VERONIQUE DE RUGY is a contributing editor at Reason.

She is a senior research fellow at the Mercatus Center at George Mason University.

According to the 2017 Global Go To Think Tank Index Report (Think Tanks and Civil Societies Program, University of Pennsylvania), Mercatus is number 39 in the “Top Think Tanks in the United States” and number 18 of the “Best University-Affiliated Think Tanks”.

The Koch family has been a major financial supporter of the organization since the mid-1980s. Charles Koch serves on the group’s board of directors.

The following is Ms. de Rugy’s article from the Libertarian website, REASON.com.The Republicans would love to cut Medicare and Social Security benefits because that would increase the income/wealth/power Gap between the rich and the rest. The Gap is what makes the rich rich. If not for the Gap, no one would be rich. We all would be the same. The wider the Gap, the richer are the rich. The GOP, the party of the rich, is always ready to help make the rich richer. Their big tax reduction during the Trump years enriched the rich and did nothing for the middle and poor. The GOP complaints about funding the IRS had to do with protecting the rich. So long as the IRS is underfunded, they don’t have the manpower to investigate the complex tax returns of the rich, so currently, they focus on the middle and lower levels. The only reason the GOP won’t try to cut Medicare and Social Security benefits is that they would be punished at the polls, not because they care about the health and well-being of the middle or poor. They don’t. Watch for the GOP “solution” to the non-problem of Social Security and Medicare finances to be something that doesn’t hurt the rich, such as increasing the FICA income limit. Rich people aren’t worried about paying FICA taxes on an above $150M salary. Not only is that chump change for the rich, but many don’t pay any FICA because they aren’t salaried.Social Security Is on the Brink of Collapse. The GOP Won’t Touch It. In 1950, there were more than 16 workers for every beneficiary. In 2035, that ratio will be only 2.3 workers per retiree. VERONIQUE DE RUGY | 1.26.2023 12:01 AM

If you follow policy debates long enough, arguments you never thought you’d hear can become key components of the two parties’ policy platforms.

That’s certainly the case when it comes to some Republicans, and their new “never touch Social Security and Medicare” position.

Over the weekend, newly elected Sen. J.D. Vance (R–Ohio) tweeted that former President Donald Trump was 100 percent correct to demand that “under no circumstances should Republicans vote to cut a single penny from Medicare or Social Security.”

Vance’s tweet was issued amid the debt ceiling fight, but Trump has long held this position.

GOP’s “well-intentioned” engagement in the debt ceiling dispute?? I didn’t realize Veronique was a humor writer. Or perhaps she believes her readers are fools.Now, to be fair, the GOP’s well-intentioned engagement in the overall debt ceiling dispute is limited by the short time Congress has to raise the limit, all but ruling out credible reforms of Medicare or Social Security.

In right-wing speak (Yes, Libertarians are closet right-wingers), “reform” Social Security and Medicare means cut benefits to the middle class and the poor.Reforming these two programs will take a considerable amount of time and requires bipartisan action. However, this reality is no reason to assert that the programs’ benefits should never be touched.

That is a bald-faced lie. The federal government could double, triple, or quadruple benefits for both programs while eliminating all FICA collections and still have money to pay Congressional, Presidential, and SCOTUS salaries. Contrary to popular myth, FICA pays for nothing. Every FICA dollar ripped from your paycheck and sent to the U.S. Treasury is destroyed upon receipt. The dollars come from the M2 money supply, so when you pay $1 in federal taxes, the M2 money supply declines by $1. But when those M2 dollars reach the Treasury, they instantly cease to exist in any money supply measure. There is no money supply measure for federal funds simply because the federal government has the infinite ability to create dollars. Thus, the federal government, being Monetarily Sovereign, has infinite dollars. Adding your tax dollars to infinity doesn’t change infinity.I cannot wait to hear the grand plan that the “don’t touch Social Security and Medicare” Republican caucus has to address the $116 trillion over 30-year shortfall—that’s 6 percent of U.S. GDP—facing the two programs.

No action from Congress means no money to pay for all the benefits. That means enormous cuts that will hurt the low-income seniors who depend on the programs.

