. Also note, that is literally Anti-Capitalist rhetoric on the Right, if capitalism means production and consumption.

LikeLike

“…. the fact that the U.S. federal government, ……. is Monetarily Sovereign, and so, does not need income.”

And, “so” ?

Actually, the GUV is only monetarily sovereign.

And, actually, the government needs income or it cannot spend.

To say that just because the government as a sovereign entity has the money creation powers that the government as public policy administrator does not require income sources in its budgeting and financial operations is a theory too far.

And there is no proof of it anywhere.

The fact that sovereignty entitles the government to create and issue its money supply, a power which the sovereign government should certainly be using, does not mean that the government DOES, in fact, issue its currency.

Sovereign government can, and have, made legal arrangements whatever regarding its monetary powers and operations, especially by delegating its money creation and issuance powers to others, while holding regulatory powers over money to itself.

Under the arrangements of this bankers-school money system, the private banks create all the money, c.e..

The government taxes that money back from the citizens for its use, and it is its ‘use’ that answers the question of why do government’s tax the citizenry.

The government also borrows for income-revenue from the private bankers who have received, and who exercise, the creation and issuing powers.

The sovereign government has fortunately set up a system by which it exercises its administrative powers over public policy and the system calls for the accountability of government revenues and expenses.

Governments are public bodies and, whether sovereign in money or not, must carry out their operations by budgeting for and obtaining revenues from various sources, and spending its budgeted expenses by using those revenue sources.

The problem with the theory that the government creates money when it spends is that ‘new money creation’ is not a revenue source in the government’s budget.

It certainly should be.

And it certainly could be.

But it isn’t.

LikeLike

Try: https://mythfighter.com/2013/07/27/i-just-thought-you-should-know-lunch-really-can-be-free/

LikeLike

Rodger,

Read through there.

Many grains of truth contained therein.

But like I said, the difference between what the government CAN do and what the government DOES, is the fully autonomous governmental creation and issuance of the nation’s money.

Quoting from your post::

“”With the passage of a few laws and the press of a computer key, our government instantly could make American citizens the wealthiest people the world ever has known, now and forever.””

And at the same time make the bankers earn their keep.

What we’re ultimately talking about is a fundamental historic difference between the sovereign money system of the currency school and the debt-based money system of the banking school.

I can never understand MMT’s preference for the latter.

I hope Dr. Huber’s explanation will be helpful.

On Modern Money and Sovereign Currency, from sovereignmoney.eu

Click to access MMT%20and%20NCT.pdf

Thanks.

Joe B.

LikeLike

I could never understand why I got paid for working for over 45 years either. Wow. Talk about returning from the dead. Ho-hum.

LikeLike

Indeed.

LikeLike

Joe,

Can you elaborate on why it would be beneficial for the population if the government issued the currency. We’ve had a gold standard, in which the supply of the currency is essentially controlled by the market and a fractional reserve system in which the debt grows without regard for real incomes.

Gold:

More currency needed? the benefits outweigh the cost of mining it (GOOD). Too much gold in the system? the benefits do not outweigh the cost of mining it (GOOD). Gold enforces immediate settlement between nations (no nation would allow others to remain in deficit/surplus for long, either pay in gold or buy), which means jobs (GOOD). The government cannot go into continuous debt (immediate inflation and future taxes) because of the same stated in the previous sentence, there is immediate settlement (GOOD).

Banking Fractional Reserve Fiat:

To defend against a flight from the dollar from massive issuance of debt (following the gold unpeg in 1971), the Fed hiked rates in the 1970s, which helped alleviate a collapse of the dollar (it collapsed nevertheless). Than, everything else coming into the system was debt after that (BAD). Nobody has been able to save for 40+ years (BAD). Because the system is built on debt, there is no growth in real incomes until crapper hits the wall (BAD). Since the government can spend on whatever it wishes WITHOUT raising taxes (which would infuriate the populace), there is no ending in sight to government spending (BAD). Government spending is a double whammy, you pay now with inflation and later with higher taxes to pay the interest. The last step is when incomes can no longer support the massive debt load and collapse on itself (VERY BAD). But you are right, the banks control the issuance of debt, not the government. In my opinion, that is actually not GOOD, but not as bad as if the government controlled it.

Government issued fiat:

The government basically just creates currency as Mr Mitchell states. This basically removes the GOOD pieces of gold, and applies the BAD pieces of fiat times 1 million. There is no control over the issuance of the currency (at least banks care about the value of their debt holdings, politicians DON’T!). Since the government doesn’t care about settlement against other nations, other nations stop exporting to it, exacerbating the price rises that will ensue. Corporations will grab whatever they can salvage and move to other countries, again, making matters worst. Why save anything in a currency that will be worth nothing tomorrow?

Government fiat may just be the next step on this arduous road, but you can be sure it won’t be for the benefit of the people. Anyone wanting this is either a direct benefactor of the government or a directer benefactor of the government. It’s insane to think the government would actually do the right thing, when even Mr Mitchell has various articles stating how many crimes they commit, spying, etc… Want collapse, ask for government issued currency.

LikeLike

If its OK, I’ll just avoid the stuff about gold which is only used to ‘peg’ a national currency in foreign exchange. Any sovereign government can peg its currency at any weight of any commodity of any fineness, so the contribution of gold to monetary economics was nil – it enriched private gold holders who played the currency markets.

Phuquem.

And I will assume the veracity of the question of why a move to public money – not what Mr. Mitchell advocates at all unfortunately – will benefit the people, the economy and the planet.

Public money has functions and characteristics.

One of those characteristics is debt-free issuance by the government and the other is permanent circulation.

Greenbacks for instance were issued without additional gold backing, though they were convertible, and they were issued without ANYONE issuing any debt, and they remained permanently in circulation, until their value was established via collectors’ preference greater than its exchange value.

So the question there becomes whether we all are better off by having a non-debt based currency in permanent circulation, issued by the government in is budgeting finance process, and the answer is, of course we are.

The avoidance of any segment of the rentier society by The Restofus can only enrich our lives. Banks and financiers can still create all the ‘credit’ we need by the use of the publicly created monies. But they can only create ‘credit’ – they cannot create more currency.

These public outcomes are well documented. No public debt. No inflation. Much reduced private debt. Economic and monetary stability. Yeah, all benefits to the real people, if not the bankers.

Unfortunately, Mr. Mitchell for all his good heartedness and expansive public purpose has bought into the MMT construct of money-as-debt advanced historically by Mitchell-Innes, and the lot of them have been lost in the ‘public-purpose-with-private-money’ woods ever since. Which is why I sent Mr. Mitchell the link to German monetary economist Joseph Huber’s new website at sovereignmoney.eu

We all hate the work of the political parties in the corruption of our governmental processes. I agree wholeheartedly with any of Mr. Mitchell’s political observations, as long as they do not involve government finance, which he gets as wrong as this posting examples. Like I said in agreement, we’re a few laws shy of being able to do what both of us want to do, and my take is to pass the Kucinich Bill proposal for public money :

http://www.govtrack.us/congress/bills/112/hr2990/text

And I’m still not sure what Mr.Mitchell’s few laws would look like.

.

Thanks.

LikeLike

Not sure why you want to avoid the gold conversation while claiming that private holders will “play” the currency markets and enrich themselves. Can’t the rich people play the currency markets today? Why isn’t that an issue today? All in all, VERY WEAK argument. Try again. As I said above, gold forces settlement between nations and is a protector of jobs. That does not sounds like a nil benefit to me.

I agree on some of the benefits you mention government issued currency, mainly debt-free issuance. However, issuing currency without backing is theft no matter how you cut it and that’s the reason why their value turned into nothing.

Whether we are better off with private currency versus public issued currency is questionable. First off, yes, the government should create money and put it into circulation. How else would the economy work if there is no currency as a medium of exchange. However, stating that the issuance of the currency should be part of the budgeting process is laughable. What “budget” is this thing you speak of? When was the last time there was a “budget”? Out of all the people on this blog you know the difference between debt based money and debt-free money. Issuing either credit or currency without backing is counterfeiting and theft.

With regards to the rentier society, you have it completely backwards. Technically, there is nothing wrong with the banks lending to other folks. One of the issues is that the banks can lend the same money times over, it’s the definition of Fractional Reserve Banking. This is what gives the rich people the advantage, since they can borrow more than anyone else, they buy assets on the cheap and sell when everyone else gets in. CEOs borrow on behalf of corporations and pay themselves huge salaries. Finally, overextend themselves to rip additional profits. These are your top issues with regards to equality. Now, guess who created Fractional Reserve Banking and who bails out banks? The same government you want to fork over power to issue the currency via the “budget” process, that’s who.

Honestly, issuance of public money can only work in one single way. It’s called one dollar of capital, as explained by Karl Denninger. For every dollar of GDP, there could be one single dollar of currency issued. However, the probability of the government limiting their expenses to real economic output is zero. Will NEVER happen.

Unfortunately, Mr. Mitchell for all his good heartedness and expansive public purpose has bought into the MMT construct of money-as-debt advanced historically by Mitchell-Innes, and the lot of them have been lost in the ‘public-purpose-with-private-money’ woods ever since. Which is why I sent Mr. Mitchell the link to German monetary economist Joseph Huber’s new website at sovereignmoney.eu

I’m not sure how anyone can possibly think that MMT could work. The good hearted-ness should be focused on goods, services and real output, not worthless pieces of paper and digits. Unless you feel people eat pieces of paper and digits.

I’m very concerned that, as you say, the government is very close to taking control over the issuance of money. If that institution hasn’t been able to pass a budget in years and are so quick to spend, spend, spend, we are in for serious issues. Just think of how many stupid ideas the geniuses in government will come up with.

