Does “printing” money cause inflation? Or is so-called “printing” money the best way to cure inflation?

1. The federal government does not print money. It prints

Federal Reserve Notes (FRN), which are not dollars, but rather are bearer certificates: Titles to dollars.

Only a small percentage of dollars are represented by FRNs.

2. Dollars are balance sheet numbers. They have no physical existence. You cannot feel, see, hear, smell, or taste dollars.

3. The government, being Monetarily Sovereign, has the unlimited ability to create dollars. The government never unintentionally can run short of dollars.

4. Printing FRNs does not cause inflations. The reverse is true. The printing of FRNs results from inflations.

5. The cause of inflations — a general increase in prices — is shortages, generally scarcities of energy and/or food.

Scarcity causes prices to rise, and widespread scarcities of food and/or oil, cause widespread price increases.

6. Federal deficit spending actually can prevent or cure inflations, if the spending cures the shortages.

Case in point: Zimbabwe’s inflation came when its government seized farmland from farmers and gave it to non-farmers, who could not grow enough food.

The resultant food shortage caused hyperinflation, which the government could have cured by deficit spending to purchase food from other countries.

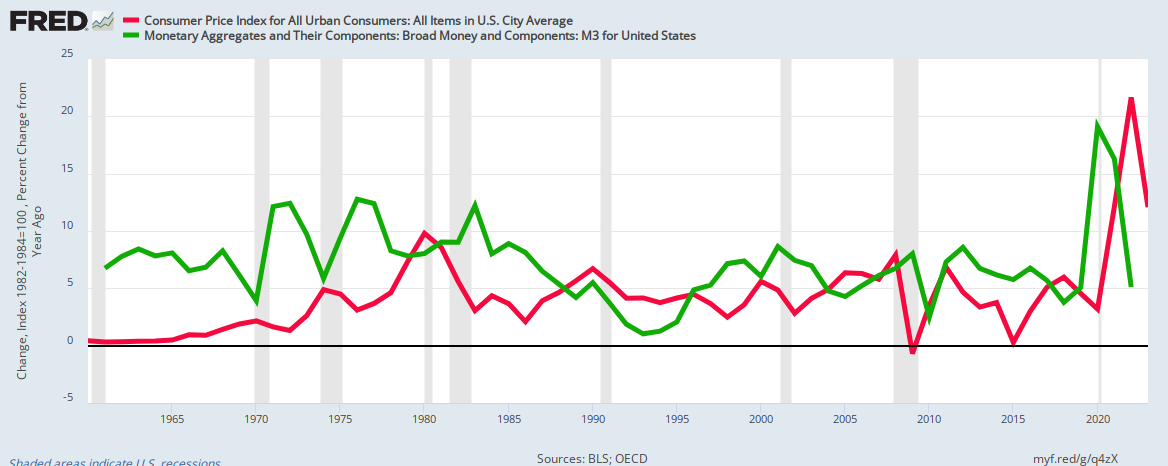

The graph below compares changes in the U.S. money supply (Green – M3) to changes in inflation (red).

The graph below compares changes in the price of oil (blue) (which closely reflect shortages) to changes in inflation. (red).

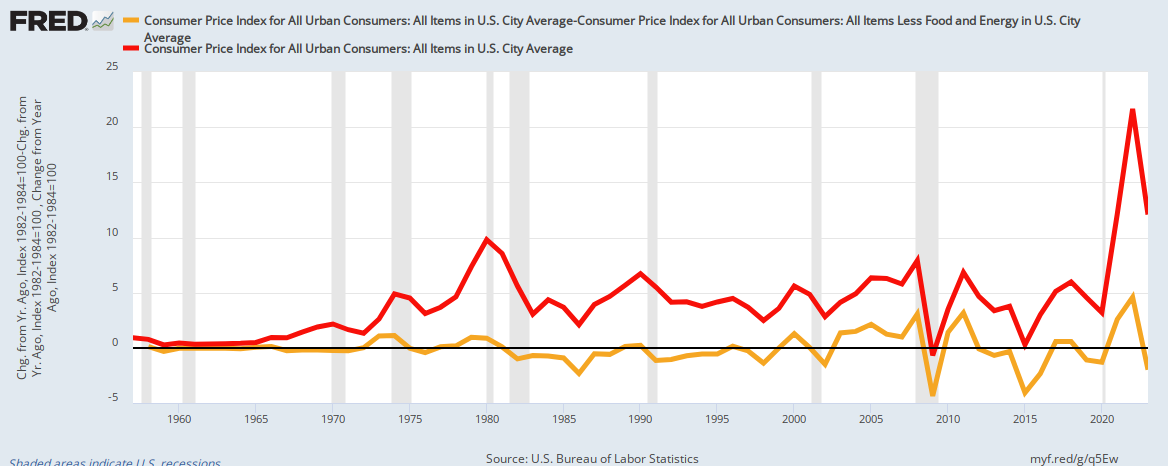

The graph below compares the overall Consumer Price Index (Red) to the price index of food and energy (gold). Food and energy prices (which reflect availability) are predictive of overall inflation.

Discussion of federal projects generally lead to the question, “How will you pay for it.” The correct answer never is, “by raising taxes” or “by cutting other spending.”

The correct answer always is, via federal deficit spending.

In summary:

Prices rise (inflation) because of scarcity, usually a scarcity of food and/or energy. Curing the scarcity reduces prices.

Scarcity can be cured by federal deficit spending to purchase the scarce items and distribute them into the economy.

The amount of deficit spending is not the key to inflation or its cure. The key is how the deficit spending is used.

Deficit spending, to purchase the scarce items, cures inflations. Poorly directed deficit spending that does not cure the scarcity, will worsen inflation.

A Monetarily Sovereign government cannot run short of the sovereign currency needed to cure an inflation.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell

Search #monetarysovereignty Facebook: Rodger Malcolm Mitchell

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

The most important problems in economics involve:

- Monetary Sovereignty describes money creation and destruction.

- Gap Psychology describes the common desire to distance oneself from those “below” in any socio-economic ranking, and to come nearer those “above.” The socio-economic distance is referred to as “The Gap.”

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Implementation of Monetary Sovereignty and The Ten Steps To Prosperity can grow the economy and narrow the Gaps:

Ten Steps To Prosperity:

2. Federally funded Medicare — parts A, B & D, plus long-term care — for everyone

3. Provide a monthly economic bonus to every man, woman and child in America (similar to social security for all)

4. Free education (including post-grad) for everyone

5. Salary for attending school

6. Eliminate federal taxes on business

7. Increase the standard income tax deduction, annually.

8. Tax the very rich (the “.1%”) more, with higher progressive tax rates on all forms of income.

9. Federal ownership of all banks

10. Increase federal spending on the myriad initiatives that benefit America’s 99.9%

The Ten Steps will grow the economy and narrow the income/wealth/power Gap between the rich and the rest.

MONETARY SOVEREIGNTY

What do you think of distinguishing between good inflation, neutral inflation, and bad inflation, by disaggregating “inflation“ and then determining which types of goods and services are good, neutral, and bad?

LikeLike

As for overall inflation, the Fed’s target is about 2%-2.5%. My own feeling is that food inflation is the worst, followed by housing, education, medical services and tax rates. What is your belief?

LikeLike