Mitchell’s laws:

●The more budgets are cut and taxes increased, the weaker an economy becomes.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Austerity = poverty and leads to civil disorder.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

==========================================================================================================================================

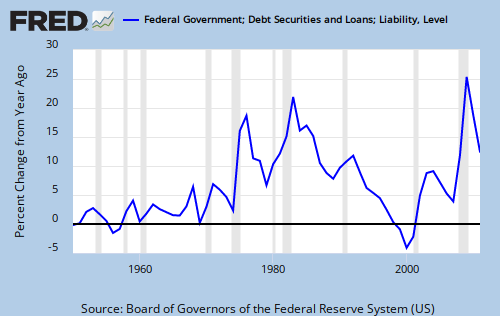

In other posts on this blog, we have discussed how reductions in federal debt growth, as shown by the following graph, “Federal Government Debt-Domestic Nonfinancial Sectors,” immediately precede recessions. This comes as no surprise, since a growing economy requires a growing supply of money, and deficit spending is the federal government’s method for adding money to the economy.

FEDERAL GOVERNMENT DEBT- PERCENTAGE CHANGE FROM YEAR AGO

Clearly, federal debt/money growth is essential to keep us out of recessions. Yet, when we look at “Debt Outstanding Domestic Nonfinancial Sectors” which includes not only Federal debt, but also outstanding credit market debt of state and local governments, and private nonfinancial sectors we do not see the same pattern.

TOTAL DOMESTIC NONFINANCIAL DEBT — PERCENTAGE CHANGE FROM YEAR AGO

In fact, when we subtract federal debt from total debt, leaving only state, local and private debt, we see the opposite pattern. Recessions more often seem to follow increases in state, local and private debt.

STATE, LOCAL AND PRIVATE DEBT, PERCENT CHANGE FROM YEAR AGO

Now in one sense, money is money. Your buying on your credit card creates debt/money, just as federal deficit spending creates debt/money. Presumably, both should have the same stimulative effect on the economy. They do, but not long term. Why?

Because, unlike the federal government, you, your business and local governments cannot create new money endlessly to service your debts. Your debts can pile up to the point where you must liquidate them by paying them off or by going bankrupt. When non-federal debts become too large, a growing number of people, states, cities and businesses must pull back and stop further borrowing, i.e. stop creating money, or even destroy money by paying off loans. When that happens, we have a recession.

(As an aside, this is one reason the early stimulus efforts had so little effect. People used the stimulus money to pay off loans, so while the federal deficit spending created money, the loan pay-downs destroyed it. Debt reduction destroys debt/money.)

During the recession, and for a short time after, we tend to cut back on our personal borrowing and liquidate debt/money. Then we begin to resume borrowing, more and more, until again, we hit our personal limits and cut back, causing yet another recession. The sole prevention of this cycle, which averages about 5 years in length, is to make sure that federal deficit spending grows sufficiently to offset periodic money destruction by the private sector.

In summary, federal deficit spending is good for the economy, always good, endlessly good (up to the point of inflation). Private and local government spending/borrowing also is good, but not endlessly. Unlike the federal government, the private and local-government sectors eventually reach a point where debt is unaffordable and unsustainable.

To prevent recessions, the government continuously must provide stimulus spending, then provide added stimulus spending to offset the periodic reduction of money creation by the private sector.

Rodger Malcolm Mitchell

Monetary Sovereignty

![]()

==========================================================================================================================================

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia. Two key equations in economics:

Federal Deficits – Net Imports = Net Private Savings

Gross Domestic Product = Federal Spending + Private Investment and Consumption + Net exports

#MONETARY SOVEREIGNTY

In your opinion, is there an upper limit of US Federal Debt beyond which federal debt becomes harmful? As the US Federal Government gets more and more in debt, the percentage of each dollar of revenue that pays interest on the debt increases. If this trend increases indefinitely, won’t we one day cross a threshold where every dollar of revenue is needed to pay interest on the debt?

LikeLike

Kevin,

At some point, creating debt/money can cause inflation. Some professors, whom I know, believe that is the point of “full employment.” There is some disagreement about that — also disagreement about what “full employment” actually is.

I discuss this at SUMMARY, point #12.

Important: “Revenue” does not pay for federal spending. If taxes were $0, this would not change by even one penny the federal government’s ability to spend. I discuss this at TAXES

Rodger Malcolm Mitchell

LikeLike

Good stuff. Are policymakers just unaware of these graphs? I’m curious what omitted variable bias they would claim is tainting your causal chain.

Also, what are your thoughts on this article:

http://mrzine.monthlyreview.org/2010/ms140610.html

LikeLike

I don’t know what policymakers are aware of. They still think the debt is too high, so clearly they are not aware of much. I’ve Emailed Warren Mosler for his take. Perhaps you know someone knowledgeable who might comment.

As for the article, the authors think federal debt is supported by “enormous productive capacity and rich natural resources.” Wrong.

Then they drift off into a meaningless discussion about the uses of debt.

However, they are right that: “. . . the issuance of currency on which no interest is paid and which would therefore eliminate the need for ever larger budgets to service the debt.” And they are right that: “The cause of past hyper-inflations has never been the printing of currency.” I’ve been preaching those points for years.

They talk about paying off the debt, not realizing this would eliminate money in America.

In total, they don’t really understand federal debt and how it is created and serviced nor do they understand that federal “debt” merely is a synonym for “net money created.” They are uncomfortable with it. But they still are miles ahead of the debt hawks.

Rodger Malcolm Mitchell

LikeLike

I think it’s at least arguable that the US’s debt is supported by its economic fundamentals, which the authors stated in a rather clumsy fashion. Most of this money is debt stuff rests on the credibility of money, which is based on the long-term viability of the economy. I think they were just trying to distinguish the US from Zimbabwe, for example.

LikeLike

Nick,

The acceptance of the U.S. dollar, as the basis for world trade, is supported partly by our economic strength. But the demand for the dollar is based on risk/reward, neither of which depends on economic fundamentals.

Risk is inflation and reward is interest rates, both over which the Fed has control, and the world knows it.

Funny how Zimbabwe always comes up. The example used to be Germany. Anyway, Zimbabwe is racked by civil war, a horrific land “reform,” Robert Mugabe and other problems having nothing to do with debt creation.

LikeLike

Interesting post, Rodger! 🙂

I wonder if there is a causal relationship between a government surplus and an increase in private debt? It could go both ways, I suppose. A gov’t surplus takes money out of the economy, which is made up for (and more) by private borrowing. Or private borrowing stimulates the economy, producing increase tax revenue and a gov’t surplus.

Anyway, there are people who compare fiat currency with a Ponzi scheme. They would have a point, I think, if they made the comparison with private debt. To illustrate, suppose that we had no gov’t debt (money) but relied totally on private bank debt for our money. Because of interest, to pay off the current debt requires the creation of even more debt, in an increasing spiral of debt. As with a Ponzi scheme, that spiral will eventually end in defaults, bankruptcies, and bank runs.

By contrast, with gov’t debt in a fiat currency, even if the spiral of debt ends, the gov’t can still pay off the debt without creating new debt. That difference is telling. 🙂

LikeLike

“. . . a growing economy requires a growing supply of money, and deficit spending is the federal government’s method for adding money to the economy”

right

“federal borrowing is good for the economy”

confusing let down following the previous, useful statement

Solution: “currency deficit” spending is NOT a debt; selling Treasury bonds is simply an arbitrary, irrelevant habit left over from Gold Std days.

Pointing that out would alleviate much of the confusion embedded in arcane economics jargon.

LikeLike

Roger, you are correct. It’s not the federal borrowing that’s good for the economy, it’s the federal spending that’s good for the economy.

I was trying to tie the graphs, which show debt, to the economic result. I use the words “debt” and “borrow” reluctantly, only because that is the way they commonly are phrased. More correct would be “money created” and “create money.”

Rodger Malcolm Mitchell

LikeLike

Rodger,

See:

http://video.google.ca/videoplay?docid=5352106773770802849#

A good explanation of debt is money/money is debt, that anyone can understand. Also, a very simple explanation as to who, what and why your theory will never fly.

I’m through,

Mike

LikeLike

It’s a nice video, but wrong in some respects. Fractional reserve banking is a popular myth. Any time a bank needs more reserves, it can get them from the government or from other banks. Bank lending is not limited by deposits or reserves. It is limited by bank capital requirements.

Also, contrary to the video, taxes do not pay for government debt.

However, I agree with the video that government should not borrow. I repeatedly have said this.

Given all the video tells you, what is there about my theory you think won’t fly?

Rodger Malcolm Mitchell

LikeLike

Too bad they discontinued the last series; it’s interesting to see the dip in State, Local and Private debt just before the rise which is just before the recession. Could we have a little money pump to the upper classes going on there? It might be interesting to plot it against the Republican birth rate…

LikeLike

Yes, I’d like to see the series continued, but don’t know a data source. Perhaps someone can help find it.

This seems to be a very important series that never is recognized.

LikeLike

John, I found an updated series, which shows exactly what you mentioned.

Rodger Malcolm Mitchell

LikeLike

Roger followed you here from warren’s consumer borrowing rare gain post.

http://www.businessweek.com/magazine/content/05_49/b3962112.htm

Remembering this article how basically the IPO’s of mastercard and visa were to dump onto the sheeple all the upcoming legal fees and lack of market growth.

Why take mastercard and visa public NOW (within the past few years relatively speaking) if the smart brains didn’t think there wasn’t much more potential for growth and profit? V has been a real loser for investors, MA a winner, still I think looking at your data and the relative recency of both IPO’s, that as Bush said, this sucker is going down! Consumer credit is going to contract for many many years. What silly fools would lend to college princess shopping machines that have NO intent to work after going to college but move back in with mom and dad and probably default on the credit cards and just not pay the student loans?

LikeLike