1. It provides financial assistance to students who may not be able to pay for their education upfront. 2. Educated individuals tend to have higher earning potential and contribute more to the economy. 3. Education provides individuals with critical thinking, problem-solving, and communication skills that are valuable in both personal and professional life. 4. Education can be a pathway out of poverty for many individuals, providing them with the tools and opportunities to improve their socioeconomic status. 5. Student loans provide a significant source of revenue for educational institutions, helping them maintain and improve their programs and facilities.

Federal student loans account for about 92% of the total outstanding student loan debt in the United States, while private student loans account for approximately 8%. Federal loan rates range from 6.5% to 9%, and private loan rates range from 3.5% to 17%. Approximately 40% of the loans provided by the government to help students pay for their education are delinquent or in default. The federal government collected approximately $4.92 trillion in tax revenue for the most recent fiscal year (FY 2024). According to the Federal Reserve, the student loan debt balance in the U.S. has increased by 66% over the past decade and now totals more than $1.74 trillion.Washington Post, January 18, 2025, By Danielle Douglas-Gabriel In his last week in office, President Joe Biden capped a tumultuous effort to deliver widespread student loan forgiveness by canceling another $600 million in education debt for longtime borrowers and those defrauded by their colleges. With Biden’s final round of student debt relief, he has approved a total of $189 billion in loan cancellation for 5.3 million borrowers — more than any other president. Yet higher education experts are split on whether his mission to ease the debt burden for millions of Americans did more harm than good. Many of Biden’s sweeping debt relief policies have either been struck down by the courts or tied up in litigation that has left the student loan repayment system in disarray.Ironically, the lawsuits and court cases depend on Republican obstruction, the party of the wealthy. Millions of people who would have benefited from debt relief voted for Trump. Now, more than ever, the wealthy have control over America. They always wish to be more prosperous, which requires widening the income/wealth/power Gap between the rich and the rest. The children of the rich do not need to borrow for college, but the children of the rest do. Therefore, forcing the rest to be indebted widens the Gap, making the rich richer. It’s the same motivation for why the rich complain about the cost of Medicare and Social Security but never about the costs of special tax breaks available only to the rich.

Still, the president’s relentless pursuit of debt forgiveness, primarily through long-existing federal programs, has helped millions of people. “Four years ago, President Biden made a promise to fix a broken student loan system. We rolled up our sleeves and, together, we fixed existing programs that had failed to deliver the relief they promised,” Education Secretary Miguel Cardona said Thursday. The Education Department announced three separate rounds of student loan forgiveness in Biden’s last week in office. On Monday, the department canceled loans for 150,000 borrowers mostly through a 1994 statute called “borrower defense to repayment,” which lets the agency cancel federal student loans when colleges violate students’ rights and state law. A majority of those cancellations were for students who attended defunct schools owned by the Center for Excellence in Higher Education, including Stevens-Henager College, Independence University and California College San Diego. “My Administration has taken historic action to reduce the burden of student debt, hold bad actors accountable, and fight on behalf of students across the country,” Biden said Monday. “For the first time in the history of the student loan system, we saw the federal loan program deliver on its promise to more than 5 million student loan borrowers,” said Persis Yu, deputy executive director at the Student Borrower Protection Center (SBPC), an advocacy group. Conservatives have also succeeded in stalling Biden’s Saving on a Valuable Education (Save) repayment plan, which ties monthly student loan payments to earnings and family size, and offers a shorter path to loan forgiveness. A court injunction has halted Save and the Education Department has suspended payments for the 8 million people enrolled in the plan but denied them credit toward loan forgiveness during the forbearance period. While President-elect Donald Trump is likely to end the program, it is unclear what his administration will do with all of those borrowers. Republicans have become hardened against what many have called a fiscally irresponsible giveaway to college graduates at the expense of taxpayers.To the Trump right-wing, “fiscally irresponsible” means anything that benefits the middle and the poor. It does not include tax breaks for the rich. Think of :

- Private foundations or charitable trusts

- Real estate depreciation deductions, tax-deferred exchanges (like 1031 exchanges)

- Family limited partnerships (FLPs)

- Offshore accounts and trusts

- Business owners can deduct expenses, including travel, entertainment, and even personal use of company assets.