Federal taxes don’t fund federal spending, so they can’t “address Social Security and Medicare shortfalls.”Of course, if Vance and friends insist on not touching benefits, they could address the Social Security and Medicare shortfalls with enormous tax hikes.

The tax hikes would have no effect on Social Security and Medicare solvency. These federal agencies and all other federal agencies are solvent because they are funded by the infinitely solvent U.S. government. The misnamed federal “debt” is not a debt of the federal government. The government has paid all its debt the same way: By creating dollars from thin air. The federal debt is the net total of all federal deficits — the difference between total spending and total taxing. That difference is bridged by federal money creation so that all obligations are paid on time. Have you ever wondered how the federal government can raise the debt ceiling whenever it wishes? According to the U.S. Department of the Treasury, the debt ceiling has been raised, extended, or revised 78 separate times since 1960. And all these increases were done without tax increases (otherwise, the debt ceiling would not have been reached) because federal taxes don’t fund anything. (State and local governments (unlike the federal government) are monetarily NON-sovereign. They don’t have the unlimited ability to create dollars, so their taxes do fund their spending.)For Social Security alone, when the trust fund dries out, they will have to agree to immediately raise the payroll tax from 12.4 percent to 15.64 percent—or close to a 25 percent tax increase.

Add to that the tax hike necessary for Medicare and then repeat the exercise over the years to fill the entire shortfall.

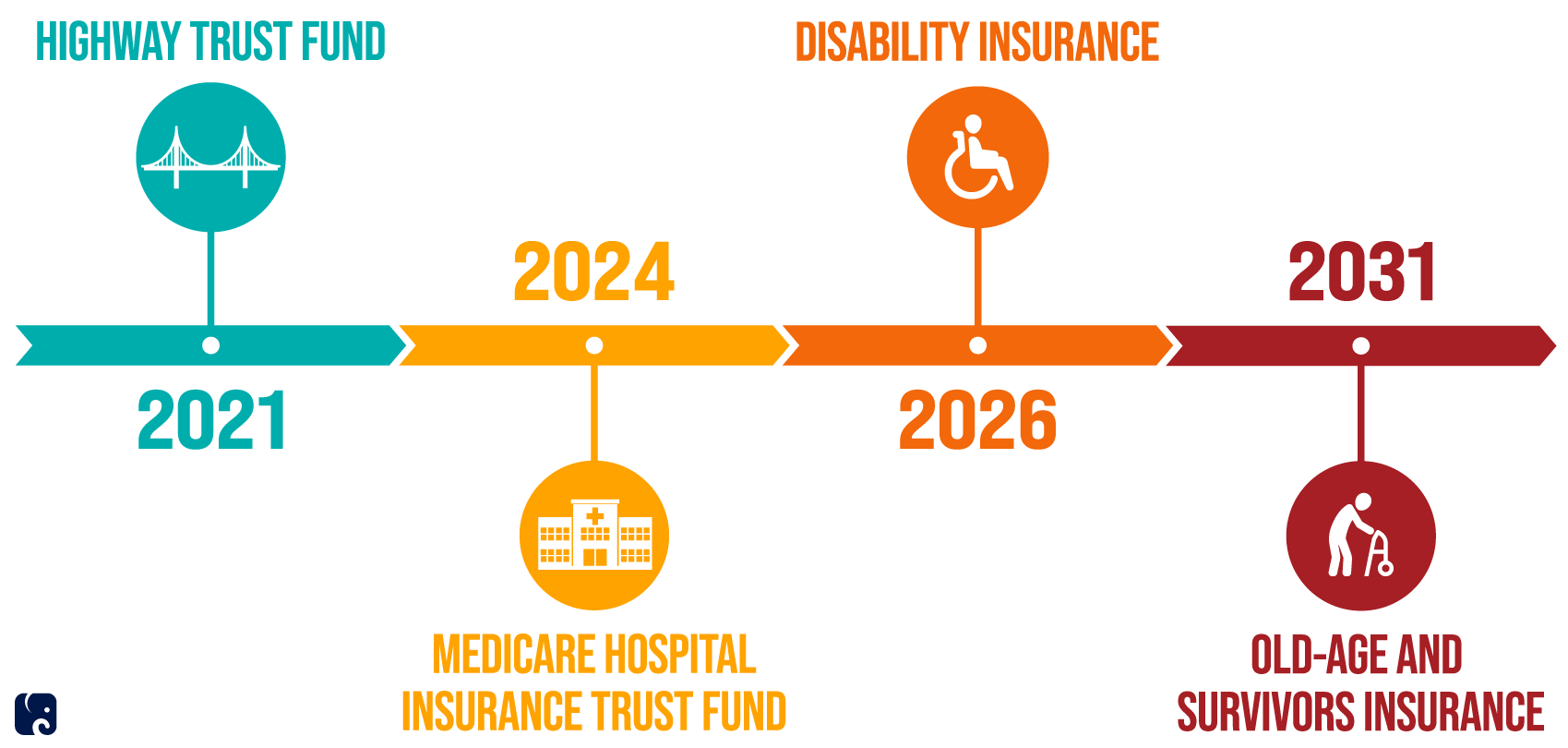

Not only does the Social Security trust fund not pay SS benefits, but it isn’t even a trust fund. To quote right-winger Pete Peterson:It’s not as if we haven’t been warning politicians that these troubles were brewing. Back in 2000, roughly when I started working on fiscal issues, experts already warned that the Social Security trust fund would run out of assets by 2037, triggering painful benefit cuts.

The misnamed trust funds are wholly owned and controlled by the federal government. It can add to them, subtract from them or do whatever else it wishes with them. The notion that the trust funds will run out of money and so can’t pay Social Security or Medicare benefits is ridiculous on its face. The federal government pays whatever benefits it wishes, regardless of so-called “trust funds.’ Further, the government has the unlimited power to add to, or subtract from those fake trust funds whenever it wishes. The whole Social Security/Medicare trust fund fiction is a giant scam to make you believe the government can’t afford SS and Medicare benefits. When politicians whined that Medicare for All or Social Security for All needed to be “paid for” by tax increases or benefit cuts, the sole purpose was to make you agree to widening the income/wealth/power Gap between you and the rich. It is America’s biggest, most crooked scam, and you have been falling for it since Social Security began on August 14, 1935. And you still fall for it without complaint. It’s a scam that makes Bernie Madoff look like an angel. One wonders why you don’t fret about the White House trust fund, the SCOTUS trust fund, the Congress trust fund, the Bureau of Labor Statistics trust fund, the Capitol Police trust fund, the Army trust fund, the Coast Guard trust fund, and all the other federal department and agency trust funds. Oh, they don’t have trust funds? So where do they get their money? Ah, the federal government simply pays the bills by creating dollars from thin air. Just pay thepreciselyand stop lying about “trust funds.” that is exactly what the federal government should do about Social Security and Medicare.WHAT ARE FEDERAL TRUST FUNDS? Sep 20, 2016, Peter G. Peterson Foundation

A federal trust fund is an accounting mechanism used by the federal government to track earmarked receipts (money designated for a specific purpose or program) and corresponding expenditures.

The largest and best-known funds finance Social Security, Medicare, highways and mass transit, and pensions for government employees.

Federal trust funds bear little resemblance to their private-sector counterparts.

In private-sector trust funds, receipts are deposited and assets are held and invested by trustees on behalf of the stated beneficiaries.

In federal trust funds, the federal government does not set aside the receipts or invest them in private assets.

Rather, the receipts are recorded as accounting credits in the trust funds, and the receipts themselves are comingled with other receipts that Treasury collects and spends.

The fake “trust fund” will run dry only if Congress and the President want it to run dry.Today, the situation has deteriorated further, with the trust fund now on track to run dry in 2035, along with any practicable hope for fixing the problem.

The number of workers per beneficiary is completely irrelevant. Workers do not pay for beneficiaries. FICA does not pay for anything. It’s destroyed. It exists only to con you. Period.In other words, these problems shouldn’t surprise anyone. When Social Security started, life expectancies were lower. In 1950, there were more than 16 workers for every beneficiary. That ratio is now below three workers per retiree and will be only 2.3 workers per retiree by 2035.

To the Libertains’ sneering and twisted minds, giving the populace benefits is “buying votes.” But the sole purpose of any government is to protect and enhance the people’s lives. If any government doesn’t provide benefits, it’s not doing what it was created to do.Add to this trend decades of politicians buying votes by expanding benefits beyond incoming payroll taxes, and you have a true fiscal crisis.

There is, in fact, an account with your name on it, and it’s called a T-security account. If you have deposited money into a T-bill, T-note, or a T-bond, you have put dollars into your T-security account. Those dollars belong to you. The federal government never touches them. When your account matures, the government returns the dollars in your account. The total of dollars in all T-security accounts is erroneously termed, “the federal debt.” But it not federal and it is not debt. Your dollars belong to you, not the federal government, and there is no debt. Your dollars are safe and comfortably resting in your account just as though they were in your pocket or safe deposit box. Just as the contents of bank safe deposit boxes are not bank debt, the contents of T-security accounts are not federal debt.That’s why it’s so alarming that so many in the GOP are giving up on educating a public that’s been brainwashed for years with misleading soundbites like “You earned your Social Security benefits, so you are entitled to the benefits now promised,” or “There’s an account with your name on it.”

Yes, that is exactly what misinformation has done.Such misinformation has made serious discussion of reform very difficult.

And so goes the “trust fund” myth. If they were trust funds, you would have a legal right to those benefits, but you don’t and SCOTUS has said so. And they are not trust funds. Congress and the President have 100% control over benefits, which can be raised or cut, arbitrarily, as can the amount of money claimed to be in those fake “trust funds.” What does that say about the mythical trust funds? What does that say about Veronique de Rugy’s claims?There’s no question that retirees deserve fair treatment, but the facts are that the Supreme Court ruled in 1960 that workers do not have a legally binding right to Social Security benefits, and if Congress cuts benefits even by, say, 50 percent, it can do so—no matter how much anyone has paid into the program.

No, no, no. Current retirees are not paid with federal taxes. They are paid by the federal government’s infinite ability to create dollars. The purpose of federal taxes is not to fund federal spending. The purpose of federal taxes is to control the economy by punishing what the government wishes to discourage and by rewarding (via tax breaks) what the government wishes to encourage.It won’t come to that, but the ruling still stands. It’s also fiction that all the benefits that have been promised were earned by workers—they weren’t.

That’s in part because current retirees are paid with taxes from current workers, not from funds saved out of the payroll taxes retirees paid when they were in the workforce.

Touching Social Security and Medicare is not a financial nonstarter. The government could increase or decrease benefits at will. But decreasing benefits could be a voter nonstarter and increasing benefits could a rich-donor nonstarter. That rug-of-war is the called the “debt-limit-debate. It’s a debate between the rich and the rest, except the “rest” don’t even know there is a debate, much less a solution.It’s magical thinking to say that touching Social Security and Medicare is a nonstarter.

No, the real “yikes” to to writers like Veroique de Rugy who repeatedly promulgate misinformation about the federal “debt” and the fictional Social Security and Medicare “trust funds.” YIKES!!!!!Even more strange, many of the same Republicans want to spare these two programs while still putting Medicaid on the chopping block. Medicaid should be reformed too, but at least that program serves poor people.

By contrast, the seniors who receive Social Security and Medicare today are overrepresented in the top income quintile while younger Americans are overrepresented in the bottom quintile.

So these guys want to cut benefits for poor people on Medicaid while subsidizing relatively wealthy boomers with taxes taken from relatively poor youngsters.

Yikes.

We agree there. Rodger Malcolm Mitchell Monetary Sovereignty Twitter: @rodgermitchell Search #monetarysovereignty Facebook: Rodger Malcolm MitchellThe GOP’s transformation into the party of big and fiscally reckless government is proceeding apace.

……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY

CONGRESS, GOVERNMENT SPENDING, SOCIAL SECURITY, MEDICARE, MEDICAID, DONALD TRUMP, ENTITLEMENTS, POLICY, FISCAL POLICY, OHIO, DEBT, NATIONAL DEBT, DEBT CEILING, REPUBLICAN PARTY, DEMOCRATIC PARTY, GDP, INCOME, POVERTY, TAXES, PAYROLL TAX, POLITICS, RETIREMENT, RETIREMENT BENEFITS, EMPLOYMENT, MISINFORMATION, SUPREME COURT, WEALTH, GOVERNMENT, FEDERAL GOVERNMENT, BIG GOVERNMENT, ECONOMY, ECONOMICS