We did it with the “Economic Stimulus Act 2008. The federal government simply sent people money.

Generally, low and middle-income taxpayers received up to $300 per person or $600 per couple.

The purpose was to stimulate economic growth and to cure the recession.

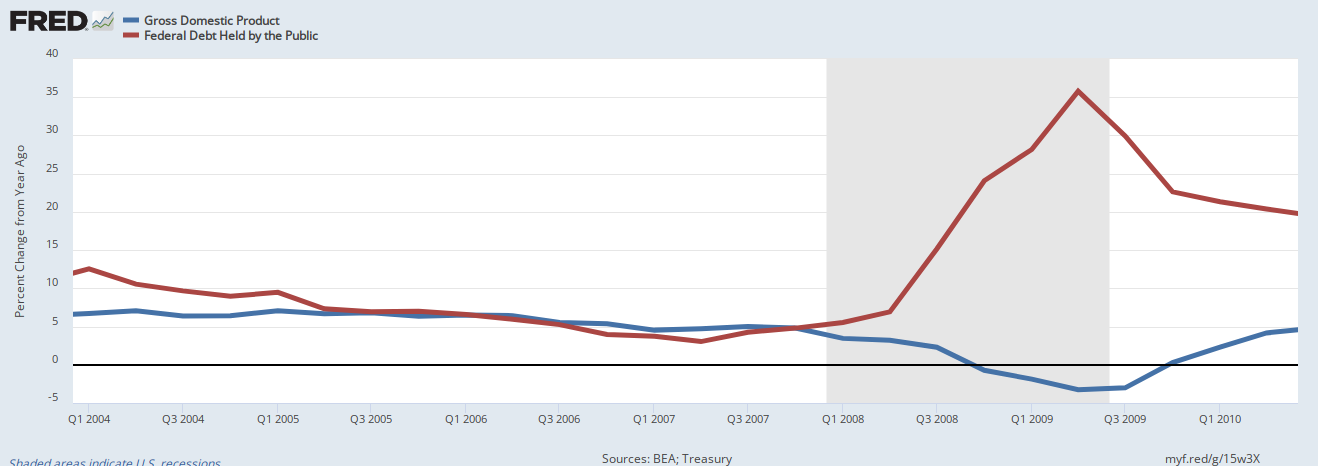

It worked:

Gross Domestic Product (GDP) is a common measure of the economy. The above graph should come as no surprise. The formula for economic growth is:

GDP = Federal Spending+ Nonfederal Spending + Net Exports

Mathematically, as federal deficit spending decreases, economic growth falls, and as federal deficit spending increases, economic growth increases.

If you want economic growth, you want federal deficit spending to increase.

I’ve written about this many times. It’s simple algebra. I’m not sure why this is a mystery to the politicians who think a debt limit is prudent finance. It’s exceedingly ignorant finance.

I mention this again because of an article I just read on MEDPAGETODAY:

Uninsured Rate Hits Record Low of 8.3%

— But that number will slowly rise as pandemic health insurance protections unwind, experts say

by Joyce Frieden, Washington Editor, MedPage Today May 24, 2023WASHINGTON — The uninsured rate in the U.S. has fallen to a record-low 8.3%, but that percentage is expected to gradually increase as insurance protections from the COVID-19 pandemic wind down, according to officials from the Congressional Budget Office (CBO).

Why will insurance protections “wind down.” For the same reason we currently have a debt=limit battle in Congress. Sheer ignorance.

The federal government has repeatedly proved that it has the infinite ability to pay for anything. Why is it “winding down” payments for healthcare insurance?

The temporary policies enacted in the wake of the COVID-19 pandemic “have contributed to a record low uninsurance rate in 2023 of 8.3% and record-high enrollment in both Medicaid and ACA [Affordable Care Act] marketplace coverage,”said Caroline Hanson, Ph.D., principal analyst at the CBO, during a briefing sponsored by Health Affairs.

“As those temporary policies expire under current law, the distribution of coverage will change and the share of people who lack insurance is expected to increase by 2033.”

CBO is projecting an uninsured rate of 10.1% by 2033, and “while that’s obviously higher than the 8.3% that we’re estimating for 2023, it is nevertheless lower than the uninsured rate in the last year prior to the COVID-19 pandemic,” which was about 12%, she said.

Think about it. America has about 330 million people. A ten percent uninsured rate means 33 MILLION (!) people in America will have to do without health care insurance. I hope you’re not among them.

Whether or not you have insurance, here are some data that should concern you:

“A widely cited study published in the American Journal of Public Health in 2009 analyzed data from the National Health Interview Survey and found that uninsured individuals had a 40% higher risk of death compared to their insured counterparts. This study estimated that lack of health insurance contributed to approximately 45,000 deaths annually in the United States.

“Another study published in the Annals of Internal Medicine in 2017 conducted a systematic review and meta-analysis of previous research. The analysis concluded that uninsured individuals faced a 25% higher risk of mortality compared to those with insurance.”

When you don’t have healthcare insurance, you die younger.

“Throughout the 2023-33 period, employment-based coverage will remain the largest source of health insurance, with average monthly enrollment between 155 million and 159 million,” Hanson and co-authors wrote in an article published in Health Affairs.

Employer-based health care insurance has two features seldom discussed.

- It ties employees to their employer, making job negotiation and movement much more difficult

- It is paid for by the employee because the employer figures the cost as part of the employment. Salaries could be higher without this “perk.”

If the federal government funded a comprehensive Medicare for All plan, employees would earn more without costing employers more.

However, they added, “in addition to policy changes over the course of the next decade, demographic and macroeconomic changes affect trends in coverage in the CBO’s projections.”

The Families First Coronavirus Response Act of 2020 gave states a 6.2-percentage-point boost in their Medicaid matching rates as long as the states didn’t disenroll anyone in Medicaid or CHIP for the duration of the COVID public health emergency.

Hanson noted that this law “allowed people to remain enrolled regardless of their changes in eligibility. So, for example, even if they had an income increase that would have made them ineligible but for the policy,” they were still able to stay on Medicaid.

The COVID public health emergency has been canceled now. Disenrollments can begin.

As a result of the law, Medicaid enrollment has grown substantially since 2019 — by 16.1 million enrollees, she said. But that has been superseded by another act of Congress, which allowed states to begin “unwinding” the continuous eligibility rules and start disenrolling people from Medicaid and CHIP beginning on April 1.

In total, “15.5 million people will be transitioning out of Medicaid after eligibility redetermination,” said Hanson. “Among that 15.5 million people, CBO is estimating that 6.2 million of them will go uninsured and the remainder will be enrolled in another source of coverage,” such as individual coverage or employment-based coverage.

Of those who are leaving Medicaid, how many are leaving voluntarily and how many are “falling through the cracks” because they didn’t receive their disenrollment notification or failed to fill out the required paperwork to reapply?

“We recognize that before these continuous eligibility requirements were put into place, people were losing Medicaid coverage, both because they were becoming no longer eligible for Medicaid, and … because they did not complete the application process despite remaining eligible,” said CBO analyst Claire Hou, PhD. However, she added, “we’re currently not aware of any data that would allow us to quantify the size of those two different groups.”

All of the above would be unnecessary if our Monetarily Sovereign federal government (which has unlimited funds) simply would fund a comprehensive, no-deductibles Medicare for All program.

Hanson delivered some bad news for those footing the bill for private health insurance. “We are projecting relatively high short-term premium growth rates in private health insurance, and this is for a few reasons,” she said.

“One is the economy-wide inflation that we’re experiencing in 2023 and that we have been experiencing, and that has not fully reflected itself in premiums yet.

And another contributor is the continued bouncing back of medical spending after the suppressed utilization that we saw earlier in the pandemic.”

