Here is a Libertarian article, as usual, complaining about the federal deficit.

Why Did Joe Biden Stop Talking About the Deficit?

You can read the entire article by clicking the above link, but here are excerpts to give you the essence. Can you guess what crucial data is missing from the report?

The federal budget deficit has exploded under Biden’s watch, and he can no longer pretend otherwise. ERIC BOEHM | 7.19.2023

At times last summer, it seemed like the only thing President Joe Biden wanted to talk about was the federal budget deficit.

“We’re on track to cut the federal deficit by another $1.5 trillion by the end of this fiscal year. The biggest decline ever in a single year, ever, in American history,” Biden claimed during a May 2022 press conference.

Later that same month, in a Wall Street Journal op-ed touting his economic program, Biden wrote that the deficit would fall by $1.7 trillion and repeated the “largest reduction in history”claim. That talking point was still getting heavy rotation in September when the president bragged on 60 Minutes about his deficit-cutting powers.

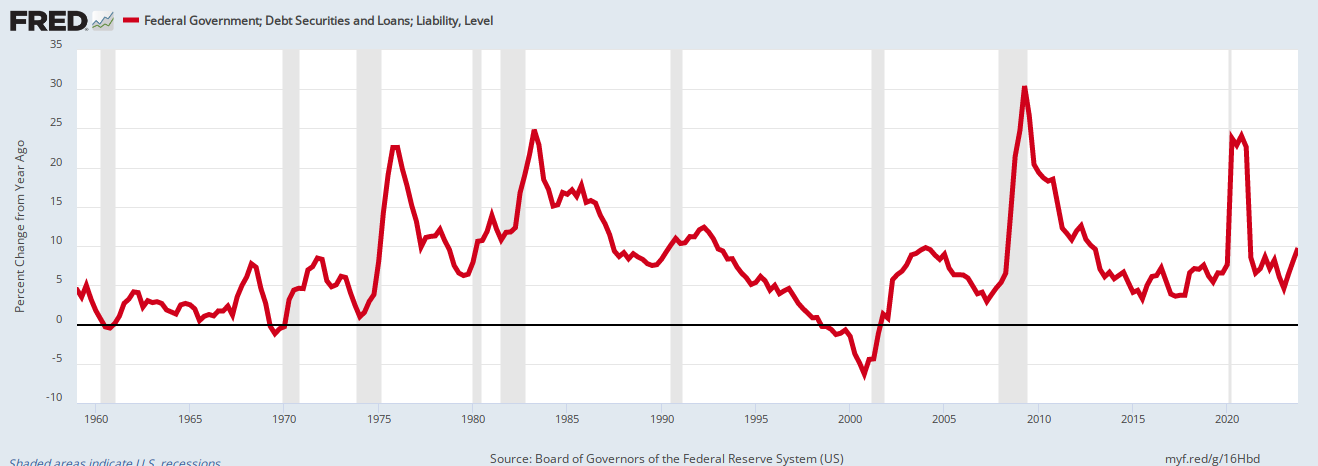

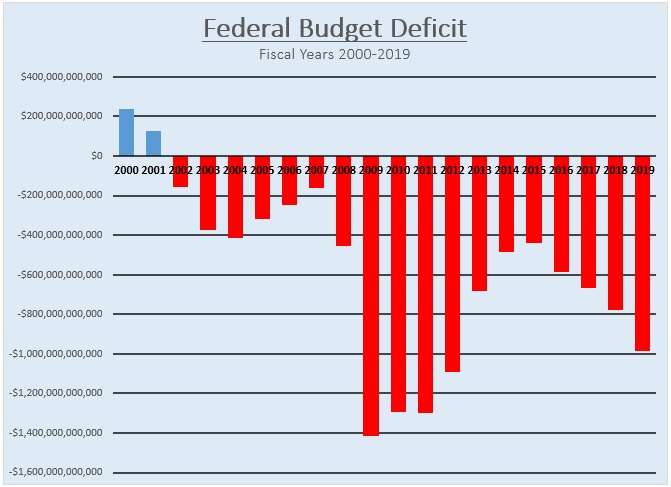

Of course, as Reason (and other outlets) clarified, the falling deficit was not the result of anything the president had done. There had been an unprecedented amount of federal spending in 2020 and 2021 due to the COVID-19 pandemic, and that spending drove the budget deficit to record highs: over $3.1 trillion in 2020 and more than $2.7 trillion in 2021.

As the pandemic passed and federal spending returned to more normal levels, so did the annual budget deficit. (In fact, the deficit would have fallen further last year if not for Biden’s policies, thanks to things like the infrastructure bill and last year’s federal budget.)

The CBO projects that the deficit will ring in around $1.5 trillion when the current fiscal year wraps up on September 30.

Funny that Biden doesn’t want to talk about that.

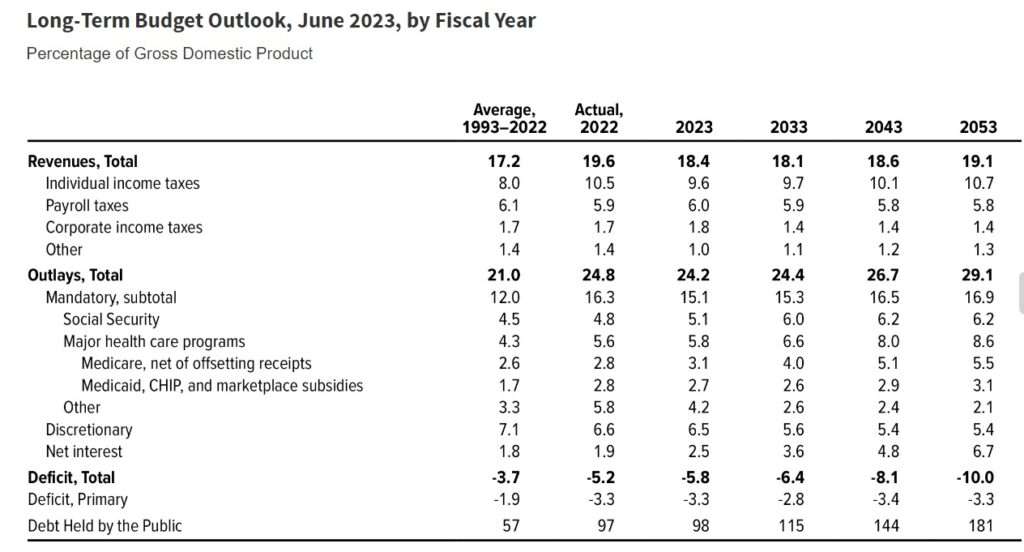

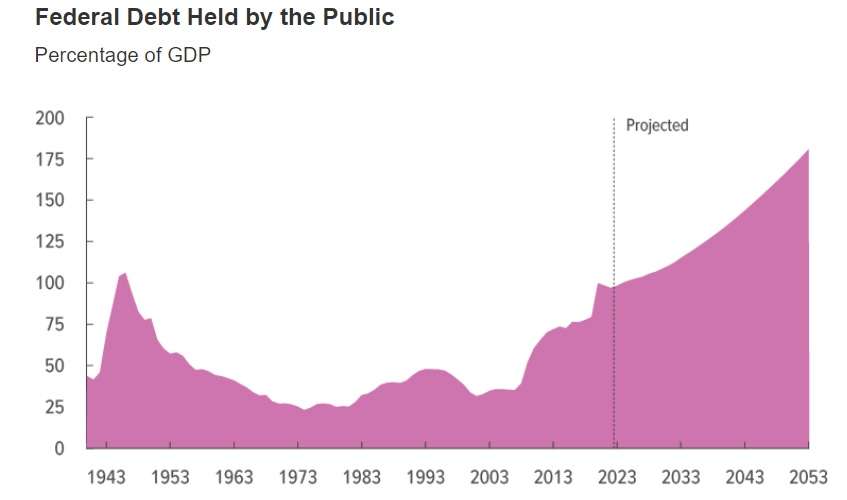

It’s less funny that he’s also ignoring the trajectory of the federal deficit in future years. Rather than shrinking, the gap between federal revenue and federal spending is on course to widen dramatically in the coming decades.

Wow, the federal budget deficit must awful for the economy. Here is what Eric Boehm, the Libertarians, and the Congressional Budget Office claim:

That means the federal government will have to take on more debt. The rising cost of that debt will “slow economic growth, drive up interest payments to foreign holders of U.S. debt, elevate the risk of a fiscal crisis, increase the likelihood of other adverse effects that could occur more gradually, and make the nation’s fiscal position more vulnerable to an increase in interest rates,” the CBO warned last month.

That’s quite a claim. Have you figured out what’s missing?

Data. There is no data. Just assumptions.

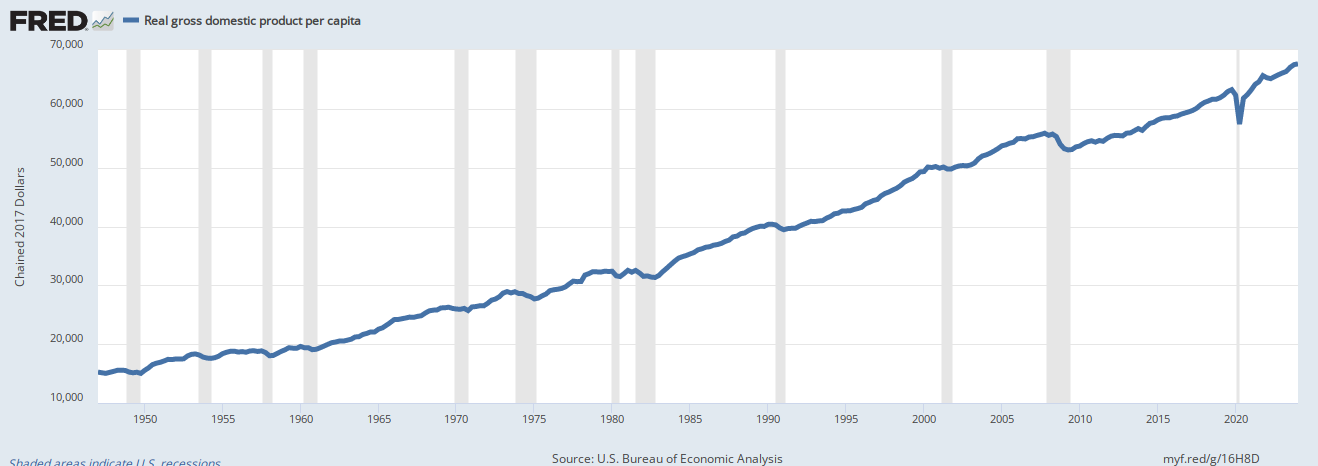

Let’s examine those assumptions: Will federal deficit spending “slow economic growth”?

The term “economic growth” means Gross Domestic Product (GDP) growth. The formula for GDP is GDP = Federal Spending + Nonfederal Spending +Net Exports.

Look at that formula and explain to me the mechanism by which federal deficit spending will “slow economic growth.”

Unless you believe there is some magic way in which increased taxes can increase economic growth, there is no mechanism by which increased federal deficit spending can “slow economic growth.”

Will increased federal deficit spending “drive up interest payments to foreign holders of U.S. debt.” Yes, of course, it will. But is that supposed to be a problem?

Being uniquely Monetarily Sovereign, the federal government has infinite dollars. It pays all its dollar-denominated debts simply by pressing computer keys. No tax dollars are involved.

And despite the massive increase in deficits, the government never has and never will run short of dollars to pay interest.

Further, the federal government has absolute control over interest rates. The Fed sets rates arbitrarily to combat inflation, not to sell T-bonds.

The federal government has no need to sell any debt. It could stop offering T-securities tomorrow, and that would not affect the government’s ability to spend.

The sole purpose of T-securities is to provide a safe place to store unused dollars, which helps stabilize the dollar, not to provide spending money to the federal government/

(This is different from state/local government taxes, which do provide spending money to state/local governments.)

Will increased federal deficit spending “elevate the risk of a fiscal crisis”? What fiscal crisis? Unlike you and me. The government can’t run short of dollars.

Liars love to use general language without data backup.

Will increased federal deficit spending “increase the likelihood of other adverse effects that could occur more gradually, and make the nation’s fiscal position more vulnerable to an increase in interest rates”? What adverse effects?

The CBO Libertarians never say because there are none.

And what do they mean by the nation’s “fiscal position being vulnerable”? Again, they never say.

The warning is one big fat load of generalized poppycock, a vast word salad with zero meaning.

Why do they embarrass themselves by spewing such nonsense? Here’s one reason, probably the main reason:

Biden successfully blocked a House Republican attempt to impose stricter spending caps as part of that deal and refused to include entitlement spending—the real driver of long-term deficit growth—in the negotiations.

Ah, yes. The “real driver” of deficit growth is entitlement spending, aka Social Security, Medicare, Medicaid, unemployment, and other “welfare” programs — all benefits to the middle- and lower-income groups.

Why do the Libertarians and the Republicans want to cut those programs? Why do they spread the nonsense that, somehow, the federal government can’t afford them, when the federal government can afford any payment denominated in U.S. dollars?

