This post may run a bit longer than usual, but it is actually a brief discussion of various issues concerning common conceptions and misconceptions about our economy.

Economics is not a normal science—it may not even be a science at all. A real science relies on proofs, but in economics, there are few, if any.

It is an unholy meld of mathematics, psychology, philosophy, history, intuition, and fortune-telling, with a dollop of pure faith in self-anointed experts.

So, with all that, we are forced to rely on experts — economists, politicians, and the media — to tell us the truth about money.

I. Laws and Dollars Are Not Physical Objects

In 1792, the new United States government passed several laws. One was the Mint Act, which created the U.S. dollar.

At the risk of being obvious, I’ll remind you that the Mint Act, and indeed all laws, has no physical existence. You cannot see, hear, taste, feel, or smell the Mint Act.

A law can be described, not sensed, as it is only a concept, not a physical entity.

Barring self-imposed limits, the federal government, as the creator of laws, could pass any number and kind of laws. Just as laws have no physical existence, the dollars that the laws create exist only as ephemeral numbers on balance sheets. You cannot see, hear, taste, feel, or smell a dollar.

In addition to coins, the Treasury has printed paper versions of currency.

Gold, silver, copper, and paper have never been money. They have always been nothing more than physical material used to create coins and dollar bills.

Gold, silver, and copper coins, and paper bills are bearer titles to dollars, signifying that the bearer is owed a dollar by the U.S. government. Just as a car title is not a car and a house title is not a house, coins and paper currency are not money.

They are government-issued IOUs. Gold, silver, and copper, but not paper, sometimes have been called the “backing” for a dollar in the same way a car is said to “back” a car title, and a house is said to “back” a house title.

But what happens if the car crashes, the house burns down, and the government arbitrarily changes the exchange value of coins and paper, which it has done many times throughout history? There goes the backing.

Despite having no physical existence, dollars have values. The government that created them arbitrarily assigns these values to dollars.

The following list shows the exchange value of the original dollars, values the government arbitrarily has changed many times over the years.

- Eagles $10.00 247+4∕8 grain gold

- Half eagles $5.00 123+6∕8 grain gold

- Quarter eagles $2.50 61+7∕8 grain gold

- Dollars or Units $1.00 371+4∕16 grain silver

- Half dollars $0.50 185+10∕16 grain silver

- Quarter dollars $0.25 92+13∕16 grain silver

- Dimes $0.10 37+2∕16 silver

- Half dismes $0.05 18+9∕16 grain silver

- Cents $0.01 11 pennyweights copper

- Half cents 0.005 5+1∕2 pennyweights copper

II.What Backs The Dollar?

The real backing for the house title, car title, and dollar bill is the full faith and credit of the signer. In the case of the dollar, the signer is the United States government.

Look at a dollar bill, and you will see that it is signed for the government by the Treasurer and the Secretary of the Treasury.

Coins are signed (engraved) by the United States of America.

It is the full faith and credit of the U.S. government, not gold, silver, or any other physical element, that always has backed the U.S. dollar.

But what is “full faith and credit”?

This may sound nebulous to some, but it actually involves certain, specific, and valuable guarantees, among which are:

A. –The government will accept only U.S. currency in payment of debts to the government (i.e., taxes, fines, etc.)

B. –It unfailingly will pay all its dollar debts with U.S. dollars and will not default

C. –It will force all your domestic creditors to accept U.S. dollars if you offer them to satisfy your debt.

D. –It will not require domestic creditors to accept any other currency

E. –It will take action to protect the value of the dollar.

F. –It will maintain a market for U.S. currency

G. –It will continue to use U.S. currency and will not change to another currency.

H. –All forms of U.S. currency will be reciprocal; that is, five $1 bills always will equal one $5 bill and vice versa.

If you trust the government, you accept its coins and paper currency; otherwise, you use some other currency. If you happen to trust gold more than you trust the U.S. government, you immediately will exchange all your dollars for gold.

All U.S. coins have two values — their face value and their material value. For example, what is a $10 gold coin worth?

At the latest valuation, it is worth both $10 in money and approximately $1,300 in barter. As money, a gold coin is worth neither more nor less than a paper $10 bill.

If a dollar has no physical existence, how can it be real? Many real things have no physical existence. Laws, patents and copyrights, sports scores, votes, numbers, poems, stories, etc., all are real but have no physical existence.

Poems and stories are real, but they are represented by books and narration.

Laws are real, but you cannot see a law. You can see representations in books, or hear representations in court, but you cannot see a law.

Numbers are real, but you cannot see, feel, etc. them. Consider the number ten. What does it look like? Is it “ten?” “10”? “5+5”? “X”? “1010” ( in binary)? “12” (in octal)? “5×2”?

The list is literally endless because, like money, the number ten has no physical properties. Why is this important? Because money’s lack of physical properties, allows the federal government to create infinite amounts, unconstrained by any supply considerations.

Even if the federal government had no gold, no silver, no copper, or paper, it still could create infinite numbers of dollars and, as the issuer, give those dollars any value it chooses.

As the holder of a U.S. coin, you are a creditor to the U.S. government, which provided the coin in lieu of providing you with some physical thing. As a creditor to the U.S. government, you have provided a loan, which also is real but has no physical existence.

The fact that the U.S. dollar has no physical existence gives the government the infinite ability to create dollars. If the dollar had a physical existence, the dollar supply would be limited by the supply of the dollar’s “material.”

III. Monetary Sovereignty

You cannot begin to understand economics unless you understand the differences between a “Monetarily Sovereign.” entity and a monetarily non-sovereign entity.

The governments of the U.S., Canada, Mexico, China, Japan, and Australia are Monetarily Sovereign. They created and issued the money they and their citizens use, and they created all the laws regarding their money.

They cannot unintentionally run short of their own sovereign currency, which was created in accordance with their own laws. By writing all their own laws, they control all their own currencies.

So long as the U.S. federal government can create its laws, it can create dollars.

For example, the board game Monopoly purports to have Monopoly money in paper form. But it is not money. It represents money. The game could be played just as well without the paper “money” simply by keeping score. By rule, the “Bank” in the game of Monopoly is Monetarily Sovereign. It cannot run short of Monopoly dollars. (See: Monopoly).

You are not Monetarily Sovereign, nor is your city, county, or state, nor is any business or even a euro nation like Germany, France, and Italy. None can legally control the currencies they use.

Euro nations use euros, and their Monetarily Sovereign entity is the European Union.

Politicians, economists, media writers, or laypeople who claim the U.S. federal government should “live within its means,” like you and I must, falsely compare the federal government’s monetary sovereignty with monetary non-sovereignty.

The federal government has no “means,” or rather, it has infinite “means.”

There is no amount of spending that is beyond the capability of the federal government to create dollars.

IV. Spending

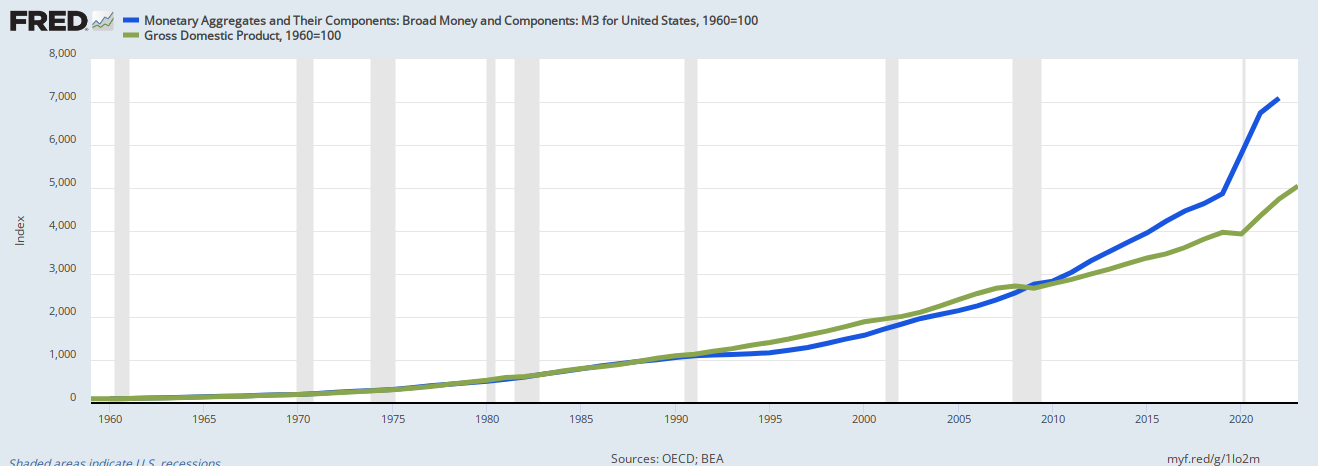

The federal government cannot unintentionally run short of dollars. It creates dollars, ad hoc, by spending dollars. The process is:

- A federal agency approves an invoice from a creditor. Then it sends instructions (not dollars) to the creditor’s bank, ordering the bank to increase the balance in the creditor’s checking account (“Pay to the order of _____”_.)

- The instant the bank does as instructed, new dollars are created and added to the M2 money supply measure.

- The bank then balances its books by clearing the transaction through the Federal Reserve, another federal government agency.

Thus, the federal government is in the enviable position of approving its own transactions. That is its superpower—the infinite ability to instruct banks to increase balances and thereby create new dollars.

That superpower means no amount of federal spending, debt or deficit can be “unsustainable,” as many people falsely claim.

V. Taxes

Notice something else important: In steps 1 through 3, above, the word “tax” never is used.

Because the federal government has the infinite ability to create dollars, which it creates ad hoc by spending dollars, it does not use tax dollars for spending. In fact, your tax dollars are destroyed the moment they reach the U.S. Treasury.

When you pay taxes, you write a check. Your dollars come out of the nation’s M2 money supply measure.

But when the dollars reach the Treasury, they instantly disappear from the M2 money supply measure and are not found in any money supply measure.

In short, they disappear. They effectively are destroyed by joining the Treasury’s infinite money supply. Adding dollars to infinite dollars still yields infinite dollars. That addition of your tax dollars to the Treasury’s supply of dollars does not increase the Treasury’s infinite supply of dollars.

Your federal tax dollars, which are not spent and are not part of any money supply, no longer exist. They have been destroyed.

VI. Why Levy Taxes?

State and local governments and euro-nation governments levy taxes to provide themselves with spending money. But the U.S. government creates its own spending money. So, what is the purpose of federal taxes?

1. To control the economy, the government taxes what it wishes to discourage and gives tax breaks to what it wishes to reward.

2. To assure demand for the U.S. dollar by requiring all tax payments to be made in dollars.

There is a third “secret” purpose to U.S. taxation:

3. To help the very rich become richer.

There is an income/wealth/power Gap between the rich and the rest of us. Without the Gap, no one would be rich; we all would be the same. Widening the Gap makes the rich richer.

Politicians, virtually all of whom are bribed (via campaign contributions and lucrative jobs), have designed federal tax laws at the behest of the rich to widen the Gap.

FICA, for instance, is not collected on salaries above $160K. Why? The rich don’t want it.

Long-term capital gains are taxed at lower levels than salaries. Why? The rich receive much of their income via long-term capital gains.

Many tax breaks are available only to the rich.

That is why someone like billionaire Donald Trump paid less in federal taxes than you probably did for the past ten years. For some years, he paid $0 while earning millions.

VII. Borrowing

If the federal government neither needs nor uses tax dollars for spending, why does it borrow dollars?

Earlier, we said that U.S. dollars are “government-issued IOUs.” While that might seem to indicate borrowing, it doesn’t. Borrowing requires a lender, and no one lends dollars to the federal government.

The “IOU” refers to the federal government owing full faith and credit to every dollar user.

Often, the issuing of Treasury Securities (T-bills, T-notes, T-bonds) incorrectly is termed “borrowing.” But the purpose of T-securities. like federal taxes, is not to supply the government with spending money but rather:

1. To provide a safe place to store unused dollars, which helps stabilize the dollar and

2. To help the Federal Reserve control interest rates by providing a base rate for the world’s safest investment.

The misnamed, and thus misunderstood, “federal debt” is the total of outstanding deposits into T-security accounts. These accounts resemble bank safe deposit accounts in that the government does not touch the contents.

When T-security accounts mature, the government pays them off simply by returning the contents, unused, exactly as it does with safe deposit boxes. In neither case has the government borrowed the contents.

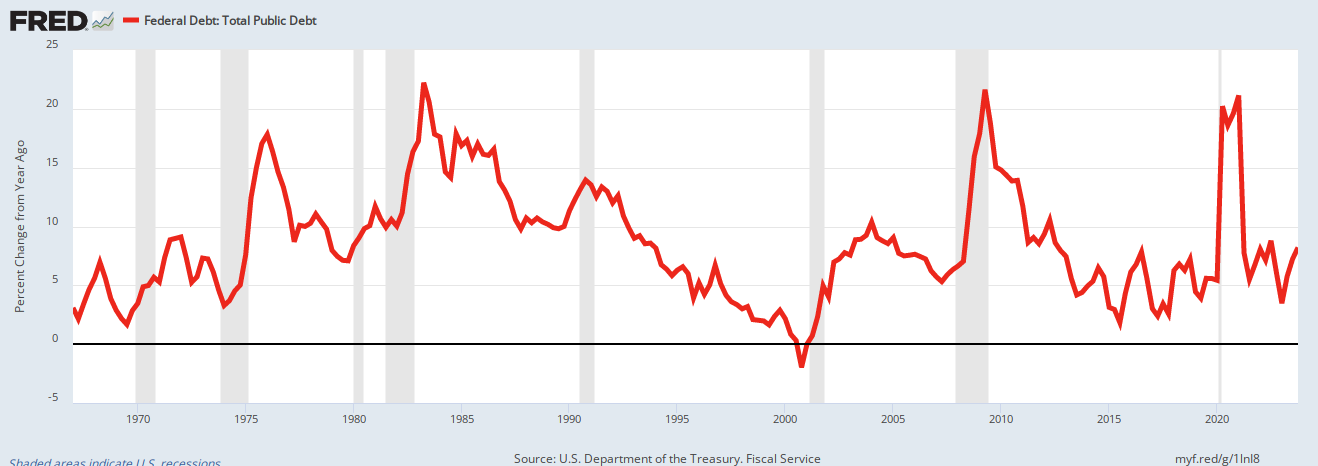

By a quirk in the law, “federal debt” also refers to the net total of all previous federal deficits (the difference between taxes collected and spending). Here, too, the word “debt” is wrongly applied because the federal government does not owe its deficits.

It already has paid those bills. The government doesn’t owe what it already has paid. The word “deficit,” in this case, refers to the net number of growth dollars the federal government has sent into the American (and other) economies.

Running deficits is necessary for economic growth. Mathematically, we would have recessions without federal deficit spending. Gross Domestic Product – Federal Spending + Non-federal spending + Net Exports.

Because the U.S. traditionally has negative Net Exports and Inflation, the only way to generate real GDP growth is to increase economic spending, and that requires adding dollars to the economy — exactly what federal deficit spending does.

So, those who decry federal deficits and debt are simply wrong. Sadly, some of those people have been influenced by the very rich, who understand that most deficit spending narrows the income/wealth/power gap by benefiting the average American.

Those who do not understand Monetary Sovereignty claim the federal government, like businesses and individuals in the private sector, should run surpluses. This is diametrically wrong.

U.S. depressions tend to come on the heels of federal surpluses.

1804-1812: U. S. Federal Debt reduced 48%. Depression began 1807.

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.

1997-2001: U. S. Federal Debt reduced 15%. Recession began 2001.

Federal surpluses take dollars out of the economy. By formula, removing dollars from an economy is recessionary.

VIII. Inflation

When the facts are explained, most people come to understand that the federal government does have the infinite ability to create dollars (incorrectly termed “printing” dollars.)

But then, doubters invariably fall back on the “Federal Spending (or Federal Deficits) Causes Inflation” idea bolstered by misleading photos of people lugging wheelbarrows filled with printed currency.

This belief comes from the false mantra, “Inflation is too much money chasing too few goods and services.”

There is no doubt that inflations, and especially hyper-inflations, go hand-in-hand with ever-higher denominations of increasingly worthless paper currencies.

At one time, Italy printed a 500,000-lira note. But that did not cause inflation. It was the Italian government’s misguided reaction to inflation.

When you hear there is a shortage of “X” (which can be anything from oil to wood to computer chips to bananas), what do you expect to happen to the price of “X”?

You’re right. The price of “X” will rise. It’s an example of supply and demand. When supply doesn’t meet demand, prices rise. So the real question concerning inflation is: Does federal money-creation cause demand to increase more than supply?

Adding dollars to the economy unquestionably increases both the demand and supply for some products and services. But for there to be inflation, overall demand would have to increase more than supply.

That is not what happens in the real world.

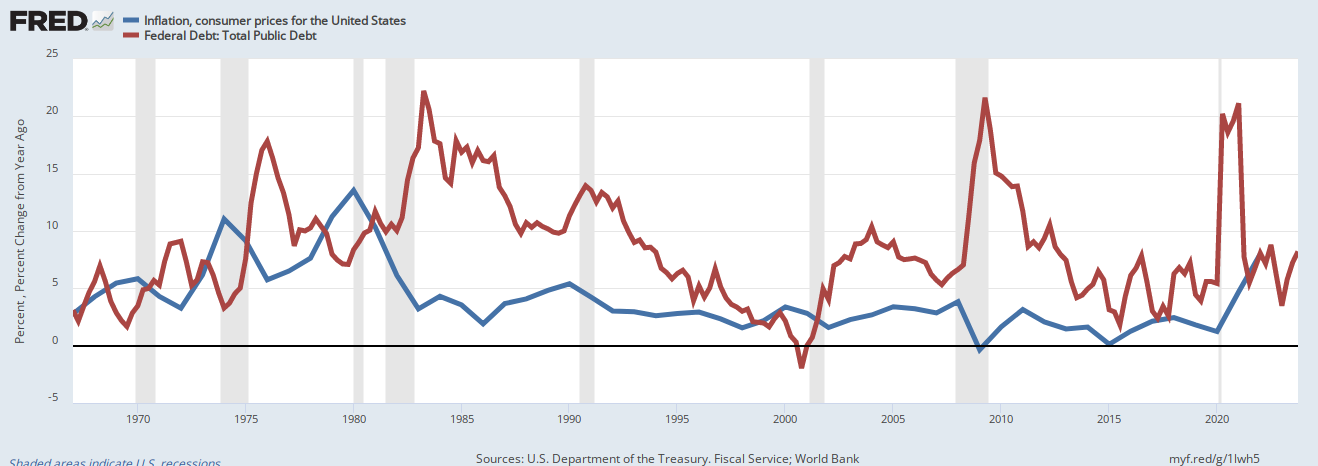

Here is a comparison of inflation vs. net federal spending (spending minus taxes), the net amount of money the federal government pumps into the economy.

The above graph demonstrates that, contrary to popular wisdom and contrary to what you have been told, net federal spending does not cause inflation. The red net-spending line does not correspond to the blue inflation line

So, what causes inflation?

The price of oil is closely related to supply and demand. When oil is scarce, its price rises.

The price of oil affects the prices of nearly every product or service because oil is universally used, not only for transportation, heating, and other energy needs (which most products and services need) but also as an ingredient in many products.

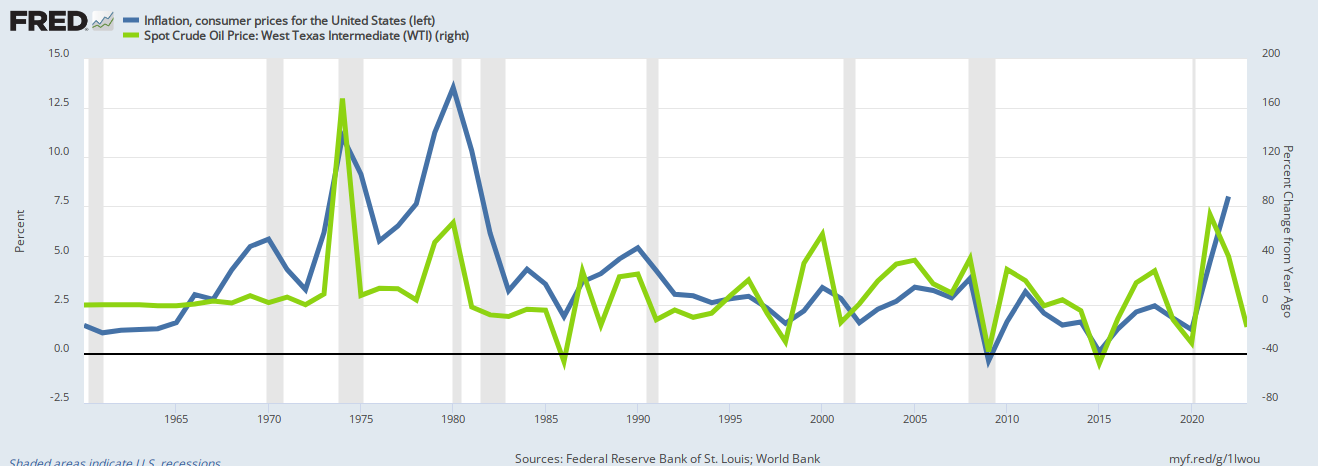

Here is a graph showing the relationship between oil scarcity and inflation:

Because oil is ubiquitous in our economy, a scarcity of oil causes an increase in virtually all other prices, aka inflation.

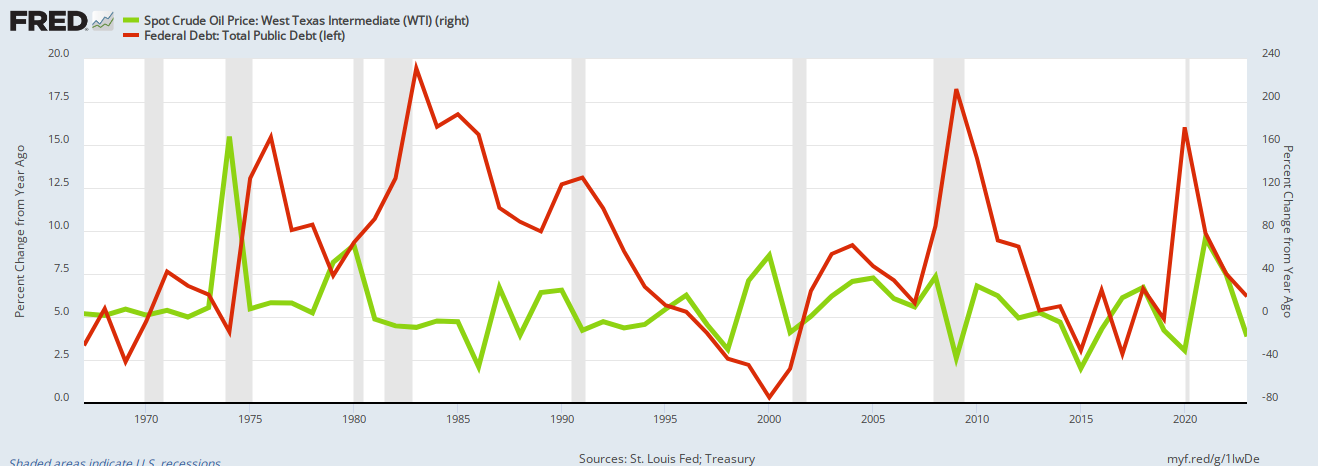

What causes oil scarcity? Is it federal spending? No, as the following graph demonstrates, net federal spending does not cause oil shortages.

Oil scarcity is caused by many factors. OPEC and Russian production cuts are the single biggest drivers of rising oil prices. Thus, the warning that federal spending leads to inflation is widely believed and claimed by some media, economists, and politicians, but it is not supported by historical fact.

What cures inflation? Additional deficit spending to increase the supply of scarce items — especially oil and food — while also supporting research and developments of substitutes.

IX. What About Interest Rate Control?

Your information sources, economists, media, and politicians tell you that raising interest rates helps prevent/cure inflation. The Federal Reserve certainly believes this or claims to.

Part of the Fed’s logic is that interest rates strengthen the U.S. dollar by increasing the demand for dollars. When interest rates rise, more people want to make deposits into interest-paying T-security accounts.

To do so, you need dollars. You can’t deposit any other currency.

When the demand for dollars goes up, the value of the dollar rises, and that “stronger” dollar can pay for more imports from nations whose currency is “weaker.” In short, raising interest rates lowers the dollar price of imports, which works against inflation.

Imports only account for approximately 14% of the economy (Gross Domestic Product). What happens to the other $86%?

Nearly all costs increase when interest rates go up. For instance, a 1% difference between a $200,000 home with a $160,000 mortgage increases your monthly payment by almost $100. Although the difference in monthly payment may not seem that extreme, the 1% higher rate means you’ll pay approximately $30,000 more in interest over the 30-year term.

But it gets worse. Interest affects the cost of building a house because material costs and transportation costs rise with interest rates. Interest also affects the cost of food, not only because of increased transportation costs but also farming costs.

Farmers generally borrow during planting season and pay their loans back when they sell their crops. Higher interest rates increase the cost of food, and of course, farm machinery prices increase.

In short, the Fed views inflation as a demand problem (people eat too much, buy too many cars and houses, and buy too much of what they don’t need).

In Fed language, the economy is “too hot” and needs “cooling.” Said another way, the economy is too healthy and needs to be recessed a little. That is why the Fed always fears its actions might cause a full-blown recession.

It’s a ridiculous proposition because the Fed raises interest rates to cure the “demand problem.”

The Fed tries to cure inflation by raising prices, which is identical to trying to cure anemia by applying leeches.

Inflation is, and always has been, a supply problem, most often caused by shortages of oil and/or food.

What is the cure for shortages? Not recession. The cure for shortages is federal spending to acquire and distribute the scarce items.

Rather than blaming people for buying too much and the federal government for spending too much, the Fed should do nothing about inflation.

Congress and the President are responsible for shortages. Unfortunately, they have avoided responsibility by shifting the blame to the Fed and interest rates.

The current inflation was not caused by people buying too much or by too low interest rates.

The current inflation was caused by COVID-related shortages of oil, food, computer chips, lumber, steel, shipping, and many other products and services, along with a shortage of labor.

Raising interest rates to cure those shortages is foolish. It exacerbates the problem. Instead, the government should have helped oil producers find, drill, and refine more oil, farmers grow more food, and manufacturers create and ship more of what we lacked.

In the long term, federal spending to increase the usage of oil substitutes will help prevent inflations.

SUMMARY

- Money is not a physical thing. It is a number on balance sheets. You cannot see, hear, taste, smell, or feel a dollar.

- Gold and silver are not, and never have been, money.

- The U.S. government is Monetarily Sovereign. It cannot run short of its own sovereign currency, the U.S. dollar. It’s finances are nothing like the finances of state and local governments, businesses, euro governments, you, and me.

- A dollar is a debt of the federal government, backed not by gold or any other physical thing but rather by the full faith and credit of the federal government.r

- A dollar bill is not a dollar. It is a bearer title for a dollar, similar to a printed IOU.

- The federal government has the infinite ability to create the laws that create dollars.

- The federal government creates dollars by sending instructions (not dollars) to banks, instructing them to increase the balances in creditors’ checking accounts.

- Federal taxes do not fund federal spending, but state/local taxes do fund state/local economies. Federal tax dollars are destroyed upon receipt at the Treasury. The purposes of federal taxes are to control the economy and assure demand for the dollar.

- The federal government never borrows dollars. The purpose of T-bills, T-notes, and T-bonds is to provide a safe storage place for unused dollars.

- Federal spending doesn’t cause inflation, and currency printing is a misguided response to, not a cause of, inflation.

- All inflations have been caused by shortages of goods and services, usually oil and food. Federal spending cures shortages by obtaining and disseminating scarce goods and services.

- Inflation is not caused by an economy being “too hot” or consumers buying “too much.” Raising interest rates increases prices, exacerbating inflation, and is recessionary.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY