Department of Agriculture Department of Commerce Department of Defense Department of Education Department of Energy Department of Health and Human Services Department of Homeland Security Department of Housing and Urban Development Department of the Interior Department of Justice Department of Labor Department of State Department of Transportation Department of the Treasury Department of Veterans Affairs

In addition to these departments, there are over 430 federal agencies in the United States, including 9 executive offices, 259 executive department sub-agencies and bureaus, 66 independent agencies, 42 boards, commissions, and committees, and 11 quasi-official agencies. Not one of the departments, agencies, executive offices, sub-agencies, bureaus, boards, commissions, committees, and quasi-official agencies can or will run short of dollars unless that is what Congress and the President want. Who says so? How about:Former Federal Reserve Chairman Alan Greenspan said: “A government cannot become insolvent with respect to obligations in its own currency. There is nothing to prevent the federal government from creating as much money as it wants and paying it to somebody. The United States can pay any debt it has because we can always print the money to do that.”

Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.” Scott Pelley: Is that tax money that the Fed is spending? Ben Bernanke: It’s not tax money… We simply use the computer to mark up the size of the account.

Not many people realize that while state/local taxes pay for state/local spending, federal taxes pay for nothing. Rather than funding federal spending, the sole purposes of federal taxes are:- To control the economy by taxing what the federal government wishes to discourage and by giving tax breaks to what the federal government wishes to reward,

- To assure demand for the U.S. dollar by requiring dollars to be used in paying taxes and

- To fool the public into believing some benefits are unsustainable unless taxes are raised, which reduces benefits.

Statement from the St. Louis Fed: “As the sole manufacturer of dollars, whose debt is denominated in dollars, the U.S. government can never become insolvent, i.e., unable to pay its bills. In this sense, the government is not dependent on credit markets to remain operational.”

Anyone who claims a federal “debt crisis” is ignorant about, or lying about, federal finances. There is no federal debt crisis. The Libertarians and their alter egos, the Republicans, are doing their best to provide you with false information. Here is a Libertarian article that could have been written by the Republicans:How can the federal government, which as you’ve just read, has the infinite ability to create dollars, have a “deteriorating fiscal condition”? It can’t. It’s like claiming the world’s oceans have a deteriorating liquid condition, or the universe has a deteriorating atomic condition. The lie about “deteriorating fiscal condition” forms the basis for the rest of the lies.Congress Is Trying To Avoid Taking Responsibility for the Debt Crisis It Created A fiscal commission might be a good idea, but it’s also the ultimate expression of Congress’ irresponsibility. ERIC BOEHM | 11.29.2023 2:30 PM

It’s inaccurate to say that no one in Congress wants to talk about the national debt and the federal government’s deteriorating fiscal condition.

Rep. Jodey Arrington either is stupendously ignorant or stupendously lying. The phrase “unsustainable national debt” consists of three words, all three of which are lies.Indeed, during Wednesday morning’s meeting of the House Budget Committee, there was a lot of talk about exactly that.

“Runaway deficit-spending and our unsustainable national debt threatens not only our economy, but our national security, our way of life, our leadership in the world, and everything good about America’s influence,” said Rep. Jodey Arrington (R–Texas), the committee’s chairman.

- “Unsustainable”: Interestingly, this word never is explained by those who use it incessantly. I suspect it means something like this: Federal finances are like personal finances. If your expenses are larger than your income, eventually, you won’t be able to pay your bills, so your debt will be “unsustainable.”The problem is that the federal government is Monetarily Sovereign while you are monetarily non-sovereign, which is totally different. You can run short of money. The federal government cannot.

- “National” This has to do with Treasury Securities, which indeed are national or federal. The federal government is the sole authority to issue T-bills, T-notes, and T-bonds. However, the owner of those T-bills, T-notes, and T-bonds is not the federal government. When someone or some nation buys a T-security, their dollars go into their T-security account. Those dollars remain the property of the buyer.They never are owned by the federal government. When the T-security reaches maturity, the dollars are returned to their owner. Think of a bank safe-deposit box. The bank never owns the contents. It holds them for safekeeping and returns the contents to the owner. The government’s storage of unused dollars for safekeeping, stabilizes the dollar.

- “Debt” relates to the mistaken claim that T-securities represent borrowing. But our Monetarily Sovereign government, with its infinite ability to create dollars, never borrows dollars. The only dollars the federal government ever owes are the dollars it uses to pay for things. Those dollars are paid in a timely fashion by a government that has the infinite ability to create dollars. There is no long-term buildup of federal “debt.”

The above paragraph refers to the infamous and much-misunderstood Debt/GDP ratio. It is a meaningless ratio that tells nothing and predicts nothing about a Monetarily Sovereign nation’s finances. A high or low ratio does not indicate solvency, growth, or any other financial factor. It is entirely useless. The so-called “Debt” (that isn’t a real debt) is the net total of all T-securities purchased and still outstanding for the past 10 years. They are not a burden on the federal government, which merely returns the dollars it holds for the owners when the security matures. By contrast, GDP is a one-year (or less) total of America’s (not just the federal government’s) spending. The formula for GDP is:He pointed to the Congressional Budget Office (CBO) projections showing that America’s debt, as a share of the size of the nation’s economy, is now as large as it was at the end of the Second World War—and that interest payments on the debt will soon cost more than the entire military budget.

GDP = Federal Spending + Non-federal Spending + Net Exports

Comparing federal “Debt” to GDP is worse than comparing your 10-year income to the federal government’s spending this week: It is meaningless. The sole purpose of this comparison is to fool you into believing the federal government is running short of the dollars it has the infinite ability to create.Unlike you, me, local governments, and businesses, the federal government’s only true “budgetary problem” is to decide where it wishes to spend its infinite hoard of dollars. While you et al. must worry about the availability of dollars, the federal government has no such constraints. It creates dollars by spending dollars. This is the process:What’s missing, however, is any sense that Congress is willing to turn those words into action. Just look at the premise of Wednesday’s hearing: “Examining the need for a fiscal commission.”

Yes, it was a meeting about possibly forming a committee to discuss perhaps doing something to address the problem. In fact, it was the second such committee hearing in front of the House Budget Committee within the past few weeks.

It seems like there ought to be a more direct way to address this. , say, if a committee already existed within Congress was charged with handling budgetary issues. A House Budget Committee, perhaps.

But instead of using Wednesday’s meeting to seek consensus on how to solve the federal government’s budgetary problems, lawmakers debated a series of bills that aim to let Congress offload that responsibility to a special commission.

- When the federal government buys something and receives an invoice, it sends to the seller’s bank instructions (not dollars), instructing the bank to increase the balance in the seller’s checking account.

- When the bank does as instructed, new dollars are created and added to the M2 money supply measure.

- The instructions then are approved by the Federal Reserve, an agency of the federal government.

All this blah, blah, blah is meant to disguise one simple fact: The rich, who run the U.S. government, want to cut benefits for the middle and lower-income groups. Here is why:What that commission would look like and how its recommendations would be handled will depend on which proposal (if any of them) eventually becomes law—and even that seems somewhat unlikely, with Democrats voicing their opposition to the idea throughout Wednesday’s hearing.

To be fair, there are plenty of good arguments for why a fiscal commission might be the best way for Congress to fix the mess that it has made. It is an idea that’s certainly worthy of being considered, even if the whole exercise seems a little bit over-engineered.

- “Rich” is a comparative. A man owning a million dollars is rich if everyone else has a thousand dollars. But a man owning a million dollars is poor if everyone else has a hundred million dollars. During the Great Depression, anyone earning $20,000 a year was rich. Today, that salary would mark him as poor.

- To become richer requires widening the income/wealth/power Gap below you and narrowing the Gap above you.

- The rich always want to be richer, i.e., to widen the Gap below them.

- Because Social Security, Medicare, Obamacare, and all aid to the poor help narrow the Gap between the rich and the rest, the rich repeatedly try to eliminate all such benefits (while giving tax loopholes to the rich).

- Under the guise of fiscal responsibility, the right-wing makes unending efforts to cut the federal deficit spending that benefits those who are not rich (while continuing to run deficits that benefit the rich).

And there it is, the true purpose of a “fiscal commission” is to cut spending on so-called “entitlements” (i.e. Medicare and Social Security.) All the lies about Social Security and Medicare “trust funds” running short of dollars are to make you compliant with the Republican effort to make you poorer and the rich, richer. What you may not realize, these so called “trust funds” aren’t even trust funds. To quote from the Peter G. Peterson Foundation web site:Romina Boccia, director of budget and entitlement policy at the Cato Institute, argues persuasively in her Substack that a fiscal commission is the best way to overcome the political hurdles that prevent Congress from taking meaningful action on borrowing and entitlement costs (which are driving a sizable portion of future deficits).

A federal trust fund is an accounting mechanism used by the federal government to track earmarked receipts (money designated for a specific purpose or program) and corresponding expenditures. The largest and best-known trust funds finance Social Security, portions of Medicare, highways and mass transit, and pensions for government employees. Federal trust funds bear little resemblance to their private-sector counterparts, and therefore the name can be misleading. A “trust fund” implies a secure source of funding. However, a federal trust fund is simply an accounting mechanism used to track inflows and outflows for specific programs. In private-sector trust funds, receipts are deposited and assets are held and invested by trustees on behalf of the stated beneficiaries. In federal trust funds, the federal government does not set aside the receipts or invest them in private assets. Rather, the receipts are recorded as accounting credits in the trust funds, and then combined with other receipts that the Treasury collects and spends. Further, the federal government owns the accounts and can, by changing the law, unilaterally alter the purposes of the accounts and raise or lower collections and expenditures.Thus, the federal government can do whatever it wishes with the “trust funds.” It can add to them, subtract from them, or change them from the wrongly presumed mission of supporting federal expenditures. At the click of a computer key or the passage of a law, the balance in the federal “trust funds” could be changed to $100 trillion or $0, and neither would affect taxpayers. Thus, the notion that any federal “trust funds” are, as the right wing claims, “in trouble,” is a lie, unless “trouble” comes from those who don’t wish you to understand the differences between the private sector’s real trust funds vs. the federal government’s phony “trust funds.”

This would be the Republican’s way of saying, “Don’t blame us for cutting your Social Security. It was the commission that did it.”Boccia’s preferred solution would allow the commission’s proposals to be “self-executing unless Congress objects,” meaning that legislators would have the “political cover to vocally object to reforms that will create inevitable winners and losers, without re-election concerns undermining an outcome that’s in the best interest of the nation.”

President Obama, of all people, tried this with the notorious Simpson/Bowles Commission, which made exactly the recommendations expected of it. Fortunately, America learned the plot, and the commission’s recommendations never were implemented. The commission’s recommendations included increasing the Social Security retirement age, cuts to military, benefit, and domestic spending, restricting or eliminating certain tax credits and deductions, and increasing the federal gasoline tax. The Simpson-Bowles proposal would have cut entitlement and social safety net programs, including Social Security and Medicare, which was opposed by critics on the left, such as Democratic Representative Jan Schakowsky (a Commission member) and economist Paul Krugman.It’s probably true that Congress itself is the biggest hurdle to managing the federal government’s fiscal situation. Unfortunately, that’s also the biggest reason to be skeptical: any decisions made by a fiscal commission will only be as good as Congress’ willingness to abide by them.

Federal deficit spending is necessary for economic growth. Deficit reduction leads to recessions, which then are cured by deficit increases.There’s no secret knowledge about reducing deficits that will only be unlocked by bringing together a collection of legislators and private sector experts, which is what most of the bills to create a commission propose doing.

No, we need our leaders to be held accountable for disseminating the lie that federal deficits are harmful. Here is what happens when we ignore the fundamental truth that federal deficits are a blessing, not a curse: Every depression in U.S. history began with a reversal of federal deficit creation:Congress should hold hearings, invite experts to share their views, draft proposals, vet those ideas through the committee process, and then put the resulting bills on the House floor for a full vote.

Shielding Congress from the electoral consequences of making poor fiscal decisions doesn’t seem to improve budget-making quality. We need Congress to be held more accountable for this mess.

1804-1812: U. S. Federal Debt reduced 48%. Depression began 1807. 1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819. 1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837. 1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857. 1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873. 1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893. 1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929. 1997-2001: U. S. Federal Debt reduced 15%. Recession began 2001.

Here is what should be done: Step 1. Call it what it really is. Rather than talking about a federal “debt,” we should talk about the economy’s income. The misnamed “debt” is income for the economy. It’s money flowing from the infinitely wealthy federal government into the economy that needs and uses the money for growth. Step 2. Rather than instituting a commission to cut private sector income, thus causing recessions and depressions, America should create a plan to improve the lives of our people. Use the infinite money-creation power of the federal government to:- Fund public education about the benefits of Monetary Sovereignty

- Fund a comprehensive, no-deductible Medicare for every man, woman, and child in America.

- for the homeless

- Fund college for everyone in America who wants an advanced degree.

- Fund Social Security benefits for every man, woman, and child in America.

- Eliminate FICA, which funds nothing but is America’s most regressive tax.

- Fund various research projects, including medical, physical, psychological, and environmental.

- Fund long-term care

- Fund housing

- Fund childcare for working families.

The article ends with ignorance and lies. Contrary to the above statements, the facts are:A $33 trillion national debt didn’t come crashing out of the sky like an asteroid that couldn’t be avoided.

“No responsible leader can look at the rapid deterioration of our balance sheet, the CBO projection of these unsustainable deficits, and the long-term unfunded liabilities of our nation and not feel compelled to intervene and change course,” Arrington said Wednesday.

He’s right, but that only draws a line under the contradiction. A responsible Congress would be working on a serious plan to get the deficit under control. Instead, the Budget Committee is working on proposals to avoid doing that.

- The federal government’s balance sheet is not “deteriorating.”

- Deficits are necessary, not “unsustainable.”

- All federal liabilities are funded by the federal government’s infinite ability to create sovereign currency.

Dear Loved Ones

I sincerely apologize for electing people who fouled your water, your earth, and your air, cut Social Security, cut Medicare, cut Obamacare, increased your taxes, lied about COVID and vaccinations, and did nothing to improve the lives of all (except the rich, who were well rewarded).

I also apologize for electing a Hitler clone who admitted he would arrest everyone disagreeing with him and give all the nation’s wealth to those who already are wealthy.

I could claim ignorance, but to be honest, I was warned about what would happen. I guess I yielded to my hatred of blacks, browns, yellows, reds, Jews, Muslims, women, the poor, immigrants, and gays.

I should have learned about Monetary Sovereignty, but I was so busy denying the danger of guns and the attempted coup I had neither the time nor the inclination to learn anything.

Perhaps you will be wiser.

I hope you will forgive me for the miserable, ignorant, hate-filled world I have left for you.

But at least the very rich are very happy.

Rodger Malcolm Mitchell Monetary Sovereignty Twitter: @rodgermitchell Search #monetarysovereignty Facebook: Rodger Malcolm Mitchell……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY

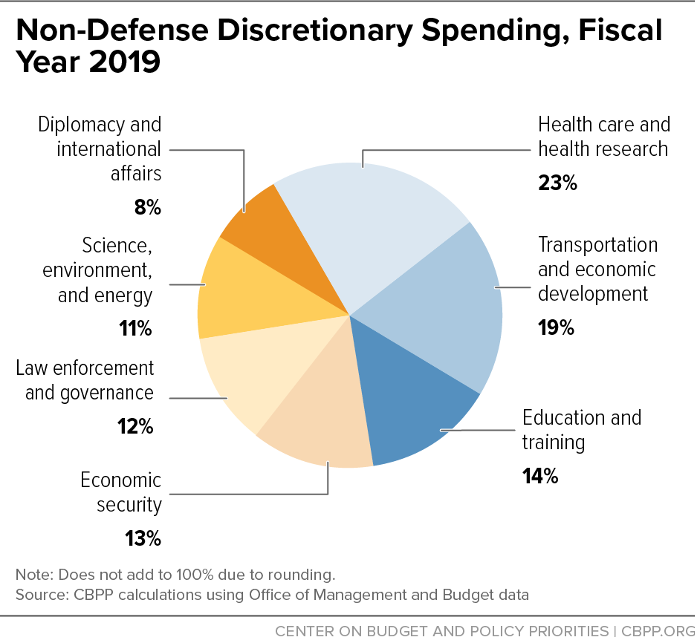

In 2019, non-defense discretionary (NDD) spending totaled $661 billion, or 14 percent of federal spending. That same year, the federal “debt” was $23 Trillion. The entire NND was less than 3% of the so-called “debt.”

Would you be willing to see every dollar cut from health care and health research, diplomacy, science, environment, energy, transportation, economic development, law enforcement and governance, education and training, and economic security?

Oh, but that’s not all.

In 2019, non-defense discretionary (NDD) spending totaled $661 billion, or 14 percent of federal spending. That same year, the federal “debt” was $23 Trillion. The entire NND was less than 3% of the so-called “debt.”

Would you be willing to see every dollar cut from health care and health research, diplomacy, science, environment, energy, transportation, economic development, law enforcement and governance, education and training, and economic security?

Oh, but that’s not all.