“The federal ‘debt’ is too high.”

That false belief — the Big Lie in economics — is so deeply implanted into the public’s brain that one seldom sees any discussion about its falsity.

The simple assumption is that debt is a burden, and more debt is a greater burden, and the federal government is deeply in debt, so the government should spend less and tax more to get rid of the debt burden.

And it’s all a gigantic, horrible, damaging lie, a Big Lie that locks the middle and bottom incomes in place while enriching the top.

That is the whole plan.

The very rich, who run America, send the Big Lie at us from all sides: The media, the politicians, and the economists, either via bribery or ignorance.

The rich bribe the media with advertising dollars or outright ownership. The rich bribe politicians with campaign contributions or promises of lucrative employment—the rich bribe economists with contributions to schools or employment at think tanks.

And those not bribed are influenced by constant repetition of the Big Lie, which addles their brains, reducing their ability to recognize obvious flaws in the Big Lie. Here are but three examples.

I. Why proposed GOP spending cuts hardly dent national debt, David Lightman

We assume David Lightman means federal, not national, debt. His reference is not to the nation’s debt but to the federal government’s.

But what he and virtually all others call “debt,” those Treasury bills, notes, and bonds aren’t debt. And contrary to popular wisdom, they aren’t “borrowing.”

We of the private sector (including state and local governments) borrow dollars to help us pay for things.

We don’t have the unlimited ability to create dollars, so we can run short. We are what is known as monetarily NON-sovereign.

You, I, and the local governments need a sovereign currency we can create instantly. We use the dollar.

By contrast, the U.S. federal government is Monetarily Sovereign. It created the first dollar and still creates the U.S. dollar from thin air merely by tapping computer keys.

The federal government cannot unintentionally run short of dollars. Even if the U.S. government stopped collecting taxes, it could continue creating and spending dollars forever.

Why does the government collect taxes if it doesn’t use them for spending?

- To control the economy by taxing what it wishes to discourage and giving tax breaks to those it rewards and encourages.

- To provide a certain demand for the dollar by requiring taxes to be paid in dollars.

- To fool the public into believing that certain benefits are unaffordable, thus widening the income/wealth/power Gaps between the rich and the rest. This is how the rich become richer.

Why does the government issue Treasury bills, notes, and bonds if this isn’t borrowing and the government doesn’t need the money? The purposes of T-securities are:

- To provide a safe, interest-paying place for the world to store unused dollars. This helps stabilize and secure the value of the dollar.

- To help the Federal Reserve control interest rates.

- To fool the public into believing the government must borrow dollars to pay for benefits given to the middle- and lower-income groups. This stifles the public’s objections to benefit cuts for the middle and lower-income groups and enriches the rich.

Why isn’t this borrowing? When you invest in a T-security, you open your account and deposit your dollars into it.

Think of this account as being like your bank safe deposit box. You, not the bank, own the contents of the box.

Similarly, you, not the federal government, own the contents of your T-security account.

The federal government neither uses nor even touches those dollars. That is why it’s not borrowing.

When your deposit reaches maturity, the government merely transfers the contents of your account to you. This is no more a burden on the federal government than is your bank allowing you to retrieve the contents of your safe deposit box.

That is why the contents of your safe deposit box are not your bank’s debt, and the contents of your T-security account are not the federal government’s debt.

Then why do so many people erroneously call T-securities “borrowing” and “debt”?

The Big Lie survives because of confusion and ignorance. The public needs to learn the differences between Monetary Sovereignty and monetary non-sovereignty. The people must also learn the differences between federal T-bills, T-notes, and T-bonds vs. private sector bills, notes, and bonds.

The words look the same, but they are homonyms. They describe vastly different things, like the word “band” (a ring vs a musical group.)

A private sector bond transfers dollars from a lender’s account to a borrower’s account. The lender surrenders ownership of the dollars in exchange for the borrower’s bond.

The borrower then controls those dollars and uses them for his purposes. This is true even for state and local government bonds. The dollars go to the state and local government checking accounts at private-sector banks.

A T-bond transfers dollars from the bond owner’s checking account to the bond owner’s bond account. The bond owner never loses ownership of the dollars, and the government never touches the dollars.

The dollars are returned to the bond owner’s checking account upon maturity.

Private sector bonds denote borrowing and resultant debt. Treasury bonds indicate deposits, not debt. This confusion and ignorance help the rich to foster the Big Lie.

The relentless conservative drive to dramatically cut federal spending — a campaign that nearly caused a government shutdown and helped topple House Speaker Kevin McCarthy — wouldn’t do much to reduce the national debt anytime soon significantly.

There is zero reason to cut federal spending and a huge reason not to: When federal spending is cut or even increased too little, we have recessions and depressions.

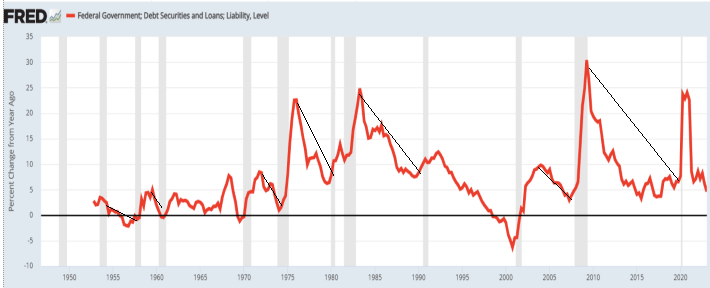

The above graph dramatically shows how reduced federal deficits lead to recessions cured by increased obligations.

The Federal Reserve calls the red line “Federal Government Debt Securities and Loans, Liability, Level” when it is more like “Deposits into T-Security Accounts.” Even the Fed gets it wrong.

Going back in time, here is what happens when the federal government runs a surplus (taxes exceed spending).

U.S. depressions tend to come on the heels of federal surpluses.

1804-1812: U. S. Federal Debt reduced 48%. Depression began in 1807.

1817-1821: U. S. Federal Debt reduced 29%. Depression began in 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began in 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began in 1857.

1867-1873: U. S. Federal Debt reduced 27%. The depression began in 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began in 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began in 1929.

1997-2001: U. S. Federal Debt reduced 15%. The recession began 2001.

Why do the rich want the government to run surpluses?

- A surplus requires a tax increase and/or a spending decrease. Congress has provided tax loopholes so the rich seldom are affected by the tax increases paid for by the rest of us. Concerns about deficit rarely translate into a reduction of loopholes for the rich. A federal surplus effectively widens the income/wealth/power Gap between the rich and the rest

- The spending decreases invariably come from benefits important to those who are not rich — Medicare, Medicaid, Social Security, and other poverty aids — further widening the Gap.

- Surpluses cause depressions and recessions, forcing unemployment and providing rich business owners with a ready supply of desperate workers who will labor at starvation wages.

During recessions and depressions, the rich can maintain their lavish lifestyles while the rest of the populace suffers.

The push for drastic reductions in federal spending is expected to come up again once House Republicans pick a new speaker.

Whoever takes the gavel is expected to keep pushing for deep cuts. The Democratic-run Senate is unlikely to go along, but the GOP effort matters as a message to constituents about what Republicans are seeking.

The Republicans are the party of the rich. They are more likely to do the rich’s bidding than the Democrats, as evidenced by the divergent stances on federal spending.

The GOP initiative is also a reminder of why Congress is so stuck on adopting a budget.

When McCarthy, R-Bakersfield, agreed last month to a bipartisan plan to continue current spending for 45 days, angry conservatives plotted his successful removal.

The GOP is so in thrall of the rich it even demoted its House Speaker when he failed to end the government’s ability to spend.

The GOP budget plans range: For instance, aid that 702,000 Californians receive to buy healthy produce (through the Women’s, Infant and Children’s program WIC) would be dramatically cut.

So would the federal tax credit for electric vehicle charge equipment.

While such reductions collectively would save billions, nonpartisan budget analysts maintain that the cuts barely address the broader question of how to reduce the nation’s $33 trillion debt significantly.

Why is reducing the government’s “debt” (that isn’t a debt) an important question? Because it’s what the rich want, and their money talks.

Republican budget-cutters claim that their changes are a vital first step toward making the federal government more efficient and starting on a useful path to reducing the debt.

