Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and poor.

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

============================================================================================================================================================================================================================================================

Look at the people running for President.

Most (all?) of them are dishonest, clueless and/or incompetent, and most of them know they cannot win.

So why do they run? Why do they waste their time and other people’s money? Why do so many of us give them our time and our hard earned dollars?

Lindsey Graham: “I’m thinking about running for President. You get a house and a car and a plane. It’s a pretty good gig.”

And there you have it: The reason why dishonest, clueless, incompetent people, not only run for President, but run for political offices in general.

They get a house and a car and a plane. It’s a pretty good gig.

For most of us, job hunting is an unpleasant chore. Calling, writing, waiting in reception rooms, answering questions about ourselves — and all the rejections, again and again — and no money coming in.

Nobody pays us to look for a job. In fact, it costs us money, what with travel, postage, printing, etc. We’d rather chew thumb tacks.

And if a potential employer finds we have been lying, or we have been fired from a previous job, or we say some really stupid things during our interview, our situation may become hopeless.

By contrast, you as a politician can do a “Fiorina”: i.e., you can lie, be shown to be lying, continue to deny you’re lying even after facing absolute proof you were lying — and still be “hired” (backed) by many thousands of people.

You can deny evolution and deny global warming. You can be an anti-gay, anti-foreigner, anti-non-Christian bigot, anti-gun control, thumb your nose at the Supreme Court because your personal beliefs differ from America’s laws, and still be favored by the electorate.

And that is why incompetents run for President, knowing they can’t win. “It’s a pretty good gig. You get a house and a car and a plane” — and lots and lots of money.

If ever you’re tempted to wonder, “Is this the best America can do”? remember, running for President is the perfect forum for an incompetent.

Good people don’t want to dirty their hands.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually Click here

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

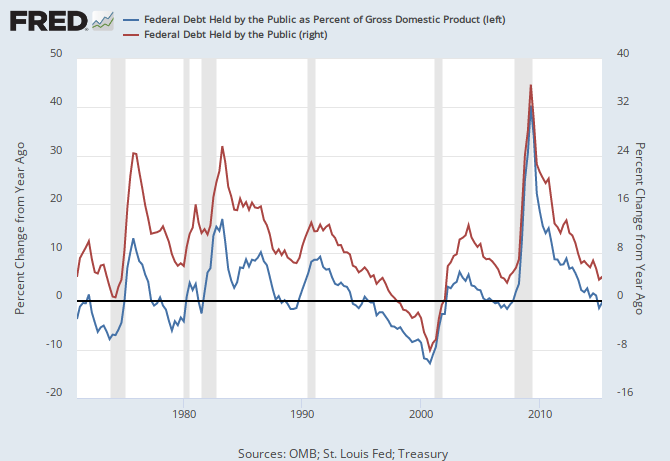

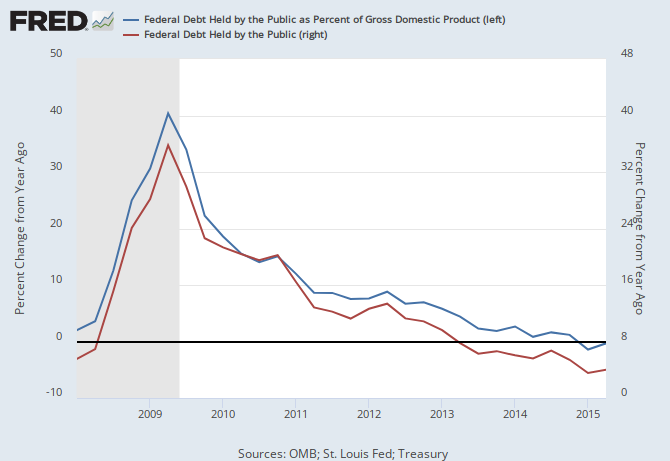

THE RECESSION CLOCK

Recessions come after the blue line drops below zero.

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY