And there it is, concise and misleading. The U.S. does not owe $35 trillion, nor do you owe the $100,000 referenced. The so-called “national debt” is based on the total of all federal deficits (spending minus taxes). The government doesn’t owe the deficits; they all have been paid. The “national debt” also includes deposits (not borrowing) into Treasury Security accounts (T-bills, T-notes, T-bonds). These accounts resemble bank safe deposit boxes in that the contents are owned and touched only by the depositors, not by the federal government. The purpose of T-security accounts is not to lend spending money to the government. The government never touches those dollars. They remain the property of the depositors. Periodically, the government adds interest dollars to the T-security accounts. These are not tax dollars (which are destroyed upon receipt.) They are created ad hoc, from thin air, at the touch of computer keys.The national debt threat The federal government is spending ever more money servicing an ever-larger debt pile. Are we headed for a crisis?

What does the U.S. owe?

The national debt stands at nearly $35 trillion, or more than $100,000 per person.

Former Federal Reserve Chairman Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost. It’s not tax money… We simply use the computer to mark up the size of the account.”

The purposes of T-security accounts is to:- Provide as safe storage place for unused dollars and,

- To help the Federal Reserve control interest rates by setting the rates for the T-securities

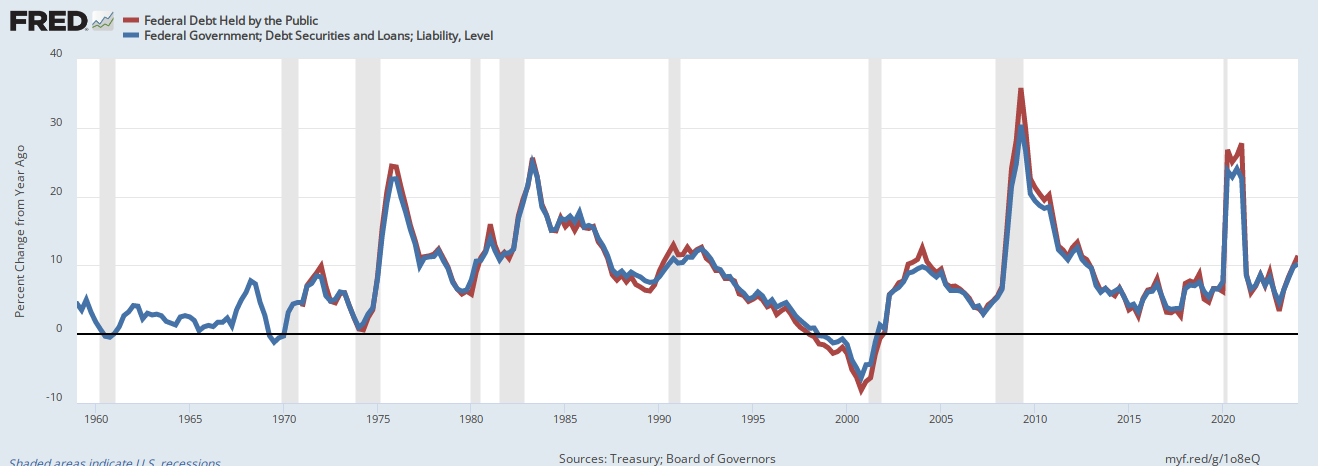

“We” (the federal government or you) don’t owe anything. It is true that the government has spent more than it took from taxpayers. This is the only way the economy can grow. It is 100% necessary for the federal government to run deficits, i.e. to create dollars and add them to the economy. When the federal government instead runs surpluses instead of deficits, this is what happens:The debt has climbed sharply over the past two decades — we owed $5.7 trillion in 2000 —with both Democratic and Republican administrations running budget deficits, meaning they spent more than they took in.

U.S. depressions come from federal surpluses.

1804-1812: U. S. Federal Debt reduced 48%. Depression began 1807. 1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819. 1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837. 1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857. 1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873. 1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893. 1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929. 1997-2001: U. S. Federal Debt reduced 15%. Recession began 2001.

By definition, a growing economy requires a growing supply of money. But federal surpluses remove money from the economy, which always causes depressions and recessions. In fact, deficits are so vital to economic growth that even insufficient federal deficits can lead to recessions.

The oft-quoted ratios of federal Debt or Deficit to gross Domestic Product are meaningless. They are a comparison of oranges versus orange crayons. The sole connection between the two measures is that federal deficit spending grows Gross Domestic Product (GDP). In fact, it’s part of the formula: GDP = Federal Spending + Nonfederal Spending + Net Exports. Federal Spending – Federal Taxes = Federal Deficit Spending, and taxes reduce Nonfederal Spending. On wonders where THE WEEK writers think the economy’s dollars would come from if there were no federal deficit spending.This year, the deficit is on track to hit $1.5 trillion, about 5 percent of gross domestic product.

The federal government has the infinite ability to “manage” (pay for) any level of debt. It has the infinite ability to create dollars. It never can run short of dollars to pay its bills.Because interest rates were low and expected to stay low, many officials and experts thought the cost of servicing that debt would remain manageable.

Former Federal Reserve Chairman Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency. There is nothing to prevent the federal government from creating as much money as it wants and paying it to somebody. The United States can pay any debt it has because we can always print the money to do that.”

This was a grave error. Interest is a business cost, and increasing interest rates increases business costs. To be profitable, businesses must raise prices above higher costs. Thus, the Fed, amazingly, increases business costs and pricing to reduce inflation. It boggles.But the pandemic and the return of high inflation changed that thinking. To curb inflation, the Federal Reserve hiked interest rates from close to zero in 2020 to above 5 percent.

A meaningless statistic. Interest rates and defense have different purposes. It’s another orange/orange crayons comparison designed solely to shock you. It’s like telling you the cost of oranges is greater than the cost of orange crayons.Partly as a result, the government is for the first time expected to spend more this year on interest payments on the debt (about $870 billion) than on defense ($850 billion).

That means the federal government would pump $2 trillion in growth dollars a year into the economy. The more interest the government pays into the economy, the stronger the growth. Interest payments do not consume federal tax revenue.If rates remain high, interest payments could reach $2 trillion a year by the end of the decade, consuming 30 percent of federal tax revenue.

- Federal taxes are destroyed upon receipt. The purpose of federal taxes is not to provide the government with spending money. Taxes have two purposes:

- To control the economy by taxing what the government wishes to discourage and by giving tax breaks to what the government wishes to reward, and

- To assure demand for the U.S. dollar by requiring taxes to be paid in dollars.

- Interest payments, like all other federal spending, are made ad hoc with dollars created by pressing computer keys.

Payments on the debt would be the second-largest federal program, behind only Social Security. “We are in a spiral now — it’s a slow spiral, but it’s still a spiral — of rising debt and rising payments on the debt,” said Phillip Swagel, director of the Congressional Budget Office (CBO). “The situation is unsustainable.”Utter nonsense. Here are some of the people who have been claiming since 1940 (!) that the federal debt is unsustainable. They called the debt a “ticking time bomb.” For 84 years, it has been “ticking.” Still no explosion. Being wrong for 84 years doesn’t seem to embarrass them. The term “unsustainable” often is used by debt worriers, but what does it mean? Does Mr. Swagel really believe the Monetarily Sovereign U.S. government, the government that invented the U.S. dollar and created the first dollar from thin air, really believe the federal government can now run out of the dollars? Let’s replay Chairman Alan Greenspan’s words: “A government cannot become insolvent with respect to obligations in its own currency.” Cities, counties, states, businesses, euro nations, you and I can run short of money. The U.S. government cannot. One is Monetarily Sovereign, while the others are monetarily non-sovereign. Apparently, Mr. Swagel doesn’t understand the difference.

How did we get here?

It’s mostly because the government doesn’t collect enough tax revenue to cover the cost of federal programs—a problem exacerbated by multiple rounds of tax cuts.

Unlike state and local taxes, which do pay for state and local payments, federal taxes pay for nothing. The federal tax cuts added growth dollars to the economy, which would have grown more slowly or sunk into recessions or depressions without them.According to the Center for American Progress, the cuts signed into law by President George W. Bush in 2001 and 2003 have added more than $8 trillion to the debt, while the tax cuts passed under President Donald Trump in 2017 have added another $1.7 trillion.

Translation: The Bush and Trump tax cuts added more than $14.7 trillion in growth dollars to the economy, and Biden added $5 trillion more. That is why U.S. economic growth has been so robust.Nearly $5 trillion in emergency pandemic outlays under Trump and President Biden further added to the debt pile.

“The pandemic created enormous economic losses, and we used borrowing not so much to make the losses vanish into thin air but to spread them out over time,” said former CBO chief economist Wendy Edelberg.

No, Ms. Edelberg. The U.S. government, being the original creator of dollars, never borrows dollars; it creates them at will by pressing computer keys. And your “vanish . . . spread” comment makes no economic sense. Think about it.All federal spending is funded by sovereign money creation. No federal spending is funded by tax collection. Federal bonds do not pay for anything. They are deposits into safekeeping accounts. The words “bonds,” “notes,” and “bills” are misleading. They do not represent federal borrowing; they are terms used when monetarily non-sovereign entities borrow.Meanwhile, the costs of Social Security and Medicare — the top two government outlays — will rise as millions more Baby Boomers retire over the coming years.

Why is this a problem?

The bigger the deficit, the more bonds the Treasury must issue to cover otherwise unfunded spending — unfunded spending that now includes repayments for those bonds.

There is no such risk:There’s a risk that investors could demand higher yields to buy the flood of government bonds, which in turn could push up borrowing costs on mortgages, credit cards, and business loans.

- The federal government does not need to offer bonds in order to pay its bills. It can create all the dollars it needs simply by pressing computer keys

- Investors have no leverage over the Federal Reserve’s setting of interest rates.

It is true that raising interest rates is recessionary, but since the U.S. federal government never borrows U.S. dollars, federal debt does not lead to federal borrowing or increased interest rates. What does lead to higher interest rates? The Fed’s misguided attempts to combat inflation.Consumer spending and corporate investment would dip, slowing the economy and causing tax revenues to drop — requiring the government to borrow even more to make up the shortfall. New debt isn’t the only problem.

Unlike with private debt, the Fed does not raise rates in response to maturing T-securities. The magazine author seems to have no concept of the fundamental differences between federal Treasury securities and private sector bonds. If inflation drops next year, the Fed will drop interest rates, regardless of how much deficit spending the government does.Over the next three years, more than half of the government’s publicly held debt will mature and need to be refinanced at higher rates.

The above two sentences could not be more misleading. Federal tax dollars (unlike local tax dollars) do not service debt. Federal tax dollars service nothing; the federal government pays all its debts by creating new dollars, ad hoc. Federal “debt servicing” does not reduce the amount available for “infrastructure, health care, or anti-poverty measures.” The government has the infinite ability to fund those programs. The CRFB is a notorious shill for the rich, always urging federal tax increases that impact the middle classes while the rich get tax breaks.And the more tax money that goes to debt servicing, the less there is for government programs that might boost growth, whether that’s investment in infrastructure, health care, or anti-poverty measures.

“We are paying for the past, not the future,” said Tim Penny and David Minge of the nonpartisan Committee for a Responsible Federal Budget (CRFB).

Yep, there it is—the CRFB’s never-ending effort to widen the income/wealth/power Gap between the rich and the rest. What do “tax hikes” and “spending cuts” have in common? They take dollars from the private sector, especially the middle classes, and widen the Gap between the rich and the rest while slowing or stopping economic growth.How could we shrink the deficit?

Through a combination of tax hikes and spending cuts. “The middle class is going to have to contribute on the tax side or on the spending side,” said Marc Goldwein of the CRFB.

“There really is no path if they’re not part of it.”

Yes, it would make several differences:In his most recent budget proposal, Biden said he’d let Trump’s tax cuts expire next year, but that only individuals making more than $400,000 would see a tax hike.

He also called for the minimum corporate tax rate to be hiked from 21 percent to 28 percent and for a 25 percent tax on individuals with more than $100 million in assets.

Would that plan make a difference?

- It would take billions or trillions of growth dollars out of the economy, assuring much slower economic growth, or, more likely, recessions

- It would do nothing to hurt the rich, who would find other tax dodges of the sort that allowed billionaire Donald Trump to pay far fewer dollars in taxes than you did in the past ten years.

- It would directly hurt the economy by taking research and development dollars from American businesses.

Thank goodness it won’t happen. The last thing the private sector needs to have $3 trillion pulled out, for no good purpose.It would shrink the deficit by nearly $3 trillion over the next decade, according to the White House.

But many of Biden’s proposals would struggle to pass even a Democratic-controlled Congress; with Republicans in control of the House, they’re going nowhere.

Trump’s promise to extend tax cuts almost (but not quite) makes me consider voting for him. Naw.Should Trump return to the White House, he has vowed to extend his 2017 tax cuts —which the CBO says would add nearly $4 trillion to the deficit over the next decade —and to push for more cuts.

Yet, I often read false claims that the Medicare and Social Security fake trust funds are going bankrupt without tax increases or benefit reductions. This is a lie based on the rich’s desire to widen the income/wealth/power Gap between them and the rest of us.Both candidates oppose making cuts to the big sources of federal spending: Social Security, Medicare, and defense. “Neither party is remotely serious about either spending cuts or tax increases,” said Brian Riedl, of the conservative Manhattan Institute.

Sadly, I’m too old to be alive 20 years from now when none of the above nonsense is scheduled to happen, and this foolish prediction has been forgotten.What happens if Congress does nothing?

Under current policy and in the best-case scenario, the U.S. has 20 years to take corrective action before the federal debt reaches an unsustainable level, according to the University of Pennsylvania’s Penn Wharton Budget Model.

I’m sorry, but this simply is wrong. The federal government cannot unintentionally default on its debts. It has the infinite ability to create dollars. If you sent the government a legitimate invoice for a trillion dollars, or a hundred trillion, or a thousand trillion, it could pay it instantly simply by tapping a few computer keys. “The analysts” do not understand the fundamental differences between a Monetarily Sovereign entity, like the U.S. government, and a monetarily non-sovereign entity, like a local government, a business, or a euro nation. And, uh oh, here it comes, as usual:After that point, the analysts note, “no amount of future tax increases or spending cuts could avoid the government defaulting on its debt.”

Such a default would be disastrous for the U.S. and global economies.

A reckoning could be delayed if interest rates fall back to recent lows, or if U.S. economic growth outpaces interest rates. But most experts agree that the country will eventually have to tackle its surging debt and deficits.

The problem is that “nobody really knows what ‘eventually’ means,” said Louise Sheiner, of the Brookings Institute. “The longer you wait, the more you are shifting costs onto the future generation.”

Those FICA taxes, like all other federal taxes, support nothing. Even Franklin D. Roosevelt, who initiated Social Security, knew the taxes were useless. Why did he create them when there were no special taxes to “fund” Congress, the Supreme Court, the White House, the Military, etc.?Saving Social Security A demographic time bomb could blow a hole in Social Security.

The program taxes current workers to support older Americans.

When told the programs could be funded the same way all other federal spending was funded, he said the taxes created “a legal, moral, and political right to collect their pensions and their unemployment benefits. With those [payroll] taxes in there, no damn politician can ever scrap my social security program.”

FICA was a political decision, not a financial one.But as the population gets grayer and lives longer, the worker-to-retiree ratio is dipping lower and lower.

As a result, Social Security’s trust fund is projected to run dry by 2035, triggering an immediate 17 percent cut in benefits.

A number of proposals have been floated to stave off insolvency, including raising the age at which full benefits can be claimed from 67 to 70; hiking payroll taxes; and raising the limit on annual earnings subject to Social Security taxes, now about $168,600.

Yet despite nearly a decade of warnings about the program’s financial health, Congress has yet to approve any meaningful reform. “Nobody’s acting as if that’s something they’ve got to take seriously,” said Andrew Biggs, senior fellow at the American Enterprise Institute.

“So, I’ll just be honest and say I’m worried about how this thing plays out.”

……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY