Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

=====================================================================

Remember the big bankers? They are the rich crooks whose gambling helped cause our worst recession since the Great Depression. The also are the rich crooks whom the federal government bailed out.

And they are the rich crooks who continue to rake in multi-million dollar compensations, even after their banks needed bailing out.

And they are the rich crooks, not one of whom even has been prosecuted, much less convicted by the Obama administration, because let’s face it, bribery works.

(Those campaign contributions and promises of lucrative employment later, create a protective barrier for rich crooks.)

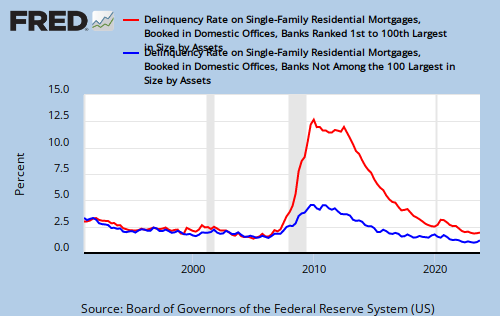

Anyway, if you remember those rich crooks, the following graph will interest you. It compares the 100 largest banks with the rest of the banks, based on mortgage delinquency.

For many years, the mortgage delinquency rate was low and essentially the same for the largest and smaller banks. But once the big banks started accepting, bundling and selling “liars loans,” that all changed.

When those liars loans inevitably fell apart, the rich crooks should have had to pay the price — except for one small detail: President Obama (the self-proclaimed friend of the poor) gave the big banks money — enough money to pay off their losses and enough money to continue paying multi-million dollar salaries.

So, while the rich bankers bleat about getting “big government” off their backs, it turns out, big government is nowhere to be found — except on the backs of the poor and middle classes.

Today, nothing has changed. The laws and federal oversight of banks remain weak and untouchable.

As you know, bribery works.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D — for everyone

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Long-term nursing care for everyone

5. Free education (including post-grad) for everyone. Click here

6. Salary for attending school (Click here)

7. Eliminate corporate taxes

8. Increase the standard income tax deduction annually

9. Increase federal spending on the myriad initiatives that benefit America’s 99%

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

#MONETARY SOVEREIGNTY

Speaking of criminal bankers, on Monday the interest rate on federal Stafford loans will double to 6.8 percent.

Most student loans are Stafford loans. When students default on the loans because students cannot find jobs, the U.S. government reimburses the lenders with money created from nothing, but keeps students on the hook for the debt.

About seven million students are expected to take out Stafford loans between 1 July and 31 Dec 2013 at the 6.8 percent rate.

If a student borrows the $23,000 maximum (which is increasingly common), then he or she would repay $27,163.20 at a 3.4 percent interest rate over 10 years, and $4,598.40 more at the 6.8% rate. (Plus fees and penalties, which compound for life.) Many students take out Stafford loans, plus other loans from private lenders.

Elizabeth Warren’s bill is being allowed to die in committee, even though petitions backing it have received over a million signatures.

Yesterday Senator John Reed (Dem- RI) introduced S. 1238 to extend the current interest rate of 3.4% for another year. Reed’s bill has 37 co-sponsors, all Democrats except for Bernie Sanders (Independent).

I doubt it has a chance, given the austerity fever that continues to plague mankind, just as it did in the 1930s.

In the USA, the blame for austerity fever lies not with bankers, politicians, and rich people, but with average Americans, most of whom would consider it immoral for college students to get free tuition (like students did until the mid-1960s).

The average American hates his neighbors. He dreams of winning a big lottery prize (or being “raptured” by Jesus to a luxury resort in the sky, which is the same thing), and he resents any suggestion that his neighbors not suffer with debt and poverty like he does. He has to suffer, so why shouldn’t all average Americans suffer? (I myself would like to see a lot less suffering for EVERYONE.)

This is the source of austerity fever: mass materialism, selfishness, and self-righteousness.

I see that selfishness in people who are contrary for the sheer fun of being contrary — like one or two who comment here on Rodger’s blog. They say, “You are wrong,” but when they are asked to give the “truth” as they see it, they go silent.

They too contribute to austerity fever.

LikeLike