One would hope that historians, and especially economists, would understand the differences between federal financing (Monetary Sovereignty) and personal financing (monetary non-sovereignty).

Sadly, any such hopes seem dashed by this MSN article.

By Nick Lichtenberg

The national debt has grown to $38 trillion. The United States’ national debt, currently standing at $38 trillion and exceeding 120% of annual economic output, demands action, experts warn.

What about that $38 trillion national debt? To understand what it means, you might wish to review: Historical bullshit about federal “debt.” From September 26, 1940, to August 12, 2025

The article lists and describes the panic-stricken statements from “experts” about the federal debt from 1940 through today. In 1940, it was $43 billion— roughly 44% of GDP at the time.

As debt and the debt-to-GDP ratio rose, the economy grew and prospered. Yet, the panic has continued, and the screams have become ever more strident. Now, the so-called “debt” (that isn’t really debt; it’s deposits) has grown nearly a thousand-fold, the sky has not fallen, and we continue to be pummelled with articles like Nick Lichtenberg’s.

Having learned absolutely nothing in the past eighty-five (!) years, the experts continue to panic and scream, hoping you, too, will panic and scream. For your amusement, and perhaps sorrow, here’s the latest.

The nonpartisan Peter G. Peterson Foundation gathered a series of distinguished national economists and historians from outside the foundation in a collection of essays published Thursday.

They analyzed risks to U.S. economic strength, dollar dominance, and global leadership.

Ah, yes, distinguished national economists and historians — distinguished by their misunderstanding of the difference between federal government financing vs. state/local government financing. The former is Monetarily Sovereign; the latter is monetarily nonsovereign — two different animals.

The experts also explored the national debt’s impact on interest rates, inflation, and financial markets, with some characterizing this moment in history as a crisis.

A crisis of ignorance.

Collectively, they argue that the nation is operating under a dangerous fiscal gamble.

Assessing the mounting liabilities delivered a stark judgment: “In simpler terms, we are guilty of spending our rainy-day fund in sunny weather.” Meaning, the government has little “dry powder” left to fund a major military effort or stimulate the economy during a crisis.

And what exactly is our “rainy-day fund”? How much is it? Where is it stored? And that “dry powder,” how much is it and where is it stored?

Feel free to ask Council on Foreign Relations President Emeritus Richard Haass and NYU professor Carolyn Kissane. However, they won’t know, because the fund and powder do not exist, not in real or even metaphorical terms.

Well, in one sense, they do exist in the Monetary Sovereignty of the U.S. government, which has the infinite ability to create dollars (and dry powder) merely by pressing computer keys.

Who says so? A few real experts, not the self-proclaimed, self-aggrandized, overly anointed kind:

Former Fed Chairman Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency. There is nothing to prevent the federal government from creating as much money as it wants and paying it to somebody. The United States can pay any debt it has because we can always print the money to do that.”

Former Fed Chairman Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost. It’s not tax money… We simply use the computer to mark up the size of the account.”

Fed Chairman Jerome Powell: “As a central bank, we can create money digitally.”

Statement from the St. Louis Fed: “As the sole manufacturer of dollars, whose debt is denominated in dollars, the U.S. government can never become insolvent, i.e., unable to pay its bills. In this sense, the government is not dependent on credit markets to remain operational.”

Former Secretary of the Treasury Paul O’Neill: “I come to you as a managing trustee of Social Security. Today, we have no assets in the trust fund. We have promises of the good faith and credit of the United States government that benefits will flow.”

Nobel Prize–winning economist Paul Krugman: “The U.S. government is not like a household. It literally prints money, and it can’t run out.” — Numerous op-eds/blog posts.

Economist Hyman Minsky: “The government can always finance its spending by creating money.”

Economist Eric Tymoigne: “A sovereign government does not need to collect taxes or issue bonds to finance spending. It finances directly through money creation.”

Now, back to the fun:

The debt crisis has reached a critical threshold. The U.S. now spends approximately $1 trillion annually servicing its debt—a figure that surpasses its defense spending.

And why is spending more on interest than on defence significant? It isn’t. Spending is spending. All federal spending adds to GDP. The phrase was just a desperate attempt to shock you. It shouldn’t.

The federal government can pay infinite interest, and the more it pays, the healthier the economy is. Here’s the evidence:

Gross Domestic Product = Federal Spending + Nonfederal Spending + Net Exports

Get it? The more the federal government spends, and the less it taxes (i.e., the greater the deficit), the more Gross Domestic Product grows.

What would be truly shocking is if the federal debt declined. History shows us examples of that decline:

Every Depression in U.S. History Came On the Heels of a Reduced Federal Debt

1804-1812: U. S. Federal Debt reduced 48%. Depression began in 1807.

