Uncanny.

Even more uncanny.

#Monetary Sovereignty – Mitchell

Economics, Money and Debt

Uncanny.

Even more uncanny.

♫ C’mon baby, let’s do the twist. C’mon baby, the biased hypocrite twist. ♫

The “biased hypocrite twist” is the attempt by a guilty party and/or his acolytes to shift the conversation about his guilt to a conversation about the bias and hypocrisy of his accuser. For example:

Mother: “Donald, you created a fake university to steal money from those innocent students.”

Donald: “Where were you when little Timmy took a nickel from your purse? Why didn’t you criticize him? You’re a hypocrite.”

Mother: “But I did criticize him.”

Donald: “And, you’re biased against me.”

Note how Donald uses his claims of bias and hypocrisy to twist the conversation away from his guilt to a conversation about the guilt of his accuser.

Right-wing columnists like the Chicago Tribune’s John Kass and those from Breibart or Fox “News” use this device all the time. The concept is this:

If I can point to anything at all that Barack Obama or Hillary Clinton did wrong, this proves Donald Trump is innocent and his critics are biased hypocrites.

Here are excerpts from a recent Kass article:

If there is one thing worse than that photograph of a little Honduran boy breathing through an oxygen mask after being hit with tear gas on our Southern border, it’s this:

Using that image as a sentimental weapon to fend off or obliterate clearheaded immigration policy.

No, Mr. Kass, tear-gassing hundreds of innocent men, women, and children is worse. Your and Trump’s lack of compassion is worse. And as for “clearheaded immigration policy,” kindly explain what Trump’s policy is.

As best as I can discern, the “clearheaded” policy is to exclude everyone from Central and South America, and to enforce that policy by separating thousands of children from their parents and keeping the children in jail. The “clearheaded policy” seems to be to keep as many out as possible, and to make people wait endlessly for a decision about their applications.

That’s a “clearheaded immigration policy”?

But that’s where we are now, aren’t we? The caravan of thousands of Central American migrants is finally at the border. Mexico is keeping them back. The other day, after rocks were thrown at American border officials, several hundred migrants bolted through, trying to illegally rush their way into America, and some were hit with tear gas.

Wrong. The gas was shot illegally into Mexico, not at those who “bolted through.” And “some were hit with tear gas” makes it sound almost accidental, rather than intentional.

The left has no answers to what’s going on along the southern border. Instead, we’re given shrieks of rage at President Donald Trump. They conveniently forget that under President Barack Obama, migrants who tried crashing the border and threatening border officials were hit with chemical agents.

Some journalists conveniently forgot this, or perhaps didn’t even bother to look at what Obama had done.

And there it is: The “biased hypocrite twist.”

So long as Obama did it, then it’s O.K. for Trump to do it. Up ’til now, the right has been telling us that everything Obama did is wrong. Isn’t it ironic how the right wing now has made Obama the example of what to do?

Now I can’t think of any responsible person who likes the idea of children suffering. I don’t think you like it either. Parents brought the little ones into that chaos on the border. I wouldn’t have done it, and perhaps you wouldn’t subject your children to that danger. Yet still, it tears at the heart to see it.

And what would you have done, Mr. Kass? Would you have stayed in your failing nation, and doomed your children to lifetime victims of crime and misery? Or would you have tried to escape to where your children could have better, safer, more productive lives?

And if Trump doesn’t like the idea of children suffering, why does he separate them from their parents, put them in a huge jail, and keep them there for months?

Is there anything wrong with mandating that immigrants legally apply for asylum rather than break into the U.S. and fade into America? I happen to think that’s fair, and it’s legal.

Nothing is wrong with mandating they legally apply, except Trump has rigged the system so that waiting times are not in the days, weeks, or even months, but years. It is a system rigged to exclude. A fake system.

Yet where are the liberal Democratic solutions to address those in the migrant caravans determined to push illegally across the borders?

