THINK: Depending on how you count it, the federal government’s “debt” totals about $30 trillion.

That means it has to pay interest on and pay back $30 trillion worth of deficits. (So-called “debt” is the net total of all previous deficits.)

How can it possibly service that amount?

Taxes can’t do it because if taxes could do it, there would be no deficits (which are defined as spending minus taxing).

Borrowing can’t do it. Who has $30 trillion dollars they are willing to lend to a “deadbeat” government — a government that continues to run growing trillion-dollar deficits year after year?

Where does the money come from?

There are all sorts of lies: Big lies, small lies, white lies, obvious lies, humorous lies, political lies, and “no-one-would-believe-that” lies. You encounter them all almost every day.

For example, despite what you have read, the IRS does not plan to hire 87,000 more agents to look over your shoulder.

Here is an excerpt from a Time Magazine article published in August 2022:

A Treasury Department report from May 2021 estimated that (the Inflation Reduction Act) would enable the agency to hire roughly 87,000 employees by 2031.

But most of those hires would not be Internal Revenue agents and wouldn’t be new positions.

Despite all the political huffing and puffing about agents coming after you, the entire rumor is a QAnon-style invention designed to inflame the naïve MAGA group, who have proven they will believe anything, no matter how outrageous (or especially outrageous).

Although the whole 87,000 IRS agents story is a load of right-wing, scare-monger poppycock, it is related to two facts that should get you angry enough to eat nails.

Fact #1. You shouldn’t have to pay any federal tax, because federal taxes pay for nothing.

Forget about how many IRS agents there are; focus on the real issue: Why are there any IRS agents at all?

Since the day of your birth, you have been immersed in the same belief: The federal government collects taxes to pay for the goods and services it buys. And because you have heard it again and again, you will find it very difficult to unlearn.

But it’s all a lie — A Big Lie.

The U.S. federal government is unique. It is not like state and local governments. It also is not like businesses, you, or me. The federal government uniquely is Monetarily Sovereign.

It is sovereign over its own sovereign currency, the U.S. dollar. It can create as many dollars as it wants, merely by touching a computer key. And it can give those dollars any value it wishes.

The federal government never unintentionally can run short of dollars.

Former Federal Reserve Chairman, Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency.”

Even if the U.S. federal government didn’t collect a penny in taxes, it could continue spending, forever.

The whole tax collection scheme, the IRS, the federal tax laws, tax evasion laws — everything to do with federal taxes — all are part of a performance to convince you that the federal government needs or uses your tax money to pay its bills.

And it simply is not true.

There’s the debt-limit fight that comes up ever few months. It’s the one where the political party out of power threatens the party in power that nothing will get done unless spending is reduced.

It’s all a charade. A lie. A Big Lie.

And they prove it’s a lie by simply agreeing to keep spending. The misnamed “debt” isn’t reduced or even limited.

Former Federal Reserve Chairman, Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

The handwringing over the federal “debt” (that isn’t a real debt) and the threatened demise of Social Security and Medicare “trust funds” (that aren’t real trust funds) — there is not an ounce of truth in any of it.

The federal government could (and should) eliminate the FICA tax while continuing to pay Social Security and Medicare benefits, forever. It even could double or triple those benefits, and still not ask you for a penny in taxes.

Quote from the 60 Minutes TV show: Scott Pelley: Is that tax money that the Fed is spending? Ben Bernanke: It’s not tax money… We simply use the computer to mark up the size of the account.

The federal government is lying to you. The politicians are lying to you. The economics professors and newspaper writers, virtually everyone who tells you anything about federal taxes either is lying to you or doesn’t understand reality.

While state and local taxes do fund state and local government spending, federal taxes do not fund federal spending. Period.

The federal government being Monetarily Sovereign, is unique. The sole purpose of federal taxes is to help the government control the economy by taxing what it wishes to discourage and by giving tax breaks to what it wishes to encourage.

Unlike state and local governments, the federal government (specifically, the U.S. Treasury) destroys all the tax dollars it receives. Those tax dollars, nearly all of which are part of the M1 money supply measure, cease to be part of any money supply measure when they are received.

Not being part of any money supply measure, they effectively cease to exist. (I know an economist who claims that the purpose of federal taxes is to give value to money. Utter beeswax. Has he never heard of bitcoin? No taxes there.

No, the sole function of federal taxes is economic control.) Federal taxes simply are a whip to beat you if you get out of line, and to refrain from beating you if you obey the government’s wishes.

Rather than using tax punishment to discourage, the government can use rewards to encourage. While taxes weaken the economy by removing dollars from your pockets, rewards would strengthen the economy by adding dollars.

The above are the absolute facts, and you probably believe none of them. You would need remarkable mental strength to ignore the false indoctrination you have received from so many trusted sources for so many years.

At first hearing, Monetary Sovereignty might seem complicated and hard to understand, yet it is the simplest idea possible. It can be expressed in one short sentence:

The federal government has the unlimited ability to create dollars.

Dollars are not found in nature. They are created by laws. The U.S. dollar exists because of U.S. laws.

Laws created the first dollar and all subsequent dollars. So long as the U.S. government has the unlimited ability to create laws, it has the same unlimited ability to create dollars.

You have no trouble visualizing that the government can create all the laws it wants. So, you just as easily should be able to visualize the government creating all the dollars it wants.

