Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and poor.

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

===================================================================================================================================================================================================================================================================================

Here are a few shameless quotes from this month’s Congressional Budget Office bulletin, as written by America’s richest.

As of March 15 (2015), the Treasury has (had) no room to borrow.

The debt limit—commonly referred to as the debt ceiling—is the maximum amount of debt that the Department of the Treasury can issue to the public and to other federal agencies.

That amount is set by law and has been increased over the years in order to finance the government’s operations.

The statement is mathematically illogical and factually wrong. Those of you who already understand Monetary Sovereignty are aware the federal debt does not, and cannot, finance the government’s operations.

First the mathematics. Federal debt is the total of T-securities — securities bought by non-government entities and by government agencies. The “debt” is nothing more than bank deposits in T-security accounts at the Federal Reserve Bank.

From where do these buyers obtain the dollars with which to buy T-securities and make these bank deposits?

All dollars come from two sources: Federal deficit spending and bank lending.

But where do the banks obtain the dollars to lend? Yes, they create most, but they must begin with “reserves.” These reserves come from the public in the form of deposits, and from the Federal Reserve Bank.

From where does the public obtain dollars to make deposits?

Bottom line: The initial source of all dollars is the Federal government. It is the federal government that, back in the 1770’s, created the first dollars from thin air. And it is the federal government that continues to create dollars from thin air, simply by paying bills.

Were it not for federal deficit spending, U.S. dollars could not exist.

The government is able to deficit spend endlessly because it is Monetarily Sovereign, i.e. sovereign over its own currency, the U.S. dollar. Being sovereign, the government can do anything it wishes with dollars.

It can create dollars endlessly (via deficit spending). It can destroy dollars (via taxing). It can change the value of dollars (via interest rate control).

Being Monetarily Sovereign, the federal government never needs to ask anyone for dollars — not you, not me, not China.

Contrary to the CBO’s implications, the U.S. Treasury never can run short of dollars unless Congress wills it.

Although dollar bills technically are not in themselves dollars (They are titles to dollars, much like car titles and house titles), the federal government can print all the dollar bills is wishes.

Being Monetarily Sovereign, the federal government makes the rules. If it wished, the federal government could print a trillion, trillion $100 bills and distribute them tomorrow. These bills would be legal tender for all debts. In short, you could use them the same way you use the dollars in your wallet.

Yes, that could cause an inflation, and yes, that is not how dollars are created. But the point is, the federal government cannot run short of its own sovereign currency — unless Congress and the President want that to happen.

The fact that Congress is able to increase the debt ceiling every year is proof there is no limit to the government’s ability to create dollars.

If the federal government did not create dollars, there would be no dollars for banks to lend and there would be no dollars with which to purchase T-securities (aka federal “debt”).

How does the federal government create dollars by paying bills?

To pay a bill, the government sends checks and wires to the creditors’ banks. These checks and wires are not money; they are instructions, telling the banks to increase the balances in the creditors’ checking accounts.

The instant the banks obey those instructions, and credit the accounts, dollars are created. The money supply (M1 and M2) increases. The Treasury creates dollars by sending instructions to banks.

The Congressional Budget Office projects that if the debt limit remains unchanged, the Treasury will run out of cash between mid-November and early December.

This sentence more properly should read, “If Congress prevents the Treasury from creating dollars, the Treasury will run out of cash between mid-November and early December.

On March 16, the debt limit was reset to $18.113 trillion to match the amount of outstanding debt.

Translation: Congress decided it doesn’t want the Treasury to create any more money. The point is not that the Treasury is unable to create all the money it wishes. The point is simply that Congress, at the behest of rich donors, doesn’t want the Treasury to create money to pay for benefits to the middle class and the poor (the “99%”).

This is not a financial decision. It is a political decision. Congress essentially is stamping its feet and saying, “I’ll take my ball and go home unless you give me my way.”

The annual battle over the debt ceiling is an extortion game, in which one party threatens to shut down the government unless certain laws are passed. And these laws may have little to nothing to do with financing.

Whenever you read that certain federal spending is “unaffordable” or “unsustainable,” you are witnessing the Big Lie.

The purpose of the the Big Lie: To fool you into believing certain benefits must be cut — i.e. Social Security, Medicare, Medicaid, poverty aids, education aids, etc.

It is the wealthy political contributors who want your benefits cut.

What Makes Up the Debt Subject to Limit?

Debt subject to the statutory limit consists of two main components: debt held by the public and debt held by government accounts.

Get it? Congress has limited the amount of T-securities it can sell to itself!

Congress includes under the misleading term “debt,” the amount of money the government has “borrowed” from itself. The purpose: To make the “debt” look more ominous.

If your left hand borrowed $100 from your right hand, would you have any difficulty paying the debt? Of course not. But Congress wants you to believe internal debt is some sort of threat or burden.

Of the $18.1 trillion in outstanding debt subject to limit, $13.1 trillion was held by the public and $5.0 trillion was held by government accounts as of July 31, 2015.

So, not only is the misnamed “debt” a phony issue, but the $18.1 trillion debt is a phony figure.

If the debt limit is not increased, the Treasury will not be authorized to issue additional debt that increases the amount outstanding.

That restriction would ultimately lead to delays of payments for government activities, a default on the government’s debt obligations, or both.

By CBO’s estimate, the Treasury would most likely be able to continue borrowing and have sufficient cash to make its usual payments through mid-November or early December without an increase in the debt limit.

Translation: If Congress fails to increase the “debt” ceiling, that is tantamount to Congress voting to cut Social Security and Medicare payments, military salaries, all other federal salaries and all other payments.

The “debt ceiling” is Congress’s method for cutting benefits to the 99%, without leaving any fingerprints.

Your senators and representatives fear being blamed for benefit cuts, so they pretend the government can’t afford these benefits. The “debt ceiling” provides a handy, no-blame excuse.

Why would Congress do that?

Because that is what the rich of America want.

The rich are rich only because of the Gap between them and the rest of us.

If there were no Gap, i.e. if everyone had the same amount of money, no one would be rich. And the wider the Gap, the richer the rich are.

More than money, the rich want relative power. An easy way for the rich to increase their relative power is to decrease the wealth of the 99% — i.e. to take away your money.

So the rich pay Congress (via campaign contributions) to cut Social Security, cut Medicare, cut Medicaid, cut federal payrolls and cut all other federal benefits to the 99%, under the pretense these benefits are “unaffordable” and “unsustainable.”

They call it “fiscal prudence.”

And they call T-securities “debt” rather than more properly “assets of the economy,” (for that is exactly what T-securities are: Assets of the economy.)

The rich know you always want to cut “debt,” but never would want to cut “assets of the economy.”

So it all is a gigantic con game, with the CBO (being an agency ruled by Congress) as a player.

You are supposed to believe that federal “debt,” (even “debt” owed to itself), is imprudent and must be cut, when in fact, cutting the debt takes dollars out of your pocket and leads to recessions and depressions, while it widens the Gap between the rich and you.

And in a great feat of cynicism and irony, the politicians pretend your children and grandchildren will have to pay the debt, when in fact, your children and grandchildren will pay for the lack of federal deficit spending.

Your children and grandchildren will be punished by needless reductions federal deficit spending, all because the rich instruct Congress to tell you the Treasury is running short of its own sovereign currency, the dollar.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

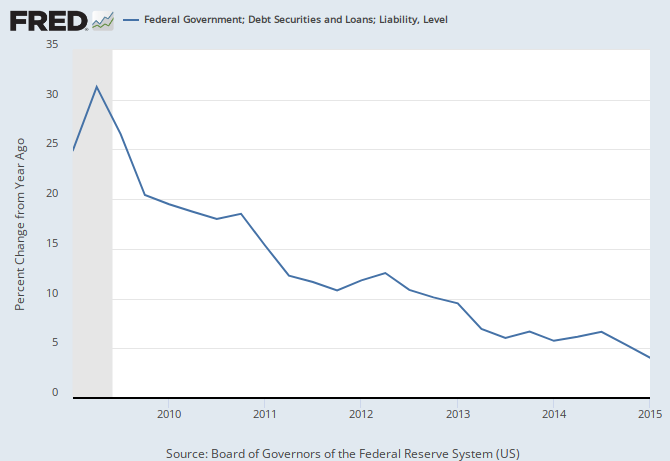

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

Hi Rodger,

I thought banks don’t lend reserves. According to James Galbraith, “Governments and banks are the two entities with the power to create [dollars] from nothing.”

Thanks,

Tyler

LikeLike

Right. Banks don’t lend reserves, but by law, they must HAVE reserves in order to lend.

Galbraith is correct that banks create dollars from nothing, but the number of dollars they create is legally limited by their reserves (and by their capital).

LikeLike

In my country (UK) there is *no* reserve requirements (as in Canada and a lot of other countries.)

Capital is not really a constraint as schemes e.g.Bank A can loan money to Bank B to buy capital.

LikeLike

Capital = Assets – Liabilities. A loan adds equally to both Assets and to Liabilities, so loans don’t increase Capital.

LikeLike

Rodger, I disagree with your idea of raising interest rates to control inflation. Monetary policy has mixed effects and raising rates may actually be inflationary (interest rates in Zimbabwe were at 300%!)

It is not a reliable way of stopping inflation.

Additionaly, Bnd Interest has always struck me as corporate welfare.

Far better to set rates at zero and just raise taxes/cut spending (fiscal policy) and/or ban things to free up real resource space.

LikeLike

While you disagree with me, you are in complete agreement with Modern Monetary Theory (MMT) relative to the potentially inflationary effect of higher interest rates.

I have argued with them frequently about this. Their position is that higher rates increase costs, which translate into inflation.

Yet for most companies, a couple of interest points would involve only the most minuscule increase in overall costs.

For many years, the Fed successfully has used interest rates to control inflation. If MMT were correct, the Fed’s strategy should not have worked.

Consider these points:

1. While large tax increases and/or spending decreases would reduce the money supply, and therefore reduce inflation, these are very unwieldy processes. Consider the time it would take to move a tax increase or spending decrease through Congress and the President.

2. Further, no one knows how much of a tax increase or spending decrease would be necessary to combat inflation at any point in time. Too little, and inflation would continue. Too much and we could have deflation.

3. Finally, tax increases and spending decreases control inflation by causing adverse effects on the economy, and on the American people. Shall we cut our biggest expenditures (Social Security, Medicare, the military) in order to reduce inflation?

Compare this with interest rate control:

1. It can be done instantly, and does not require Congressional endless debate.

2. It can be done in tiny increments, so much less guesswork is required and less possibility of “overshoot.”

3. Interest rate increases have no had adverse effects on the economy. While they increase borrowers’ costs, they also increase lenders’ profits. Consider the adverse effects on T-security, CD, bond and bank account holders of today’s low rates.

As for Zimbabwe, it suffered not only from hyperinflation, but from severe recession.

Its hyperinflation and recession were caused by economic factors that would have been exacerbated by increased taxes and/or reduced government spending.

LikeLike

Bank created dollars also are accompanied by private sector liabilities (loans) whereas federally created dollars are not. Thus, bank dollars do not add to private sector net assets, except maybe in the case of loan defaults. I am fuzzy on reserve mechanics however. If the bank makes a loan which is then deposited by the lendee, the bank does not actually then redeposit some of that deposit into reserves does it? Would it not then have created reserves from thin air too?

LikeLike

Correct on all accounts. Bank loans don’t add to NET private sector dollars, though they do add to the total money supply (which is gross).

When the bank makes a loan IT (not the borrower) deposits the dollars into the borrower’s account, which temporarily increases reserves.

However, these dollars ordinarily are soon spent (i.e. leave the account), so the bank needs additional reserves.

This seldom is a problem, since reserves are freely available from the government, from other banks and from private sources.

One of my companies used to lend banks reserves in a process called “overnights.”

Since reserves are calculated in the evening, we lent the money before 5:00 PM, and the bank paid it back (plus interest) the next morning.

The most meaningful limit to lending is bank capital.

LikeLike

Sorry Rodger, one thing I’m unclear on. Does the bank’s depositing its loan to the lendee’s account automatically increase the bank’s reserves? I thought the bank always had to acquire reserves, such as the borrowing you mentioned, to keep up its percentage of its loan deposits. Thanks.

LikeLike

At the instant the bank deposits the loan into the borrower’s account, reserves are increased.

But these deposits normally are spent quickly — that usually is the purpose of the loan — at which time reserves fall, again.

Think of a car loan or a house mortgage. The money may be in the borrower’s account for a micro-second or perhaps even bypass the account.

So you are correct; The bank needs to add to its reserves when it lends.

LikeLike

“When the bank makes a loan IT (not the borrower) deposits the dollars into the borrower’s account, which temporarily increases reserves.”

I don’t think this is correct. Only the Fed/Treasury can increase reserves. When a bank lends to a customer, no reserves are created, not even temporarily. Banks do not have the power to create reserves. The customer’s account is credited which is a liability for the bank, and the only offsetting asset for the bank is that the customer is legally obligated to repay the loan. This is why a bank needs reserves in order to lend, i.e. if the borrower transfers the money to an account at another bank, whether his own account or someone else’s, the lending bank may need reserves in order to honor that payment after netting out the transactions between banks.

It is also important to add something to your description of how the Treasury creates money. When the Treasury makes a payment to someone, the Fed does indeed instruct the payee’s bank to increase the payee’s bank balance by the amount being paid. However, at the same time the Fed increases the reserve account of the payee’s bank by the same amount, unlike in the case of a loan by the bank. Otherwise the credit to the payee’s account would create a liability for the bank with no offsetting asset for the bank.

LikeLike

Reserves requirements is a Federal Reserve requirement. The Fed requires banks to hold a certain amount of reserves in relationship to deposits. I believe the current reserve requirement is 10%, which means that banks are suppose to keep 10% of all deposits they take in. Example, the get $100 dollars in deposit, lend $90 and keep $10. That 10% is then deposited at the Federal Reserve bank account.

The Fed NEVER increases the account of the payee’s reserve account – a transfer from the Fed to a payee happens the same way a payment from any other bank happens, the Fed’s account is debited on their books and credited on the payee account. I am aware of the Fed’s flows.

LikeLike

“Example, the get $100 dollars in deposit, lend $90 and keep $10. That 10% is then deposited at the Federal Reserve bank account.”

My understanding is that banks do not lend deposits or reserves, but rather create new money by lending. What Bam describes sounds like the old classic but debunked tale of fractional reserve lending. But I’m willing to listen.

LikeLike

It’s not debumked – it’s actually how banks create money. I work for a bank.

What I explained may sound like no money is created, but money is created nonethelss. Keep in mind that the bank receiving the deposit will lend $90 to another bank, Bank B will recevie the $90, keep another $10 and lend 80 and so on. So you can see how just $100 dollars becomes balances across various banks.

There are various government entities, like the OCC, Treasury, Fed – that audit banks to uncover fraud and similar schemes. If banks could create money at will, than why have these institutions? Also, why would any bank go bankrupt if it could create money by lending new money into existence?

Bank accounts get audited regularly and they better have a debit where a debit belongs and a credit where the credit belongs. What creates the new money is not the bank per se – it’s the process of fractional reserve banking. If you know anything about accounting you would know that for every credit there has to be a debit and that for every debit there has to be a credit. Otherwise what you have is fraud – plain and simple. And the government agencies I outlined above are in place for the same exact reasons.

With that said, there is some truth to the fact that for there to be deposits, money has to be “lent” into existence. Lending comes before deposits. However, to say that creating money out of thin air is good for the economy borders insanity – unless you are a masochist and unless you can eat, wear, drive, live in paper and digits. And, if this money creation thingy is good for all of us – than why is all this money by the banks not helping us out?

I will take that token worth a pound of meat and will give you 10 of these tokens (just won’t say they are worth half a pound of meat for now). Yes…….. you are now a token wealthy sucker….

LikeLike

Bam, your description implies that banks are constrained from making loans by the amount of their deposits (“lend $90 and keep $10”), but I don’t think that is so. I think banks make loans regardless of deposits, then adjust their reserves afterward in whatever manner they deem best. My understanding is that banks do not lend their deposits.

LikeLike

SO who creates offsetting assets, the Fed or the banks or both? Seems to me since there are no local reserves– only a federal reserve, then reserve creation is only reserved for the federal reserve. Isn’t that why it’s called the federal “reserve” instead of the federal loan?

I.e., if a bank makes a loan and deposits the dollars into the borrower’s account, are increases to reserves being done at that instant locally by the bank or by the long distance assistance of the Fed?

LikeLike

August, you are mostly correct.

Each private bank has a “reserves” account at the Federal Reserve Bank. This account, plus vault cash, constitutes the total reserves a bank is required to have.

When a bank makes a loan, it makes a deposit in the borrower’s checking account and simultaneously, the bank must make sure its reserves (which also include vault cash) are sufficient to “back up” this additional deposit.

LikeLike

Jim, you are correct. Bam is wrong — as always. I suggest not trying to educate him.

LikeLike

Banks are not constrained by deposits. These “deposits” move from Bank to bank on a daily basis. The same money has been lent and relent time and time again. But banks must get “deposits” before they lend. The idea that banks can issue a loan without first having the money is stupid and moronic.

LikeLike

Bam (and probably a lot of other people too) seems to think that the deposit itself is what gets shifted around between the banks when a withdrawal is made, rather than reserves. In fact, Bam appears to consider reserves as just a portion of the deposit rather than as a regulatory requirement separate from the deposit. Anyway, Bam, here is a pretty simple description of the accounting that takes place when a bank makes a loan and when a withdrawal is made: http://www.cnbc.com/id/100497710

LikeLike

Jim, thanks for the excellent explanation.

It is wasted on Bam.

LikeLike

At the end of the day, it doesn’t matter whether money is created the way I say or you say. What matters is that “money” is created – and that this process in which money is created steals from each dollar holder as it devalues existing dollars.

Again, I will trade you these 10 tokens that can buy you half a pound of meat for that single token that can buy you a pound. This “more money is good for us” and “we are running out of money” idea is stupid and moronic.

LikeLike

As I said, education is wasted on Bam, because now, after all the discussion, when trapped by facts, he says,“It doesn’t matter.”

Now he changes the subject. Now, he espouses the equation:

Money Value = 1 / Money Supply

The correct equation is:

Money Value = Money Demand / Money Supply.

In short, any description of inflation must include the Demand for money, not just the Supply.

LikeLike

I did not change the topic – I am right. Go ask any bank if they can credit an account without debiting another. I bet none will say they do. The banking system as a whole creates money, a single bank does not – and if it does it’s performing fraud and counterfeiting – the same reasons the entities I’ve listed are in existence to prevent.

In regards to your response on money supply and inflation – this is the first time I’ve read such nonsense. Money value = money demand/money supply? Is this some sort of joke or something?

Then isn’t the value of money is infinite? I mean – who isn’t interested in getting more money? Everyone? So demand is infinite – isn’t it?

If demand is infinite and the value is infinite, than why have we had the issues with hyperinflation in various nations that resorted to creating money like mad?

Inflation = an increase in the money supply (PERIOD)

Whether that increase comes via the bank or the government – it’s the same exact thing. It’s theft, fraud…

LikeLike

Damn, I disregarded my own advice about trying to explain anything to Bam.

Anyway, if the demand for money were infinite, you never would buy anything.

LikeLike

How do you get inflation if supply, assisted by better and better technology, is able to keep up with demand assisted by deficit spending and Roger’s Ten Steps? In fact, the more mass production the more unit costs and inflationary pressure are reduced and profits are increased.

LikeLike

Exactly… if producers are getting more efficient than why, other than devaluation, are those lower prices not making it to consumers. Money creation cheapens laborers earnings and makes the rich richer. Inequality? Same, money printing is the culprit.

We have been in the same boat since 1913 and we still can’t see it.

LikeLike

Bam, are you honestly saying you believe no more US dollars should be issued? Really?… Really?

LikeLike

Inflation = an increase in the money supply (PERIOD

yea but only if too much money is chasing to few goods which isn’t the case with our high tech infrastructure that’s chomping at the bit to be tested as to its true capacity.

LikeLike

Some libertarians differentiate between “money inflation” and “price inflation,” which makes about as much sense as the rest of libertarianism.

LikeLike