Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

●Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

●The single most important problem in economics is the gap between rich and poor.

●Austerity is the government’s method for widening the gap between rich and poor.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Everything in economics devolves to motive, and the motive is the Gap.

=========================================================================================================================================================================================================================

Cutters: How they destroy the American middle class and depress all America

The Cato Institute is an American libertarian think tank headquartered in Washington, D.C. It was founded as the Charles Koch Foundation in 1974 by Ed Crane, Murray Rothbard, and Charles Koch.

Here is what the Cato Institute proposes:

(What do these cuts have in common?)

(A) Table 1. Proposed Federal Budget Cuts

Health Care and Social Security, Annual Savings, $Billions, 2025

Health Care

(B) Repeal ACA exchange subsidies 107.0

(B) Repeal ACA Medicaid expansion 105.0

(B) Block grant Medicaid and grow at 2% 110.0

(B) Increase Medicare premiums 60.0

(B) Increase Medicare cost sharing 19.0

(B) Cut HHS non-Medicaid state grants by 50% 43.5

Total cuts 444.5Social Security Administration

(B) Price index initial Social Security benefits 39.1

(B) Raise the normal retirement age for Social Security 10.4

(B) Cut Social Security Disability Insurance by 25% 54.0

(B) Cut Supplemental Security Income by 25% 18.0

Total cuts 121.5Total annual spending cuts in 2025 $566.0

………………………………………………………………………………………………………………………………………………………………………………………….

(A) Table 2. Proposed Federal Budget CutsDiscretionary Programs and Other Entitlements, Annual Savings, $Billions, 2015

Department of Agriculture

(B) End farm subsidies 24.8

(B) Cut food subsidies by 50% 53.2

(B) End rural subsidies 4.2

Total cuts 82.2Department of Commerce

(B) End telecom subsidies 0.8

(B) End economic development subsidies 0.5

Total cuts 1.3Department of Defense

End overseas contingency operations 74.0

Total cuts 74.0Department of Education

(B) End K-12 education subsidies 26.3

End all other programs (?) 77.0

Total cuts (terminate the department) 103.3Department of Energy

(B) End subsidies for energy efficiency 2.4

(B) End loan programs 0.2

(B) End fossil/nuclear/electricity subsidies 3.5

(C) Privatize the power marketing administrations 0.4

Total cuts 6.5Department of Homeland Security

(C) Privatize TSA airport screening 5.1

(B) Devolve FEMA activities to the states 14.2

Total cuts 19.3Department of Housing and Urban Development

(B) End rental assistance 30.4

(B) End community development subsidies 11.2

(B) End public housing subsidies 6.4

Total cuts (terminate the department) 48.0Department of the Interior

(B) Cut net outlays by 50% through spending

cuts, privatization, and user charges 6.5Department of Justice

(B) End state/local grants 5.4Department of Labor

(B) End employment and training services 3.5

(B) End Job Corps 1.6

(B) End Community Service for Seniors 0.4

(B) End trade adjustment assistance 0.3

Total cuts 5.8Department of Transportation

(B) Cut highway/transit grants to balance trust fund 13.0

(C) Privatize air traffic control (federal fund savings) 1.3

(C) Privatize Amtrak and end rail subsidies 3.3

Total cuts 17.6Department of the Treasury

(B) Cut earned income tax credit by 50% 30.1

(B) End refundable part of child tax credit 21.5

(B) End refundable part of AOTC 4.3

Total cuts 55.9Other Savings

Cut foreign aid by 50% 12.0

(B) Cut federal civilian compensation costs by 10% 32.9

(C) Privatize the Corps of Engineers (Civil Works) 7.5

(C) Privatize the Tennessee Valley Authority 1.0

(C) Repeal Davis-Bacon labor rules 9.0

(B) End EPA state/local grants 4.1

Total cuts 66.5Total annual spending cuts $492.2.0

…………………………………………………………………………………………………………………………………………………………………………………………….

What do these cuts have in common?

(A) 1. They all take dollars from the private sector, thus depressing the economy

(B) 2. (With only a handful of exceptions) They punish the middle and lower income groups.

(C) 3. A few benefit the rich directly while punishing the rest.

This is the classic Republican/Libertarian approach to economics: Take from the middle and poor, and give to the rich, i.e widen the Gap between the rich and the rest.

As we have seen from the previous post (The solution to the single, most serious problem facing the U.S. economy), as people are impoverished, they become less productive.

Reduced productivity by an ever greater proportion of the American public has adverse effects on all of America. We lose economic competitiveness in an ever more competitive world.

Think of America as a team. Does it benefit the team to punish some teammates and make them less productive?

This is what Cato says:

Spending cuts would spur economic growth by shifting resources from lower-valued government activities to higher-valued private activities.

How do spending cuts “shift” any resources? Spending cuts merely . . . cut spending. No “shift” involved.

Cuts would also expand freedom by giving people more control over their lives and reducing the regulations that come with federal programs.

Yes, federal programs come with laws and regulations, the vast majority of which protect the public.

No wonder the rich hate laws and regulations. They want to be the ones to control the lives of the people.

The rich have their minions work tirelessly to return to the “good old days,” when the public was enslaved by monopoly coal barons, railroad barons, oil barons (Hello, Koch brothers) and bankers, and there were fewer regulations.

The rich use their money to elect puppets in Congress, who continually invent new fake reasons to oppress the poor and middle income people — our “teammates” — without whose efforts America will fall as a world power.

The cutters are taking from you. They are destroying America.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

The Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Federally funded, free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually. (Refer to this.)

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

Initiating The Ten Steps sequentially will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

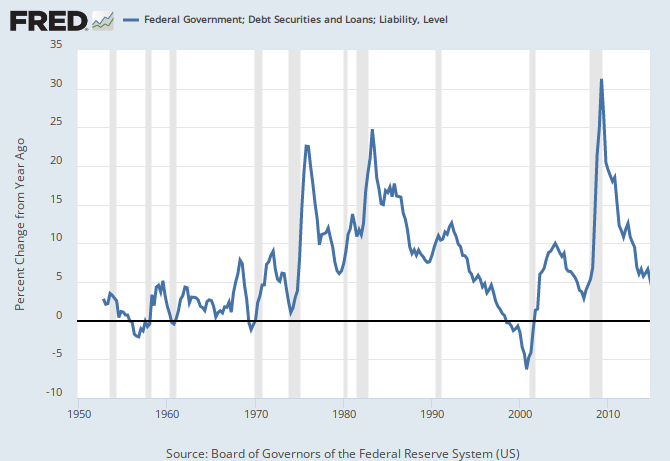

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

I see now a lot of companies are finally raising wages with some CEOs taking a pay cut. Meanwhile fox news claims that the gov’s war on poverty is a failure blaming both the left and right for spending that did not get the poor out of poverty. Then admits the percentage living in poverty would have been greater without the spending.

LikeLike

This Week In Crazy

LikeLike

Chris Edwards (Cato Institute) writes:

“Consider Canada’s experience. In the mid-1990s, the federal government faced a debt crisis caused by overspending, which is similar to America’s current situation. But the Canadian government reversed course and slashed spending from 23 percent of GDP in 1993, to 17 percent by 2000, to just 14.5 percent today. The Canadian economy did not sink into a recession from the cuts as Keynesians would have expected, but instead has grown strongly over the past two decades.” – See more at: http://www.downsizinggovernment.org/plan-to-cut-federal-spending#sthash.hVueJdmo.dpuf

Chris Edwards is flat-out lying. Or he’s being incredibly (purposefully) dishonest as to please his Cato masters.

Private debt levels continue to rise in Canada. (162%/GDP, Q3, 2014). This is a potentially unsustainable situation. These dangerous private debt levels derive directly from the Canadian federal government going into (near) surplus.

http://globalnews.ca/news/1814419/household-debt-hits-record-levels-says-statistics-canada/

http://www.budget.gc.ca/2015/home-accueil-eng.html

Also negatively affecting Canada is the fact that the Canadian economy is now running a Current Account Balance (deficit) at an average of 3%/GDP over the past 3 years. The USA has averaged a Current Account Balance (deficit) of 2.5%/GDP over the same time frame!

http://www.tradingeconomics.com/canada/current-account-to-gdp

LikeLike