There is the Big Lie in all its glory. As an American, you are responsible for exactly $0 of the so-called “debt” (that isn’t even a real debt).Dems, Republicans Far Apart On Soaring U.S. Debt: I&I/TIPP Poll, Terry Jones, April 17, 2023

The perennial dance between the president and Congress over the budget and raising America’s debt ceiling is a widely reported but much-ignored, event. This time around, it shouldn’t be.

Even as our national debt soars, Americans are split over how serious the problem is, the latest I&I/TIPP Poll shows. Meanwhile, a government shutdown, or even possibly default, looms.

At the last official count, federal debt totaled about $31.5 trillion. Looked at from a different perspective, $31.5 trillion means each American household is now responsible for roughly $237,500 in U.S. debt.

What exactly is the “threat”? Is it that our Monetarily Sovereign government, which has the infinite ability to create its sovereign currency, the dollar, will be unable to service the “debt”? No, as previous Federal Reserve Chairs have said:And it’s getting bigger fast, posing a threat to both the economy and the financial system. If Congress and President Joe Biden can’t make a deal soon, a government shutdown, or worse, possible default, loom.

Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency.”

Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

Will the interest on the “debt” bankrupt the government? No:Alan Greenspan: “There is nothing to prevent the federal government from creating as much money as it wants and paying it to somebody.”

The federal “debt” isn’t even federal debt. It is the net total of deposits into T-security accounts held at the Federal Reserve. Each account resembles a safe deposit box. The depositor owns the contents. When each account matures, the contents are returned to the owner by transference to the owner’s checking account. It’s a simple asset transfer that does not involve you — not as a debtor, taxpayer, or American citizen — not in any way. So you can forget about the $237,500 Terry Jones, the author, claims you owe. You don’t.The respondents were given the false choice of two wrong answers. The “debt” is neither sustainable nor “manageable.” It is meaningless. The size of the economy is not the point. So long as America’s obligation to creditors is in U.S. dollars, it is totally under the control of the U.S. government. Governments get into financial trouble when:How does the public feel about this? The online I&I/TIPP Poll for April, taken from March 29-31 from 1,365 Americans across the country, asked the following question: “Some say that the debt is not sustainable.

Others say that the debt is manageable relative to the size of the American economy. Which is closer to your viewpoint?”

- They are monetarily non-sovereign, so they cannot create whatever currency they use (Examples are cities, counties, states, and euro nations) or

- They are Monetarily Sovereign but still trade and borrow in U.S. dollars or some other currency, not their own (Examples are Argentina, Russia, Venezuela).

It was a meaningless poll. The public believes what they are told, and they are wrongly told that federal (Monetarily Sovereign) financing is like personal (monetarily non-sovereign) financing.Overall, voters saying the debt is “not sustainable” totaled 48%, a plurality, compared to those who called the debt “manageable relative to the size of the economy” at 35%. (The poll’s margin of error is +/-2.8 percentage points.)

It isn’t the split that makes it hard to forge a satisfactory deal. It’s just that the two alternatives are of the “stork vs. angel” variety. The third alternative — that the so-called “debt” (i.e., deposits) is meaningless — was not offered.The political breakdown, however, is telling and perhaps explains why the debt debate each year gets increasingly divisive and angry: Republicans (74%) and independents (50%) overwhelmingly call the debt unsustainable, compared to Democrats at just 32%.

Only 14% of Republicans and 28% of independents call the debt “manageable,” versus 51% of Democrats who do.

This huge split between Democrats on one side, and Republicans and independents on the other, will make it hard to forge a deal satisfactory to both sides. Failure to do so risks a financial cataclysm.

As though the use of the term “debt” to mean “deposits” and the wrongheaded worries about “sustainability” (whatever that means) weren’t enough, the not-a-debt also repeatedly has been called a “ticking time bomb” every year since 1940. In 1940 the Gross Federal Debt was $51 Billion. By 2022, it was $31 Trillion, an astounding 60,000% increase. Annual predictions have been made that the “debt” is not sustainable, and every year America sustains it. Although it is the slowest time bomb in history, you can rely on this year’s repeat of the annual predictions that the “debt” is “unsustainable.” And as for that “shell game,” it’s the result of a strange law that essentially says, “We will punish our creditors unless they immediately return the dollars that T-security account owners have deposited.”What can be done? On Jan. 19, the debt ceiling was hit, meaning the government has had to play a kind of fiscal shell game to pay its bills.

