Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

It has been two years since we’ve discussed this specific fact: We can have a federal deficit without a federal debt, and a debt without a deficit.

See:

“Dick Durbin succinctly expresses the basic source of Congressional economic ignorance,”“Letter to Tony Hunter, president, publisher and CEO of Chicago Tribune Company,”

“How to enjoy the debt ceiling debates,”

“The great semantic misunderstandings of our time: Debt, deficit, fundamentalists, originalists”

and “Monetary Sovereignty: The key to understanding economics.”

So it seem like it’s time for a reminder.

When you and I spend more than we earn, we say we are running a personal “deficit,” and the total of these deficits is our personal debt. For us, debt and deficit fundamentally are connected. To have a debt, we must run a deficit.

Not so with the U.S. government, for which federal debt and federal deficit are not fundamentally connected. The U.S. government can have deficits without having any debt, and it can have debt, without running deficits.

The same words — “debt” and “deficit” — have different implications, when applied to federal finances vs when applied to personal finances.

The government runs a “deficit” when its spending exceeds its tax income. The federal government runs a “debt” when it sells Treasury securities.

The two actions are connected, not by fundamentals, but only by a law requiring their connection.

The law requires the federal government to issue T-securities in the same amount as the deficit. These T-securities do not pay for a deficit, do not offset a deficit, do not fund a deficit. They merely are issued in the same amount as the deficit.

The federal government could double its spending and eliminate taxes, to create a monster deficit, without selling a single T-security.

Similarly, the federal government could sell trillions in T-securities, while having no deficit — no difference between spending and taxing.

If you are a “lender” to the federal government, you have taken dollars from your bank checking account and deposited them into your T-security account at the Federal Reserve Bank. A T-security account essentially is a bank savings account.

Your deposit has increased the so-called “debt,” but has had no effect on the deficit. You simply have made a bank deposit, but rather than calling it a “deposit,” the media, politicians and mainstream economists misleadingly call it “debt.”

To “pay off” the federal debt, the Federal Reserve Bank does exactly the same as any bank does when “paying off” your savings deposit: It transfers dollars from your T-security savings account to your personal checking account.

Period. Done.

All the hand wringing about the federal deficit and the federal debt merely serves to confuse the public and to blur the line between personal finances and federal finances. The purpose: To reduce spending that benefits the poor and middle-classes.

In short, the argument about the debt and deficit is to make you believe the gap between the rich and the rest should be wider.

It’s done at the behest of the rich.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

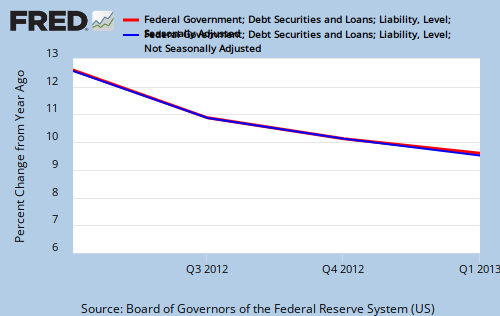

THE RECESSION CLOCK

As the federal deficit growth lines drop, we approach recession, which will be cured only when the lines rise.

#MONETARY SOVEREIGNTY

Your argument is actually true and not true at the same time.

I really can’t figure out the difference between personal and federal deficits. Let me repeat what you’ve said. I am in deficit when I spend more than I take in. All funds borrowed in excess of income is debt. One down…

The Federal government runs a deficit when it’s spending exceeds tax income. Fair enough, sounds just like my personal situation above, cool. The government issues treasury bills for the same amount as the amount spent in excess.. Also, the government does not fund itself using funds from treasury bills. Hmmm, that sounds different. There is a “law” that requires the government to undertake this useless process when spending exceeds tax income. Hmmm, sounds like very questionable to me (which law is that?).. let’s move on… When you buy a t-bill, you are lending your money to the government, but the government doesn’t do anything with it. It just pays you interest to have the money sitting there doing nothing. Hohohohohohoh… Why do they have bond auctions Roger? Is that also a “law”?

But… your argument is also true.. See, the government “could” in fact double it’s spending and lower taxes to zero to create a monster deficit.By the same token, the government “could” do the opposite, cut spending and increase taxes to balance the budget. Notice the key word, “could”. Yes, the government can do so in theory. In practice, things tend to work a wee bit differently.

I feel you are trying to justify why we need to raise the debt ceiling, “it’s just a stupid meaningless law”. Yeah right….

LikeLike

“I really can’t figure out the difference between personal and federal deficits.”

Yes, you don’t understand the difference between Monetary Sovereignty and monetary non-sovereignty.

Until you understand the difference, you simply cannot understand economics, and your comments will continue to be considered foolish by all who read them.

In answer to your question: The U.S. Treasury maintains an account at the Federal Reserve Bank, from which government bills are paid. When the government issues a check, that check clears through the Treasury’s account at the FRB.

According to the Federal Reserve Act, this account is not allowed to go into negative. To prevent that from happening, the Fed “lends” money to the Treasury by buying T-securities. (See: http://www.winterspeak.com/2010/10/federal-reserve-should-run-overdraft.html) It’s strictly an accounting technicality to maintain accordance with the law. No dollars actually move anywhere, as the Fed merely debits its own checking account at the FRB and credits the Treasury account at the FRB.

Thus, from an accounting standpoint, the total of open T-securities essentially must equal the deficit. I say “essentially,” because there are time lags involved with booking deficits.

By the way, even the ownership of T-securities by government agencies (i.e., the government “owing” itself) is counted as “debt.” It’s ridiculous, but no more ridiculous than a uniquely U.S. debt ceiling.

LikeLike

Govt could massively (net) DESTROY more financial assets in the private sector, or Govt could massively CREATE more financial assets in the private sector. What the Govt CANNOT do is “save” these “Account Credits” of which it is the sole source issuer.

How can an entity whose function is to legally create account credits, functionally “save” account credits? How much does an account credit weigh? How much labor and capital equipment does it take to create an account credit?

Fed Gov “saving money” is logically meaningless as a dog “saving” fur by not shedding in the spring, or trees “saving” sunlight by not growing. A balanced budget in solar energy would mean the NET energy received on earth each day or year is zero. Would the sun therefore be “saving energy”?

The choice depends (should depend!) on whether the private sector needs more dollars or less dollars, at a given time.

Remember? The all important real world Market? Capitalism? Life? Production & consumption? Adam Smith? Why is an accounting log inside the Fed Bank more important than the real Market, Living, Production & consumption & work?

Let’s see, are new businesses starting in droves, and succeeding? Are banks flooding the market with loans to capture and start new business and home sales? Is business clamoring to hire people? Do most people have enough income to pay debts and buy stuff?

WHOSE budget really NEEDS to be balanced, the account log on the Fed’s computers, our OURS?

LikeLike

>> I really can’t figure out the difference between personal and federal deficits.

You are not LEGALLY assigned the Power to issue Securities backed by the full faith and credit of the institution called the United States of America.

You are legally allowed to issue Promissory Notes backed by the full faith and credit of … YOU. If someone chooses to accept your Promissory Notes, great. Good luck.

When YOU have a deficit (loan), you must GET Dollars from someone else in the private sector, or from the Govt, to amortize (pay back) that loan. That’s a legal contract.

When the Fed Gov has a deficit, it is legally empowered, albeit through a convoluted process, to “borrow” from a Govt bank created by Congress, which anyhow returns to Treasury 100% of it’s net profits from all activity between itself, global banks, and govt.

The Fed isn’t out for a profit for itself, as evidenced by the fact that it purchased $29 Trillion of KNOWN JUNK toxic assets that the banks had created. The Fed even purchased toxic assets to take them off of McDonalds, as well as Bear-Stearns, etc.

Sure the Fed didn’t exactly GIVE that money away. They are holding “valuable” paper assets — securities they bought. It’s just that the paper assets became “non-performing” on schedule, since the legal paper included plenty of 3-year and 5-year Balloon Mtg Loans, and are now functionally worthless. Oh well. Those are just sitting outside the Market as an account balance in an entity the Fed created called “Maiden Lane”, a kind of financial toxic landfill.

As Rodger stated, the Federal Reserve Act, a law created by Congress, requires that the Treasury MUST sell Securities (as he described) and furthermore MUST sell these to banks in Germany, Japan, Korea, Canada, as well as US banks, and Congress FORBIDS Treasury from selling these directly to our own Central Bank.

Those banks CAN run an overdraft (credit). Treasury CANNOT run an overdraft.

Quo Bono?

Why is Congress so adamant about giving away free money (interest) to rich people? Or is that question just too stupid?

Same reason as Truman launched the Cold War rhetoric and the Marshall Plan, a great excuse — life or death!!! — to give money away to fat corporations and rich people.

There’s other ‘functional’ operational reasons that exist within the existing paradigm.

Laws such as the Financial Modernization Act (anti-Glass-Steagal) and Commodity Futures Mod Act (hog wild subsidy for derivatives) were far more complex to create than what legal changes would be required for the Treasury & Fed to “create money” together by swapping paper, without having to engage the banks in a free giveaway, and worse, a free giveaway that is counted as part of our “Budget”.

LikeLike

this article is off-topic, but i thought you might find it of interest if you haven’t seen it already:

http://www.reuters.com/article/2013/10/04/us-swiss-pay-idUSBRE9930O620131004

LikeLike

Thanks Kim,

It’s a good plan, similar to #3 in the “Nine Steps,” but for one detail: “The initiative’s organizing committee said the basic income could partly be financed through money from social insurance systems in Switzerland.”

Someone should ask them, “How about simply creating the Swiss francs necessary to fund the program?”

LikeLike

On an important technicality- is there actually a law that forced the immediate issuance of debt to match spending, or is it an executive order, Treasury policy, or something to that effect? If the latter, there would be fewer hurdles to cross to moving toward a more rational policy position.

LikeLike

The U.S. Treasury maintains an account at the Federal Reserve Bank, from which government bills are paid.

According to the Federal Reserve Act, this account is not allowed to go into negative.

To prevent that from happening, the Fed lends money to the Treasury by buying T-securities. (See: http://www.winterspeak.com/2010/10/federal-reserve-should-run-overdraft.html)

Thus, from an accounting standpoint, the total of open T-securities essentially equals the deficit. I say “essentially,” because there are time lags involved with booking deficits.

LikeLike

Rodger,

I saw Stephanie Kelton of the University of Missouri at Kansas City in a panel of three on the All In With Chris Hayes show last night on 108/08/2013 and I was very disappointed.

During the lead in, Chris Hayes correctly explained that the Federal budget was not like a houehold budget, but he incorrectly explained that the debt was the aggregate of the yearly deficits and that the debt represented the borrowing of money.

When it came time for the one and only time for her to speak, she had the chance to correct Chris Hayes misconception that the deficit and the debt are related and that the debt represented the borrowing of money, yet she didn’t correct him!

Why in the world would she let that golden opportunity to teach everyone watching get away?

LikeLike

FYI….I’ve been following this blog for 5 years and you have said this same thing countless times but this is the best summary yet. Thank you

LikeLike