It is a nonprofit educational organization that promotes conservative thought on college campuses. It lists the following six as its core beliefs: limited government, individual liberty, personal responsibility, the rule of law, free-market economics, and traditional Judeo-Christian values. ISI was founded in 1953 by Frank Chodorov with William F. Buckley Jr. as its first president.Yet, does that Republican Party, led by William Buckley, still exist? The following article, from Scientific American, describes one aspect of the new Republican Party:

Elected officials who campaigned against critical race theory (CRT) (the study of how social structures perpetuate racial inequality and injustice), are being sworn into office all over the U.S. These candidates captured voters’ attention by vilifying CRT, which has become a catch-all to describe any teaching about racial injustice. Lessons about the genocide of Native Americans, slavery, segregation and systemic racism would harm children, these candidates argued. Calling its inclusion divisive, some states have enacted legislation banning CRT from school curricula altogether. This regressive agenda threatens children’s education by propagating a falsified view of reality in which American history and culture are outcomes of white virtue. It is part of a larger program of avoiding any truths that make some people uncomfortable, which sometimes allows active disinformation, such as creationism. Children are especially susceptible to disinformation, as Melinda Wenner Moyer writes in “Schooled in Lies.” Removing conversations around race and society removes truth and reality from education. This political interference is nothing new—political and cultural ideologues have fought for years to remove subjects such as evolution, Earth history and sex education from classrooms and textbooks.That is today’s Republican party, preaching “limited government, individual liberty, and personal responsibility“, but voting for government book-burning with regard to racial history. “Limited government”? “Individual liberty”? Is that today’s Republican Party? Or does the following better describe today’s Republican Party?:

Many of the school districts that brought in anti-CRT board members are the same ones that refuse to mandate masks, despite the evidence that masks can prevent the spread of COVID. These school officials also rail against vaccine mandates as a violation of personal choice. It is the same prioritization of individuals over community and a discomfort with hard truths that characterize the movement against the teaching of true history.Or, perhaps this is the real Republican Party: Newt Gingrich, a former House speaker and candidate for the Republican presidential nomination, stoked outrage on Sunday by predicting members of the House committee investigating the Capitol attack will be imprisoned if Republicans retake the chamber this year.

One of two Republicans on the committee, Liz Cheney, said, “A former speaker of the House is threatening jail time for members of Congress who are investigating the violent attack on our Capitol and our constitution. This is what it looks like when the rule of law unravels.”“The rule of law” once was a cornerstone of Republican politics. But no more. That rule is gone. Now, it is “the rule of Trump.” Or perhaps more accurately, the cornerstone of the Republican party now is, the rule of Trump’s lies.” Some of his doozies, according to Updated 9:28 AM ET, Sat January 16, 2021, were:

- It never rained on his inauguration. (It poured)

- The coronavirus is under control. (Never was)

- Sharpiegate (Alabama never was threatened)

- “The head of the Boy Scouts called him “to say my address to the Scouts’ National Jamboree was “the greatest speech that was ever made to them.” (No such call ever was made._

- Rep. Ilhan Omar supports al Qaeda. (Ugly, bigoted lie.)

- The US for years had a $500 billion annual trade deficit. (Never even reached $400.)

- Big, burly men repeatedly came up to him crying tears of gratitude. (No record of it ever happening).

- He didn’t know anything about a $130,000 payment to porn performer Stormy Daniels. (He personally reimbursed Cohen, who made the payment.)

- He claimed to end family separation at the border. (He ended his own policy of family separation after the public uproar.

- Claimed Biden would destroy protections for people with pre-existing health conditions. (This was part of Obamacare that Trump tried for years, to destroy.)

- Claimed got the Veterans Choice program passed after other presidents tried and failed for years. (It was a lie. When asked about it, he left the room).

- “They say” the noise from windmills “causes cancer.” (This was just one of his many, many “they say” or “people tell me” lies.)

- Trump’s big health care plan was eternally coming in “two weeks.” (It never arrived, just as his many other plans and announcement never arrived.)

- Claimed he was named “Michigan Man of the Year.” (Never happened, though he claimed it more than 100 times.

- And the winner is: “I won the election.” (It didn’t happen. Fifty judges, many Republican, said it didn’t happen. Recounts said it didn’t happen. Republican election officials said it didn’t happen. And he lost the popular vote by 7 million, a huge difference.)

/cdn.vox-cdn.com/uploads/chorus_asset/file/20014029/GettyImages_1216828192.jpg)

- Free preschool for 3-4-year-olds

- Child-care financial aid

- Financial aid to care for the elderly or disabled

- Increased child tax credits

- Clean energy tax credits and investment

- Investment in coastal renovation, forest management, soil conservation

- Cost reduction for prescription drugs

- Reduced premiums for Obamacare

- Close the Medicaid coverage gap

- Medicaid hearing benefits

- Investment in affordable housing

- Expanded Earned Income Tax Credit for low-wage employees

- Funds education beyond high school

- Expands funding for low-income children’s meals

- Funds reduced immigration backlog

Vote Republican and you are patronizing that restaurant you once loved but now is filled with vermin — the restaurant that no longer exists as you remember it.

.

.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell

Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Vote Republican and you are patronizing that restaurant you once loved but now is filled with vermin — the restaurant that no longer exists as you remember it.

.

.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell

Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

THE SOLE PURPOSE OF GOVERNMENT IS TO IMPROVE AND PROTECT THE LIVES OF THE PEOPLE.

The most important problems in economics involve:- Monetary Sovereignty describes money creation and destruction.

- Gap Psychology describes the common desire to distance oneself from those “below” in any socio-economic ranking, and to come nearer those “above.” The socio-economic distance is referred to as “The Gap.”

- Eliminate FICA

- Federally funded Medicare — parts A, B & D, plus long-term care — for everyone

- Social Security for all

- Free education (including post-grad) for everyone

- Salary for attending school

- Eliminate federal taxes on business

- Increase the standard income tax deduction, annually.

- Tax the very rich (the “.1%”) more, with higher progressive tax rates on all forms of income.

- Federal ownership of all banks

- Increase federal spending on the myriad initiatives that benefit America’s 99.9%

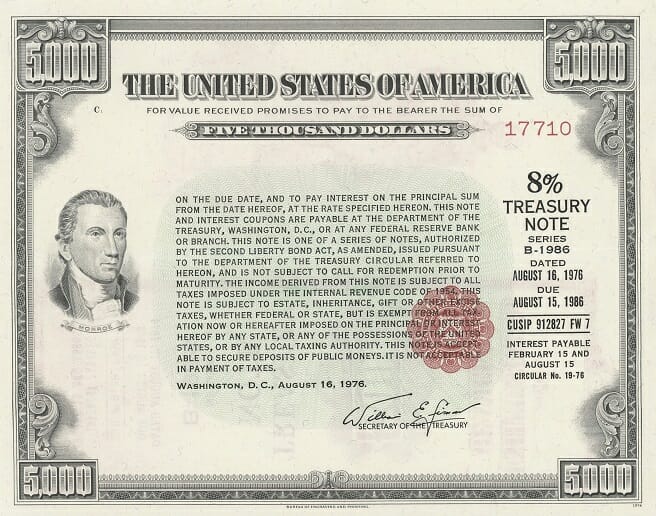

MONETARY SOVEREIGNTY

Here are some of the facts.

Here are some of the facts.