Statement from the St. Louis Fed: “As the sole manufacturer of dollars, whose debt is denominated in dollars, the U.S. government can never become insolvent, i.e., unable to pay its bills. In this sense, the government is not dependent on credit markets to remain operational.”

Get it? “Not dependent on credit markets. That’s Fed-speak meaning the government does not need to borrow, and in fact, does not borrow. It creates all the dollars it needs by pressing computer keys.

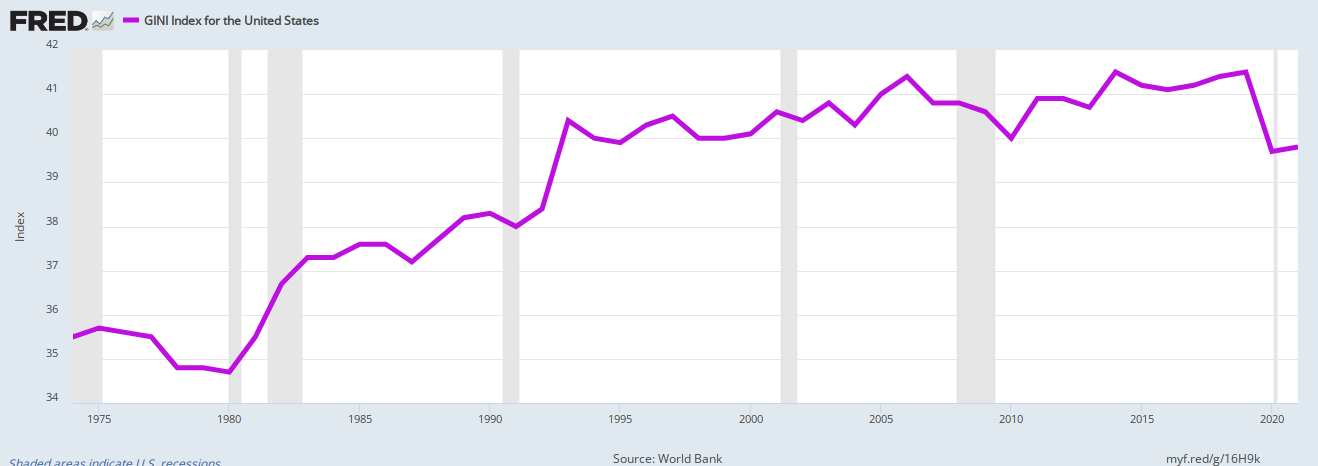

The reason has to do with Gap Psychology. The logic goes like this:

- “Rich” is a comparison, not an absolute. If you had $1,000, you would be rich if everyone else had $10, but you would be poor if everyone else had $10,000.

- To become more affluent, you must widen the Gap between you and those who have less while narrowing the Gap between you and those who have more.

- You can widen the Gap in two ways: Get more for yourself or make sure those below you have less.

- The rich, who run America, get richer by widening the Gap below them. This includes spreading the false tale that Social Security, Medicare, etc., must be cut. They spread the tale by bribing three influencers:

- The media, bribed by advertising dollars and media ownership

- The politicians, bribed by campaign contributions and promises of future employment

- The economists, bribed by university contributions and lucrative jobs in “think tanks.”

Thus, the Big Lie (federal finances resemble personal and state/local government finances) is disseminated.

The public is led to believe their federal tax dollars fund federal spending. They don’t. The purpose of federal (as opposed to state/local) taxes is to control the economy by taxing what the federal government wishes to discourage and giving tax breaks to what the government wishes to help.

Additionally, federal taxes can help increase demand for the U.S. dollar by requiring taxes to be paid in dollars.

So, the entire article is based on lies. That is why it contains no historical data.

These general claims seem logical to the public because the claims apply to monetarily non-sovereign entities, not the Monetarily Sovereign U.S. government.

You never will see this graph presented by any Libertarian or Republican:

Note to politicians, media writers, and right-wing economists, you’ve done a great job lying to the public on behalf of the rich. You have helped make the rich richer. Congratulations.

One day, soon (I hope), the public will catch on to your lies.

At that time, the people will demand, vote for, and receive such benefits as Free Medicare, expanded Social Security, affordable food and housing, and free college education.

The rich already receive those benefits, courtesy of “friendly” tax laws.

The rest of the population soon will catch on to the fact that the federal government can supply all the benefits the rich receive, while collecting zero taxes.

The public just needs to see that they have been lied to.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY