- Increase taxes on the rich (“rich” by any arbitrary measure).

- Reduce taxes on those who are not rich.

- Provide supplementary income and benefits to those who are not rich.

GDP = Federal Spending + Nonfederal Spending – Net Imports.

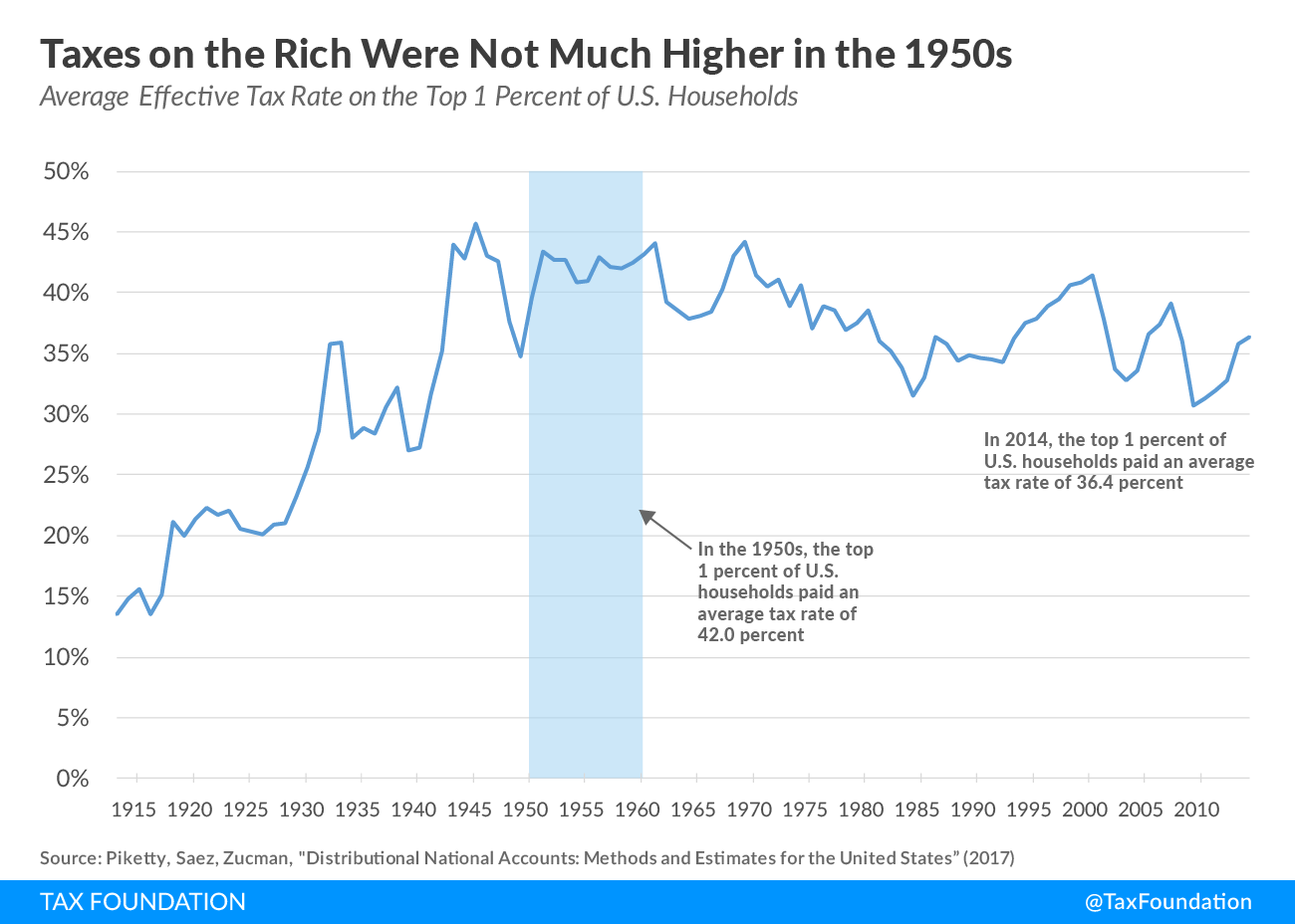

If the rich paid more taxes (#1), Nonfederal Spending would decline. The amount of the decline would be determined by various factors, most having to do with how much the rich actually pay. History indicates that payment would be less than anticipated because of existing loopholes and/or new loopholes the rich would bribe Congress to enact. Considering that the top tax rate in the 1950s was 90%, the rich did not pay much more in that period than they do now. And some of the richest among us pay little if anything.

For example, Donald Trump paid no income taxes at all, during ten of the fifteen years, 2000-2015, despite being a billionaire. Tax laws, favorable to the rich, gave him the ability to claim losses on investments that an ordinary taxpayer may not look at as “losing” money.

In summary, using federal taxation of the rich to narrow the Gap is bad economics. History shows the rich would find ways to avoid paying higher rates.

But, even if the rich were forced to pay more, the higher rates would take dollars out of the economy and recess the economy. Option #1 is a “heads-you-lose (the rich don’t pay more), tails-you-lose” (GDP falls) plan.

Sadly, that is the plan Biden seems to have chosen, and it will cost him the November election.

The electorate may be ignorant about economics, but the rich would make sure the voters understood that raising taxes — anyone’s taxes — would hurt the economy.

It’s simple math. The more the federal government takes out of the economy, the less the economy (GDP) has.

Reducing federal taxes and/or providing supplementary benefits to those who are not rich, (#2 and #3) are the sole economically sensible ways to narrow the income/wealth/power Gap.

Sadly this sensible approach is blocked by the non-sensible belief that federal deficit spending is “unsustainable.”

That’s associated with the equally wrong belief that “excessive” federal spending or an “overheated” economy cause inflation. The fact: Inflation is not caused by “heat” (whatever that is) or by federal spending.

All inflations are caused by shortages of critical goods and services, most often oil and food. Inflation can be cured by additional federal spending to acquire and distribute the scarce goods and services.

Here is what the right-leaning Tax Foundation thinks:Details and Analysis of President Biden’s Fiscal Year 2025 Budget Proposal

Considering that the top tax rate in the 1950s was 90%, the rich did not pay much more in that period than they do now. And some of the richest among us pay little if anything.

For example, Donald Trump paid no income taxes at all, during ten of the fifteen years, 2000-2015, despite being a billionaire. Tax laws, favorable to the rich, gave him the ability to claim losses on investments that an ordinary taxpayer may not look at as “losing” money.

In summary, using federal taxation of the rich to narrow the Gap is bad economics. History shows the rich would find ways to avoid paying higher rates.

But, even if the rich were forced to pay more, the higher rates would take dollars out of the economy and recess the economy. Option #1 is a “heads-you-lose (the rich don’t pay more), tails-you-lose” (GDP falls) plan.

Sadly, that is the plan Biden seems to have chosen, and it will cost him the November election.

The electorate may be ignorant about economics, but the rich would make sure the voters understood that raising taxes — anyone’s taxes — would hurt the economy.

It’s simple math. The more the federal government takes out of the economy, the less the economy (GDP) has.

Reducing federal taxes and/or providing supplementary benefits to those who are not rich, (#2 and #3) are the sole economically sensible ways to narrow the income/wealth/power Gap.

Sadly this sensible approach is blocked by the non-sensible belief that federal deficit spending is “unsustainable.”

That’s associated with the equally wrong belief that “excessive” federal spending or an “overheated” economy cause inflation. The fact: Inflation is not caused by “heat” (whatever that is) or by federal spending.

All inflations are caused by shortages of critical goods and services, most often oil and food. Inflation can be cured by additional federal spending to acquire and distribute the scarce goods and services.

Here is what the right-leaning Tax Foundation thinks:Details and Analysis of President Biden’s Fiscal Year 2025 Budget Proposal

Because the Tax Foundation has a right-wing agenda, one may doubt the specifics of their calculations, but I believe they are on the right track. When the federal government collects more taxes, the economy loses money. When the economy loses money, the GDP, wages, and jobs all shrink. It’s straightforward math.March 22, 2024, By: Garrett Watson, Erica York, William McBride, Alex Muresianu, Huaquin Li, Alex Durante

11-Year Revenue (Trillions) Long-run GDP Long-Run Wages Long-Run FTE Jobs +$2.2T

-2.2%

-1.6%

-788k

In plain English, the government would remove from the economy, an additional $2,2 Trillion. This would cause GDP to fall by 2.2%, wages to fall by 1.6%, and Full-Time Equivalent Jobs to shrink by 788 thousand.

I urge you to read the entire Details and Analysis of President Biden’s Fiscal Year 2025 Budget Proposal as this post offers you the barest outline. Everything Biden may propose is based on two false assumptions:The tax changes Biden proposes fall under three main categories: additional taxes on high earners, higher taxes on U.S. businesses—including increasing taxes that Biden enacted with the Inflation Reduction Act (IRA)—and more tax credits for a variety of taxpayers and activities.

The combination of policies would move the tax code further away from simplicity, transparency, and neutrality while making the U.S. economy less competitive.

The increase in the corporate tax rate and the additional taxes on top earners would result in U.S. top marginal tax rates on income that are among the highest in the developed world.

- The federal government is running short of money while the private sector has too much money.

- The middle- and lower-income taxpayers will not understand that taking dollars from the economy is recessive, and instead will happily vote for a “soak-the-rich” administration.

- The end of the FICA tax deduction from your salary

- Comprehensive, no deductible Medicare for every adult and child.

- Social Security benefits for everyone of all ages

- Food cost aid

- Free college for those who want it

- Free public transportation

- Housing aid

- And a myriad of other benefits our Monetarily Sovereign government easily could afford, while preventing recessions and inflations.

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics. •Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money. •The more federal budgets are cut and taxes increased, the weaker an economy becomes. •Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless. •The single most important problem in economics is the Gap between rich and poor. •Austerity is the government’s method for widening the Gap between rich and poor. •Until the lower 99% understand the need for federal deficits, the upper 1% will continue to rule. •Everything in economics devolves into motive, and the motive is the Gap between the rich and the rest.

Rodger Malcolm Mitchell Monetary Sovereignty Twitter: @rodgermitchell Search #monetarysovereignty Facebook: Rodger Malcolm Mitchell; MUCK RACK: https://muckrack.com/rodger-malcolm-mitchell……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY

Rodger … sadly I have to agree you are correct. The big money is sucking up to the crime-boss big time while the general public is clueless concerning what is the economic realities.

LikeLike

Tax the rich if you want to, it makes no difference if all taxes are destroyed upon receipt. But not taxing the little people at all makes much more sense, as does guaranteed income supplements. The healthier the lower classes, the better off everyone is. Health comes from an affordable food supply, good and safe shelter, low-cost or free healthcare based on a preventative model rather than a purely reactive model, no need for credit, and a number of other factors.

And if Biden loses this election, none of this is going to matter! There will be no more federal democracy, and possibly no state democracy either!

LikeLike

Rawgod, I have pointed out before, every one who has an income should pay tax. The more people who pay tax, the less each one has to pay to make the same bottom line.

Too many don’t pay any tax, loop holes, exemptions and dodgy dealings, the result, the rest of us have to pay more.

There is an answer, introduce a Financial Debits Tax (FDT), it cannot be avoided and it would save the government money.

Sadly, big business is opposed to it, I wonder why?

LikeLike

jonangel, you said, “The more people who pay tax, the less each one has to pay to make the same bottom line.”

Your comment would be correct for monetarily NON-sovereign state and local governments.

But the U.S. federal government, being MONETARILY SOVEREIGN, has an infinite bottom line. You could pay $100 trillion in taxes and it wouldn’t change by even one penny the amount anyone else has to pay.

Your federal tax dollars are destroyed upon receipt. The federal government can change its bottom line by pressing a few computer keys.

Former Fed Chairman, Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency. There is nothing to prevent the federal government from creating as much money as it wants and paying it to somebody. The United States can pay any debt it has because we can always print the money to do that.”

LikeLike

Roger, I thank you for your response which highlights the failings of the American system. This is as a result, some years ago, of the world rejecting the gold standard, I remember when British bank notes bore the following “I promise to pay the bearer on demand” and they would in gold.

The issue is complex, but the world has to have a system and without and failing a massive upheaval we are stuck with what we have. What I suggested falls within the current system and is, I feel, fairer to all, either we ALL pay, or no one pays, which is what I think you are suggesting?

LikeLike

That said, a top marginal tax rate (beyond the first million dollars per year) north of 50%, and especially north of 70%, would still act as a de facto maximum wage. Executive pay is seriously out of control these days, over 300x the average employee and thousands of times their lowest-paid employees. In the 1970s, in contrast, the ratio was more like 25 to 50. Which is still greater than the ratio that Aristotle (5x) or Plato (7x) considered ideal.

So I say, kick ’em in the margins!

LikeLike

I don’t agree with everything you said but I agree that Biden’s tax policy is not the right way to help inequality.

LikeLike