Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and poor.

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

===================================================================================================================================================================================================================================================================================

You may have noticed that the stock market has dropped like a boulder — for reasons that may or may not portend a recession. Stock prices are based on price predictions and the “lemming factor.”

Price predictions, in turn, are based on the wrongly predicted effects of wrong predictions, such as interest rates, Greek defaults, wars, ISIS and your grandmother’s purchases of Victoria’s Secret underwear.

In short, there are many wrong predictions multiplied by many wrong imputations of effects, which is why only frauds (including your stock broker) pretend they can predict the stock market.

By way of example, most security psychics, mystics and clairvoyants believe raising interest rates slows the economy.

It simply is not so. See: here.

But, the Fed lowers rates to “stimulate” the economy, so they falsely can claim they are “doing something” to grow the economy. (The same reason witch doctors do rain dances.)

As for the “lemming factor,” it’s much more than panicky people following other panicky people to unload a few shares of stock at the slightest whiff of a decline.

It’s panicky computers unloading gigantic amounts of stock when artificially created support levels are breached.

And this unloading begets further drops in price, which beget further unloading.

And later, when the economy has crashed, the people and the machines start buying again — all of which has little-to-nothing to do with the realities of the U.S. economy.

The lifeblood of the U.S. economy is dollars, and the fundamental (though not the largest) source of dollars is federal deficit spending.

Now, everyone has been trained to hate “deficits” and “debt,” so when you hear that the federal government is running a $500 billion Deficit, and has a $13 trillion Debt Held by the Public, you are shocked, shocked, shocked.

And when you hear: Barack Obama claims deficit has decreased by two-thirds since taking office, you are assured cutting deficits must be a good thing.

After all, why would the man brag about something he’s done to screw up the economy?

Obama said. “We’ve seen the fastest economic growth in over a decade, our deficits cut by two-thirds, a stock market that has doubled, and health care inflation at its lowest rate in fifty years.”

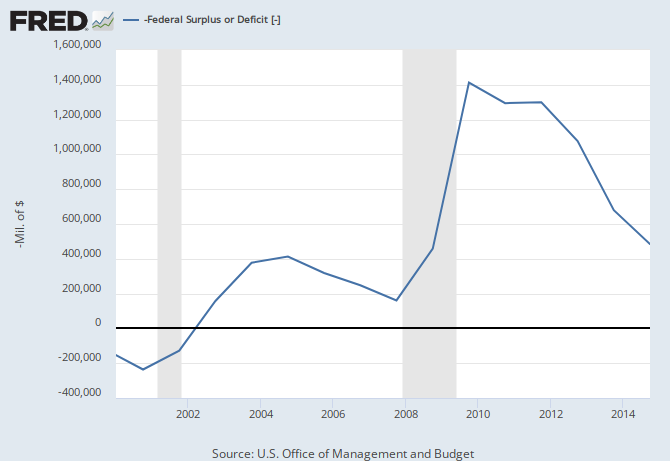

Deficits cut; stock market up; inflation low. Well that sounds pretty convincing. Here’s what that deficit cut looks like:

See that cut, from $1.4 trillion in 2009 to $484 billion the first quarter of this year? Do you also see anything wrong with that claim?

Sure you do. The deficit still is higher than it was just before the “Great Recession” and before Obama became President.

“This is not to say that that large deficit was his fault, but if one used the 2008 deficit as a frame of reference, the comparison would be quite different,” said Alan Auerbach, University of California Berkeley professor of economics and law.

Princeton University economics professor Harvey Rosen said the more important question is if Obama has put the government on a path that will keep deficits stable. “And the answer is no,” Rosen said, because entitlement programs, such as Medicare, Medicaid and Social Security, have not had substantial reform.

Notice how Professor Auerbach uses the word “fault.” Why “fault,” when a federal deficit is the economy’s surplus?

Imagine Bill Gates — he of the $60+ billion wealth — is the federal government and you are his nephew. Imagine Uncle Bill Gates “government” gives you an allowance of $1 thousand a week.

His “deficit” vis a vis you is $52 thousand. Do you believe his “deficit” is too high? Would you like to see his “deficit” reduced? (“Please Uncle Bill, give me less money. I don’t want you to run a deficit.”)

And while it is unlikely Uncle Bill Gates could run short of dollars, it is absolutely, 100% impossible for the federal government to run short of dollars.

It never has and it never will. The federal government is Monetarily Sovereign, meaning it is sovereign over the dollar. It can create all the dollars it wants at the touch of a computer key.

The U.S. economy (meaning you and me) can and often does run short of dollars, but the federal government cannot and does not.

So why is Obama proud of having reduced the federal government’s “allowance” paid to us?

And why does Professor Auerbach talk about whose “fault” the deficit is?

And why does Professor Rosen speak of Social Security, Medicare and Medicaid “reform” when he really means “cuts” to these economic benefits?

And why don’t they more properly talk about the economy’s surplus or deficit?

We’ll answer those questions, but first let’s look at another graph:

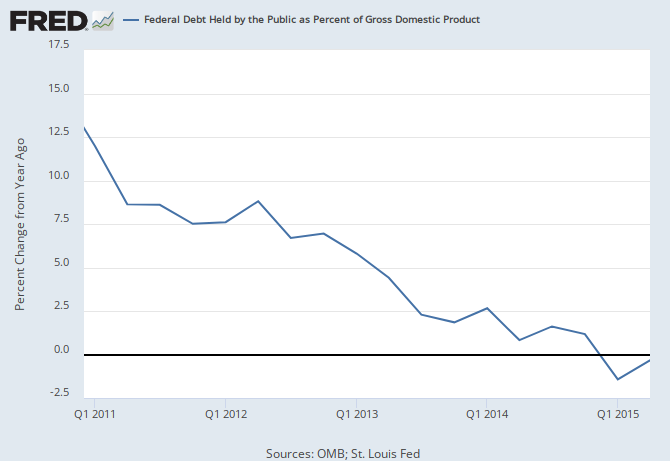

The graph shows annual percentage changes in the federal “debt” (i.e. the net number of dollars the government has sent into the economy) relative to the size of the economy. (Or the net number of dollars “Uncle” Bill Gates has given you).

Look at the graph and decide: When do we have recessions? What is the prelude to our recessions?

The prelude to recessions is when Uncle Bill Gates (the federal government) gives us (the economy) enough less this year to take us below that 0% line.

So tell me again. Why are the federal deficit and debt bad? Why do we want the federal government to run a balanced budget or even a surplus? Why do we want Uncle Bill to send us less money?

What are the reasons President Obama is so proud of reducing the amount the federal government sends you and me? What are the reasons Professors Auerbach and Rosen speak of “fault” and “reform” when discussing the federal deficit?

Some reasons may involve ignorance and some may involve intent.

For typical Americans, not educated in economics, the reasons may involve ignorance. After all, they have been brainwashed, for years and years, about the need to reduce the debt.

But surely President Obama, with all his economic advisors, and the media, with their researchers, and economists like Auerbach and Rosen — surely they are not ignorant of these two facts:

1. The federal government can pay off any size debt instantly, at the press of a computer key.

2. The federal deficit is the economy’s surplus, and is necessary for economic growth.

In fact: U.S. depressions tend to come on the heels of federal surpluses.

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.

In further fact, recessions invariably are cured by financial “stimuli,” i.e federal deficit spending.

So why the intentional misstatements, from the President and Congress, the media and the economists?

Answer: They are paid by the rich to widen the Gap between the rich and the rest.

Most federal deficit spending benefits the rich much less than it benefits the rest, so it narrows the Gap. But it is the Gap that makes the rich rich. Without a Gap, no one would be rich, and the wider the Gap, the richer they are.

So, the politicians are paid (bribed) via campaign contributions, the media are paid via ownership and the economists are paid via contributions to their universities.

When is the next (unnecessary) recession? (Unnecessary, because it could be prevented with increases in federal deficit spending, that add dollars to your pockets.)

Unless the downward trend of federal deficit spending is halted, and dramatically reversed, the recession should come no later than 2020 — perhaps sooner.

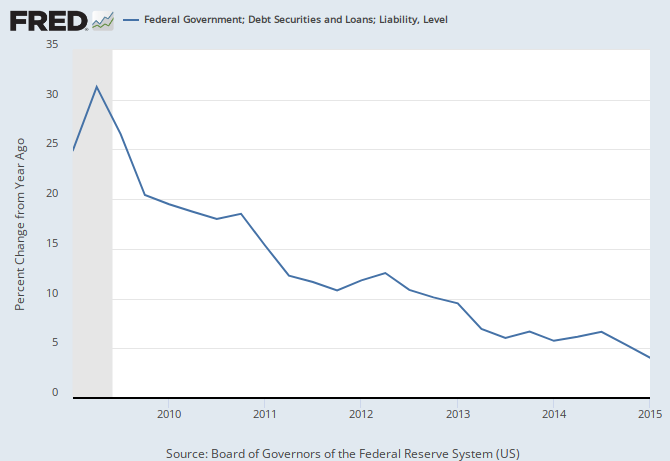

Here is a close-up of the graph, showing more clearly where we are now:

We already have arrived at the tipping point (the zero line in the above graph) and that tipping point seems to occur three-five years in advance of a recession.

So, here is what will happen:

1. Net federal support for social programs (Social Security, Medicare, Medicaid, poverty aids, etc.) will continue to decline, until we approach or even exceed a balanced budget or a surplus. (The politicians will term this “reform.”)

2. The Gap between the rich and the rest will continue to grow.

3. We will enter a recession, during which unemployment will rise and workers’ salaries will fall. (Top executive’s salaries will grow, thus widening the Gap.)

4. To combat the recession, the politicians, fearful for their jobs, will be forced to increase deficit spending.

5. Deficit spending will bring us out of the recession, at which time you again will hear calls to decrease the deficit and federal debt.

Since the U.S. became fully Monetarily Sovereign, we have had an unnecessary recession every ten years on average

They all have been caused by ignorance and intent — the public’s ignorance and our leaders’ intent.

Here we go, again.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

Interesting chart, Rodger.

LikeLike

Watch this video and tell me whether this guy is drunk

LikeLike

Is there a list of spending cuts? Thanks

LikeLike

Click to access ccs(3).pdf

LikeLike

It looks like Paul Krugman may just be starting to get the MS/MMT idea.

LikeLike

I’m afraid “just starting” are the operative words. I’ll write a post about this.

LikeLike

I am in complete agreement with everything said here, but offer just one caution regarding raising interest rates in order to inject additional govt dollars into the money-starved economy. While I believe it would have that effect, I’m concerned for what it would do to the dollar vis-a-vis all other currency, particularly the Yuan and Euro, with CBers currently devaluing. A stronger dollar will further decrease US exports with consequences for GDP and employment that could very well overshadow the positive impact of higher interest payments into the economy ( particularly when holders of US debt tend to be those with a higher propensity to save rather than to spend).

This concern is not to counter the central thesis that further fiscal spending, by higher interest rates or whatever, is very much needed. It is more a nuance that further reflects just how weak monetary policy is in effectiveness relative to fiscal policy – the question remains how to get f’n Congressional morons to just f’n spend more money. Gawd, it’s frustrating!

LikeLike

Agreed.

Raising interest rates will add federal interest dollars to the economy, but increase the trade deficit, which will subtract dollars from the economy.

I agree with: ” . . . get f’n Congressional morons to just f’n spend more money. Gawd, it’s frustrating!”

By the way, isn’t it interesting that debt nuts always worry that federal spending will cause inflation (by adding dollars to the economy), but want a trade surplus (which also would add dollars to the economy)?

LikeLike

I’m way past “interesting” and might soon be leaving “frustrating” to move onto “homicidal.”

Just kidding. You’re blog helps keep me sane. Thanks!

LikeLike