How about processing them faster. That would be fairer, cheaper, and easier than sending thousands of troops to the border, firing tear gas across the border, separating children from their parents and doing everything possible to exclude everyone with brown skin?

Political asylum is reserved under law for those who are threatened or attacked because of who or what they are. Asylum doesn’t apply to the majority who’d like to come here for better paying jobs and social welfare benefits.

The Trump/Kass solution is to exclude everyone and to torture children and their parents.

What we have in place of Democratic policy is a steady stream of wailing, anger and virtue signaling.

Yes, the stone hearts of the right wing wail and anger only when the white rich have to pay more taxes.

Remember that for several weeks leading up to the midterm elections, as the migrant caravan formed in Central America and made its way north, Trump, in his typically heavy-handed and overstated Trumpian fashion, kept loudly insisting that the caravan was a danger, replete with “criminals” and “Middle Easterners.”

Are there “Middle Easterners” among them? It sounds far-fetched. Are they all “criminals”? No. Some are thugs, but many want a better life.

“Heavy-handed, overstated, far-fetched, not criminals” — yet Kass defends it.

The Democratic response to the caravan as it trudged north was also cynical. Democratic politicians insist they’re not for open borders, but they don’t support strict border enforcement. Theirs is a let-them-in-and-sort-it-out-later approach. This is a de facto open borders policy.

No, there is a “follow-existing-law-and-process-the-applicants-faster” policy. It is Trump who has instituted a cruel, mindless, “heavy-handed and overstated” policy — an unAmerican policy.

And just weeks ago, those who dared suggest that a country should have secure borders were subject to media shaming. Caravan? What caravan? They’re just women and tiny children in strollers. How dare you say otherwise?

But that wasn’t true either, was it? You read the pundits, you heard the snickers over the radio, and saw the smirks on TV. Americans got the point: Shut up about securing your own borders or be shamed.

And that’s not sound policy, either, is it?

And in typical right-wing, Kass-speak, it isn’t honest either, is it? We can have secure borders, while showing compassion and allowing entrance by valuable contributors to America. Those are the people who built America.

Immigrants are the real people who “made America great,” not the criminal phonies like Trump and the Trumpian apologists like Kass.

History will remember you, Mr. Kass, as one of those who supported the Trump lies and insanity. Your legacy is well-established.

Now, tell me again how it’s O.K. for Trump to do anything so long as Obama did something even vaguely similar — but Obama was a bad President.

Rodger Malcolm Mitchell

Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Federal finances are different from your personal finances. They also are different from city, county, and state finances. And they are different from business finances.

How different?

Who says so?

Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

Alan Greenspan: “Central banks can issue currency, a non-interest-bearing claim on the government, effectively without limit. A government cannot become insolvent with respect to obligations in its own currency.”

St. Louis Federal Reserve: “As the sole manufacturer of dollars, whose debt is denominated in dollars, the U.S. government can never become insolvent, i.e.,unable to pay its bills. In this sense, the government is not dependent on credit markets to remain operational.

In short, even if all federal tax collections were $0, the federal government could continue paying its bills, forever.

Yet the AARP, repeatedly spreads the false idea that federal finances are like personal finances and so, Social Security can run short of dollars.

Here are excerpts from their latest “informational article” with regard to Social Security:

12 Top Things to Know About Social Security

Understanding the program that helps secure your future

by Kenneth Terrell, AARP Bulletin, November 20181. Social Security is not going bankrupt

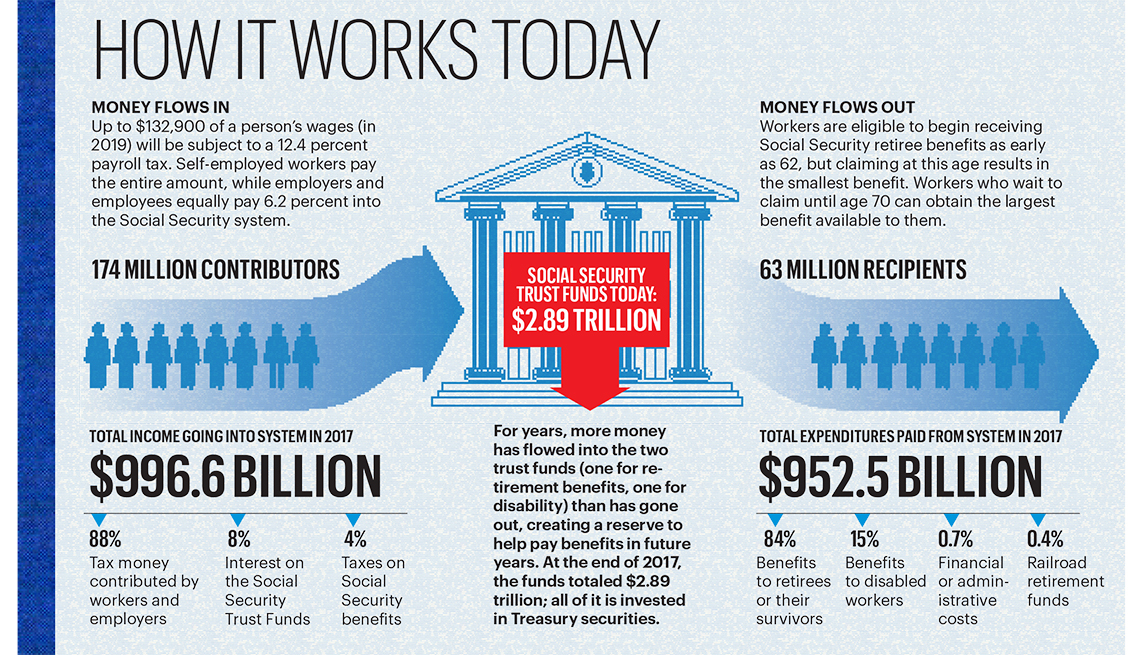

At the moment, you could say the opposite; the Social Security trust funds are near an all-time high. “The program really is in good shape right now,” says David Certner, AARP’s legislative policy director. “But we know it has a long-term financial challenge.”

Here’s why: For decades, Social Security collected more money than it paid out in benefits. The surplus money collected from payroll taxes each year got invested in Treasury securities; today, the trust fund reserves are worth about $2.89 trillion.

But as the birth rate has fallen and more boomers retire, the ratio of workers to Social Security recipients is changing. This year is a tipping point: The program will need to dip into its reserves to pay full benefits from this point forward, absent any change to the program.

It’s now forecast that the trust fund reserves could be exhausted in 2034. “The longer we wait to fix Social Security funding, the more the cost will be paid by the younger generations, either on the tax side or the benefits side,” says Kathleen Romig, a Social Security analyst at the nonpartisan Center on Budget and Policy Priorities.

The above is the classic “Social Security finances are like your finances” myth. But, the federal government does not pay its bills out of “trust funds” as the term ordinarily is used:

From the Bureau of the Fiscal Service, U.S. Department of the Treasury: The Federal Government uses the term “trust fund” differently than the way in which it is commonly used.

In common usage, the term is used to refer to a private fund that has a beneficiary who owns the trust’s income and may also own the trust’s assets.

A custodian or trustee manages the assets on behalf of the beneficiary according to the terms of the trust agreement, as established by a trustor.

Neither the trustee nor the beneficiary can change the terms of the trust agreement; only the trustor can change the terms of the agreement.

In contrast, the Federal Government owns and manages the assets and the earnings of most Federal trust funds and can unilaterally change the law to raise or lower future trust fund collections and payments or change the purpose for which the collections are used.

Although AARP speaks about the Social Security “trust fund” having a “financial challenge” and reserves “could be exhausted,” the truth is that the federal government has 100% control over the “fund.”

It has the unlimited power to add dollars, deduct dollars, or do anything else it wishes. It could eliminate the “trust fund” and the FICA tax completely, and still continue to pay Social Security benefits.