At the end of the day, capital and wealth is NOT currency and is not credit/debt. Capital and wealth is what you will need to improve the lives of your society. If you steal their capital and wealth via the issuance of either credit or currency, your population will stop producing as they are doing now. You think it’s a surprise the economy is in the dull-drums? Nobody, nobody works for free, yet everyone wants free things. You tell me how you connect those 2.

LikeLike

Danny

It’s not a weak argument at all. The difference is that in today’s currency markets, currency is the commodity that gets traded, whereas with any gold-backed currency proposal, gold is the commodity that is traded, being a private, hoardable peg that can threaten all of the national currency systems. My Dad used to say there’s no problem with a gold standard as long as governments control all of the gold (currency) production and distribution. It’s just stupid and nobody has a workable proposal for conversion from fiat to commodity backing in an era where the trust of the commodity markets is as low as it can get. (I’ve read Rothbard and Huerta de Soto’s unworkable proposals on these matters.)

Take your anti-GUV blinders off. Again, a stupid statement : “issuing currency without backing is theft”. I already explained Greenbacks – you explain the theft.

Which argument is repeated without any foundation – just parodies of anarcho-capitalist rhetoric. I’ve read all the Austrians on money. You need to get out of your box and make reasoned and rational arguments. I mentioned the Kucinicg Bill and gave a link. It explains how debt-free money issuance fills the deficit gap between revenues and expenses IN THE NATIONAL BUDGET. Do some reading, then, let’s talk. Mr. Mitchell should do the same because the Kucinich Bill lays out how to accomplish what MMT believes should be the way forward.

I know all about and, unlike Mr Mitchell here, am completely opposed to, fractional-reserve banking. Kucinich ends fractional-reserve banking. By resort to rhetoric that I have the rentier issue ‘backwards’ – with regard to MONEY, shows how limited your understanding is of the salient points about a national money system.

EITHER the private banks LEND us the national money system at interest (again, OK with Mr. Mitchell) or we issue our own money without debt or interest. One is private privilege and rentier, the other public purposed debt-free. Get yer head out, Danny.

Denninger actually has some good ideas on money. He totally supports the Kucinich proposal for good reasons – it ends issuing money as debt. Let me know if you want the Ticker link. What he calls the ‘dollar-of-capital’ system, we call the “real money’ system.

Your anti-GUV rhetoric is expansive, but vacuous. And I am not ‘against’ MMT, because MMT has an underlying principle that says that government SHOULD, and does, issue the nation’s money as a first-use public purpose money-utility. They’re just wrong to believe that it “does” so. It does not. Never has.

Finally, while correct that wealth is not currency and credit, your association of capital and wealth as the drivers of our well being is just as bad. I suggest a read of Dr. Frederick Soddy’s book “Wealth, Virtual Wealth and Debt” for a clearer understanding of why we need to differentiate debt and other paper claims on the national wealth from the national wealth itself. Once done, the distribution of the real wealth will flow to its producers – the workers of America.

Thanks.

LikeLike

Joe,

I still think your argument on gold is weak. The trust in commodities markets is low? Yet gold has gone from $250 to $1900 (800%). Anyway, let’s leave gold alone for now.

Take your anti-GUV blinders off. Again, a stupid statement : “issuing currency without backing is theft”. I already explained Greenbacks – you explain the theft.

I’ve read about the Kucinic bill and as I explained on the previous post, there is nothing wrong with the bill, the people managing the budget are the ones I fear.

I think you are mis-understanding my point about the issuance of money. I am not saying banks should issue it, I agree that the government should issue the currency. I disagree that the government should be issuing MORE money when they run out of tax reserves. The Denninger proposal is to issue more of it as REAL GDP grows (not to be confused with the made up GDP based on debt), however, I see that as a long shot. In my opinion, the economy does NOT need “more” money to grow. It needs more real output (capital, wealth).

Again, Denninger’s idea is good in theory, in practice, the government will issue all the money they “need”. I’m not sure what real money system is, but I’ve read through his work, and he believes the government could issue one dollar for every real growth in output. As I said above, it wont happen that way in a million years. Mish went after Denninger for the same reason, and I agree with Mish, we dont need more dollars.

I may sound like I’m anti-government, but I digress. Even the lefties are hating Oboso at the moment for not sending enough “free” checks. The right is doing what the right always does, bashing the left. The left is also doing what the left always does, bashing the right. Somewhere in the middle you have folks like me, who heard the same line over and over again.

I will be honest, I didn’t understand money until a few short years ago and will go on the record saying that 99% of Americans don’t understand it. If they did, the course of the country would look alot different. I actually thought the same things MMT proposes money is and should be when I was a kid.

I also disagree with your final statement, and not because I am in love with wealth. I say this because of the same MMTers, socialists, leftists, Marxists and everyone else in the country. Everyone needs more, medicare, social security, welfare, etc, – is that not wealth?

The difference between the virtual and the real wealth is as clear as water. Look around you, all the homes, the stores, the food, the farm, the infrastructure, all that is the wealth. MMT believes that it is the issuance of currency that creates wealth/purchasing power/good economy, etc. It’s not.

In summary, the American worker will not see the fruit of his labor until his greed gets sponged. The bankers and politicians are fooling everyone and our eyes are too full of dollar signs to see any different, we are stupid. The bankers push loans onto the population to grow their “equity” (GREED) while taking what used to be theirs and pushing them into debt. The politicians will offer all kinds of goodies “food, medical care, etc” (GREED) because, after all, they are looking for the good of society. They just forget to add that all that food, medical services, etc will have to be paid for and that in the process they will just skim a nice profit. Wait, you are telling me I have to pay you $100 dollars to get back $50? Can you now see why we will not get anything until we get hammered by a collapse?

LikeLike

Joe,

what happens when people send payments to the IRS, the Fed (routine ops) clears checks by reducing the account balance of the payor, via back room operations on bank’s Reserves.

Inside the Fed’s accounting system, true enough, a Treasury tax account is credited … usually held at a private bank like JP Morgan-Chase.

Treasury spending is when it issues a payment, ordering the Fed to increase someone’s account balance. But Treasury and IRS are not functionally operationally connected, and the IRS does not “bring in” more money than the Treasury would otherwise “have”. Because a currency issuer neither “has” nor “doesn’t have” money, operationally. When it creates money by spending, that money exists. When it taxes, that previously-created money is deleted, just like the delete or backspace or minus key on your keyboard.

Treasury does SEEM to obtain money from “borrowing” but in reality that “borrowing” is monetary operations (Fed policy, conservative, Friedmanite). This “borrowing” is selling T-Bills to banks to conduct a “reserve drain”, which keeps overnite Interbank Lending rates from falling to Zero (without any intervention).

So the Govt “borrows” by the Fed debiting banks’ reserve acct balance and crediting banks’ securities acct balance.

Congress has a mandate that the Fed is prohibited from closed Treasury Auctions. The Central Bank is prohibited from directly swapping assets — FRNs vs T-Bills and T-Bonds and T-Notes — with Treasury, thereby funding the Govt directly. Instead, the Central Bank tells a collection of private banks (primary dealers chosen by the Fed itself) how much Securities it intends to buy, and the PD banks (foreign and domestic) make purchases at closed Treasury auctions. Then they sell those T. Securities to other banks that bid in OPEN Market Operations, including selling to the Central Bank.

Congress is responsible for setting up and keeping that convoluted cluster-f__k of a system. If they didn’t want that, they could alter their own laws and rules. They could allow the Fed & Treasury to interact directly … and 100% of Fed’s net “profits” after legislated and rules-based expenses (like paying dividends back to banks that are charged for loans) go back to the Treasury. The Fed paid some $45B back to Treasury .. which really didn’t have a need for that $45B, which could have been left in the private sector, e.g. that was a hidden “tax” on savers & investors. But golly, that sure helped the imaginary “budget crisis”.

If Congress changed their own rules on Fed & Treasury ops, so that Treasury wouldn’t have to “borrow” from private banks (which are allowed to lend money that they have borrowed from the Fed’s “overdraft” allowance), then that would cut out the Middlemen from their “free money” ENTITLEMENT program. Is Congress likely to cut out THAT “free lunch”? Ha ha. Don’t bet on that one.

LikeLike

Wow. So many words.

Sorry,

Another ‘shoehorning’ attempt to translate the theory of monetary sovereignty, autonomy and independence into this bankers-school construct of debt-based money. It don’t fit at all.

The government NEVER creates the money that it spends, except with Greenbacks and a few US Notes..

Show me some proof that they do.

Don’t say any fifth-grader could figure it out.

I will provide the links to the government financial management handbooks that show there MUST be a flow into the TGA from traditional private money sources BEFORE the government can spend any money on anything.

But, what do you have for proof that the government creates money when it spends?

Nuanced reserve accounting?

Soft currency economics?

Have a visit at sovereignmoney.eu for a discussion by people who understand what sovereignty in money really means..

Thanks.

LikeLike

Gary,

Starting with a primary example of somewhat incomprehensibe (as usual) Mosler-speak.

“Treasury and IRS are not functionally operationally connected”

Really? Not functionally operationally connected?

You have obviously never bothered to seek out the IRS’ financial management handbooks on the agency’s responsibility for handling the tax payments it receives in transferring these, operationally, to Treasury, whether the TGA or former TTL accounts.

IRS is part of Treasury and they are BOTH functionally and operationally connected.

“and the IRS does not “bring in” more money than the Treasury would otherwise “have”.

I can’t imagine what that means nor the purpose of making such a statement.

“Because a currency issuer neither “has” nor “doesn’t have” money, operationally.”

This is big fail for MMT – its inability to distinguish between two things. The GUV as sovereign money issuer would be exercising a sovereign power. But that same GUV as spender of revenues is exactly the same as any other governmental entity,

As such, even when we restore the money creation power TO the government, we MUST require accountability OF that government as an implementer of public policy. Becoming the currency issuer is NOT the same as having a blank-checkbook by the government. That would require an aristocracy.

The government as a public body MUST have a budget, and thus MUST acquire revenues as income in order to make payment on its expenses. Otherwise would be public anarchy in money.

Thus the currency-issuer may or may not have money, but the public policy implementer MUST have money in order to function properly.

Please stop with these meaningless clichés that always follow a declaration of – “Once you understand how the money system works…..”

I understand how the money system works.

“ When it creates money by spending, that money exists. When it taxes, that previously-created money is deleted, just like the delete or backspace or minus key on your keyboard.”

Ah, the keystrokers of the money system – MMT’s modern banker school legacy.

EITHER the government (Treasury) MUST have money in its TGA account PRIOR to spending, or it must not.

Where is your proof that the GUV does not need a positive TGA balance prior to spending, such that : “it creates money by spending”?

Here’s a clue. None exists. Because it’s not true.

The government taxes or borrows or receives via internal transfer ALL of its annual revenues that enable ALL of its payments.

Must admit I LOVE this one…

“Treasury does SEEM to obtain money from “borrowing” but in reality that “borrowing” is monetary operations …….to ….. keep(s) overnite Interbank Lending rates from falling to Zero (without any intervention).

That was never credible, but is illogical in face of IOR monetary operations.

But when the smoke clears, a claim is being made that we the people are $16 Trillion or so in debt to the private sector, in order to satisfy the overnite liquidity preferences of that same private sector.

You see, controlling interest rates to control the money supply to meet the broad policy objectives of the central bank is like doing a monetary Rube Goldberg blindfolded with one hand tied behind your back.

If you want to control the money supply, then see how Kucinich does it. Once the ‘quantity: of money is established, the “price” for money can be set by the market.

I really wish that MMT adherents understood more about the history of money and monetary systems.

Thanks.

LikeLike

Also, an Austrian Mises dittohead friend argued that without the “theft” of inflation, bank interest alone would have made him and us BILLIONAIRES since the Depression.

Of course this is idiotic, because Banks pay interest BECAUSE of the interest they get from the Treasury Bonds. Not to mention that prior to the Fed, banks routinely collapsed every few years, which not only wiped out interest gains but wiped out savings too. Your savings was not safe in the banks, because they were speculating on high risks but constrained by gold. So it was like 2007, on a smaller scale, every 4-10 years or so. Look it up.

Look up the “Free Banking” era. There was tons of fraud and bank owners fleeing in the night. Capital base and reserves were stretched farther than in 2005-2007.

This was too chaotic for actual capitalism — production & consumption — to work effectively. Actual tangible wealth was periodically wiped out, not just financial “vapor” wealth.

The Fed, plus abolishing the “by fiat” Fixed Exchange peg with gold was supposed to abolish periodic bank collapses. What happened? Behind the scenes, within the structure of the current system of guarantees plus controls and regulations, private interests and lobbyists kept the explicit and implicit guarantees but shredded the controls and regulations … in at least one case using a chainsaw to dramatize the shredding of safety controls.

Another word for that is purposely creating “moral hazard” for their benefit. Yet they have the GALL to preach to 300 million Americans about their lack of morality in our culture and debt repayment.

LikeLike

Every form of fiat money is, and always must be, a form of debt. Since, by definition, fiat money has no intrinsic value, it must be backed by some form of guarantee. That guarantee is the collateral that gives the money value.

The U.S. dollar is a debt of the federal government, the collateral for which is the full faith and credit of the government. The holder of a dollar is owed U.S. full faith and credit.

Thus, there never can be “debt-free” dollars.

There can be, however, dollars that are issued without the concurrent issuance of T-securities, which are not collateral for anything. T-securities merely are bank accounts, essentially identical with savings accounts and CDs.

In short, the federal government could spend without debt, by foregoing T-securities.

As to whether the federal government or banks creates dollars, this is akin to the carpenter/hammer question: Is it the carpenter that drives the nail? Or is it the hammer?

The government creates about 20% of the dollars in existence by paying bills, i.e. by sending instructions to banks, to increase the numbers in creditors’ checking accounts.

Both are involved, but like the carpenter, the government makes the decisions, and like the hammer, the banks carry out the process.

The other approximately 80% of the dollars are created by lending, most of which is done by banks.

LikeLike

Rodger,

Thanks for another of the MMT traditional Mitchell-Innes errors of monetary science and history.

RMM : “Every form of fiat money is, and always must be, a form of debt.”.

SCience and History:

The ‘father’ of Greenback money was Elbridge G. Spaulding.

A successful businessman.

A lawyer.

A banker – as in President of a bank.

The City Clerk and Mayor of Buffalo, New York.

A state legislative leader.

A Congressman, elected as BOTH a Whig and Republican to serve the people – he was Chair of the House Ways and Means Committee.

The New York State Treasurer.

It was Elbridge Gerry Spaulding who taught Lincoln that there was no need to issue debt in order to issue money.

As architect of both the Legal Tender and National Banking Acts, he saw that money was issued directly by the government into circulation, remaining in circulation for over a hundred years.

No debt was issued. Never.

From his Wiki page:

T. J. Stiles wrote in his biography of Cornelius Vanderbilt, “The First Tycoon”, that Spaulding “performed a true miracle: he conjured money out of nothing, and so contributed more toward the Union victory (and the future of New York’s financial sector) than any single battlefield victory.” Stiles continued, “If Wall Street had saints, then the college of financial cardinals would surely canonize Elbridge G. Spaulding.”[4]

But here we are, and Mr. Mitchell says it cannot be done.

RMM : “Thus, there never can be “debt-free” dollars.”

FYI, Rodger, ALL fiat money forms are backed first by the full faith and credit of the issuer, but importantly, hold their value based upon by the actual potential economic throughput of the nation. The national economy backs the money.

I will not try again to explain the difference between a liability of a ‘money’ issuer and a debt of same. I simply ask that you get hold of F.A. Mann’s The Legal Aspect of Money and digest the Chapters on The Monetary System: Its Organization and Incidents, and Monetary Organizations: Types and Payments.

The government creates and issues the coin-based currency units into circulation – more like one percent of the total money. Private banks issue the paper currency into circulation. But importantly, and without any doubt,the government creates ZERO PERCENT of our money supply when it pays its bills.

That is a complete fallacy and I ask you for any proof of its truth.

Thanks.

LikeLike

Banks certainly don’t print money. The Bureau of Engraving does that.

When a private bank issues a loan deposit, obviously there is an equal (greater with interest) debt obligation. Loan minus debt = zero. Therefore banks issue NO MONEY. Yet those loan deposits tend to “exist” for a term of 7 or 30 years or more, and are often never actually “paid back” or fully retired. Most home mortgages are rolled over into new bigger mortgages when the house is sold. Now car dealers pay off old car loans. People float HUGE lines of credit … and banks allow that.

So the total volume of money in circulation (is that M2? M3? M4? whatever) includes this non-retired credit.

ONLY the Federal Govt can issue payments (to military contractors and grandparents alike) which DO NOT require repayment as taxes or anything. That is pure money creation.

The fact that the Govt the “borrows” that money back — i.e. offers T-Securities accounts for banks to deposit their surplus reserves in the Fed, which they already do, but also earn interest on that savings — is a function of monetary operations and hitting targets for Interbank Lending.

People get MYSTIFIED and obsessed with financial operations and financial debt — that shadow of tangible wealth — while becoming oblivious to real tangible wealth, like health, food, housing, clean air, nice toys, secure retirement, aka “the good life”. It has taken quite an education by Neo-Classical Neo-Liberal “experts” — the same experts who didn’t see and created the speculative Bubble and inevitable Collapse — to get people to obsess on the shadow of wealth, the abstract numbers, and not on the real thing, our manner of living and overall prosperity, satisfaction, happiness, surplus.

LikeLike

Gary,

Your errant conclusion about banks not issuing any ‘money’ because of the double-entry bookkeeping system is pithy and in error. It must be fun creating these new realities about money as we go along, but they must also be reckoned with by people who do understand money beyond its ‘accounting identities’, and into its political-economic reality.

Money is legally defined as that which serves as the universal exchange media in the jurisdiction of issue. So-called bank credit serves that money function under the bankers-school system of money.

When banks make loans, they increase the money supply and the purchasing power of the exchange media extant. Banks create ALL the money, c.e. .

To foible around the accounting identity of a debt-based money system where one of its more serious shortfalls, that of its temporal nature requiring replacement upon repayment with another loan, is used to deny its money-system reality, deserves a little correction here,

Banks create the money by making loans. Period.

They create purchasing power.

They create exchange media.

They create ALL of the exchange media and ALL of the purchasing power in the national money system. What happens with non-monied financial assets is another matter.

Again, read the Fed’s MMM publication.

That the balance sheets of the loan-transaction parties balance to -$0- thereafter does nothing to change that reality. These banker-centric efforts by MMTers continually drift further from any credibility when these statements are made.

“ONLY the Federal Govt can issue payments (to military contractors and grandparents alike) which DO NOT require repayment as taxes or anything. That is pure money creation.”

It is not repayment AFTER the expense is paid that is in question, the question is of whether the GUV (Treasury) MUST HAVE a positive balance in its TGA account PRIOR TO making the payment, and it must.

Read the Treasury’s financial management bulletins.

So that is the opposite of the GUV being a money-creator. It is the GUV being a money-system USER. Which is what we all are.

Rather than denying this reality, MMT should be seeking to achieve the reality it says already exists. Then they would be reformers. And worth following.

Thanks.

LikeLike

It’s quite ludicrous to think that paper currency, which comes with the stamped signature of the Treasurer of the United States and Secretary of the Treasury, is printed willy-nilly by private banks, with their raft of printers running full steam in the back office.

THAT would be counterfeiting, just like if you wrote a check and forged someone’s signature.

When banks issue loans, they simply do an Asset Swap with the borrower, which they are legally licensed to do.

When YOU lend money to a friend, you lend your own capital assets, your savings.

When banks which maintain accounts in a system that includes the CB issue loans, they take in an IOU which is a valuable (and trade-able) asset, backed by property-collateral or unbacked like a credit card, and then issue a bank account deposit in an equivalent amount, which is also an IOU. That nets to zero.

That’s one reason that it’s nigh impossible to imagine abolishing private credit, as some non-MMT “public money” people say they want to do. This would mean making it illegal to take on an asset or IOU, and swap that with another IOU.

Congress has the POWER to do that, to rewrite the laws, but besides the fact of them not understanding that at all, that would be a horrific burden on commerce which would be deprived of quick and easy access to credit (and credit lines), made by private on-the-fly agreements.

Capitalism NEEDS credit as its lifeblood, future production and profits built on past borrowing, just like ancient farmers borrowing in the spring and reaping profits in the fall, or a typical development and production system, or wholesale to retail.

I’m pretty sure Congress would consider the abolition of credit to be full-out “communism”.

But it’s equally idiotic in the opposite direction to subject education and health care and other “infrastructure” basics in a modern capitalistic economy to the same “market” rules as farming and industry and high tech R&D … which itself has been protected and subsidized for over 100 years, all throughout the “glory days” of American capitalism.

LikeLike

I have been without computer and internet for several days and this is the first opening of a comment. Maybe the only one.

It would be ridiculous to say that I said that the banks ‘print’ the currency – that only happened in Weimar after the Allied victory – at our Orders.

The government ‘prints’ the currency(creates the money) – the banks ‘issue’ the currency into circulation. It happens in a collateralizing transaction between the regional FR banks and the depository institutions that are Members of that Regional Fed – as an addition to the money supply.

Why is that so hard to understand?

And there’s ZERO talk about abolishing private credit – except by you.

What is abolished is private money creation.

Government’s create and issue the money into circulation – for real, unlike you seem to think they do now – and the banks use that money for private credit creation.

You foment the myth that the government does not need to acquire from existing money its revenues – ALL of them.

Again, google up the government budgeting constraint – and apply the revenue-side tenets to government finance today.

LikeLike

Gary

I answered this rather hurriedly last night while visiting a friend’s house.

Today I have internet restored(?) and am at home.

I tried to clarify two majors:

1. NOBODY, especially me, said that the banks “create” (print) the paper money and I explained how the banks “issue” the money the GUV prints into circulation. I suggest a close read of the Fed’s “Modern Money Mechanics” publication, as it 100 percent comports with my description. It should really be required reading No. 1 on the MMT reading list.

IOW, I know what happens when banks make loans, especially as relates to money-creation.

2. NOBODY, especially me, advocated for the abolishing of private credit. We want private banking and private credit-creation. But there is world of political-economic difference between private credit creation and private money creation – not yet grasped by the MMT banking school theory.

3. When you fail to comprehend the comments that you reply to, and in doing so resort to language like ‘ludicrous’ and ‘idiotic’ based on that misunderstanding, your fingers are pointing those words back at you. I am glad to have a reasoned discussion on any issue with which we disagree.

Thanks.

LikeLike

You are right about the dollar being a debt of the Federal government, but the Federal government ain’t issuing dollars these days, it’s issuing bonds and receiving debt/credit (not dollars). The government/Fed created these dollars a LONG time ago and the money supply of the US actually remained at around 1 trillion for a very long time, only recently did it double to about 2 trillion (during the 2008 crisis). Compare that to the amount of debt out in the system, in the 100s of trillions. These figures are made public by the Federal Reserve.

As I said above, the issue has not been the issuance of dollars, it’s lending the same dollars over and over and over and over (Fractional Reserve Lending). That is the only way you end up with trillions in debt on top of 2 trillion dollars. In other words, it’s a ponzi scheme.

So, when the government borrows, say 100 billion, the banks will lend the government the same funds it lent someone else a year earlier. There is no creation of dollars, there is just an additional pledge on the same money.

With regards to Joe’s comment on the creation of the currency. The government created the currency a long time ago as I said above. And honestly, there is no need to create more currency. Have you heard anyone complain about being able to buy too many things with their earnings? I dare you to find one person with such complain, yet we hear stupid comments on how savers are hoarders and harm others. Truth is the opposite is true, Bernanke and our government has been destroying and punishing savers for a LONG time.

There is a need to end fractional reserve lending, which is essentially akin to a Maddoff ponzi scheme in which your own funds are lent to you and your neighbor. Like I said before, MMT proposes things that I thought were correct before I even learn math. Anyone with a 5th grade math should be able to figure out MMT is a myth.

LikeLike

Anyone with a 5th grade math should be able to figure out MMT is a myth.

Agreed. That’s what a person with a 5th grade math education might think.

LikeLike

Fractional Reserve Lending is a myth. The reality is more like NO reserve lending.

In fact, banks are “not reserve constrained” at all.

Banks DO NOT take money OUT of Reserves and then Lend that same money to borrowers.

In fact, when a bank issues a loan, it creates and Asset .. the signature and promise of the borrower. That’s a real asset and future income, assuming the borrower remains solvent, hence risk.

With that loan-asset as “collateral” (so to speak), the bank creates an equal deposit, by adding a balance to an internal checking account or transferring that balance to an external checking account.

Reserves are not a question.

Two weeks in ARREARS, banks are required to balance the loan payments that left the bank vs came into the bank (etc.) and determine if they are short or over on their required reserve balance. Then they borrow that from other banks, transparently (apparently) to the general public, or borrow from the Fed window, so they can clear payments.

So this is actually resolved FOUR WEEKS in arrears of bank lending. Obviously, that therefore has nothing to do with any “fractional reserve” idea, a relic of archaic thinking and operations.

Alan Greenspan took this a step further by a policy called “sweeps” (which resembles “kiting checks” in the most grotesque description). Banks are permitted to “sweep” checking aka unstable demand deposit balances into reserves for a few hours overnite and PRETEND those checking balances are saving reserves. After all payments are cleared, banks then “sweep” those fund balances back into checking accounts, for the next day’s operations. Fully legal. After all, it’s the banks money, not yours. You just have an IOU from the bank, your balance statement.

Since your assets-savings is a LIABILITY aka DEBT that your bank owes you, when your bank deposits its savings in Federal Securities accounts, that is an asset to the bank and a LIABILITY aka “Debt” of that account issuer, the Govt.

That is the ONLY reason this is called “national debt”. Uncle Sam provides a free service of Bank Accounts for banks and for the Super Rich, and by definition if that’s an Asset of the Banks and Rich people, it MUST BE a liability aka debt of the Govt, by basic accounting definitions.

LikeLike

CORRECTION:

Then they borrow that from other banks, which is apparently “opaque” to the general public .. i.e., the general public is not aware of these back room operations of banks and the Fed.

LikeLike

Gary,

“Fractional Reserve Lending is a myth. The reality is more like NO reserve lending.

In fact, banks are “not reserve constrained” at all.” …..

“Obviously, that therefore has nothing to do with any “fractional reserve” idea, a relic of archaic thinking and operations.”

First, as you describe, fractional reserve-based lending is not a myth, though it does not mean that the banks are reserve constrained in lending. As you also describe, the regulatory requirement is not against lending, but in acquiring the ‘required reserves’. While those ‘required reserves’ must be made available by the CB, they must also be a ‘fraction’ of loans made against checking deposits.

So, while the ‘money-multiplier’ has been shown to by a myth, causally-speaking, that fact should not lead to any conclusions about fractional reserve lending also being a myth. Rather its understanding merely requires explanation.

Much more importantly, you are WAY correct about reserve-based lending being a throwback to the gold-standard.

Why is MMT in favor of continuing with this bankers-school fractional-reserve (private debt-based money creation) system?

The Kucinich Bill corrects both of these errors. It moves us completely away from reserve-based banking (by lending real money) and puts the government in charge of actually issuing the currency.

http://www.govtrack.us/congress/bills/112/hr2990/text

Because its OUR money system.

LikeLike

I thought it was 3% vs 97%, but that’s probably changed a lot since the private financial sector blowout and collapse of all that “vapor” financial assets.

LikeLike

You said, ” . . . there was no need to issue debt in order to issue money.”

Correct. As I said, “The federal government could spend without debt, by foregoing T-securities.”

That is why so-called “debt clocks” measure the total of outstanding T-securities, not the total of dollars.

However, money itself is debt, because the federal government owes the holder of dollars, the collateral for dollars, i.e., full faith and credit.

Without that collateral, money would be worthless.

Notice that the green paper is called dollar “bills” and federal reserve “notes.” The words “bill” and “note” are used to denote debt.

You said, ” Private banks issue the paper currency into circulation.” Obviously wrong, as it is the U.S. government Treasury that issues paper currency.

Also, irrelevant.

Just as a car title is not a car and a house title is not a house, paper currency is a title to money, but is not, in of itself, money. See: https://mythfighter.com/2011/06/20/why-a-dollar-bill-is-not-a-dollar-and-other-economic-craziness/

If you are old enough to receive Social Security, you will notice that once a month, your checking account balance increases, which increases the money supply. By whose command does this happen, your bank’s or the federal government’s?

Without the government’s command, your bank would not increase your checking account. The government tells your bank to increase your checking account balance and by how much, and your bank does as it is told..

But, if you think the bank actually is creating the money, then you also believe the hammer, not the carpenter, decides where to drive the nails, how many nails and which nails to drive.

Banks do create dollars by lending however. That’s the 80%

Recently, the government had to destroy $30 million worth of paper currency, because of some sort of misprint. Do you believe that at the moment of destruction, the nation became $30 million poorer?.

LikeLike