The debt hawks are to economics as the creationists are to biology. Those, who do not understand monetary sovereignty, do not understand economics. Cutting the federal deficit is the most ignorant and damaging step the federal government could take. It ranks ahead of the Hawley-Smoot Tariff.

==========================================================================================================================================================================================

In today’s Washington Post, I saw an article that could get some traction within three debates: deficit, energy and climate/ecology:

To save the planet and the budget, cut energy off the dole

By Jeffrey Leonard, (chief executive of a private equity investment firm), Friday, January 14, 2011President Obama promised in the fall that a top priority of his legislative program for 2011 would be an energy policy “that helps us grow at the same time as it deals with climate change in a serious way.” With global warming deniers now in charge of the House of Representatives, there would seem to be little hope for major legislation on clean energy or climate in this Congress. Even a member of his own party, West Virginia’s new senator, Joe Manchin, has boasted of extracting “a deep commitment and personal commitment” from Senate Majority Leader Harry Reid “that cap-and-trade is dead.”

But all is not lost. If Obama wants to set us on a path to a sustainable-energy future – and a green one, too – he should propose a very simple solution to the current mess: eliminate all energy subsidies. . . And with anti-pork Tea Partyers loose in Washington and deficit-cutting in the air, it’s not as politically inconceivable as one might think.

As long as current energy subsidies stay in place, and K Street lobbyists have sway over what interests deserve congressional favoritism, American tax dollars will continue to retard the market forces that are pushing the United States toward energy independence and a greener future.

RMM: Deficit cutting is the last thing the U.S. should do, and since tax dollars do not pay for federal spending, this part of his thesis is suspect.

Major changes in the picture of domestic energy supply make it possible to sweep away decades of accumulated subsidies without seriously threatening the affordability of energy . . . The real game-changer among several major trends is the discovery in recent years that America is sitting on many decades’ worth of exploitable natural gas. Natural gas emits half the carbon dioxide of coal. Other long-term market trends complement the availability of cheaper, abundant natural gas: the growing likelihood in 2011 of more expensive oil; the extended life of existing nuclear facilities, adding thousands of megawatts of unexpected power to American generating capacity; the increasing competitiveness of solar and wind power coupled with state mandates for utilities to adhere to renewable portfolio standards; and the slow but steady electrification of transportation. The U.S. energy market, if left to its own devices, without distortions or subsidies, will provide plentiful and affordable energy while gradually evolving away from oil and coal as the primary fuel sources.

RMM:The reality is that natural gas is not a suitable substitute for oil, under current or even projected technology, and we are decades away from the time when nuclear, solar and wind can take over from coal and oil. I see no way that reduced federal subsidies would not increase the price of energy.

The federal government . . . should invest heavily in long-term research and development to hasten the progress of new commercially viable energy technologies.

RMM: Agreed.

It should stiffen regulations on coal use so that the fuel’s environmental and health costs are borne by industry and reflected in its price.

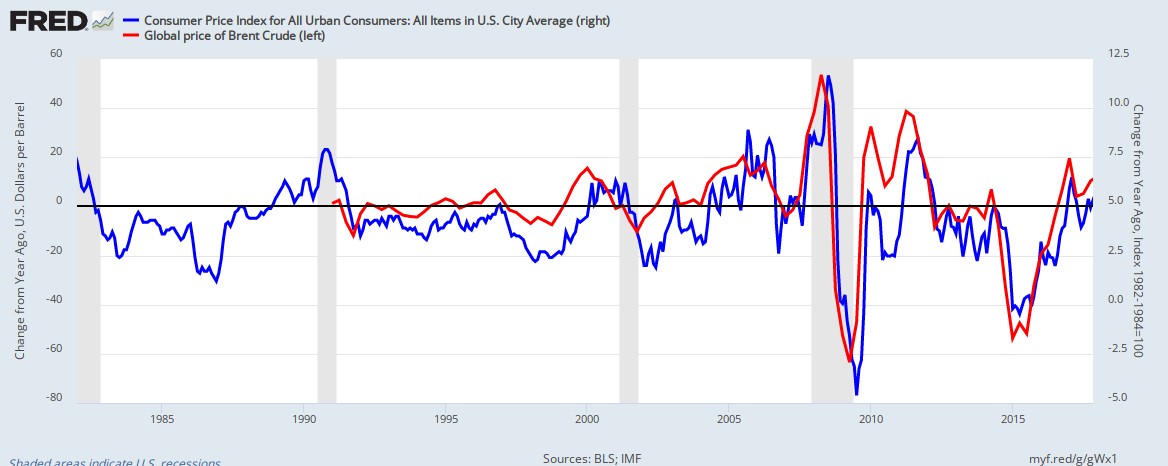

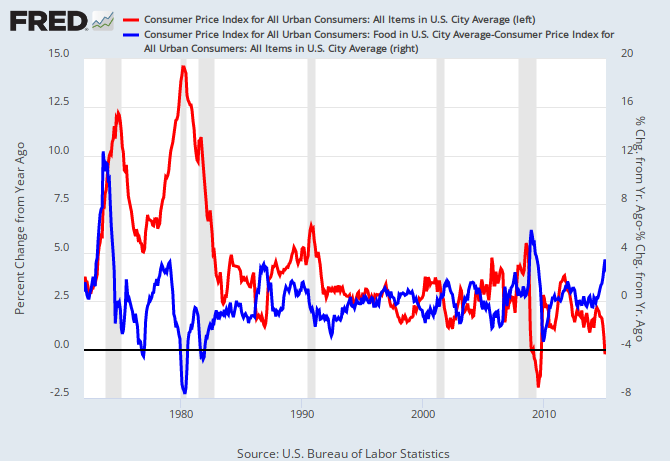

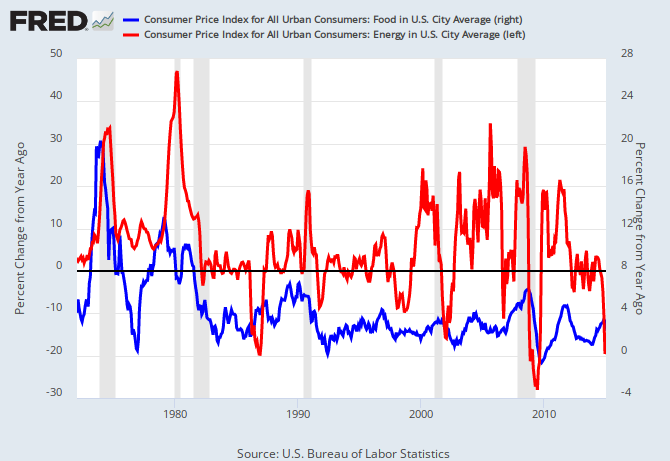

RMM: The rise in energy prices is the prime motivator for inflation. See: Inflation. Rather than raising the price of coal, the government should help the industry be “cleaner.” Subsidies, not penalties, may be more productive.

Eventually, when the political climate is right, it should impose some form of tariff on carbon and other greenhouse-gas emissions to ensure that the market internalizes the global “costs” of threats to the planet’s life-giving atmosphere.

RMM: All taxes are anti-stimulus. The market cannot “internalize” anything. All costs are passed on to the consumers (aka the taxpayers).

Is eliminating all energy subsidies politically possible? There have always been libertarian elements in the Republican Party that have railed against “corporate welfare,” including the massive tax expenditures that favor oil production. Now they are joined by many Tea Party sympathizers who, appalled by the bailouts of the big banks and automakers, instinctively share the same hostility toward subsidies of big business. Though progressives are inclined to forget, Sarah Palin imposed a steep tax on oil companies’ windfall profits while serving as Alaska’s governor.

RMM: Again, they aren’t “tax expenditures.” Mr. Leonard has no understanding of monetary sovereignty, And, if the Tea Party and Sarah Palin are proposed as experts in this debate, one has to wonder.

Nevertheless, the energy debate is one of our most important. What do you think of the fundamental idea that the federal government should get out of the energy business and allow the market to dictate where we should go and what we should do?

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

No nation can tax itself into prosperity. Those who say the stimulus “didn’t work” remind me of the guy whose house is on fire. A neighbor runs with a garden hose and starts spraying, but the fire continues. The neighbor wants to call the fire department, which would bring the big hoses, but the guy says, “Don’t call. As you can see, water doesn’t put out fires.”