In economics, as in most other fields, ignorance leads to failure and to further ignorance. Nowhere is this more evident than in discussions about the so-called “national debt,” which is neither national nor debt.

The following article appeared in the June 2, 2025 Florida Sun Sentinel:

Can Trump manage national debt? Several investors, GOP senators and Musk have doubts By Josh Boak Associated Press

WASHINGTON — President Donald Trump faces the challenge of convincing Republican senators, global investors, voters and even Elon Musk that he won’t bury the federal government in debt with his multitrillion-dollar tax breaks package.

The response so far from financial markets has been skeptical as Trump seems unable to trim deficits as promised. The overall national debt stands at more than $36.1 trillion.

Mr. Josh Boak seems to misunderstand the difference between federal financing and personal financing. He insists our Monetarily Sovereign federal government is at risk of being “buried in debt.“

The federal government is Monetarily Sovereign. That means it never can run short of dollars. It could continue spending at its current rate, or even at three times its current rate, forever.

Your city, county, and state can be buried in debt. Your business can be buried in debt. You can be burning in debt, as can I. We are monetarily non-sovereign. We cannot create unlimited dollars.

But the U.S. federal government cannot be “buried in debt.” Not now. Not ever.

Why would anyone want to reduce annual deficits? The government never can run short of dollars, and federal deficits are essential for economic growth.

The most common measure of economic growth is Gross Domestic Product (GDP). The formula for GPD is:

GDP = Federal Spending + Nonfederal Spending + Net Exports

“Nonfederal” is the private sector.

Simple algebra shows that cuts to Federal Spending reduce economic growth. Federal Spending increases GDP directly, but also tends to increase Nonfederal Spending by sending dollars into the private sector, which spends them.

“All of this rhetoric about cutting trillions of dollars of spending has come to nothing — and the tax bill codifies that,” said Michael Strain, director of economic policy studies at the American Enterprise Institute, a right-leaning think tank.

It is surprising that someone titled “Director of Economic Policy Studies” does not understand the fundamentals of federal finance. Mr. Strain appears to misunderstand the differences between monetary sovereignty and monetary non-sovereignty.

“There is a level of concern about the competence of Congress and this administration, and that makes adding a whole bunch of money to the deficit riskier.”

Yes, there is a level of concern about the competence of people who believe the government can run short of its own sovereign currency.

The White House has viciously lashed out at anyone who has voiced concern about the debt snowballing under Trump, even though it did exactly that in his first term after his 2017 tax cuts.

Trump often attacks anyone who disagrees with him, despite his limited understanding of economics.

White House press secretary Karoline Leavitt opened her briefing Thursday by saying she wanted “to debunk some false claims” about his tax cuts.

Leavitt said the “blatantly wrong claim that the ‘One, Big, Beautiful Bill’ increases the deficit is based on the Congressional Budget Office and other scorekeepers who use shoddy assumptions and have historically been terrible at forecasting across Democrat and Republican administrations alike.”

Here is the irony. Rather than imitating Trump by lying, insulting, and criticizing, Leavitt should have stated, “Yes, we increase the deficit because it stimulates economic growth. We draw from the federal government, which has an infinite supply of dollars, and give support to the economy, specifically, the private sector.”

In summary, she apologizes for unintentionally doing the right thing while believing it to be wrong, and then she denies that she is doing it.

House Speaker Mike Johnson piled onto Congress’ number-crunchers Sunday, telling NBC’s “Meet the Press”: “The CBO sometimes gets projections correct, but they’re always off, every single time, when they project economic growth. They always underestimate the growth that will be brought about by tax cuts and reduction in regulations.”

Tax cuts bring about growth because they leave more dollars in the private sector, which is exactly what federal deficit spending does. So why does Johnson promote tax cuts but oppose federal deficits, both of which accomplish the same thing?

Is he really that ignorant about economics, or is he just trying to defend Trump no matter what?

But Trump has suggested that the lack of sufficient spending cuts to offset his tax reductions came out of the need to hold the Republican congressional coalition together.

“We have to get a lot of votes,” Trump said last week. “We can’t be cutting.”

Get it? Trump is saying, in effect, that “we should cut spending, but the Republican coalition seems to know that spending cuts are harmful, so we’ll keep spending, which will grow the economy.”

That gibberish is what passes for wisdom in Washington.

That has left the administration betting on the hope that economic growth can do the trick, a belief that few outside of Trump’s orbit think is viable.

“Economic hope can do the trick?” What trick? Is Boak saying that the Republicans hope economic growth can cure the federal deficit?

How does that work? The deficit is the private sector sending fewer dollars to the government than the government sends to the private sector. How does economic growth cure that? It’s mathematical nonsense.

In the equation, GDP = Federal Spending + Nonfederal Spending + Net Exports, the Republicans hope that GDP goes up, while Federal Spending and Nonfederal Spending go down!

Would someone please find a 5th grader who will explain algebra to the politicians and Mr. Boak?

Most economists consider the nonpartisan CBO to be the foundational standard for assessing policies, although it does not produce cost estimates for actions taken by the executive branch, such as Trump’s unilateral tariffs.

Tech billionaire Musk, who was until recently part of Trump’s inner sanctum as the leader of the Department of Government Efficiency, told CBS News: “I was disappointed to see the massive spending bill, frankly, which increases the budget deficit, not just decreases it, and undermines the work that the DOGE team is doing.”

Musk may understand business finance, but he has no clue about federal finance. The goals are different. The goal of business is to increase income compared to outlay, thus increasing profits. So cost cutting is a viable, even necessary, option.

The goal of the federal government is to increase benefits to the people (by pumping more dollars into the economy). So taxing less and spending more are the best options — exactly the opposite of what a business should do.

In short, the sole purpose of any government is to improve the lives of the people. The purpose of a business is to improve its own life. Totally different goals and totally different abilities. Musk repeatedly proved he didn’t understand that.

To him, “government efficiency” means taking more dollars from the people and giving fewer dollars to the people.

Why do we need a government for that?

The tax and spending cuts that passed the House last month would add more than $5 trillion to the national debt in the coming decade if all of them are allowed to continue, according to the Committee for a Responsible Financial Budget, a fiscal watchdog group.

Translation: The tax cuts primarily benefiting the wealthy, along with spending cuts that hurt middle- and lower-income groups, are projected to inject 5 trillion growth dollars into the pockets of the rich over the next decade.

This estimate comes from the Committee for a Responsible Federal Budget, which is a Libertarian organization that opposes providing benefits to people who are not affluent.

To make the bill’s price tag appear lower, various parts of the legislation are set to expire. This same tactic was used with Trump’s 2017 tax cuts and it set up this year’s dilemma, in which many of the tax cuts in that earlier package will sunset next year unless Congress renews them.

But the debt is a much bigger problem now than it was eight years ago. Investors are demanding that the government pay a higher premium to keep borrowing as the total debt has crossed $36.1 trillion.

The interest rate on a 10-year Treasury Note is around 4.5%, up dramatically from the 2.5% rate being charged when the 2017 tax cuts became law.

Tell me this. Why would an entity, with the endless ability to create dollars by simply pressing a few computer keys, ever need to borrow dollars? Think about it.

The federal government, unlike state and local governments, does not borrow dollars. Federal bonds are completely different from state and local bonds, though they use the same word, “bonds.”

State and local governments do borrow dollars, when tax income is not sufficient to pay bills.

The federal government always can pay its bill simply by creating more dollars.

Fed Chairman Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency. There is nothing to prevent the federal government from creating as much money as it wants and paying it to somebody. The United States can pay any debt it has because we can always print the money to do that.”

Fed Chairman Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.” It’s not tax money… We simply use the computer to mark up the size of the account.

Fed Chairman Jerome Powell stated, “As a central bank, we have the ability to create money digitally.

Statement from the St. Louis Fed: “As the sole manufacturer of dollars, whose debt is denominated in dollars, the U.S. government can never become insolvent,i.e., unable to pay its bills. In this sense, the government is not dependent on credit markets to remain operational.” You can find it in their publication titled “Why Health Care Matters and the Current Debt Does Not” from October 2011.

Paul Krugman (Nobel Prize–winning economist): “The U.S. government is not like a household. It literally prints money, and it can’t run out.”

Hyman Minsky (Economist, key influence on MMT) “The government can always finance its spending by creating money.”

Eric Tymoigne (Economist) “A sovereign government does not need to collect taxes or issue bonds to finance spending. It finances directly through money creation.”

Every knowledgeable economist knows the federal government cannot run short of dollars and does not borrow (i.e., “dependent on credit markets” as the St. Louis Fed confirmed).

So what about T-bonds, T-notes, and T-bills? Aren’t they borrowing?

No. They are interest-earning deposits, the purpose of which is not to provide spending money to the government. Instead, they provide a safer place (compared to banks and insurance companies) for people and countries to store unused dollars.

The federal government never touches those dollars. So they are not borrowed. They are just held for safe-keeping, and at agreed-upon dates, the dollars, plus interest, are returned to their owners.

Think of them as similar to bank safe-deposit boxes, where the bank never touches the contents.

The confusion arises because the word “bonds” describes state and local government borrowing, while the same word, “bonds,” means federal safety-deposit accounts.

The idea that the U.S. federal government, which created the U.S. dollar, would need to borrow its own dollars from China or anyone is absurd.

(It’s equally absurd to believe that the federal government would need to levy taxes so it could have dollars for spending.)

The White House Council of Economic Advisers argues that its policies will unleash so much rapid growth that the annual budget deficits will shrink in size relative to the overall economy, putting the U.S. government on a fiscally sustainable path.

As the quotes from knowledgeable individuals indicate, the U.S. government always is on a fiscally sustainable path.

White House budget director Russell Vought said the idea that the bill is “in any way harmful to debt and deficits is fundamentally untrue.”

“Harmful to debt and deficits”? Does he mean that increasing the so-called “debt” and deficits is true, but it could be beneficial to the economy (if it were not so skewed in favor of the rich)? Hard to know exactly what he means.

Most outside economists expect additional debt would keep interest rates higher and slow economic growth as the cost of borrowing for homes, cars, businesses and even college educations would increase.

Additional debt (which, as you have seen, is not “debt’) does not keep interest rates higher or lower. The Fed sets the rates arbitrarily in its misguided effort to fight inflation. Accepting deposits into Treasury Security accounts does not affect interest rates.

( Raising interest rates to fight inflation is misguided because it raises business costs, thus raising prices.)

“This just adds to the problem future policymakers are going to face,” said Brendan Duke, a former Biden administration aide now at the Center on Budget and Policy Priorities, a liberal think tank.

Duke said that with the tax cuts in the bill set to expire in 2028, lawmakers would be “dealing with Social Security, Medicare and expiring tax cuts at the same time.”

It’s quite easy for an informed economist to solve the “problems” of Social Security, Medicare, and tax cuts. Just create the needed dollars by pressing computer keys.

The government would need $10 trillion of deficit reduction over the next 10 years just to stabilize the debt, Tedeschi said. Even though the White House says the tax cuts would add to growth, most of the cost goes to preserve existing tax breaks, so that’s unlikely to boost the economy meaningfully.

“It’s treading water,” he said.

If the government wanted to stabilize the misnamed “debt,” it has plenty of simple options.

- Simply refuse to accept any more deposits into T-security accounts. The government neither needs nor uses the dollars. They just sit there, safely earning interest.

- Enact legislation to add $10 trillion to the General Account, which is the account used for federal payments.

- Have the Treasury mint a $10 trillion coin, as it has the legal authority to do so, and deposit the coin with either the Federal Reserve or the General Account.

If It’s So Simple, Why Don’t They Do It?

Here’s why so many smart people can’t seem to solve a simple problem: They don’t want to.

America is run by the very wealthy. What does “wealthy” mean?

“Wealthy” does not mean having a thousand, a million, a billion, or a trillion dollars. “Wealthy” means having substantially more wealth than 95% or 99% (pick your percentage) of the country.

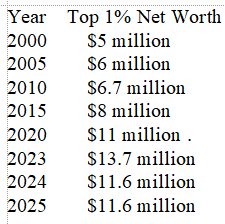

Look at this table of the amount of wealth required to be in the top 1% of Americans:

In the year 2000, having $5 million would have put you in the upper 1%, but only 2o years later, you would have needed to more than double your wealth to be as wealthy.

So, to remain wealthy, you had two options.

- Dramatically increase the amount of money you have, and/or

- Make sure those below you don’t increase their wealth

If it is difficult to double your money in twenty-five years, consider ensuring that those beneath you do not increase their wealth. This way, your top 1% ranking would remain secure.

How do you prevent them from rising? By convincing them with the false notion that the government cannot afford to provide benefits.

Make them pay for their own healthcare. Keep Social Security benefits low. Don’t help them financially with college, so they either pay the tuition or are forced to work lower-paying jobs.

Consider the FICA tax. You might think you pay half, but in reality, you pay the full amount. Your employer takes FICA into account when determining salaries. FICA represents a significant percentage of your income.

For the wealthy, FICA taxes are insignificant or nonexistent. Why is this the case? To ensure that the Gap between you and the top 1 percent does not narrow.

You hear the government claim that it “can’t afford” Medicare for everyone, Social Security for everyone, or college for anyone who wants to attend. They say this is because the federal debt (which isn’t truly federal and isn’t really debt) is too large, and that deficits need to be reduced. Meanwhile, tax loopholes for the wealthy are being widened.

And government spending causes inflation, so any increase in spending must be paid for by your taxes.

And it’s all a lie, a Big Lie, for federal tax dollars are not used to fund federal spending.

That’s what the rich want you to believe. It’s how they stay rich. Or get even richer.

IN SUMMARY

- Unlike state and local governments, the federal government is Monetarily Sovereign. It has infinite money.

- It does not borrow the currency it originally created and continues to create by passing laws.

- “Federal debt” is neither federal nor debt. It is deposits in T-security accounts, wholly owned by depositors and never used by the government. The purpose is to provide a safe place to store unused dollars. This stabilizes the dollar.

- Federal deficits are necessary for economic growth.

- Federal spending does not cause inflation; it results from shortages of essential goods and services. Federal spending can alleviate inflation by acquiring these scarce assets.

- The Big Lie in economics is that the federal financing is like personal financing. The federal government needs no income. It creates all its income.

- The Big Lie aims to benefit the wealthy by increasing the income, wealth, and power Gap between the rich and the rest.

Rodger Malcolm Mitchell

Twitter: @rodgermitchell

Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell;

MUCK RACK: https://muckrack.com/rodger-malcolm-mitchell;

……………………………………………………………………..

A Government’s Sole Purpose is to Improve and Protect The People’s Lives.

MONETARY SOVEREIGNTY

:max_bytes(150000):strip_icc()/GettyImages-545810055-5a4aef159e942700378d55b2.jpg)