Inflation is still red hot, and it’s forcing the Federal Reserve into a new game plan Updated December 15, 2021 SCOTT HORSLEY The Federal Reserve is paving the way for possible interest rate hikesnext year, in an effort to contain stubbornly high inflation.If oil, food, chip manufacture, shipping, and lumber-growing remain scarce, and FICA continues to chase people out of the labor poor, we will continue to have inflation, even if interest rates are raised to 10% or more.

At the conclusion of a two-day policy meeting Wednesday, the central bank announced plans to phase out its large-scale bond-buying program faster than initially planned. The Fed started purchasing bonds during the pandemic as a way to keep borrowing costs across the economy low and to prevent any market disruptions.What the Fed bond-buying program actually does is to pump growth dollars into the economy. Unfortunately, turning off that money-creation pump will bring us closer to recession.

Ending the bond purchases earlier would give the Fed more flexibility to raise interest rates sooner, if necessary, to keep prices from spiraling out of control. The central bank said previously it wanted to stop its bond purchases before considering raising interest rates.Utter nonsense. The Fed doesn’t need more “flexibility.” It has the infinite ability to raise interest rates. It merely does so by fiat, and up the rates go. There is a zero relationship between bond purchases and the Fed’s ability to raise interest rates.

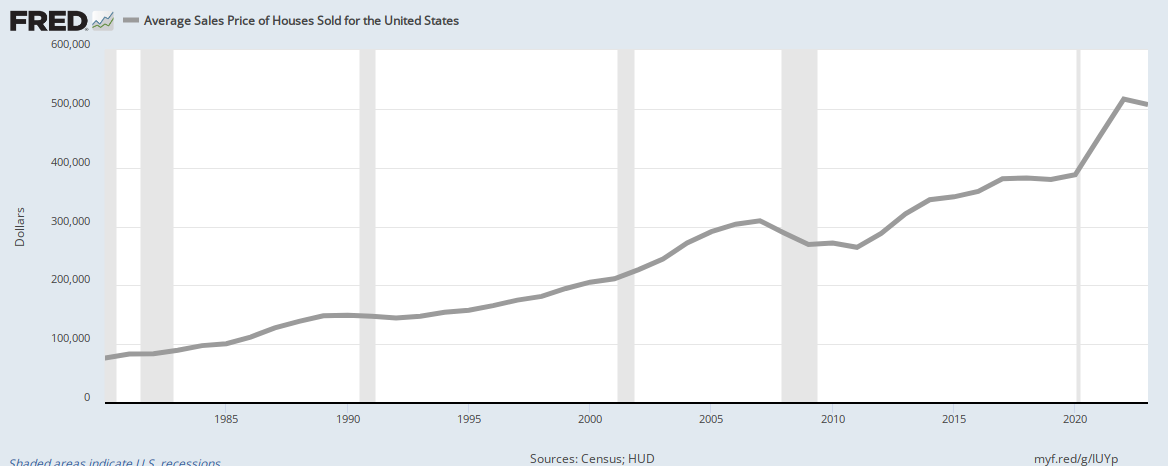

The Fed is taking a harder line against inflation after consumer prices in November jumped 6.8% from a year ago — the largest increase in nearly four decades.The sudden jump in prices was not caused by the federal deficit spending, which will take place over as much as ten years. It was caused by COVID-related, OPEC-related, and regulation-related scarcities.

In a statement, the Fed acknowledged the rapid runup in prices. Although the central bank still believes inflation is largely driven by factors tied to the pandemic, which should ease when the health outlook improves, policymakers are no longer taking that as a given.Yes, correct. Today’s inflation is not just largely driven, but totally driven, by pandemic factors.

Notably missing from Wednesday’s statement was the word “transitory,” which the Fed had used in the past to describe inflationary pressures. “The risk of higher inflation becoming entrenched has increased,” Fed chairman Jerome Powell told reporters. “It’s certainly increased. I don’t think it’s high at this moment but I think it’s increased. And I think that’s part of the reason behind our move today.”He is clueless about the future for the same reason we all are clueless. He has no idea how much oil will be pumped, how much food will be grown (including weather considerations), or how many computer chips will be manufactured or needed. He has no way to know how and when the shipping situation will be fixed, and what we will do about the lumber shortage. Like all of us, he doesn’t know what the effect of the omicron variant of COVID will have, nor if there will be other variants and what their effect will be. He has no idea what effect global warming will have on shortages, and when. I would just as soon lay tarot cards on an ouija board as rely on economic predictions by the Fed chairman, or anyone else, including me. His problem is not just his inability to predict the future, but also his inability to judge cause and effect.

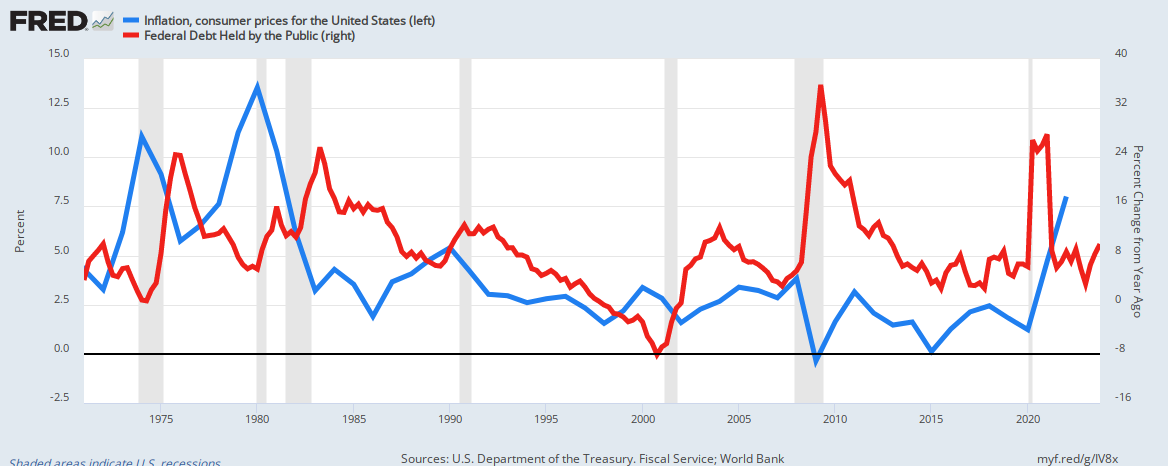

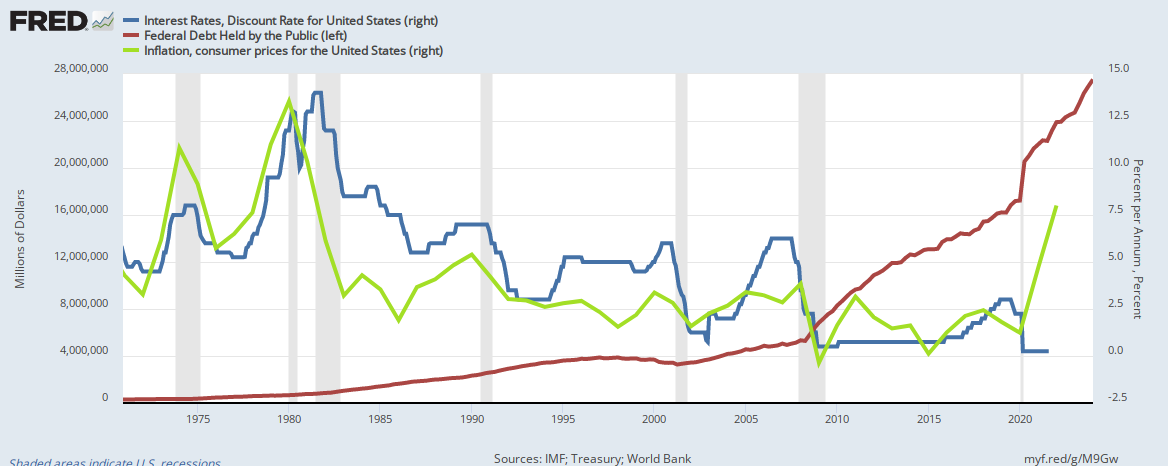

The Fed has kept interest rates near zero throughout the pandemic in an effort to prop up the economy.And during all that time of low interest rates, we had massive federal deficits with low inflation. That alone should provide any thinking person with sufficient evidence to determine that deficits and debt do not cause inflation.