The study authors project average premium increases of 6.5% in 2023, 5.9% during 2024-2025, and 5.7% in 2026-2027.

The current and projected-to-increase hardship on the American people is totally unnecessary. The federal government efficiently could ameliorate this hardship by:

- Funding comprehensive, no-deductible Medicare for every man, woman, and child in America

- Funding Social Security benefits for every man, woman, and child in America.

Both would add dollars to Gross Domestic Product, thus growing the economy.

Instead, Congress battles over the unbelievably stupid debt ceiling. How do those people manage to dress themselves in the morning, much less be elected to America’s Congress? It boggles the mind.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY

The final realization will be that we not only have unlimited funds for whatever we need but that no funding is necessary at all. Whether money exists or not, the work of society and its machinery must continue or else we all die a slow death. Money is no more than a superimposed scarcity trick to keep the super-rich where they are and everyone else where they are. Money can disappear, but responsibility cannot.

LikeLike

The final realization will be that we not only have unlimited funds for whatever we need but that no funding is necessary at all. Whether money exists or not, the work of society and its machinery must continue or else we all die a slow death. Money is no more than a superimposed scarcity trick to keep the super-rich where they are and everyone else where they are. Money can disappear, but responsibility cannot.

LikeLike

The decisions and behavior of Congress are determined by policy, not by ignorance or ineptitude. They serve the oligarchs, not the people who elected them, hence, Congress spends and otherwise legislates in ways that principally benefit corporations and the wealthy. Efforts to cut the social safety net or privatize public services are calculated to help redistribute public dollars into private hands. To suggest that they are the bumbling errors of fools in Congress is to enable their betrayal of the American people.

LikeLike

You are 90% correct. I’d guess 10% may be ignorant of the facts. The other 90% are owned by the rich.

LikeLike

I know for a fact that Matt Gaetz puts his pants on backward every day.

LikeLike

He is a perfect Republican.

LikeLike

His HEAD is on backwards, lol.

LikeLike

Republicans hate giving anyone but themselves and their wealthy masters free money! This does not surprise me at all.

What I hate is that Canadian Conservatives want to privatize healthcare in Canada, which they are doing by purposely destroying our heallthcare system to make it look unviable. Yet they are still giving Oil and Gas huge tax breaks to keep increasing production of fosdil fuels, including cosl, without any thought to Climate Disasters, which they deny are real.

I know it boils down to greed, but because they can afford private healthcare they think everyone should have to pay out-of-pocket for it. They have no hearts, no compassion, and yet they convince poor people it is somehow better for them. How do they succeed? Why are voters so gullible? This I will never understand!

LikeLike

Indeed, “death by a thousand (austerity) cuts” is the classic conservative/neoliberal MO when it comes to realizing their goal of privatization.

LikeLike

Amen to that!

LikeLike

“Employer-based health care insurance has two features seldom discussed.

It ties employees to their employer, making job negotiation and movement much more difficult

It is paid for by the employee because the employer figures the cost as part of the employment. Salaries could be higher without this “perk.”

If the federal government funded a comprehensive Medicare for All plan, employees would earn more without costing employers more.”

BINGO. The rentier class wants it that way, so as to reduce the bargaining power of the working class. Employer-based health insurance coverage is really a form of serfdom, basically. It originated through an accident of history, and has remained as a result of the oligarchy that wants it to stay that way. No wonder they fight so hard against single-payer Medicare for all (and of course UBI as well).

I remember when former Bain Vulture Capitalist Edward Conard openly said the quiet part out loud years ago about that, claiming it is a “misallocation of resources” for the government to give health insurance coverage to employees since it is not tied to their “productivity” (read: contribution to making the rich richer). As if the basic human right to LIVE is somehow inherently dependent on one’s arbitrarily-defined “productivity”. Ironically, by his very own dubious metric, vulture capitalists like himself would deserve NO healthcare, since people in his dubious profession produce literally NOTHING of value, while generating negative externalities on the rest of society and the planet.

LikeLike