2. Congress probably will not take up Social Security reform anytime soon

Several members of Congress have proposed legislation to address the program’s long-term funding issues.

But given the deep political divides on Capitol Hill, it’s unlikely that Congress will make any effort to reform Social Security until there’s the possibility of bipartisan support.

There are concerns that the tax-cut legislation passed in late 2017 could lead some lawmakers to look for places where they might cut spending. “The stage has been set by the tax bill to take another run at Social Security, Medicare and Medicaid,” says Max Richtman, CEO of the National Committee to Preserve Social Security and Medicare.

Here, the myth is that taxes, especially FICA, pay for Social Security benefits. Though state and local taxes do fund state and local spending, federal taxes pay for nothing.

In fact, federal taxes are destroyed upon receipt at the U.S. Treasury. and all payments are made with new dollars created ad hoc.

3. Some ideas to reform funding are starting to take shape

One proposal is to either raise or eliminate the wage cap on how much income is subject to the Social Security payroll tax. In 2019, that cap will be $132,900, which means that any amount a worker earns beyond that is not taxed.

Remove that cap, and higher-income earners would contribute far more to the system.

Other options lawmakers might consider include either raising the percentage rate of the payroll tax or raising the age for full retirement benefits.

All of the above options are completely unnecessary. None of them would add even one cent to the federal government’s ability to fund Social Security benefits.

4. Lawmakers do not raid the trust fund

Another common myth about Social Security is that Congress and the president use trust fund assets to pay for other federal expenses, such as education, defense or economic programs.

That’s not accurate. The money remaining after the Social Security Administration (SSA) has paid benefits and other expenses is invested directly into U.S. Treasury securities.

The government can use the money from those securities, but it has to pay the money back with interest.

Via fictional bookkeeping, the government arbitrarily increases and decreases balances in “trust fund” accounts and Treasury Security accounts.

None of this affects, even to the slightest, the federal government’s ability to fund Social Security benefits.

Then, we are treated to the following graph, which would apply to a personal trust fund, but is entirely fictional when describing federal finances.

The dollars “flowing in” are tax dollars destroyed upon receipt. The dollars flowing out are brand, new dollars, created ad hoc by the government. There is no connection between what “flows in” and what “flows out.”

The remainder of the “Twelve things to know” deal with specific rules, not the health of the “trust fund.”

In Summary, Social Security is a federal agency. Because the U.S. government is Monetarily Sovereign, and so cannot run short of its own sovereign currency, the U.S. dollar, no agency of the federal government can run short of dollars unless Congress and the President will it to.

The federal government does not need to “raise or eliminate the FICA wage cap.” Nor does it need to “raise the percentage rate of the payroll tax .” Nor does it need to “raise the age for full retirement benefits.”

None of these acts will improve Social Security’s solvency, which is infinite .

The federal government doesn’t want you to understand the above, lest you demand more benefits. Why doesn’t the government want you to have more benefits?

Because of Gap Psychology. You can read more about that, here.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

The single most important problems in economics involve the excessive income/wealth/power Gaps between the have-mores and the have-less.

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Implementation of The Ten Steps To Prosperity can narrow the Gaps:

Ten Steps To Prosperity:

1. Eliminate FICA2. Federally funded medicare — parts a, b & d, plus long-term care — for everyone

3. Provide a monthly economic bonus to every man, woman and child in America (similar to social security for all)

4. Free education (including post-grad) for everyone

5. Salary for attending school

6. Eliminate federal taxes on business

7. Increase the standard income tax deduction, annually.

8. Tax the very rich (the “.1%) more, with higher progressive tax rates on all forms of income.

9. Federal ownership of all banks

10. Increase federal spending on the myriad initiatives that benefit America’s 99.9%

The Ten Steps will grow the economy, and narrow the income/wealth/power Gap between the rich and you.

MONETARY SOVEREIGNTY