Twelve of the 18 members of the Fed’s rate-setting committee now say they expect interest rates to rise by three-quarters of a percent or more in 2022. That underscores the evolution in the Fed’s thinking. Three months ago, no one on the committee envisioned rates climbing by that much next year.It’s not “evolution.” It’s ignorance. From just three months ago their thinking totally has reversed. Why would anyone trust their predictions?

The Fed has repeatedly been surprised this year by both the strength and staying power of inflationary forces. While average wages have been rising at a rapid pace, prices are climbing even faster.Really? Given all their inside information, were they really surprised by the oil shortage? The computer chip shortage?

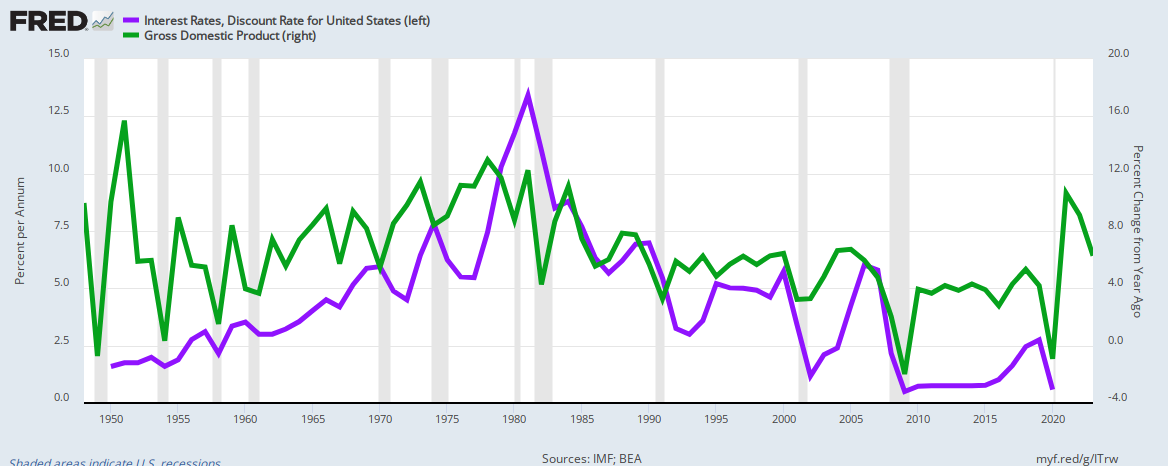

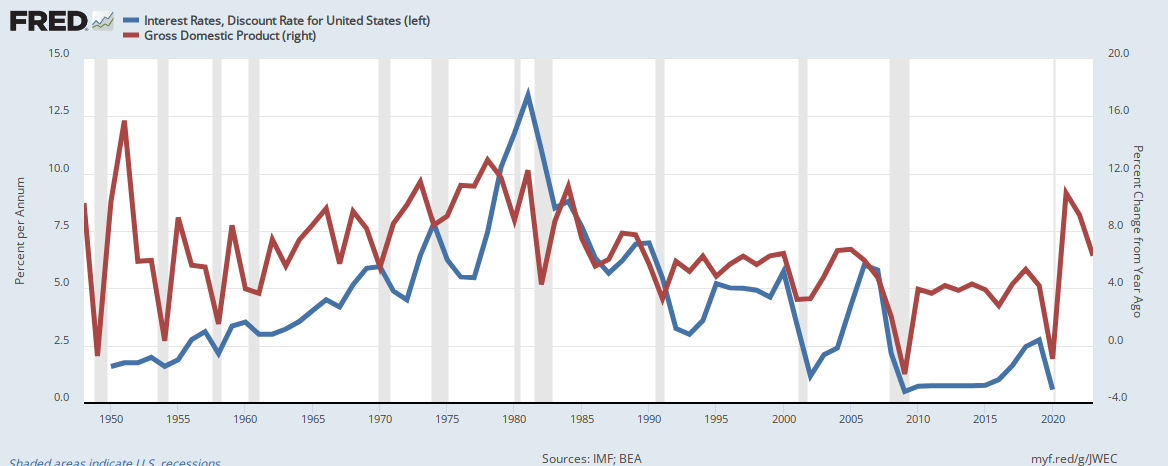

Committee members now say they expect inflation to be 2.6% at the end of next year, up from 2.2% that was projected in September. Raising interest rates is the Fed’s traditional tool for keeping inflation under control, but it comes with its own price. Higher borrowing costs typically lead to slower economic growth, and the Fed has been reluctant to raise interest rates until it feels the U.S. had achieved “maximum employment.”

That’s the challenge facing Fed policymakers. “This was a different kind of recession that we’ve never really been through,” said Greene, who’s also chief economist at the Kroll Institute. “So the jury’s still out on what’s going to happen with the labor force.” Powell suggested that if inflation goes unchecked, that in itself could jeopardize a complete jobs recovery.The inflation can be checked, but not by the Fed. Congress can check the inflation by:

- Using tax policy and spending policy to encourage the development and use of renewable energy.

- Using tax policy and spending policy to encourage the development of more and better food crops and other foods, that are able to feed more people, using less land, labor, and fertilizers, while renewing the soil.

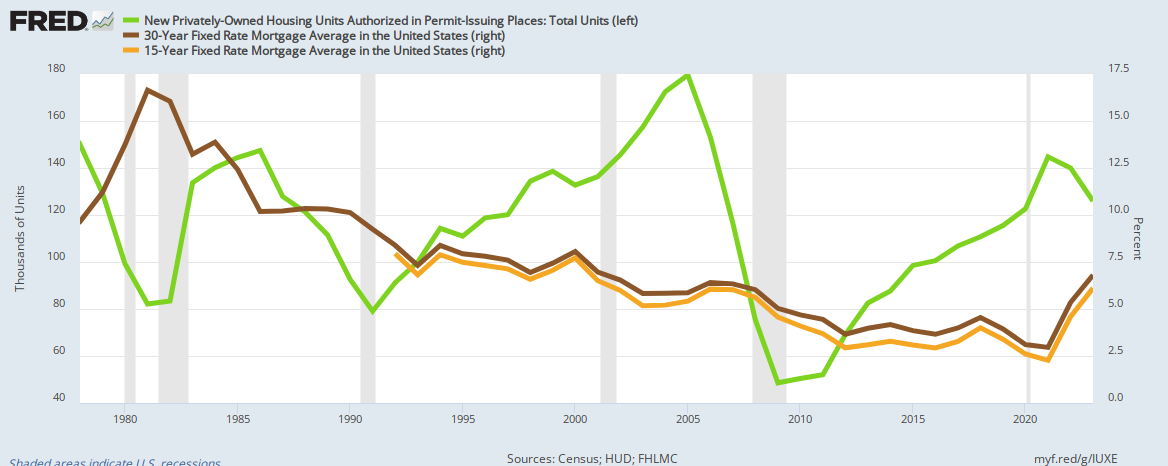

- Using tax policy and spending policy to encourage the supply of lumber and other building-related materials.

- Using tax policy and spending policy to encourage the development of U.S. based computer chips and other computer-related hardware and software.

- Using tax policy and spending policy to improve both international and domestic shipping and mail. The postal service should be funded by the government and not be required to make a profit.

- Eliminating FICA so that employers are encouraged to raise salaries.

- Providing Medicare for All so that employers do not need to fund healthcare insurance, and again, are encouraged to raise salaries.

“What we need is another long expansion like the ones we’ve been having over the last 40 years,” Powell said. “And to have that happen, we need to make sure that we maintain price stability.”“Price stability,” i.e. low inflation, is beneficial, but it does not lead to “another long expansion. The primary factor leading to a long economic expansion is ongoing and increasing federal deficit spending. Rodger Malcolm Mitchell Monetary Sovereignty Twitter: @rodgermitchell Search #monetarysovereignty Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

THE SOLE PURPOSE OF GOVERNMENT IS TO IMPROVE AND PROTECT THE LIVES OF THE PEOPLE.

The most important problems in economics involve:- Monetary Sovereignty describes money creation and destruction.

- Gap Psychology describes the common desire to distance oneself from those “below” in any socio-economic ranking, and to come nearer those “above.” The socio-economic distance is referred to as “The Gap.”

- Eliminate FICA

- Federally funded Medicare — parts A, B & D, plus long-term care — for everyone

- Social Security for all

- Free education (including post-grad) for everyone

- Salary for attending school

- Eliminate federal taxes on business

- Increase the standard income tax deduction, annually.

- Tax the very rich (the “.1%”) more, with higher progressive tax rates on all forms of income.

- Federal ownership of all banks

- Increase federal spending on the myriad initiatives that benefit America’s 99.9%

MONETARY SOVEREIGNTY