Why do you want to starve the poor?

Oh, you don’t. Well, your government does. Here are excerpts from an article that appeared in a recent issue of the New York Times:

SNAP cuts can be costly elsewhere

Recipients of food stamps are healthier, studies found

By Austin Frakt and Elsa Pearson The New York TimesThe Department of Agriculture recently finished work on a new rule that may take food stamps away from nearly 700,000 Americans by tightening work requirements.

Why do you wish to tighten work requirements on the poor? Is it that you harbor Puritanical instincts demanding that people labor to receive benefits from the federal government?

Many of the rich don’t work, or they labor only minimally. Yet, they receive massive tax benefits from the U.S. government. Why the “special” rules for the poor?

Why don’t you demand that the rich labor in real jobs to receive those tax benefits? Why do you demand that the poor be required to work in order to receive their minimal benefits?

Give me one good excuse.

Fake Excuse 1. No, your tax dollars do not pay for food stamps, so you can’t use that excuse. The federal government creates brand new dollars to pay for food stamps. Federal tax dollars do not pay for anything.

Fake Excuse 2. And no, even if the government gave loafers food stamps, that would not lead to nationwide indolence. Food stamps comprise such a meager amount of money, you know full well that you wouldn’t quit your job in order to receive them.

Any others?

Continuing with the excerpts:

Several times in the past year, the government has proposed cutting food stamp eligibility. The new rule is intended to save almost $8 billion over five years.

The problem with that reasoning is:

Fake Excuse 3. While food stamps are an important part of many poor people’s survival income, $1.6 billion represents pocket change to the federal government, barely noticeable to a government that spends trillions.

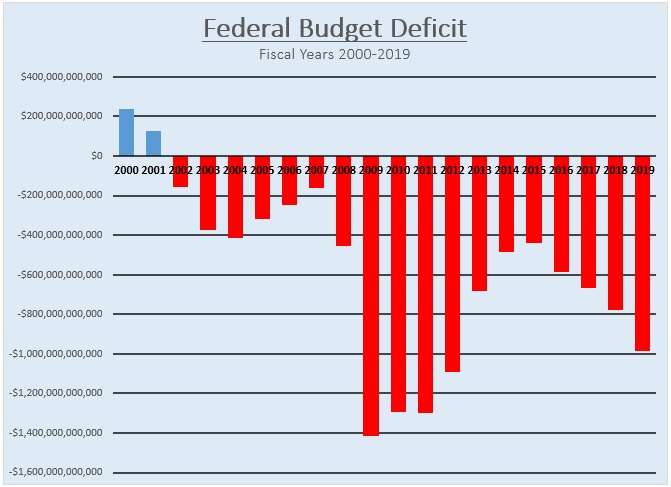

Fake Excuse 4. The federal government, being Monetarily Sovereign, does not need to save money. It freely creates all the dollars it needs simply by pressing computer keys.

The article continues:

It’s not clear how much money would actually be saved, research suggests, given the costs that might come from a decline in the health and well-being of many of the country’s 14.3 million “food-insecure” households.

The Department of Agriculture defines food insecurity as a lack of consistent access to enough food for an active, healthy life. It affects low-income, single-parent, and black and Latino households the most, but it cuts across many demographic lines and affects 11% of American households overall.

Citing a strong job market, the Trump administration has said helping able-bodied adults was no longer necessary.

Sonny Perdue, the agriculture secretary, said: “We need to encourage people by giving them a helping hand but not allowing it to become an indefinitely giving hand.”

Sonny, doesn’t believe in giving people money, because . . . well, just because:

Sonny Perdue, 72, Secretary of Agriculture. The former Georgia governor built a fortune in agribusiness and real estate. Shortly after joining Trump’s cabinet, he transferred control of investments worth at least $8 million—including a stake in a multimillion-dollar grain-merchandising business—to his four adult children.

Correction: Sonny doesn’t believe in giving money to poor people who desperately need it. Giving billions to his rich kids is just fine, however.

Continuing the excerpts:

Food insecurity is linked to worse health outcomes, including poor mental health, high blood pressure and diabetes, with children particularly vulnerable.

Low-income people may be eligible for federal Supplemental Nutrition Assistance Program benefits, better known as food stamps. The details vary by state.

“SNAP recipients often work, but their employment can be unsteady,” said Dr. Seth Berkowitz, an internist and assistant professor at the University of North Carolina School of Medicine.Seasonal variation in some labor markets — like agriculture or even retail consumer jobs when sales may spike around the winter holidays — can put people temporarily out of work, making it hard for them to keep food on the table. “The way these work requirements are imposed could pull support out from under people even when they are working.”

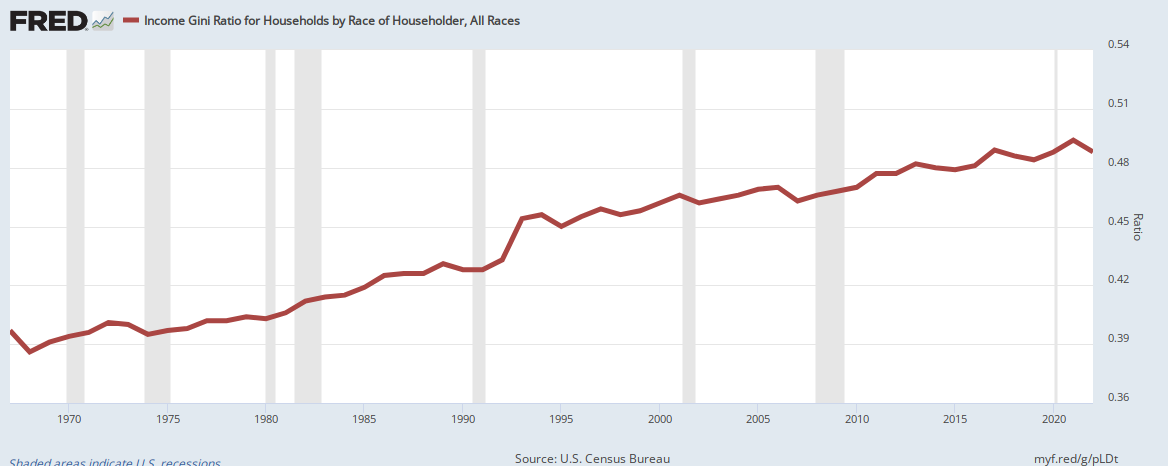

The real motive of the GOP (“Party of the Rich”) is not to force people to labor for their money, but rather to widen the Gap between the rich and the rest. (See: Gap Psychology)

Because there is no limit to the lust of the rich to be richer and ever richer, there also is no limit to the punishment they dole out to the poor. Whatever rule the Department of Agriculture publishes, it will not ever be enough to satisfy the rich.

Depend on this: Immediately after the rule is published, the Party of the Rich will begin to demand an even harsher rule.

One study found that receiving SNAP benefits was associated with a reduction in annual health care spending of about $1,400 per person among low-income adults.

Another study found that each additional $10 of monthly SNAP benefits was linked with a lower risk of hospitalization for Maryland residents enrolled in both Medicare and Medicaid.

In Massachusetts, an increase in SNAP benefits slowed the increase in Medicaid hospitalization costs.

The authors of the article, Austin Frakt and Elsa Pearson, in typical New York Times fashion, try to make their point based on cost, not on compassion or concern for Americans’ health.

This probably is wise, because compassion totally is missing from the GOP, from Trump and from the “religious” right (who are perhaps the least religious people on earth). That lack of religion is proved every day at the U.S. southern border.

And as for cost, it is a phony concern. The federal government, being Monetarily Sovereign, can afford anything.

The Special Supplemental Nutrition Program for Women, Infants and Children WIC is similar to SNAP, but as its name suggests, it provides nutritional support only for low-income mothers and their young children.

What about low-income fathers? What about low-income teens? What about low-income adults who don’t have children?

The only social concern exhibited by the “religious right” involves the survival of fetuses. There is no concern for the pregnant woman or for the fetuses after they are born. In their world, abortion is bad, but feeding children and adults is worse.

How do they know? Jesus told them.

For additional help, people often turn to local food pantries, such as those that partner with the Greater Boston Food Bank.

Local food pantries are funded by the private sector and local governments, none of which is Monetarily Sovereign. They can run short of money. The federal government cannot.

Illogic is taking money from those whose money is limited instead of taking it from a government with unlimited funds.

Research suggests food pantries are also effective at providing immediate relief. They have far fewer eligibility requirements than SNAP or WIC — sometimes none — but limit when and how often clients can receive food.

Some pantries are even on college campuses, helping the almost 40% of college students who report struggling to afford food.

Food pantries also serve as a community entry point for a variety of initiatives, including cooking and nutrition classes.

The federal government has the financial power to do all of the above, yet the burden falls on the private sector and local governments.

A review of 12 pilot pantry-based programs found these could improve participants’ nutritional knowledge and diet.

One of the interventions studied a novel approach to food pantry design that allows clients to choose their own food and take part in monthly nutritional goal setting.

Three months in, participants were less likely than those using a traditional food pantry to experience severe food insecurity.

A year later, they were eating more fruits and vegetables.

What a concept. Actually allowing poor people to choose their own food! Who would have believed it would allow the poor to eat more healthfully? Not the federal government, which is dominated by the Gap Psychology of the rich, who run America, and the “religious” right, which runs the GOP.

While interventions can help, they are not long-term solutions nor do they address underlying problems, like food deserts (communities where healthy food is hard to find) and food swamps (those where unhealthy food abounds). We eat what’s available and affordable, even if that’s bad food.

The Trump administration’s solution to food insecurity is to cut funding for food stamps. Presumably, the rationale is: By starving the poor to death, there will be fewer poor to feed. Problem solved.

Feeding America estimates at least 30% of those with food insecurity nationwide aren’t eligible for SNAP. In some states, it’s nearly 50%.

Tightening eligibility for the program, as new work requirements would do, would only increase that number.

And that, dear friends, is how we make America great, again.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell

Search #monetarysovereignty Facebook: Rodger Malcolm Mitchell

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

The most important problems in economics involve:

- Monetary Sovereignty describes money creation and destruction.

- Gap Psychology describes the common desire to distance oneself from those “below” in any socio-economic ranking, and to come nearer those “above.” The socio-economic distance is referred to as “The Gap.”

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Implementation of Monetary Sovereignty and The Ten Steps To Prosperity can grow the economy and narrow the Gaps:

Ten Steps To Prosperity:

2. Federally funded Medicare — parts A, B & D, plus long-term care — for everyone

3. Provide a monthly economic bonus to every man, woman and child in America (similar to social security for all)

4. Free education (including post-grad) for everyone

5. Salary for attending school

6. Eliminate federal taxes on business

7. Increase the standard income tax deduction, annually.

8. Tax the very rich (the “.1%”) more, with higher progressive tax rates on all forms of income.

9. Federal ownership of all banks

10. Increase federal spending on the myriad initiatives that benefit America’s 99.9%

The Ten Steps will grow the economy and narrow the income/wealth/power Gap between the rich and the rest.

MONETARY SOVEREIGNTY