If you type “unsustainable federal debt” into your search bar, you will see this: (Try it)

Implications of Unsustainable Debt

1. Economic Growth Risks: Rising debt levels can lead to slower economic growth as more government resources are allocated to interest payments rather than productive investments.

2. Increased Borrowing Costs: As debt accumulates, the government’s borrowing costs may rise, crowding out investments in other critical areas such as infrastructure and education.

3. Potential Default: If corrective actions are not taken, the U.S. could face a situation where it defaults on its debt obligations, either explicitly or through inflationary measures.Experts suggest that without significant fiscal reforms, the U.S. government may face a fiscal crisis within the next 20 years.

Recommendations for Addressing Federal Debt To mitigate the risks associated with unsustainable federal debt, policymakers are urged to develop strategies that include:

*Reforming Spending: Addressing the key drivers of federal spending, particularly in healthcare and social programs, to align expenditures with revenues.

*Increasing Revenues: Exploring options to enhance tax revenues, such as eliminating certain tax deductions and increasing corporate and individual income taxes.

*Implementing Fiscal Policies: Establishing a comprehensive fiscal policy framework that prioritizes long-term sustainability over short-term gains.

Not one sentence in the above is true. Together, they form what is widely known in economics as “The Big Lie.”

It’s a series of lies that may not be the result of malevolence; it may just be ignorance. Either way, it’s wrong and harmful.

Let’s begin at the top:

The Lie: “Rising debt levels can lead to slower economic growth as more government resources are allocated to interest payments rather than productive investments.”

This lie includes two false assumptions: That federal deficit spending slows growth and government resources are limited by interest payments.

The Truth: Government deficit spending adds growth dollars to the economy as this formula illustrates: Gross Domestic Product = Federal Spending + Nonfederal Spending + Net Exports.

By formula, the more federal spending, the more economic growth.

The lie that federal deficit spending slows growth is disproven by the mathematical definition of economic growth.

The idea that Government resources are limited by interest payments is disputed by the experts from the three Fed Chairmen, the St. Louis Fed Bank, and the Treasury, all acknowledging that the federal government has unlimited resources. It cannot run short of dollars.

=======================================

The Lie: “As debt accumulates, the government’s borrowing costs may rise, crowding out investments in other critical areas such as infrastructure and education.”

This Lie makes false assumptions:

False assumption: The federal government borrows U.S. dollars.

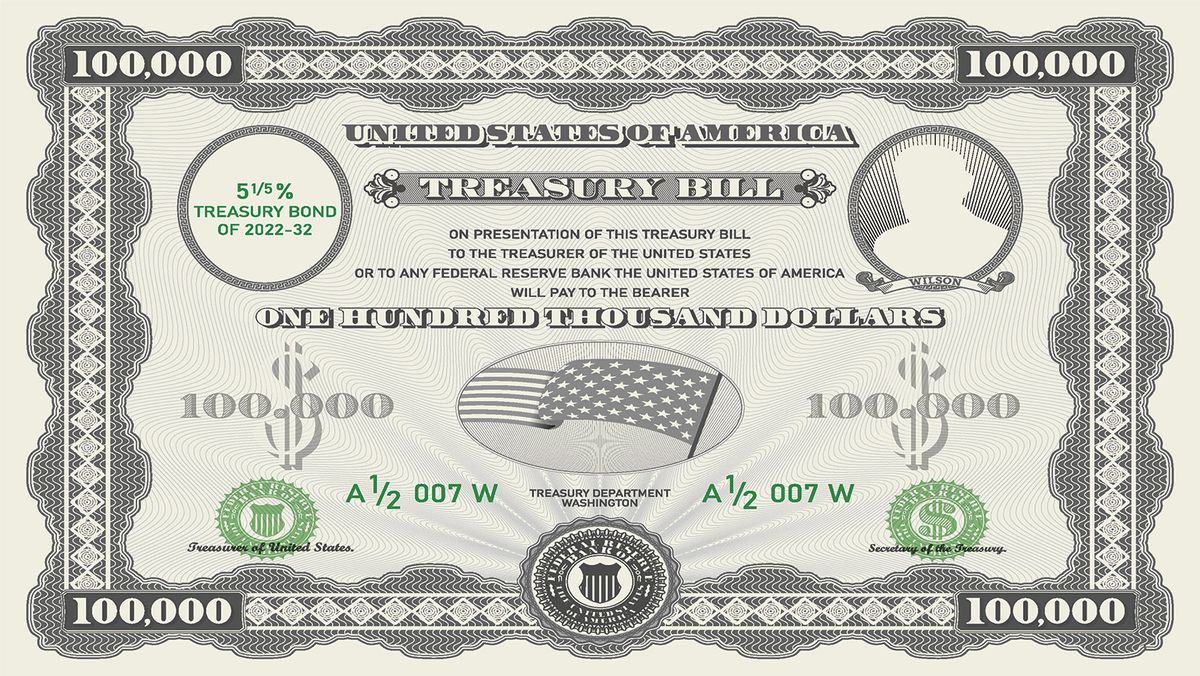

The Truth: The federal government never borrows U.S. dollars. Having the infinite ability to create dollars, the assumption makes no sense on its face. The confusion arises because of the words, “bill,” “note,” “bond,” and “debt” all of which have different meanings in federal finance vs. private finance.

In private finance, those words indicate that money is owed. In federal finance, a T-bill, T-note, and T-bond represent deposits (not borrowing) into Treasury security accounts.

The purpose of those accounts is not to acquire spending money but rather to:

*Provide dollar holders with a safe place to store unused dollars — safer than any bank in the world — which is why nations such as China store dollars there, and

*Help the Fed control interest rates by creating a base rate upon which all other rates are calculated.

The total of outstanding T-bills, T-notes, and T-bonds is misnamed “debt,” though nothing is owed. These accounts resemble bank safe-deposit boxes, in which valuables are held by a bank but not owed to the depositor.

The so-called “debt” is nothing more than a simple exchange of money. You send dollar bills to the government, and the government sends you Treasury bills. They both are U.S. money, with exactly the same backing: the full faith and credit of the United States government.

A dollar bill and a Treasury bill are identical in terms of government liability. They both are U.S. money issued by the U.S. government.

As the St. Louis Fed clearly said, “the government is not dependent on credit markets (i.e., does not borrow) to remain operational.”

False assumption: “… the government’s ‘borrowing’ costs may rise, crowding out investments in other critical areas

The Truth: The government’s “borrowing costs” (meaning interest payments) will have no effect on the government’s ability to pay interest. It has infinite ability to pay for anything.

We are not sure what “crowding out” means. If it means the government will run short of dollars, that clearly is impossible.

If it means that private sector borrowers will be unable to borrow, that too is false. Interest rates are arbitrarily controlled by the Fed and are not related to the issuance of Treasury securities. The Fed sets interest rates to control inflation.

===================================

The Lie: “… the U.S. could face a situation where it defaults on its debt obligations, either explicitly or through inflationary measures.

The Truth: Again, we see multiple false assumptions:

First false assumption: “… the U.S. could face a situation where it defaults on its debt obligations.”

As every competent economist (including those mentioned above) has said, “The federal government never can become insolvent, i.e., unable to pay its bills.” Having the infinite ability to create dollars confirms this.

Second false assumption: “… through inflationary measures.”

We are not sure if this means that federal spending causes inflation, a claim not in accord with history.”

Inflation never has been caused by federal spending. Every inflation has been caused by shortages of critical goods and services. The most recent COVID-related inflation was caused by shortages of oil, food, shipping, metals, lumber, labor, computer chips, and other needs. Inflation was being mitigated by federal spending to obtain and distribute scarce items.

See: “At long last, let’s put this inflation question to bed.”

Or does “inflationary measures” mean that the measures to forestall inflation actually cause defaults on debt obligations? The Fed mistakenly raises interest rates to combat inflation, but a nation with the ability to create its own money can never default.

And in any event, the government pays its misnamed “debt” by the simple act of returning the dollars that reside in T-security accounts. This is not a financial burden on the government.

Did you know that the federal “debt” has been called “unsustainable” for the past eighty-five years? (See: “A trip down memory lane, or proof ignorance is hard to conquer if the ignorant want to remain that way.”)

Yes, for eighty-five years, they have been crying wolf, and the people have yet to catch on. Talk about slow learners!

Why the lies?

That is the most important question. The so-called “cures” for the non-existent “problem” of federal debt involve tax increases on the poor and/or reducing social programs that primarily aid those who are not wealthy, such as Social Security, Medicare, Medicaid, and food stamps.

Thought seldom is given to reducing benefits for the rich, like eliminating tax loopholes.

This was driven home yet again when billionaire President Trump revealed that he had paid virtually no income tax for ten years, a most enviable position — and his political party just passed a “Big, Beautiful” law that saves the rich billions, while the rest receive a pittance while losing some benefits.

This is no accident.

The lies that FICA taxes fund Social Security and Medicare, and that social programs must be cut, are told on behalf of the rich, whose money runs America.

Those of our information sources that promulgate The Big Lie either are ignorant of the facts or are bribed to lie. The rich bribe:

- The media, via ownership and advertising dollars

- The politicians, via political contributions and promises of lucrative employment later

- The economists, via promises of employment with “think tanks” and university endowments.

IN SUMMARY

Even if the federal government did not collect a single penny in taxes, it could fund:

- A generous “living-income” Social Security benefit for every man, woman, and child in America.

- A livable Social Security benefit for every man, woman, and child in America

- Comprehensive, no-deductible Medicare for every man, woman, and child in America

- Generous aid for grades K-12.

- Free college for all who want it.

- Housing assistance

- Generous support for the various scientific and medical research projects in America.

- Economic growth

And it could do all of that without causing inflation.

America, you have been cheated and lied to, perhaps intentionally, perhaps ignorantly. The federal government has the wherewithal to make America a paradise on Earth. But the rich don’t want that, because if we all were equal, no one would be rich.

The rich want the income/wealth/power gap between the rich and the rest o us to widen. They want the desperation that forces people to accept jobs they don’t like and receive low pay.

So they bribe your sources of information to promulgate The Big Lie, that federal finances are like personal finances, and the government can’t afford to aid the “lazy” poor (who, on average, work harder than the rich).

It doesn’t have to be this way. However, it will remain so if the people reject the facts and choose to believe the lies.

If you don’t protest — if you don’t call, write, and gather groups to demand what if rightfully yours — if you weakly accept The Big Lie and think the truth “is too good to be true– then it always will be that you work hard, receive little, and your children and their children will do the same.

Now that you have heard the facts, the choice is yours.

Rodger Malcolm Mitchell

Twitter: @rodgermitchell

Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell;

MUCK RACK: https://muckrack.com/rodger-malcolm-mitchell;

……………………………………………………………………..

A Government’s Sole Purpose is to Improve and Protect The People’s Lives.

MONETARY SOVEREIGNTY