Reduced spending does not make government “more efficient.” Growing the economy is the government’s job, so reducing federal spending makes the government less efficient at its job.

Gross Domestic Product (GDP) is a common measure of the economy.

GDP = Federal Spending + Non-federal Spending Net Exports.

When Federal Spending increases, Non-federal spending also increases. When two terms of the equation increase, GDP increases.

Mathematically, there is no way for the government to do its job — growing the economy — by cutting spending.

“Stop bleeding money, stop racking up debt, defend the United States, stop social engineering, and just do your damn job as Congress.

I think that ought to be a pretty simple goal and a bipartisan goal,” said Rep. Chip Roy, R-Texas.

The key words are “stop social engineering.” This is right-wing speak for “cut Social Security, Medicare, Medicaid, and cut all benefits received by those who aren’t rich but don’t touch the loopholes that allow people like Donald Trump to pay $500 per year in federal taxes.”

Struggling with debt, The federal budget had annual surpluses from fiscal 1998 to 2001, as a booming economy, a 1995 budget deal, and a 1993 tax increase helped revenue pour into the Treasury.

As you can see in the above graph, the recession of 2001 resulted from the federal surplus that began in 1998 and ended in 2002, when we emerged from the recession.

Since then, there have been nothing but annual deficits—$1.35 trillion in fiscal 2022—and the national debt has grown to $33 trillion.

David Lightman conveniently forgets that in the same period, Gross Domestic Product more than tripled, due to federal spending.

The deficit began climbing as Washington responded to the Sept. 11, 2001, terrorist attacks, pumping an estimated $2 trillion into wars in Iraq and Afghanistan. It spent to combat the Great Recession in 2009, delivered significant tax cuts in 2017, and passed huge COVID aid packages in 2020 to 2022.

Here is where the logic gets wacky. The government always spends to combat recessions. Federal spending is the one thing that cures recessions.

Why, then is it so hard for the debt nuts to understand that federal spending prevents recessions and grows the economy?

In fiscal 2022, the 12-month period that ended last September, the federal government spent $6.2 trillion. About two-thirds is called “mandatory spending,” meaning Congress does not have to vote on it. This includes Social Security benefits and Medicare payments.

That leaves only about one-third that Congress can control annually.

Wrong. Congress and the President have 100% control. They can, and should, expand Social Security and Medicare to include everyone in America, from birth to death, and for heaven’s sake, stop taxing Social Security benefits. That makes no sense from any standpoint.

Roughly half is defense, and the other half is domestic programs like education, transportation, energy, and others.

Most independent budget analysts agree that meaningful debt reduction involves costly entitlement spending. Social Security is estimated to be 11 years from insolvency. Medicare also faces financial problems in a few years.

You never will read a better expression of the Big Lie than the preceding paragraph. The phrase “meaningful debt reduction” should be changed to “harmful debt reduction.”

Neither Social Security nor Medicare can be “insolvent” or face “financial problems” unless that is what Congress and the President want.

The prevention and cure for those problems: A few touches of computer keys to provide money to these two vital programs — programs that benefit the “not-rich” far more than the rich.”

Those programs’ benefits are automatically funded and adjusted annually for inflation. Social Security benefits this year are up 8.7%, and next year are expected to climb about 3%.

The House’s GOP-run budget committee released a budget blueprint this summer that, while it proposes deep spending cuts, would not change Social Security. It does propose billions in Medicare savings through reforms.

Isn’t it clear why the budget cutters always use the word “reforms” when the honest word would be “cuts.”

Every conceivable “reform” for Medicare involves the Monetarily Sovereign federal government sending fewer dollars to the monetarily non-sovereign private sector.

As we repeatedly have experienced, reducing federal spending is recessionary or depressionary.

“Our budget protects and strengthens Medicare through policies that drive down out-of-pocket costs for seniors, stop overpayments, and enhance our healthcare workforce,” the budget says.

The budget does no such thing, neither protecting nor strengthening Medicare. To protect and strengthen:

- Eliminate FICA, which pays for nothing. Instead pay for Medicare the same way the government pays for Congress, POTUS, SCOTUS and nearly every other federal program: Create new dolllars, ad hoc.

- Eliminate Medicare deductibles.

- Cover all the things that aren’t covered (dental, drugs, many procedures, etc.)

- Cover every man, woman. and child in America, from birth.

- Stop referring to the non-existent, fictional, phony Medicare Trust Fund.

It also urges the creation of a bipartisan commission to tackle the programs’ future. The commission would devise ways to get the programs on a sustainable financial path and help modernize the systems.

We don’t need another fake “bipartisan commission” that is ignorant (or feigns ignorance) of Monetary Sovereignty. Point #1 would get Medicare on a 100% sustainable path.

This sort of commission was arguably successful in the 1980s, when Social Security faced financial uncertainty.

It proposed what at the time were politically shaky reforms, including tax increases to fund the program and an increase in the age of eligibility.

The commission may have been “arguably” successful, but it wasn’t actually successful. It was a disaster.

The so-called “reforms” did nothing but shift the financial burden from the Monetarily Sovereign federal government (which never can run short of dollars) to the monetarily non-sovereign private sector (for which dollars always are scarce).

That could be called “successful” only in the eyes of the very rich. The Gap below widened, which is how the rich become richer.

Cuts and more cuts. The political focus is on spending cuts and taking incremental steps that are unlikely to get final approval. Once the House gets down to business again, those cuts will be the main topic of debate for some time.

Spending cuts always are harmful. By mathematical definition, they reduce GDP.

The House Budget Committee said in its blueprint that its plan can deliver a surplus by fiscal 2033. In addition to cuts, it assumes 3% economic growth per year, above what the nonpartisan Congressional Budget Office forecasts. More growth usually means more revenue and less spending.

The same surplus that repeatedly caused depressions in the past 200 years? Or Clinton’s surplus that “only” caused a recession?

Do these people not understand simple algebra? GDP=Federal Spending + Nonfederal Spending + Net Exports. How will federal spending cuts increase GDP?

The budget also reverses some of the plans Democrats recently approved. Outlays for green energy and technology “should have been targeted towards traditional roads and bridges, not wasteful initiatives,” the committee said, listing several programs it found excessive.

The committee claims that green energy and technology to save our planet are “excessive” and “wasteful initiatives”? What planet do these people live on?

Among them: $7.5 billion for electric vehicle charging stations, $5 billion for electric and low emissions buses and ferries and $10 million for career skills training to install energy efficient building technologies.

The Republicans prefer CO2-emitting, pollution-causing, gas-guzzling cars, busses, and ferries. And of course, they don’t want “energy efficient building technologies”.

Rep. Marjorie Taylor Greene, R-Georgia, proposed the reduction in Pentagon Secretary Austin’s salary, arguing “he is destroying our military.” She cited the chaotic American withdrawal from Afghanistan, saying Austin “failed America.”

If Marjorie Taylor Greene speaks for the GOP, need I say more?

Some analysts warn that such cuts have the potential to harm the people who need help the most.

Not “potential” harm; real harm to real people.

Cutting Women, Infants and Children program funds to buy healthy produce would leave recipients with roughly $11 to $15 monthly to spend, the left-learning Center on Budget and Policy Priorities estimates.

It said the cuts would affect an estimated 702,000 toddlers, preschoolers, and pregnant, postpartum, and breastfeeding California participants in the program.

This is exactly what happens when politicians value the federal government’s finances (which are infinite) more than personal finances (which are limited).

Republicans have argued that strengthening work requirements in assistance programs will help motivate people to work, reducing the programs’ cost and helping the economy as people pay more taxes and increase their spending.

“Motivate people to work” follows the right-wing claim that the poor are lazy takers who would rather wallow in their poverty than work, while the rich are industrious givers who labor so hard on their yachts, private planes, gated communities, and chauffeur-driven limos.

===================================

Then there was this example of economics ignorance from Chartr, the web site that provides graphs for many different subjects:

II. Like most developed nations, the US spends more than it takes in taxes — essentially “living beyond its means”. For years, that wasn’t an issue, with Uncle Sam able to borrow at close to record-low rates for a decade.

Again, Uncle Sam never borrows its own sovereign currency, the U.S. dollar. It creates all the dollars it needs

However, higher borrowing costs have changed the game. Indeed, forecasts from the Congressional Budget Office project that the majority of future government deficits will not be down to net new spending, but rather paying the interest on what’s already owed (some $33 trillion), with deficits expected to rise as a share of GDP for the coming decades.

“Living beyond its means” is another version of the Big Lie, this one popularized by economically dense Democrat Barach Obama. The federal government has infinite means, so cannot live beyond it.

The deficit/GDP fraction is a popular, but meaningless number. It demonstrates nothing about the federal government’s financial health or its ability to pay its debts (which is infinite) and predicts nothing about the future.

You can visit a related website, “Debt to GDP Ranking by Country” and decide for yourself what the fraction tells you about anything at all.

Would the author of this article prefer to be owed money by Zambia (with a 119% score) rather than by the United States (with an “inferior” 128% score).

==========================================

And finally, to demonstrate how the Big Lie is everywhere, we come to the New York Times:

Higher rates stoke growing chorus of deficit concerns NYSE on June 13. The interest rate on 10-year Treasury bonds has spiked since July. By Jeanna Smialek, Jim Tankersley and Joe Rennison The New York Times

The U.S. government’s persistent budget deficit and growing debts were low on Wall Street’s list of worries when interest rates were at rock bottom for years.

But borrowing costs have risen so sharply that it is causing many investors and economists to fret that the United States’ big debt pile could prove less sustainable.

In 1940, The Gross Federal Debt Held by the Public totaled $41 Billion and was called a “ticking time bomb.” Now, it’s somewhere near $31 TRILLION.

Yet the bomb still ticks, and we still sustain, though the NY Times continues to clutch its pearls. Must be a slow tick.

The exact cause of the latest run-up in Treasury rates is hard to pinpoint. Many economists say a combination of drivers is probably helping to drive it — including strong growth, fewer foreign buyers of America’s debt, and concerns about debt sustainability in and of itself.

Gee, does the Times think “the run-up in Treasury rates” might be related to the Fed’s repeated rate increases?

That old worry about “foreign buyers” not buying America’s “debt” should be retired. It’s complete nonsense.

The federal government is not in debt and does not rely on foreigners to provide it with its own sovereign currency, the U.S. dollar. It creates all the dollars it needs by touching computer keys. No limit.

What’s clear is that if rates remain elevated, the federal government will need to pay investors more interest in order to fund its borrowing.

“Paying investors more” is a good thing. It adds to GDP. But, since the U.S. federal government never borrows dollars, investors can’t “fund borrowing.”

The nation’s gross national debt stands just above $33 trillion, more than the total annual output of the U.S. economy. The debt is projected to keep growing both in dollar figures and as a share of the economy.

The fact that the non-existent “debt” (i.e., deposits in Treasury security accounts) is greater than GDP reveals zero about the economy. The oft cited Debt/GDP fraction is meaningless.

It’s like saying the Chicago Cubs had more runs than the Bears had field goals. Same “meaningful” comparison.

While the climbing cost of holding so much debt is stoking conversations among economists and investors about the appropriate size of the government’s annual borrowing, there is no consensus in Washington for deficit reduction in the form of either higher taxes or big spending cuts.

There’s no consensus because both higher taxes and spending cuts would injure the economy. Both take dollars from the economy and give them to the federal government, which promptly destroys them.

Should you cure anemia by applying leeches or by cutting wrists? No consensus there, either.

Still, the renewed concern is a stark reversal after years in which mainstream economists increasingly thought that the United States might have been too timid when it came to its debt: Years of low interest rates had convinced many that the government could borrow cheap money to pay for relief in times of economic trouble and investments in the future.

Our Monetarily Sovereign federal government has the infinite ability to “pay for relief in times of economic trouble,” no matter what interest rates have been. It does not borrow, cheap money or otherwise.

As always, the media confuse Monetary Sovereignty with monetary non-sovereignty. The former cannot run short of money; the latter can and often do.

“How big a problem deficits are depends — and it depends very critically on interest rates,” said Jason Furman, an economist at Harvard and former economic official under the Obama administration.

Oops, another Obama economist. That tells us all we need to know. What is it with Harvard that their economists believe the federal government borrows and needs to worry about the interest it pays?

We’ll finish with a lovely compilation of economic ignorance, widely promulgated, widely believed, and widely wrong.

Furman had previously estimated that the growing cost of interest on federal debt would remain sustainable for some time, after factoring in inflation and economic growth. But now that rates have climbed so much, the calculus has shifted, he said.

The deficit has been sustainable since — uh, since the federal government had the power to create laws, and laws had the power to create dollars.

The deficit will continue to be sustainable forever. The U.S. government cannot unwillingly run short of dollars. Not now. Not tomorrow. Not ever.

Higher interest rates are a leading cause, along with surprisingly weak tax collections, of what the Congressional Budget Office projects will be a doubling of the federal budget deficit over the last year.

The deficit, when properly measured, grew from $1 trillion in the 2022 fiscal year to an estimated $2 trillion in the 2023 fiscal year, which ended last month.

This means the federal government will pump about two trillion growth dollars into the economy. And this is a bad thing??

If borrowing costs climb further — or simply remain where they are for an extended period — the government will accumulate debt at a much faster rate than officials expected even a few months ago.

The federal government does not owe the misnamed “debt,” and even if it did, it could pay it all instantly.

The Big Lie in economics is that the federal government can run short of its sovereign currency. The Lie is repeated endlessly by nearly every information source — media, politicians, and economists.

The facts as explained by Monetary Sovereignty, are overwhelmed by the sheer volume of lies being promulgated from everywhere.

At long last, is there any one out there who has world standing plus even a modicum of knowledge about economics and Monetary Sovereignty? Is so, would that person please debunk the false notions that federal finances resemble personal finances and that federal benefits are “unsustainable”?

Hello?

Anyone?

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY

Some of those laws, which were created, from thin air, produced the political entity known as “the United States of America.” and some of those laws created, also from thin air, the U.S. dollar.

Those laws arbitrarily created millions of dollars, and arbitrarily created the value of those dollars, with regard to arbitrary amounts of silver and gold.

And now for the question that I believe to be the most important question in economics:

Some of those laws, which were created, from thin air, produced the political entity known as “the United States of America.” and some of those laws created, also from thin air, the U.S. dollar.

Those laws arbitrarily created millions of dollars, and arbitrarily created the value of those dollars, with regard to arbitrary amounts of silver and gold.

And now for the question that I believe to be the most important question in economics:

The closest parallel to a T-security account is a safe deposit box.

When you put dollars into your safe deposit box, your bank never touches those dollars, and your bank doesn’t owe you those dollars.

They neither are loans to your bank nor are they debts of your bank.

The bank “pays you back” simply by allowing you to take back whatever dollars are in your box.

Similarly, when you make a deposit into your T-security account, the federal government never touches those dollars. The government “pays you back” by allowing you to take back whatever dollars are in your account.

Since the federal government has no need to ask anyone for dollars, why does it provide for deposits into T-security accounts? There are two real reasons and one secret reason:

The closest parallel to a T-security account is a safe deposit box.

When you put dollars into your safe deposit box, your bank never touches those dollars, and your bank doesn’t owe you those dollars.

They neither are loans to your bank nor are they debts of your bank.

The bank “pays you back” simply by allowing you to take back whatever dollars are in your box.

Similarly, when you make a deposit into your T-security account, the federal government never touches those dollars. The government “pays you back” by allowing you to take back whatever dollars are in your account.

Since the federal government has no need to ask anyone for dollars, why does it provide for deposits into T-security accounts? There are two real reasons and one secret reason:

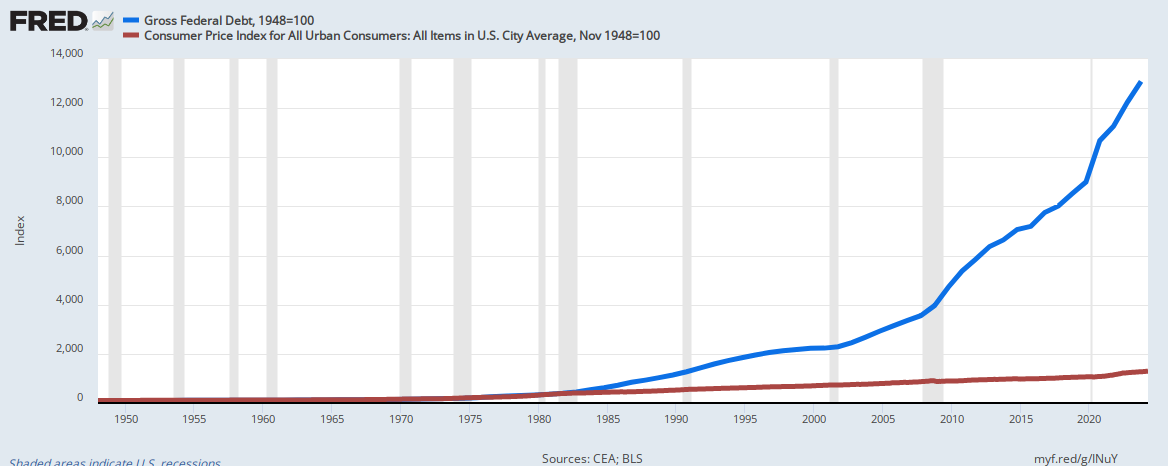

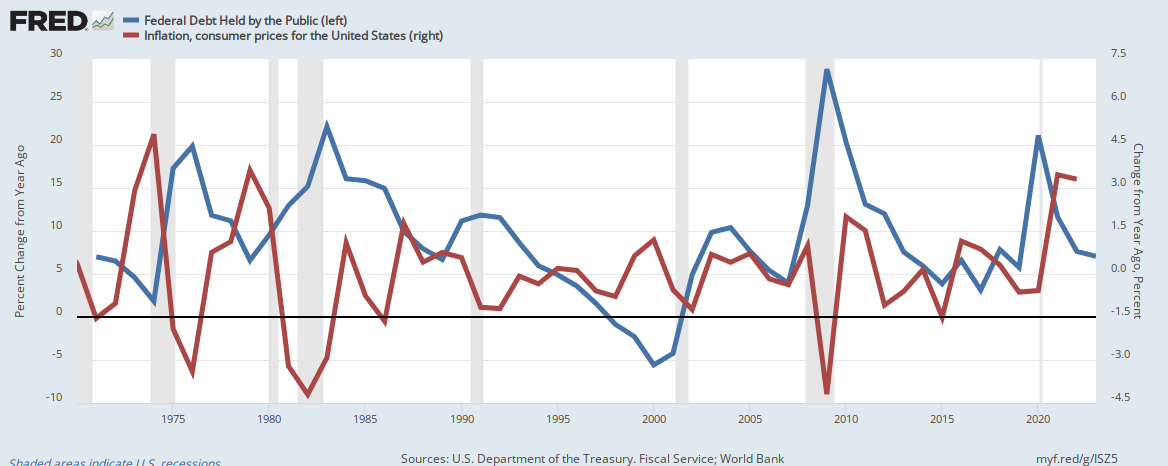

If federal deficit spending caused inflations, the blue line (federal deficits) and the red line (inflation) would be parallel.

Claims that future federal deficit spending, in any given amount, will cause inflation are based on intuition and guesswork and not on historical precedent.

Politically, is there a point beyond which federal deficit spending gives the federal government “too much power”?Libertarians think so.

In fact, Libertarians can be trusted to object to any amount of federal deficit spending, or even any amount of federal spending at all. They think people should be “free” to pay for unaffordable health care, education, infrastructure, housing, schooling, sustenance, and retirement.

Others think local governments should do what the federal government does because, in their belief, local governments know what local people want, and after all, aren’t we all “local” people?

Sadly, while the federal government, being

If federal deficit spending caused inflations, the blue line (federal deficits) and the red line (inflation) would be parallel.

Claims that future federal deficit spending, in any given amount, will cause inflation are based on intuition and guesswork and not on historical precedent.

Politically, is there a point beyond which federal deficit spending gives the federal government “too much power”?Libertarians think so.

In fact, Libertarians can be trusted to object to any amount of federal deficit spending, or even any amount of federal spending at all. They think people should be “free” to pay for unaffordable health care, education, infrastructure, housing, schooling, sustenance, and retirement.

Others think local governments should do what the federal government does because, in their belief, local governments know what local people want, and after all, aren’t we all “local” people?

Sadly, while the federal government, being