Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

Often, I receive notes from folks on the right, who hating government and professing macho self-sufficiency, tell me government doesn’t create anything or do anything or benefit anything, and that all the benefits come from the hard work of private people and private companies.

In one sense, these folks are correct, as everything ultimately does come from people (so far, until the machines take over ala “Terminator”), but diminishing the vital role of government seems especially ignorant of fact.

I won’t get into the myriad scientific, environmental and social initiatives funded by the federal government. To deny them is to be deliberately obtuse.

Rather, I’ll allow those on the right to stew over the following graph:

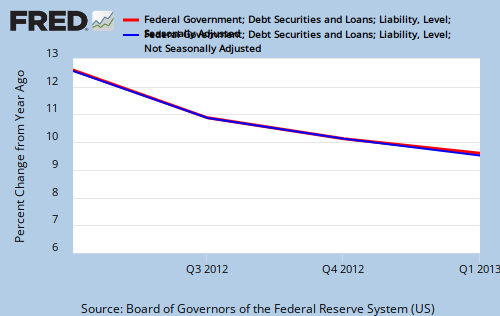

The red line shows annual changes in federal deficit spending. The blue line shows annual changes in corporate profitability.

There are many causes for corporate profitability and unprofitability, and deficit spending is just one of them, so the lines are not perfectly in parallel — but pretty close for economics, a science in which every effect has multiple causes.

So, unless one wishes to believe that corporate profitability somehow stimulates federal deficit spending, or that the whole thing is one giant coincidence, and not cause-and-effect, we are left with the fact that federal deficits increase corporate profits.

This makes logical sense, if for no other reason than deficits pump dollars into the economy, and dollars are what fund work. Corporations are part of the “private people and private companies” that ultimately accomplish everything.

[You may believe that not only is government spending useless, but corporate profits are equally useless, in which case please return to chipping your stone ax prior to skinning a mastodon.]

During recessions, when the federal government and the public temporarily remember the need for deficit spending, corporate profits actually rise.

But after the recessions end, when the government and the public forget what cured those recessions, and “stimulus” becomes a bad word, the government cuts deficit spending, and corporate profit growth begins to fall — as is happening, now.

And the whole ridiculous charade begins anew.

Now, yet again the public has turned against what lifted us from the last recession and we yet again are in the deficit cutting mode, and we yet again head for recession, and corporate profit growth yet again is falling.

Yet again and yet again and yet again and yet again — learning nothing from yesterday.

Isn’t it amazing how the world’s most intelligent species can be so ignorant?

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

THE RECESSION CLOCK

As the lines drop, we approach recession, which will be cured only when the lines rise.

#MONETARY SOVEREIGNTY

Great Post Rodger, the art of cognitive dissonance or more likely simple intellectual dishonesty has been absolutely perfected by conservatives and corporate dems alike.

I’ve been trying to get a satisfactory answer to the comment I posted the other day and have had a hard time finding one. Maybe you could help?

How much money did Congress appropriate to come out of the Treasury General Fund to “pay back” the debt during the Clinton surplus years? Obviously, I’m aware that the nominal amount of US securities deposits still rose during the period due to the still positive cash flow into the SS “trust fund” which of course by law must be deposited into securities accounts at the Fed.

You are much better navigating the FRED than I am. Maybe you can find an answer. My MMT\MS understanding tells me that, of course no Treasury money went to payback existing principle on maturing securities because all the Fed does is transfer your money from one of your accounts to another or your accounts, but for the mainstream…. If the Treasury literally doesn’t pay back debt (thats the Fed’s job) and we have the financial records from just 13 short years ago to prove it, then how can anyone realistically talk about the “federal debt” and about how bad it is with a straight face? Aside from the whole “expand the gap” theory? Shameful

LikeLike

Clinton merely ran a surplus, meaning tax collections exceeded spending.

You’ve not found any Congressional appropriation to pay back so-called “debt,” because It doesn’t work that way.

So-called “debt” is “paid back” every day, as T-securities mature. Meanwhile, so-called “debt” is increased every day as T-securities are sold to match spending.

So, if the spending rate is less than the maturing rate, the “debt” goes down automatically. That is what happens when the government runs a surplus.

LikeLike

You would think that so-called serious economists would have noticed that the Treasury never pays back any debt, even in a surplus environment. And if that’s the case, how can the “national debt” ever be something to worry about? And yes, that question is rhetorical 🙂

LikeLike

These deficit cutters apparently had a chance “to learn” decades ago:

“Business profits are equal to the sum of capitalist consumption, investment, government deficits and net exports, minus worker savings.” -Michal Kalecki, (Theory of Economic Dynamics ,1965)

Decreases in government deficits guarantees a decrease in all the other variables of the above equation and of course a lower GDP. Rodger has stressed this for years.

LikeLike