Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

Alan Greenspan: “Central banks can issue currency, a non-interest-bearing claim on the government, effectively without limit. A government cannot become insolvent with respect to obligations in its own currency.”

St. Louis Federal Reserve: “As the sole manufacturer of dollars, whose debt is denominated in dollars, the U.S. government can never become insolvent, i.e.,unable to pay its bills. In this sense, the government is not dependent on credit markets to remain operational.

———————————————————————————-

There is a website known as “Reason” (the libertarian magazine of “Free Minds and Free Markets.”) and its editor, Nick Gillespie, who can be depended upon to display incredible ignorance about federal financing.

Fundamentally, Gillespie seems to believe that federal financing resembles personal financing.

He does not understand, or refuses to acknowledge, that the federal government is Monetarily Sovereign, while you and I, and the state and local governments, and businesses all are monetarily non-sovereign.

The U.K. created and distributes the British pound. Japan created and distributes the Japanese yen. The U.S. government created and distributes the U.S. dollar.

That little prefix “non” should have given him a clue, but for those who are unfamiliar with the terms, a Monetarily Sovereign entity is the creator and distributor of a type of money. A monetarily non-sovereign entity uses money, but did not create that money.

By contrast, the State of Illinois, the City of Chicago, you and I, did not create the dollar. We are users of the dollar. France and Germany did not create the euro they use. All are monetarily non-sovereign.

One functional advantage of a Monetarily Sovereign government is that it cannot unintentionally run short of its own sovereign currency. By contrast, a monetarily non-sovereign entity can, and often may, run short of the currency it uses.

Here are excerpts from one of Reason’s recent articles:

The National Debt Is Coming Due, Just Like We Told You

By 2020, interest on the debt will cost more than Medicaid. By 2025, it will cost more than defense spending. And that’s just the start.

Right away, Gillespie tosses in a scare headline. You are supposed to be frightened that the national debt is “coming due” whatever that means.

To be clear, Gillespie isn’t really talking about “national” debt (which would include all of a nation’s debt, public and private); he is talking about the federal debt.

And, the fact that, in the future, interest will exceed the cost of Medicaid and defense spending, is a good thing, not a problem:

- The federal government, being Monetarily Sovereign, has the unlimited ability to pay any amount of interest, so interest payments are no burden on the government.

- Because the Federal government is Monetarily Sovereign, federal taxes do not fund federal spending.

- The federal government (unlike the monetarily no-sovereign state and local governments) creates brand new dollars each time it pays a bill. Federal spending on interest adds growth dollars to the economy.

In short, the more interest the federal government pays into the economy, the richer is the economy.

Returning to the article:

In 2017, interest costs on federal debt of $263 billion accounted for 6.6% of all government spending and 1.4% of gross domestic product, well below averages of the previous 50 years.

The Congressional Budget Office estimates interest spending will rise to $915 billion by 2028, or 13% of all outlays and 3.1% of gross domestic product.

The above figures are meant to be alarming. But, interest as a percentage of all spending is an irrelevant ratio.

And interest as a percentage of GDP is similarly irrelevant. Neither ratio has any effect on the economy.

A quick recap of our dismal national fiances: The U.S. economy generates about $21 trillion in annual activity. Debt owed to the public comes to about $15.5 trillion, but when you add intra-governmental debt (which you should, because it represents actual commitments to pay), the figure is…about $21 trillion.

This is not good, both for obvious and and for less obvious reasons. Among the obvious problems: When you have to pay more in interest, it crowds out your ability to spend on other things.

If you’re a government, it also might mean that you raise taxes or inflate your money. (You could also cut spending, but politicians tend to resist that for as long as possible.)

The “crowds out” statement demonstrates Mr. Gillespie’s ignorance about the differences between Monetary Sovereignty and monetary non-sovereignty.

He is absolutely correct with regard to a monetarily non-sovereign entity, and is absolutely wrong with regard to a Monetarily Sovereign government like the U.S. government.

If you have the unlimited ability to create your own sovereign currency, how can your spending for some things crowd out your spending for anything? It can’t.

Absent significant changes in current law, what the government spends on will be more and more limited.

From a libertarian perspective, less government spending is a good thing, but we’re not really going to get that, even with a gridlocked Congress.

The only change in current law, that would be necessary, is the elimination of the ridiculous, useless “debt ceiling, a law that tells the government it cannot pay for things already purchased and received.

In short, it is a law that asks the federal government to be a deadbeat — a law that has no redeeming characteristics.

Other than that useless law, what the government spends cannot be limited. Having the unlimited ability to create U.S.dollars, the government can pay any bills of any size, instantly.

In 1940, the federal “debt” was 40 Billion. Today, 78 years later, it is 16 Trillion, a 40,000% increase.

Yet, federal spending is not limited, because federal money creation is not limited.

Libertarians wrongly believe “less government spending is a good thing.” That belief is utter nonsense. Reductions in federal spending lead to recessions and depressions, simply because a growing nation requires a growing supply of money.

Do you think less spending for roads, bridges, and dams is a “good thing”? Should less be spent for Social Security, Medicare, education, research & development, the military, and the myriad other activities that improve our lives?

GDP = Federal Spending + Non-federal Spending + Net Exports.

Money growth is stimulative; money shrinkage is recessive. Period.

We cannot help but wonder what Mr. Gillespie would say about this:

U.S. depressions tend to come on the heels of federal surpluses.

1804-1812: U. S. Federal Debt reduced 48%. Depression began 1807.

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929

And this:

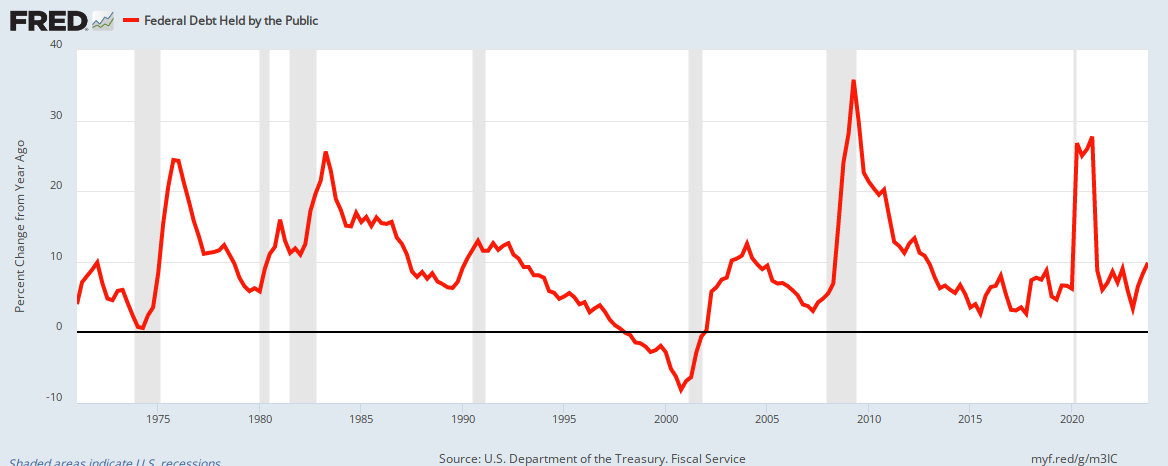

When federal debt growth declines, we have recessions (vertical gray bars), which are cured by increases in federal debt growth.

Finally, the cut-federal-spending libertarians resort to the laughable, the already discredited team of Carmen Reinhart and Kenneth Rogoff.

These preachers of austerity who spent years creating a massive document that was based on erroneous arithmetic. They claimed to have discovered that high levels of government debt are associated with weak economic growth.

It was total nonsense on many levels, including bad math and selective examples, but perhaps the biggest problem was that they lumped the results from dozens of countries, some of which were Monetarily Sovereign and some of which were monetarily non-sovereign.

It was absurd.

Greece, France, Italy and the other euro nations struggle with high debt. So do many American states, businesses and citizens. Why? They all are monetarily non-sovereign. They can run short of money with which to pay their bills.

By contrast, the U.S. has unlimited access to dollars. It can pay any financial obligation denominated in dollars.

So lumping Monetarily Sovereign nations with monetarily non-sovereign nations, is like lumping pigs and giraffes to get average height.

This foolishness did not deter Mr. Gillespie, whose article continued:

More importantly and less obviously, high levels of national debt exert a downward pressure on long-term economic growth.

In a 2012 paper, economists Carmen Reinhart and Kenneth Rogoff define a “debt overhang” as a situation in which the debt-to-GDP ratio exceeds 90 percent for five or more consecutive years.

After looking at 26 debt overhangs in 22 advanced economies since 1800, they conclude that “on average, debt levels above 90 percent are associated with growth that is 1.2 percent lower than in other periods (2.3 percent versus 3.5 percent).”

Whether or not there is anything magical about 90 percent, there’s every reason to be concerned when the government is spending far more than it can ever collect in taxes.

We’re essentially entering an era where “debt overhang” is the new normal and there’s no sign that’s going to change any time soon.

There is zero reason to be concerned when a Monetarily Sovereign government spends more than it taxes. The reverse is true.

Spending less than taxes (i.e. running a federal surplus) causes recessions if we are lucky and depressions if we are not, by taking money from the economy.

And as it turned out, there is nothing magical about 90% at all. In fact, the whole thing is a bunch of hooey, as this article from 2013 points out. Read it for yourself:

The Reinhart and Rogoff Controversy: A Summing Up

By John CassidyApril 26, 2013

As the euro nations now have learned, austerity kills. By formula, GDP growth requires money growth, and money growth comes from deficit spending. There simply is no way around it.

Gillespie concludes his libertarian screed with yet one more misstatement:

We’re already poorer for lower economic growth, even as the government spends more (and borrows more to cover those costs).

The Congressional Budget Office (CBO) says the economy grew by 3.1 percent in 2018, but it estimates that annual growth is going to slow to 1.7 percent annually between 2023 and 2028.

The federal government does not borrow to cover anything. Its finances are not like yours and mine. It does not even borrow. It merely accepts deposits, not to gain spending money, but rather to:

- Provide a safe place to park dollars, which stabilizes the dollar, and

- To assist the Fed’s ability to control interest rates and inflation.

Federal tax dollars are destroyed upon receipt. The federal government creates brand new dollars every time it pays a creditor.

Yes, that’s right. Those tax dollars you send to the federal government instantly disappear from any money measure. Doesn’t that make you feel good?

(State and local taxes, by contrast, are not destroyed. They are used to pay bills — another difference between Monetary Sovereignty and monetary non-sovereignty.)

I suspect Mr. Gillespie knows all this (After all these years, how can he not?) and if so, it truly is a shame that he keeps fooling the public by writing such tripe.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

The single most important problems in economics involve the excessive income/wealth/power Gaps between the have-mores and the have-less.

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Implementation of The Ten Steps To Prosperity can narrow the Gaps:

Ten Steps To Prosperity:

1. Eliminate FICA2. Federally funded medicare — parts a, b & d, plus long-term care — for everyone

3. Provide a monthly economic bonus to every man, woman and child in America (similar to social security for all)

4. Free education (including post-grad) for everyone

5. Salary for attending school

6. Eliminate federal taxes on business

7. Increase the standard income tax deduction, annually.

8. Tax the very rich (the “.1%) more, with higher progressive tax rates on all forms of income.

9. Federal ownership of all banks

10. Increase federal spending on the myriad initiatives that benefit America’s 99.9%

The Ten Steps will grow the economy, and narrow the income/wealth/power Gap between the rich and you.

MONETARY SOVEREIGNTY

I haven’t looked, but I wonder if in some of the cases of those countries that have/had “debt overhang” if they were paying so much interest on their bonds that it caused too much money to be sucked out of the economy as people chased a more certain return versus the private securities market and thus there was less spending and thus a lower GDP as a result.

And if Debt to GDP ratio was an actual thing wouldn’t that mean Japan should be a misery-infested hellhole instead of having one of, if not the highest, standards of living in the world?

LikeLiked by 1 person

Morgath, no matter how one figures it, federal spending on interest adds dollars to the economy. The federal government accepts exactly as much in deposits (i.e. sells as many T-securities) as it wishes, neither more nor less. High interest does not increase the money being “sucked out of the economy.”

Your comment about Japan is correct. Similarly, Russia’s debt/GDP ratio would make it one of the richest nations on earth. The debt nuts refuse to look at facts, but instead, rely on gut feel. That is their version of science.

LikeLiked by 1 person

But the interest paid out is only a fraction of what is placed into gov’t securities.

Imagine if some country put their interest rate on their bonds at 20%, that would pull almost all the money in circulation into those bonds and if the government did not then increase spending there would be a net reduction of money in the economy. Which would mean less spending and thus a lower GDP growth rate.

Yes, the interest payment would still go out but it would not come close to matching what had left.

LikeLiked by 1 person

As I wrote, “The federal government accepts exactly as much in deposits (i.e. sells as many T-securities) as it wishes, neither more nor less. High interest does not increase the money being “sucked out of the economy.”

The government could pay 50%, 100% or 1,000%, and the amount of T-securities sold would be exactly what the government wishes to sell.

LikeLike

“Greece, France, Italy and the other euro nations struggle with high debt. So do many American states, businesses and citizens. Why? They all are monetarily sovereign.”

I think you mean monetarily non-sovereign.

LikeLike

Yes, thanks. I’ll change it. I really need an editor.

LikeLike

Rodger, you are the first person to separate out Federal Debt{Government debt} from national debt which adds the private debt on to it. Nobody I have read distinguishes them, they are always kept separate, On Quora I’m always assuming the questions refer to the Federal debt, the Private debt much less often, even though it’s the one to worry about.

MMT [and MS] are getting to the stage now that they are being vehemently opposed, so it is possible Gillespie is just toeing that line. Correspondents are now picking fault with it, based on misinterpreting it. Have you written to him about MS? If you can disabuse him of being ignorant it’ll flush him out. Or maybe he will come around.

One day these types will say that “they knew it all along” Bill Mitchell told me it wouldn’t be in his lifetime, but we can be more optimistic I think.

LikeLiked by 1 person

It isn’t just Gillespie, of course. This is what is so disheartening: https://www.breitbart.com/politics/2018/11/14/dnc-ceo-seema-nanda-do-not-know-how-pay-medicare-all/?utm_source=newsletter&utm_medium=email&utm_term=daily&utm_content=links&utm_campaign=20181114

LikeLike

I followed the link and added my own comment. It amazes that people hold such beliefs knowing that they don’t trust politicians to tell them the truth yet they accept what they say as gospel. A convenient lie.

LikeLike

Consider this: Virtually everyone thinks the public needs healthcare. But when asked who will pay for it, they think the people are better able to pay than is the Monetarily Sovereign federal government. It’s beyond ignorant.

LikeLike

Time is on MS’ side. The debt can’t go on and on on. Eventually people will say,” Hey, what’s up with the good economy in the face of godzillions of dollars of debt.”

Somebody is wrong; either scarcity loving economists, or MS abundanites.

For the time being, the scarcity lovers are doing all they can to myopically hang on to power and yesteryear. Total success frightens the hell out of them and puts it onto us.Thus our unending world wars are meant to suppress middle class hope for success while keeping war monger industry fed. God forbid we should all enjoy life.

LikeLiked by 1 person

Hi Rodger, in a recent blog Frances Coppola stated: “For various reasons, therefore, most countries are not monetarily sovereign [..] Monetary sovereignty is largely a myth”. https://www.coppolacomment.com/2018/11/the-myth-of-monetary-sovereignty.html

Is she right or is she wrong? Could you shine a light on her opinion please. thx

LikeLiked by 1 person

She is way, way wrong. She does not understand foreign exchange, so she thinks Monetary Sovereignty requires a nation to pay for everything with its own currency. Utter nonsense. Even the U.S. doesn’t pay for everything with its own currency, yet it can pay for anything simply by exchanging dollars for the source nation’s money.

Every nation does that, with the difference being a MS nation cannot run short of its own currency with which to exchange for other nations’ currencies. While France can run short of euros to exchange for U.S. dollars, Japan cannot run short of yen to exchange for U.S. dollars.

Further, she says, “FRED shows us that even in the U.S., only one recession in the last century has been preceded by a government surplus.” What she omits is the fact that virtually all recessions are preceded by reductions in debt growth (and are cured by increases in debt growth.)

LikeLiked by 1 person

In her opinion for countries outside the US it is not that a country can run short of it’s own currency but it would find itself shut out from the international Forex markets so it is merely unable to convert the own currency into foreign currencies because of the falling exchange rate. So a FX crisis is looming.

>> ” After all, for you to buy dollars, someone has to be willing to buy your currency. And who in their right minds would buy a currency whose value in dollars was falling through the floor?” <<

LikeLiked by 1 person

That is not what she’s saying. She claims MS is a myth, something altogether different from those few cases where no one will accept a hyperinflated currency.

LikeLike

I’m not sure- but I could be wrong- that she ever mentioned MS though she has a lot to say about MMT. I get the feeling she is unaware of the ten prosperity rules and all the rest of MS.

She speaks only in terms of “money economics” and seems oblivious to technical development of the third world, i.e., the relationship of regional electrical energy growth & development to the reduction in poverty and birth rate, as per Energy, Earth, and Everyone (Doubleday), World Game Institute and elsewhere.

What good is money if the means of production are absent.

LikeLike