Think of the board game, Monopoly. The Monopoly dollars exist because of Monopoly rules, which are written by people.

Current rules dictate that the Monopoly Bank cannot run short of dollars. If during a game, it would run short of paper dollars, you simply cut some paper and create new dollars.

So it is with the U.S. government. It always can create new dollars.

Remember that the next time someone tells you the federal government “can’t afford” something, or the government should run a balanced budget, or the federal debt is a burden on the government or on taxpayers. Or the Social Security trust fund is going bankrupt. All lies.

Here is the federal government taking billions, no trillions, from the economy, all for naught. It is the single biggest money scam in all of human history, and it is based on the Big Lie.

Imagine what that Big Lie has cost us: Healthcare, food, education, poverty, progress in every form, research, millions of great things that could have been done were it not for the falsely perceived shortages of money — the most expensive lie, ever.

Fact #2: The overriding goal of the Republican Party is to make the rich, richer.

The rich become richer, not just when they make more money, but rather when the income/wealth/power Gap between them and the middle widens. The goal of the Republican party is to widen the Gap, i.e., to make the rich richer.

They truly are the party of the rich. They proved it when they gave tax breaks to the rich. They proved it when they repeatedly tried to destroy Obamacare.

They prove it when they refuse to expand Medicare. They prove it when they refuse to support gun control (It’s mostly poorer Americans who die from gun killings).

They prove it when they cry crocodile tears about federal spending coming from taxpayer pockets (which it doesn’t.) They proved it when they voted against the veterans’ health bill, expanding other veterans’ benefits, paid family leave, and most other benefits for the poor.

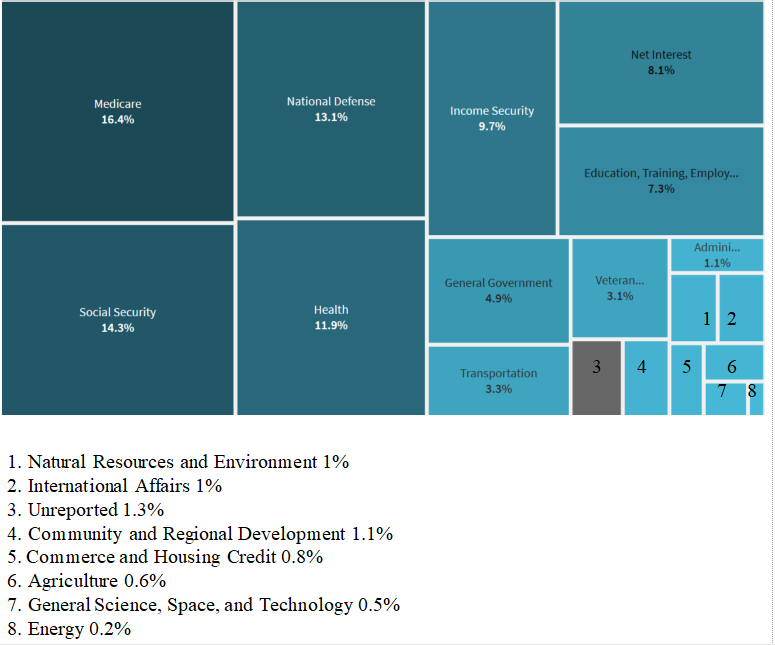

Why the focus on the Republicans? Because they are the primary debt complainers. They are the ones who most want to cut federal spending. And here is where that spending goes:

While the rich receive the most lucrative tax breaks, the “not-rich” receive most of the spending. So, the focus of the GOP always is on spending cuts, which come from middle-class wallets.

The rich seldom want to cut the tax breaks that allow people like billionaire Donald Trump to pay far less in federal taxes than you do.

The rich love to pretend the federal government can’t afford to provide Americans with healthcare, retirement funds, free transportation, school lunches, good housing, education and other benefits that rich people accept as their due in life.

In Summary, the broad populace suffers because of economics ignorance. They believe the federal “debt” is a real debt when it merely is the total of deposits into privately owned accounts resembling safe deposit boxes.

The government doesn’t owe the debt any more than it owes the contents of those boxes. It merely returns the debt to the owners.

The populace believes the Social Security and Medicare “trust funds” are real trust funds. They believe the Big Lie that federal spending must be paid for by federal taxes.

These beliefs make them passive about paying for things that should be free, while the rich avoid paying.

False beliefs make the people accept the notion that the rich are concerned about those 87,000 IRS agents going after the poor and middle classes, when their real concern is that more agents would check on the rich.

If you are one of the people who believes federal taxes are necessary to pay for your federal benefits than you will go to your grave ignorant about your own complicity in cheating . . . YOU.

I understand why you believe the lies. Everyone around you has been spouting them for decades. But it’s time for you to use your own brain. Ask yourself this:

“How could the federal government service $30 trillion in deficits, unless it had the unlimited ability to create dollars?”

The answer: It couldn’t. No amount of clever bookkeeping could service deficits of that magnitude — unless the government had infinite dollars at its disposal.

And that is the answer to the title question.

The federal government created the first U.S. dollar from thin air and gave it an arbitrary value, by creating laws from thin air.

Ever since, the government has been doing that same thing. It can continue, forever. No taxes necessary. Just laws.

You have been conned your entire lifetime and will be conned until you understand the facts, and then protest.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY