Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

…………………………………………………………………………………………………………………………………………………………………………..

It takes only two things to keep people in chains: The ignorance of the oppressed and the treachery of their leaders..

………………………………………………………………………………………………………………………………………………………………………………

The term “Theory of Everything” has been related to physics.

Quoting Wikipedia, “A theory of everything (T)E) is a hypothetical single, all-encompassing, coherent, theoretical framework of physics that fully explains and links together all physical aspects of the universe.

“Finding a ToE is one of the major unsolved problems in physics.”

The two primary “frameworks” in physics are General Relativity and Quantum Field Theory, which in their current interpretations are incompatible. A “theory of everything” would unite these two frameworks.

If we class General Relativity as a theory of big things, and Quantum Field Theory as a theory of small things, we might draw an interesting parallel in economics with macroeconomics and microeconomics.

And just as General Relativity is the basis for explaining how gravity affects big things, Monetary Sovereignty is the basis for explaining how money affects macroeconomics.

General Relativity is based on the relationships among mass, energy, time, space, and gravity. Monetary Sovereignty is based on the relationships between money creators and money users.

Consider such subjects as income and wealth distribution, health care, taxation, poverty, education, employment, inflation, deficit spending, and economic growth. Any intelligent discussion of these subjects requires an understanding of Monetary Sovereignty.

Obamacare Vs. Trumpcare:

You’ve been reading and hearing about the Democrats’ “Obamacare” vs. the latest iterations of the Republicans’ “Trumpcare.” Both are attempts to provide health care to Americans, and in different ways, both suffer from fundamental, incorrect assumptions.

The incorrect assumptions are that the federal government’s supply of dollars is limited, and an increase in federal spending requires an increase in taxes, an increase in borrowing, and/or inflation.

The facts are:

- Our federal government, unlike state and local governments, is now Monetarily Sovereign (since 1971, when it went off a gold standard).

- It cannot unintentionally run short of its own sovereign currency — the currency it originally created from nothing — the U.S. dollar. It instantly can pay any size debt denominated in dollars.

- It needs neither to borrow nor to tax in order to obtain dollars, as it creates dollars ad hoc, by paying creditors.

- Being sovereign, the federal government has the unlimited ability to increase or to decrease the value of its sovereign dollar, thus creating or preventing inflation.

Obamacare rightfully is criticized for taxing younger, healthier citizens and for not covering several million people, all because the realities of Monetary Sovereignty have been ignored.

Trumpcare reduces the taxation and the coverage for the same wrong reasons.

The U.S. federal government has the unlimited power to fund comprehensive, no-deductible health care and long-term care for every man, woman, and child in America.

It can fund “Medicare for All” without collecting any tax, and without borrowing, and without price inflation.

Trying to determine whether Trumpcare does or does not outweigh Obamacare, is a fool’s mission. Both are seriously lacking due to their false underlying assumptions about federal affordability.

The Kansas’s Experiment With Tax Reduction:

We discussed this at “Kansas is nothing like America.” An article in THIS WEEK Magazine (6/23/17) illustrates the problem:

“The nation’s most aggressive experiment in conservative economic policy is dead,” said Russel Berman in TheAtlantic.com. Supply-side economics “never works,” saod Eugene Robinson in The Washinbgton Post.

The Wall Street Journal, in an editorial said (Kansas Governor) Brownback was “unlucky in his timing. . .” Said Pat Garofalo in USNews.com, “Conservatives always try to explain away supply-side failures by saying the reforms weren’t quite right.

The big question is whether national Republicans will heed the lessons of Kansas, said Jordan Weissmann in Slate.com. President Trump is being advised by the same economists who engineered Brownback’s disastrous scheme, and he has proposed a similar strategy of massive income tax cuts and pass-through exemptions for businesses. “Kansas has admitted its mistake” — but Republicans may try to repeat it anyway.

Supply-side economics, often exemplified by “the Laffer curve,” teaches that tax-rate cuts can pay for themselves by increasing taxable income.

This supposedly will happen because lower taxes will increase both the Supply and the Demand for products and services.

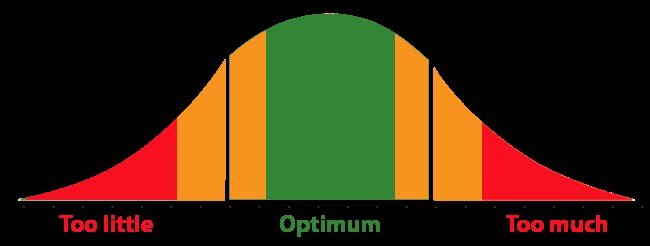

In this vein, Arthur Laffer said that tax rates of 0% or 100% will generate zero taxes, so somewhere between 0% and 100% there is a “best” tax rate that will generate the maximum tax.

“Best” is defined as the point at which taxes collections are maximized, but not the point of maximum benefit to an economy.

Supply-siders fail to take into consideration four facts:

- The federal government has no need for taxes, so federal tax cuts always will be pro-growth for the economy.

- Federal deficit spending adds dollars to the economy and so is pro-growth

- Federal taxes always remove dollars from the economy, but a growing economy requires a growing supply of dollars. Thus, federal taxes always are anti-growth.

- State and local governments do need taxes, though complexity prevents knowing what that magical “best” tax rate is. For each state, it could be lower or higher than the current rate. State and local government deficit spending neither adds nor removes dollars from the economy, so may or may not facilitate growth.

Berman, Robinson, the Wall Street Journal, Garofalo, Weissmann, Brownback, and Trump do not seem to understand the differences between Monetary Sovereignty (the U.S. federal government) and monetary non-sovereignty (the states, counties, cities, you, and me).

The federal government, having neither the need for, nor the use of taxes, should not use the Kansas experiment as a model. Unlike Kansas, the federal government could eliminate all taxes today and yet continue spending, forever.

Kansas needs and spends tax dollars. It can, and has, run short of dollars. Though the Kansas experiment seems to have failed — tax rate reduction did not generate enough taxable income to “pay for itself” — exactly the same experiment might work for other states.

Florida, Alaska, and others have no income tax, simply because they receive dollars from outside sources, Florida from tourism and Alaska from oil. The Kansas experiment may apply to some states and not to others, but it definitely does not apply to the federal government.

The common element among the arguments about Obamacare, Trumpcare, and the Kansas experiment is Monetary Sovereignty, or rather, the lack of understanding it.

A need to understand Monetary Sovereignty is at the foundation of meaningful discussions about education access, federal and local tax reform, income and wealth inequality, poverty, Social Security, immigration, inflation, unemployment, infrastructure, climate change, war, scientific research, states’ rights, charity, business regulation and many other dollar-related subjects.

In that sense, Monetary Sovereignty is the “theory of everything” only in macroeconomics. It is not a Theory of Everything in all of economics because it barely touches on microeconomics

(Monetary Sovereignty does include “Gap Psychology,” the popular desire to distance ourselves from people below us on the income/wealth/power scale, whom we view as inferior, while wishing to come closer to people above us, whom we deem superior).

Microeconomics, being a subset of Psychology, is like Quantum Field Theory in that both involve predictable unpredictabilities we have yet to master. Thus, like physics, economics will have to wait for its Theory of Everything (though I suspect individual humans will continue to be even less predictable than quantum particles).

In summary:

Those who do not understand and use Monetary Sovereignty, do not understand federal economics, and cannot develop workable economics plans.

They are fixated on cost-cutting and budget-balancing, when the federal government needs neither, and both are anti-growth.

Rodger Malcolm Mitchell

Monetary Sovereignty

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

The single most important problems in economics involve the excessive income/wealth/power Gaps between the have-mores and the have-less.

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Implementation of The Ten Steps To Prosperity can narrow the Gaps:

Ten Steps To Prosperity:

1. ELIMINATE FICA (Ten Reasons to Eliminate FICA )

Although the article lists 10 reasons to eliminate FICA, there are two fundamental reasons:

*FICA is the most regressive tax in American history, widening the Gap by punishing the low and middle-income groups, while leaving the rich untouched, and

*The federal government, being Monetarily Sovereign, neither needs nor uses FICA to support Social Security and Medicare.

2. FEDERALLY FUNDED MEDICARE — PARTS A, B & D, PLUS LONG TERM CARE — FOR EVERYONE (H.R. 676, Medicare for All )

This article addresses the questions:

*Does the economy benefit when the rich can afford better health care than can the rest of Americans?

*Aside from improved health care, what are the other economic effects of “Medicare for everyone?”

*How much would it cost taxpayers?

*Who opposes it?”

3. PROVIDE A MONTHLY ECONOMIC BONUS TO EVERY MAN, WOMAN AND CHILD IN AMERICA (similar to Social Security for All) (The JG (Jobs Guarantee) vs the GI (Guaranteed Income) vs the EB (Economic Bonus)) Or institute a reverse income tax.

This article is the fifth in a series about direct financial assistance to Americans:

Why Modern Monetary Theory’s Employer of Last Resort is a bad idea. Sunday, Jan 1 2012

MMT’s Job Guarantee (JG) — “Another crazy, rightwing, Austrian nutjob?” Thursday, Jan 12 2012

Why Modern Monetary Theory’s Jobs Guarantee is like the EU’s euro: A beloved solution to the wrong problem. Tuesday, May 29 2012

“You can’t fire me. I’m on JG” Saturday, Jun 2 2012

Economic growth should include the “bottom” 99.9%, not just the .1%, the only question being, how best to accomplish that. Modern Monetary Theory (MMT) favors giving everyone a job. Monetary Sovereignty (MS) favors giving everyone money. The five articles describe the pros and cons of each approach.

4. FREE EDUCATION (INCLUDING POST-GRAD) FOR EVERYONE Five reasons why we should eliminate school loans

Monetarily non-sovereign State and local governments, despite their limited finances, support grades K-12. That level of education may have been sufficient for a largely agrarian economy, but not for our currently more technical economy that demands greater numbers of highly educated workers.

Because state and local funding is so limited, grades K-12 receive short shrift, especially those schools whose populations come from the lowest economic groups. And college is too costly for most families.

An educated populace benefits a nation, and benefitting the nation is the purpose of the federal government, which has the unlimited ability to pay for K-16 and beyond.

5. SALARY FOR ATTENDING SCHOOL

Even were schooling to be completely free, many young people cannot attend, because they and their families cannot afford to support non-workers. In a foundering boat, everyone needs to bail, and no one can take time off for study.

If a young person’s “job” is to learn and be productive, he/she should be paid to do that job, especially since that job is one of America’s most important.

6. ELIMINATE FEDERAL TAXES ON BUSINESS

Businesses are dollar-transferring machines. They transfer dollars from customers to employees, suppliers, shareholders and the federal government (the later having no use for those dollars). Any tax on businesses reduces the amount going to employees, suppliers and shareholders, which diminishes the economy. Ultimately, all business taxes reduce your personal income.

7. INCREASE THE STANDARD INCOME TAX DEDUCTION, ANNUALLY. (Refer to this.) Federal taxes punish taxpayers and harm the economy. The federal government has no need for those punishing and harmful tax dollars. There are several ways to reduce taxes, and we should evaluate and choose the most progressive approaches.

Cutting FICA and business taxes would be a good early step, as both dramatically affect the 99%. Annual increases in the standard income tax deduction, and a reverse income tax also would provide benefits from the bottom up. Both would narrow the Gap.

8. TAX THE VERY RICH (THE “.1%) MORE, WITH HIGHER PROGRESSIVE TAX RATES ON ALL FORMS OF INCOME. (TROPHIC CASCADE)

There was a time when I argued against increasing anyone’s federal taxes. After all, the federal government has no need for tax dollars, and all taxes reduce Gross Domestic Product, thereby negatively affecting the entire economy, including the 99.9%.

But I have come to realize that narrowing the Gap requires trimming the top. It simply would not be possible to provide the 99.9% with enough benefits to narrow the Gap in any meaningful way. Bill Gates reportedly owns $70 billion. To get to that level, he must have been earning $10 billion a year. Pick any acceptable Gap (1000 to 1?), and the lowest paid American would have to receive $10 million a year. Unreasonable.

9. FEDERAL OWNERSHIP OF ALL BANKS (Click The end of private banking and How should America decide “who-gets-money”?)

Banks have created all the dollars that exist. Even dollars created at the direction of the federal government, actually come into being when banks increase the numbers in checking accounts. This gives the banks enormous financial power, and as we all know, power corrupts — especially when multiplied by a profit motive.

Although the federal government also is powerful and corrupted, it does not suffer from a profit motive, the world’s most corrupting influence.

10. INCREASE FEDERAL SPENDING ON THE MYRIAD INITIATIVES THAT BENEFIT AMERICA’S 99.9% (Federal agencies)Browse the agencies. See how many agencies benefit the lower- and middle-income/wealth/ power groups, by adding dollars to the economy and/or by actions more beneficial to the 99.9% than to the .1%.

Save this reference as your primer to current economics. Sadly, much of the material is not being taught in American schools, which is all the more reason for you to use it.

The Ten Steps will grow the economy, and narrow the income/wealth/power Gap between the rich and you.

MONETARY SOVEREIGNTY