- Grantor-retained annuity trusts (GRATs) and dynasty trusts

- Carried interest

- Deferred compensation plans

- Foreign tax credits

- Opportunity zone investments

- Grantor trusts

- Conservation easements

- Like-kind Exchanges (Section 1031)

House Education and the Workforce Committee Chairman Tim Walberg (R-Michigan) accused the Biden administration of giving “handouts with zero accountability.”“Handouts with zero accountability” is how Donald Trump paid virtually no taxes during the years he made billions.

“Instead, the administration should have been working to address the fact that student loan debt is too high, completion rates are too low, and far too many students are left worse off after paying for college than if they had never enrolled in the first place,” Walberg said Monday. “Which is precisely what Biden’s loan forgiveness does.

It is shameful that, in its final days, the Biden-Harris administration is doubling down on efforts to push as much forgiveness as possible through the door, once again ignoring the rule of law.”Neither Walbert nor the rest of the Republican Party has solutions for reducing excessive student loan debt, low completion rates, and the financial strains students face after college. In fact, as the techies say about flawed programs, “Those aren’t bugs; they’re features.”

Congressional Republicans are likely to push wholesale changes to the federal lending system through the budget reconciliation process, including a proposal to eliminate Plus loan programs for graduate students and parents. For his part, Trump has derided Biden’s student loan forgiveness policies as “vile,” but has not put forth a plan of his own.This is a common complaint by Trump, who routinely criticizes anything the Democrats do, then promises to come up with a better plan and, in the end, fails to do so. Who could forget the eight years of broken promises to develop an “improved” version of Obamacare?

Persis Yu, the Deputy Executive Director and Managing Counsel at the Student Borrower Protection Center (SBPC) said, “The last Trump administration looked the other way when students’ and borrowers’ rights were denied — routinely siding with predatory schools and servicers.The fact that education benefits America was known to our first settlers, whose first acts were to create schools. The first free public school in what is now the United States was established in 1635 in Boston, Massachusetts, funded by taxpayer dollars Today, grades K-12 are still funded by taxpayer dollars, without direct student cost, by monetarily non-sovereign governments. So surely, grades 13+ can be financed by our Monetarily Sovereign government without taxpayer dollars. These days, advanced education is more important than it was four centuries ago, so all the same reasons for free elementary and high school now exist for free college and advanced. The solution to educating everyone who wants it is federal funding of all education. Further, the federal government should fund student salaries to compensate for lost working hours. The “federal debt” excuse is meaningless for a Monetarily Sovereign government. The “inflation” excuse is false. Inflation is caused by shortages of oil, food, shipping, labor, etc., none of which is affected by federal spending on education. We seem to have plenty of money for the military, Congress, the White House, and SCOTUS, as well as tax breaks that benefit the rich. (There is no FICA for tax shelters.) Rich property and business owners receive massive tax breaks; renters and salaried employees get nothing. Trump famously stated, “I love the poorly educated.” It seems he is so enthusiastic about the poorly educated that he wants millions more to join that group. The federal government does not need to lend. Federal lending is a Mafia-like solution for students of modest means who are desperate to climb the social/financial ladder, but become trapped in future-destroying debt. The government should give benefits to the people rather than lend, which would not only help the individuals receiving benefits but, unlike lending, add growth dollars to the economy. We should end all student loan programs and start anew with comprehensive student support programs for grades K-16+, financed by the federal government at no cost to federal, state, or local taxpayers. “Comprehensive” should encompass tuition, books and materials, room and board, tutoring, transportation, and salaries to cover lost work time. This would decrease the number of poorly educated individuals, increase the number of well-educated individuals, and alleviate a significant financial burden on students, their families, and state or local governments. Rodger Malcolm Mitchell Monetary Sovereignty Twitter: @rodgermitchell Search #monetarysovereignty Facebook: Rodger Malcolm Mitchell; MUCK RACK: https://muckrack.com/rodger-malcolm-mitchell; https://www.academia.edu/

……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY

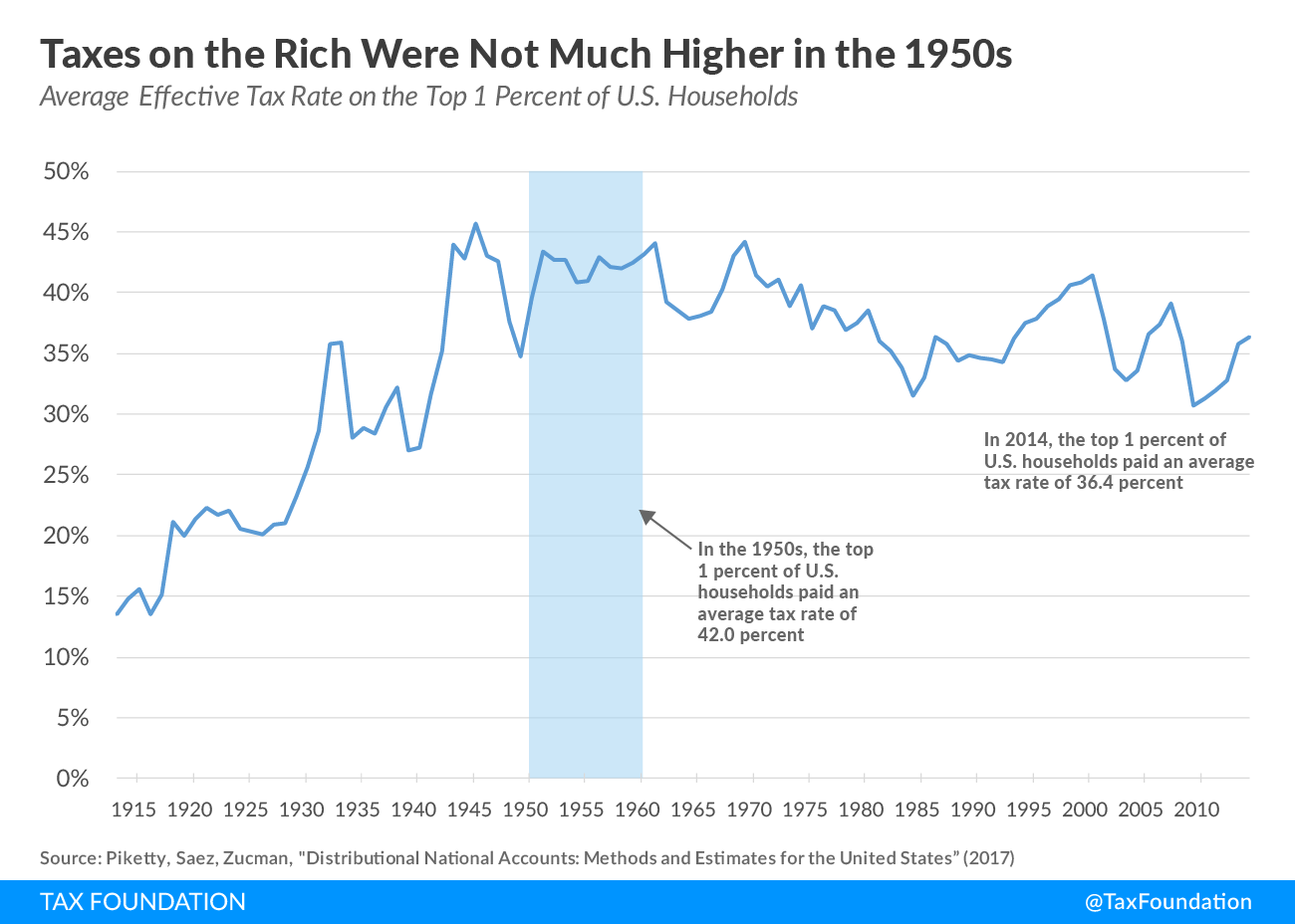

Considering that the top tax rate in the 1950s was 90%, the rich did not pay much more in that period than they do now. And some of the richest among us pay little if anything.

For example, Donald Trump paid no income taxes at all, during ten of the fifteen years, 2000-2015, despite being a billionaire. Tax laws, favorable to the rich, gave him the ability to claim losses on investments that an ordinary taxpayer may not look at as “losing” money.

In summary, using federal taxation of the rich to narrow the Gap is bad economics. History shows the rich would find ways to avoid paying higher rates.

But, even if the rich were forced to pay more, the higher rates would take dollars out of the economy and recess the economy. Option #1 is a “heads-you-lose (the rich don’t pay more), tails-you-lose” (GDP falls) plan.

Sadly, that is the plan Biden seems to have chosen, and it will cost him the November election.

The electorate may be ignorant about economics, but the rich would make sure the voters understood that raising taxes — anyone’s taxes — would hurt the economy.

It’s simple math. The more the federal government takes out of the economy, the less the economy (GDP) has.

Reducing federal taxes and/or providing supplementary benefits to those who are not rich, (#2 and #3) are the sole economically sensible ways to narrow the income/wealth/power Gap.

Sadly this sensible approach is blocked by the non-sensible belief that federal deficit spending is

Considering that the top tax rate in the 1950s was 90%, the rich did not pay much more in that period than they do now. And some of the richest among us pay little if anything.

For example, Donald Trump paid no income taxes at all, during ten of the fifteen years, 2000-2015, despite being a billionaire. Tax laws, favorable to the rich, gave him the ability to claim losses on investments that an ordinary taxpayer may not look at as “losing” money.

In summary, using federal taxation of the rich to narrow the Gap is bad economics. History shows the rich would find ways to avoid paying higher rates.

But, even if the rich were forced to pay more, the higher rates would take dollars out of the economy and recess the economy. Option #1 is a “heads-you-lose (the rich don’t pay more), tails-you-lose” (GDP falls) plan.

Sadly, that is the plan Biden seems to have chosen, and it will cost him the November election.

The electorate may be ignorant about economics, but the rich would make sure the voters understood that raising taxes — anyone’s taxes — would hurt the economy.

It’s simple math. The more the federal government takes out of the economy, the less the economy (GDP) has.

Reducing federal taxes and/or providing supplementary benefits to those who are not rich, (#2 and #3) are the sole economically sensible ways to narrow the income/wealth/power Gap.

Sadly this sensible approach is blocked by the non-sensible belief that federal deficit spending is Some of those laws, which were created, from thin air, produced the political entity known as “the United States of America.” and some of those laws created, also from thin air, the U.S. dollar.

Those laws arbitrarily created millions of dollars, and arbitrarily created the value of those dollars, with regard to arbitrary amounts of silver and gold.

And now for the question that I believe to be the most important question in economics:

Some of those laws, which were created, from thin air, produced the political entity known as “the United States of America.” and some of those laws created, also from thin air, the U.S. dollar.

Those laws arbitrarily created millions of dollars, and arbitrarily created the value of those dollars, with regard to arbitrary amounts of silver and gold.

And now for the question that I believe to be the most important question in economics:

The closest parallel to a T-security account is a safe deposit box.

When you put dollars into your safe deposit box, your bank never touches those dollars, and your bank doesn’t owe you those dollars.

They neither are loans to your bank nor are they debts of your bank.

The bank “pays you back” simply by allowing you to take back whatever dollars are in your box.

Similarly, when you make a deposit into your T-security account, the federal government never touches those dollars. The government “pays you back” by allowing you to take back whatever dollars are in your account.

Since the federal government has no need to ask anyone for dollars, why does it provide for deposits into T-security accounts? There are two real reasons and one secret reason:

The closest parallel to a T-security account is a safe deposit box.

When you put dollars into your safe deposit box, your bank never touches those dollars, and your bank doesn’t owe you those dollars.

They neither are loans to your bank nor are they debts of your bank.

The bank “pays you back” simply by allowing you to take back whatever dollars are in your box.

Similarly, when you make a deposit into your T-security account, the federal government never touches those dollars. The government “pays you back” by allowing you to take back whatever dollars are in your account.

Since the federal government has no need to ask anyone for dollars, why does it provide for deposits into T-security accounts? There are two real reasons and one secret reason:

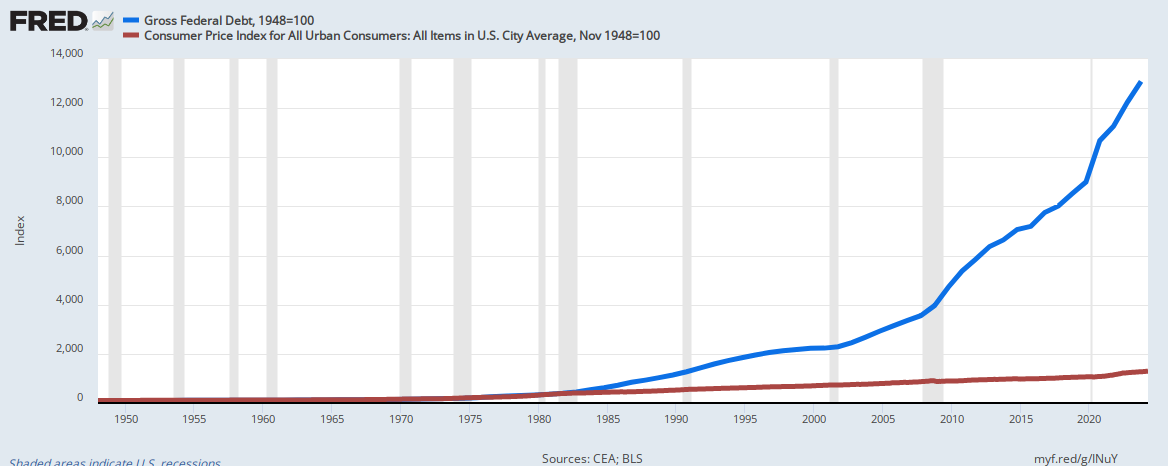

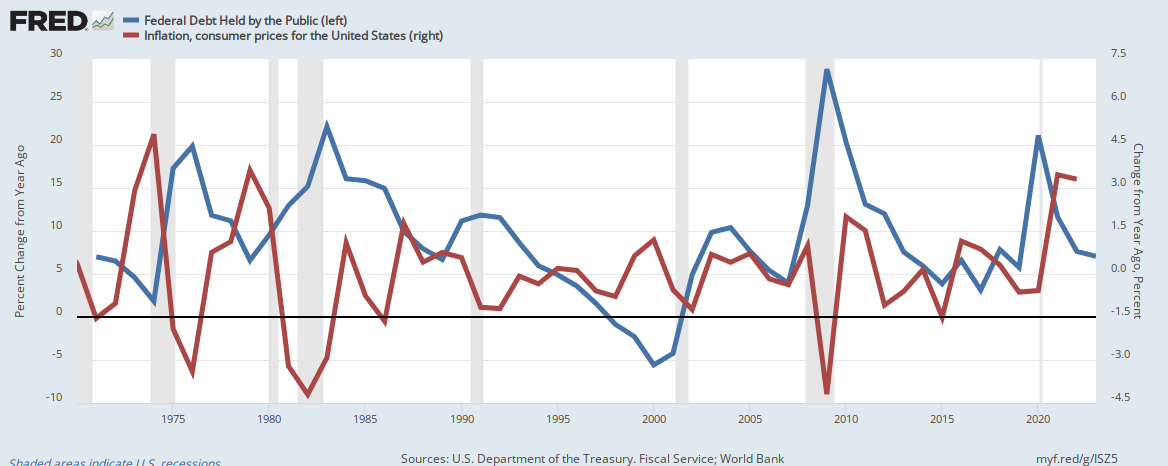

If federal deficit spending caused inflations, the blue line (federal deficits) and the red line (inflation) would be parallel.

Claims that future federal deficit spending, in any given amount, will cause inflation are based on intuition and guesswork and not on historical precedent.

Politically, is there a point beyond which federal deficit spending gives the federal government “too much power”?Libertarians think so.

In fact, Libertarians can be trusted to object to any amount of federal deficit spending, or even any amount of federal spending at all. They think people should be “free” to pay for unaffordable health care, education, infrastructure, housing, schooling, sustenance, and retirement.

Others think local governments should do what the federal government does because, in their belief, local governments know what local people want, and after all, aren’t we all “local” people?

Sadly, while the federal government, being

If federal deficit spending caused inflations, the blue line (federal deficits) and the red line (inflation) would be parallel.

Claims that future federal deficit spending, in any given amount, will cause inflation are based on intuition and guesswork and not on historical precedent.

Politically, is there a point beyond which federal deficit spending gives the federal government “too much power”?Libertarians think so.

In fact, Libertarians can be trusted to object to any amount of federal deficit spending, or even any amount of federal spending at all. They think people should be “free” to pay for unaffordable health care, education, infrastructure, housing, schooling, sustenance, and retirement.

Others think local governments should do what the federal government does because, in their belief, local governments know what local people want, and after all, aren’t we all “local” people?

Sadly, while the federal government, being