1817-1821: U. S. Federal Debt reduced 29%. Depression began in 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began in 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began in 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began in 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began in 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began in 1929.

1997-2001: U. S. Federal Debt reduced 15%. The recession began in 2001.

Economist Heather Long wrote that the 2020s are “fast becoming the era of big permanent deficits” with annual budget gaps projected to remain high (around 6% of GDP) even though unemployment is low, a startling departure from U.S. historical norms.

Let us pray for an “era of big permanent deficits.” The alternative is small deficits or surpluses (which lead to recessions or depressions).

Economists warn that solutions that worked in the past—such as the post-World War II debt reduction or the 1990s surpluses—are unavailable today. Economist Barry Eichengreen explained that the debt’s steep decline after World War II was supported by a highly favorable interest-rate-growth-rate differential (low real interest rates and fast GDP growth). Likewise, the 1990s reduction was fueled by the “peace dividend,” enabling deep cuts in defense spending. “None of these facilitating conditions is present today.”

The only necessary “facilitating conditions” for economic growth are increased federal deficit spending — exactly the thing that creates economic growth.

The Threat to National Security and the DollarDefense spending increases, if they occur, will grow the economy.Eichengreen, for his part, noted that current security threats from Russia, Iran, and the South China Sea create pressure for defense spending increases, not cuts.

Compounding the problem is political polarization, which is cited as the most robust determinant of unsuccessful fiscal consolidation.

“Successful fiscal consolidation” is economics-speak for reduced deficit spending, which causes recessions and depressions.

With major entitlement programs politically protected, this fiscal gridlock leaves raising additional revenue as the most viable path, given that the United States is a low tax-revenue economy compared to its peers.

As the real economists — Greenspan, Bernanke, and Powell — stated above, the federal government neither needs (nor even uses) revenue. It creates all its spending money in three easy steps:

- Congress votes.

- The President signs

- Federal employees press computer keys

And voila, all the millions and billions of dollars the federal government spends are magically created. No tax dollars are involved. It’s all bookkeeping notations.

The debt is framed not just as a financial strain but as a direct threat to security. Haass and Kissane emphasized that money spent on borrowing is “money not available for more productive purposes, from discretionary domestic spending to defense,” a classic case of crowding out.

The above statement is ridiculous on its face, for two, what-should-be-obvious reasons:

- The federal government has the infinite ability to create dollars and,

- The dollars the government spends go into the economy, where the private sector can use them for productive purposes.

There never has been “crowding out,” and never will be. The government can’t run short, and every dollar spent is added to the economy, boosting spending.

Other underfunded programs—including cybersecurity and public health—hollow out internal capacities that protect the homeland.

It is unclear how an entity with the unlimited ability to create dollars can be “hollowed out,” nor is it explained how an economy that receives more dollars is being “hollowed out.”

I imagine there is no explanation simply because it cannot be explained. It is utter nonsense.

The crisis was characterized by Haass and Kissane as moving in “slow motion,” the most challenging type for democratic governments to address effectively. Avoiding a sudden “cliff scenario” in which bond markets crash, experts argue, is not avoiding the crisis itself; they added: “The day will come when the boiling water finally kills the frog.”Ah, yes, “slow motion” because it isn’t happening yet, even though we’ve been predicting it for 85 years. And that darn old frog simply doesn’t understand that it’s supposed to have died by now.

The institutional integrity undergirding the U.S. dollar is also at risk. Historian Harold James wrote that he sees the situation as “the middle of a very dangerous experiment with the U.S. dollar, and with the international monetary system, whose fundamental driver is a fiscal gamble.” Erosion of the rule of law, accountability, and transparency raises the “specter of political risk in U.S. sovereign bond markets,” making it harder to maintain dollar dominance. Disturbingly, the potential for political interference in institutions, such as the Federal Reserve or the tampering with national statistics—as seen in Argentina’s cautionary tale—further erodes confidence.

Historian Harold James probably doesn’t realize it, but he’s not talking about the federal debt. Instead, he’s talking about dictator wannabe Donald Trump, and a cowardly do-nothing Congress, plus the morally compromised right wing of the Supreme Court.

They are the ones — not the essential debt growth –who are creating and countenancing the fall of the American economy, .

James’ colleague, Princeton politics professor Layna Mosley, cited the famous comment from the French statesman Valéry Giscard d’Estaing, who described the “exorbitant privilege” the U.S. enjoyed on the back of the dollar. She noted that, by virtue of the global role of the U.S. dollar and the U.S. leadership of the international financial system, the U.S. government has been able to borrow significant amounts on generous terms. But now, government actions and policy generate uncertainty and instability and “undermine the rules-based liberal international order from which the U.S. benefited greatly.”

Sounds frightening, except for one small detail. The U.S. federal government does not borrow.

As the representative of the St. Louis Fed correctly stated (above), “the government is not dependent on credit markets to remain operational.”

The federal government creates all the dollars it spends just by pressing computer keys. The government neither needs nor uses any income, whether from borrowing or taxes.

Rather than providing spending money, the purposes of federal taxes are to:

- Control the economy by taxing what the government wishes to discourage and by giving tax breaks to what it wishes to reward.

- Assure demand for the U.S. dollar by requiring taxes to be paid in dollars.

- To help the Fed control interest rates by providing a “floor” rate.

- To provide dollar holders with a safe, interest-paying place to store unused dollars, which supports the value of dollars.

This loss of credibility empowers bond markets, and their displeasure can lead to sudden, painful economic consequences for everyday Americans through surging mortgage and loan interest rates. Haass and Kissane turned to another metaphor, saying the situation is akin to “forgoing fire or automobile insurance just because the odds are you will not suffer from a fire at home or an accident on the road.”

The above metaphor is a backward attempt to explain why all those “doomsday” predictions have been wrong. The better advice would be: “Don’t bet your life savings on misinformation from the media, the politicians and many economists, because for 85 years, you’d have lost.”

Learn from experience. The only loss of credibility will be endured by the noted historians and economists who, once again, as they have for the past eighty-five years, will be forced to come up with excuses for why the economy does not obey their dire predictions.

Rodger Malcolm Mitchell

Twitter: @rodgermitchell

Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell;

MUCK RACK: https://muckrack.com/rodger-malcolm-mitchell;

……………………………………………………………………..

A Government’s Sole Purpose is to Improve and Protect The People’s Lives.

MONETARY SOVEREIGNTY

The U.S. federal government is

The U.S. federal government is The government also has the infinite power to change Social Security laws, as demonstrated by the 12 benefit changes shown in this chart.

More than half of all Social Security recipients take benefits before the official retirement age when benefits are reduced.

This demonstrates an early need for benefits by those in lower-income groups.

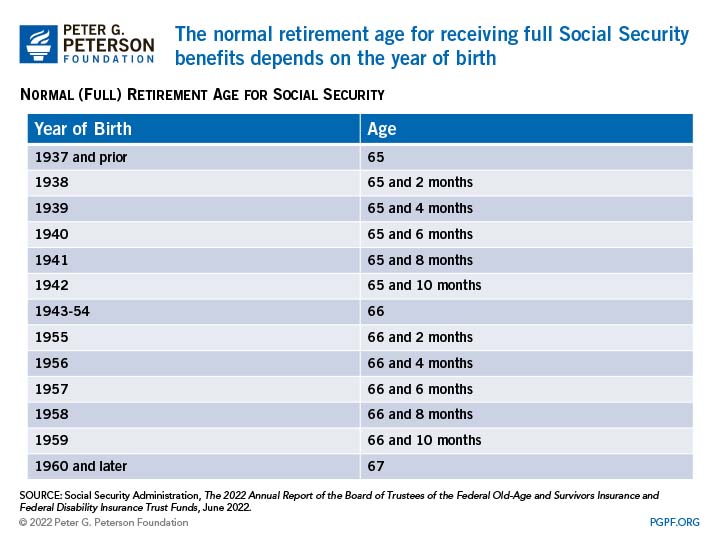

The government also has the infinite power to change Social Security laws, as demonstrated by the 12 benefit changes shown in this chart.

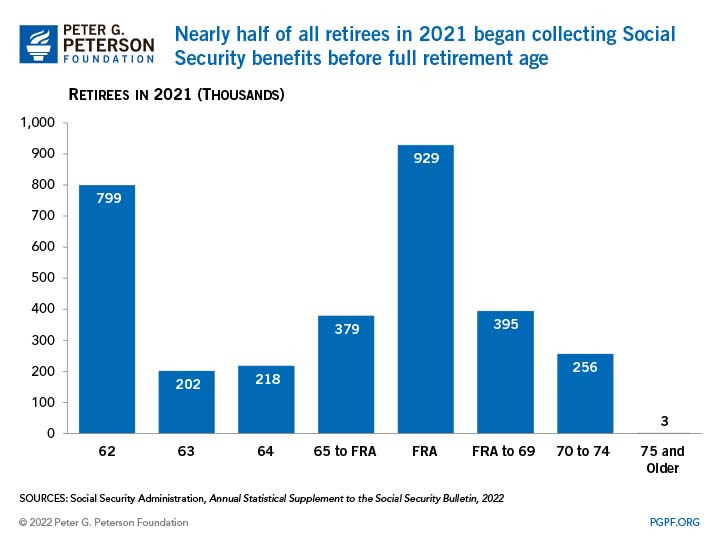

More than half of all Social Security recipients take benefits before the official retirement age when benefits are reduced.

This demonstrates an early need for benefits by those in lower-income groups.