The argument is this. The debt is unsustainable, but we’ll raise this unsustainable ceiling if you take dollars from the middle classes and the poor. Yes, really.House Republicans, negotiating with the Biden administration, have put forward a plan to temporarily raise the debt ceiling until May of next year. In exchange for avoiding a possible federal default, they seek caps on federal spending,

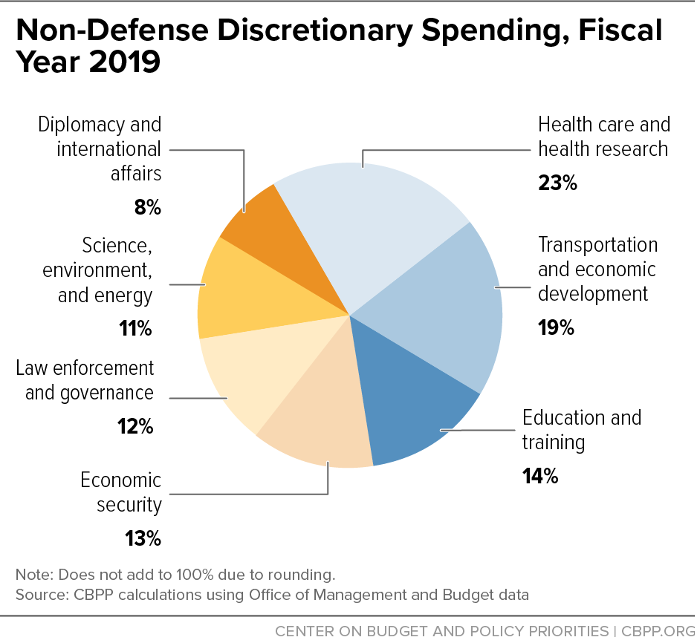

What exactly is “non-defense discretionary spending“?“The GOP proposal would call for a cap on either non-defense discretionary spending or overall discretionary spending after paring the federal budget back to 2022 levels,” the Washington Times reported last week.

In 2019, non-defense discretionary (NDD) spending totaled $661 billion, or 14 percent of federal spending. That same year, the federal “debt” was $23 Trillion. The entire NND was less than 3% of the so-called “debt.”

Would you be willing to see every dollar cut from health care and health research, diplomacy, science, environment, energy, transportation, economic development, law enforcement and governance, education and training, and economic security?

Oh, but that’s not all.

In 2019, non-defense discretionary (NDD) spending totaled $661 billion, or 14 percent of federal spending. That same year, the federal “debt” was $23 Trillion. The entire NND was less than 3% of the so-called “debt.”

Would you be willing to see every dollar cut from health care and health research, diplomacy, science, environment, energy, transportation, economic development, law enforcement and governance, education and training, and economic security?

Oh, but that’s not all.

Essentially, the GOP’s idea is to punish the poor and middle classes and reward the military-industrial complex, all for the dubious accomplishment of immediately returning the deposits in T-security accounts. Of course, the GOP doesn’t have a real plan. Those were some general suggestions. They have refused to devise an actual plan because their only thought is to negate anything Biden suggests and exact Trumpian revenge by investigating Democrats. It’s the failed Benghazi investigation all over again.“The proposal would also claw back unspent COVID-19 funds, block President Biden’s student loan forgiveness plan that is currently tied up in a Supreme Court battle, institute work requirements for social welfare programs and implement the Republican plan to lower energy costs, which passed the House but is expected to languish in the Senate,” the report said.

And the White House’s position has always been: No preconditions. Just raise the debt ceiling.

The real position should be “No preconditions. Just eliminate the debt ceiling. But, the public has been imbued with the notion that having a debt ceiling makes for prudent finance. So flat-out elimination only can be accomplished when the public is educated that the “debt” is meaningless for a Monetarily Sovereign government. Strangely, the public doesn’t complain when the ceiling arbitrarily is raised — 90 times — but probably would object to it being eliminated. That’s human thought.Fresh from his April 11-14 trip to Ireland, Biden had this to say when asked if he would talk to McCarthy:

“Of course, I’ll speak to him. Show me his budget,” Biden told reporters. “That old expression — ‘show me your budget.’ You know, he — we agreed early on, I’d lay down a budget, which I did on March 9th, and he’d lay down a budget.”

“I don’t know what we’re negotiating if I don’t know what they want,” Biden added.

Sunday was the deadline for Congress to agree on a new budget. For the 20th year in a row, it failed in that responsibility. No surprise there since the Senate is controlled by the Democrats and the House by Republicans, who remain far apart in their priorities.

What should be done?

It’s not a difficult question. The debt ceiling should be eliminated. Period.The Biden Administration believes the solution to America’s economic woes is more federal spending and higher taxes.

Having increased federal spending by nearly $5 trillion in its first two years, the Biden administration now proposes additional tax and spending increases totaling $4.7 trillion and $1.9 trillion, respectively.

Those who understand Monetary Sovereignty know that our Monetarily Sovereign government has no need or use for taxes. It has the infinite ability to create dollars at the touch of a computer key. Monetary Sovereignty became a reality in 1971 — the “Nixon Shock” — when President Nixon made the most significant move of his administration: He divorced the U.S. dollar from gold. We no longer needed to match the value of gold (which changed daily) to any fixed number of dollars. We could create dollars at will as we needed them. The debt ceiling was created in 1917 to allay fears about dollar acceptance. It tried to make lenders and users confident that the dollar would not suddenly lose value. Today, the debt ceiling is laughably useless.Depending on who is doing the research, it is said that the US raised its debt ceiling (in some form or other) at least 90 times in the 20th century.

Anyone with at least half a brain would understand that if any limit is increased 90 times, it has served no useful purpose. The sole purpose is to give the party that is not in power some leverage over the party in power. It’s a foolish idea, which is why Congress loves it.The debt ceiling was raised 74 times from March 1962 to May 2011,[14] including 18 times under Ronald Reagan, eight times under Bill Clinton, seven times under George W. Bush, and five times under Barack Obama. The debt ceiling has never been reduced, even though the public debt itself may have been reduced.

Congress has raised the debt ceiling 14 times from 2001 to 2016. The debt ceiling was raised a total of 7 times during Pres. Bush’s eight-year term, and it was raised 11 times during Pres. Obama’s eight years in office.

Meanwhile, White House assertions that it will actually cut deficits over the next decade by $3 trillion have been roundly criticized by budget hawks. In fact, projections from the nonpartisan Congressional Budget Office show annual deficits growing from $1.4 trillion this year to $2.7 trillion in 2033, while as a result total federal debt will soar from $32.4 trillion at the end of this year to $52 trillion in 2033.

The White House, the entire Democratic Party, and the entire Republican Party (with the possible exception of Marjorie Taylor Greene) understands the debt ceiling is a fraud. But the public doesn’t understand it, so all politicians suck up the “fiscal responsibility” of the debt ceiling. In a way, it’s something like the GOP denying that Donald Trump is a criminal or the Democrats saying that a tax increase on the rich would “pay for” something.The IMF’s Fiscal Affairs Director Vitor Gaspar recently told Yahoo Finance that it is clear “that from the viewpoint of medium- and long-term prospects, there is a very strong case for fiscal adjustment in the U.S.”

Actually, “there is a very strong case for” Gaspar lying or ignorant of Monetary Sovereignty.Of greater concern is what would happen if foreign holders of U.S. government debt suddenly get spooked and start to sell their holdings of U.S. securities.

Officially, foreign treasuries and investors own about $7.6 trillion of U.S. government debt. Bad news here, such as a default on U.S. debt this summer, could spark a run on the dollar and cause interest rates to surge, sending a recessionary shock wave through the U.S. and global economies.bad news

If Congress would forget about the phony debt ceiling, it could, if it wished, pay off the federal “debt” tomorrow simply by returning the dollars sitting in T-security accounts. The purpose of those accounts is not to provide the U.S. government with spending dollars. It has infinite amounts of those. T-bills, T-notes, and T-bonds, the purpose of which is to provide a safe, interest-paying place to store unused dollars. This stabilizes the dollar. All this nonsense about debt ceilings is about to do exactly what the debt Henny Pennys fear: Cause a run on the dollar.Recent deals among the Russians, Chinese, and Saudis to create alternatives to the world’s dollar-based trade are already threatening the dollar’s preeminent position as the No. 1 global currency.

A debt panic might push the dollar to the brink, bringing inflation and perhaps eventually forcing the U.S. to do something it hasn’t had to since before World War II — pay some, if not most, of its bills in someone else’s currency, a huge disadvantage.

No, the Russians, Chinese, and Saudis won’t cause a run on the dollar, but this year the Republican Party might do just that.Americans’ complacency about our growing fiscal problems has so far not hurt us too badly. That might not always be the case, however.

Complacency won’t hurt us. The nutty debt ceiling eventually might, however. We should get rid of the damn thing before it causes real damage.I&I/TIPP publishes timely, unique, and informative data each month on topics of public interest. TIPP’s reputation for polling excellence comes from being the most accurate pollster for the past five presidential elections.

Terry Jones is an editor of Issues & Insights. His four decades of journalism experience include serving as national issues editor, economics editor, and editorial page editor for Investor’s Business Daily.

And by the way, when the federal debt doesn’t rise enough, we have recessions.

……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY