One definition of “science” is: A systematic enterprise that builds and organizes knowledge in the form of testable explanations and predictions about the universe.

Economics is a “social science. One wonders whether it can be called a science at all, for it really is an accounting-based branch of psychology, which itself holds to the title, “science,” by its fingertips.

As for “testable explanations” and “testable predictions,” not so good. The psychology role in economics testing is at its best when “predicting” history, but fails repeatedly when trying to predict the future.

Economics approximates religion, which predicts that your following (or not following) certain arbitrary, often illogical and meaningless, rules will be rewarded in some vague way by an omniscient entity.

Accounting

While accounting can have complex and changing rules, it is based on simplicity: The direct relationships among income, saving, and outgo.

Any change in one factor is balanced by a mathematically equal change in the other factors, thus the word “balance” sheet.

Based on its arbitrary rules, accounting strictly is logical and eminently predictable. Adding to the left side of a balance sheet always requires adding to the right side, yesterday and tomorrow.

Though based on arithmetic, and in one sense on algebra (the relationship to the “=” sign), accounting is not a science. Though it organizes knowledge, it doesn’t create testable explanations and predictions about the universe. It simply is a score-keeping method for money-related valuations.

Psychology

This brings us to the other leg of economic’s extremely shaky, two-legged stool, psychology.

In its attempts to rise above religion (the pompous quest to know God’s mind) psychology does run tests and many of these tests provide results that pass for explanations that even are the basis for predictions.

But the economic results seldom are conclusive, while the explanations are subjective, and the predictions often are laughably random — just like with religion.

In real science, testing attempts to change one variable while holding all other variables stable. In psychology, and so in economics, holding all other variables stable generally proves to be impossible. So results vary wildly.

But that impossibility does not deter people known as “chartists.” From Investopedia:

A chartist is an individual who uses charts or graphs of a security’s historical prices or levels to forecast its future trends.

Chartists generally believe that price movements in a security are not random but can be predicted through a study of past trends and other technical analysis.

Generally, chartists will use a combination of indicators, personal sentiment, and trading psychology to make investment decisions.

Serious chartists can seek to obtain the Chartered Market Technician designation which is sponsored and written by the Market Technicians Association.

Even if charting could predict future prices, it still could not predict future prices.

Future stock prices are based on demand. So if charting could predict future prices, everyone would wish to buy or sell according to what the chart indicates.

In that way, charting would affect demand, which in turn would affect charts in an endless helix of price changes, all having little to do with a security’s underlying value.

Thus, charts destroy their own predictions, the “better” the chart, the more the destruction.

Though securities charting doesn’t work as claimed, it does have one value: It establishes a pseudo-scientific, mathematical veneer to its one area of economics.

That is why economics is obsessed with graphs. We economists wish to use mathematics, so to demonstrate our “real science” chops.

That also is why economists love complexification. Read any economics textbook, I dare you. You will discover a convoluted amalgam of graphs, charts, and equations and balance sheets, and difficult wording, all designed to give scientific credence to a non-credible forecasting ability.

How about “Externality,” “Autraky,” “Opportunity set,” “Convexity,” “Dynamic stochastic general equilibrium,” and one of my favorites that often is in the news, “quantitative easing.”)

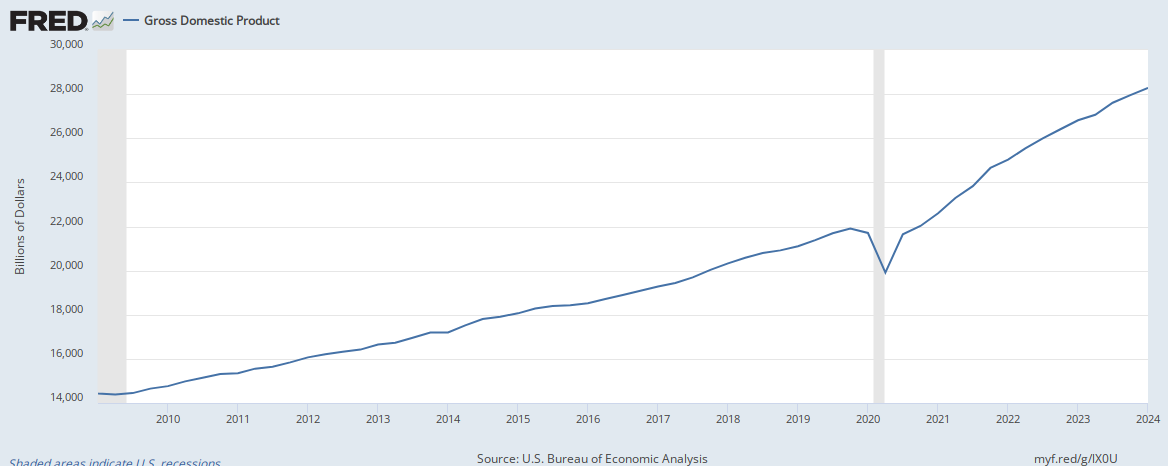

I too am guilty of graphs and charts, though I use them mostly to disprove economic nonsense. For instance.

The above graph disputes the “debt-clock” worriers, who falsely claim the federal debt is like personal debt and so is “unsustainable” because of the following myths:

A. The federal debt is too big (blue line) to sustain, [though it has grown massively and still is “sustained.”]

B. The federal debt is too high a percentage of GDP (red line), [though it repeatedly has passed predicted limits with no ill economic effects.]

C. The huge federal debt will slow economic growth (green line), [which has shown scant signs of slowing for 80 years.]

The faux simplicity is the false claim that federal debt is like personal debt. The public understands personal debt, so it is led to believe it understands federal debt.

The effect of complexity is to confuse either the author or the readers, and in that it has done remarkably well. The vast majority of the literate world is confused.

Once we wipe away the faux complexity, we are left with the following simplicity:

I. The U.S. federal government, unlike state, local, and euro governments is Monetarily Sovereign, which means it is sovereign over the U.S. dollar. It never unintentionally can run short of dollars. Even if all federal tax collections fell to $0, the federal government could pay any size debt denominated in dollars. Further, it has absolute control over the relative value of the dollar.

Monetary Sovereignty is fundamentally simple. Anyone who has played the board game, Monopoly, knows the Monopoly Bank is Monetarily Sovereign. By rule, it never can run short of Monopoly dollars and can create all it needs.

II. Recessions are caused by a lack of money, and they are cured by money creation, particularly by federal deficit spending.

III. Inflations are not caused by government currency printing but rather by shortages, usually shortages of food or energy. Counter-intuitively (for many), increased government spending, to reduce food or energy shortages, reduces inflation.

IV. The human side of economics is ruled by Gap Psychycholgy, the desire to distance oneself from those “below” on any social scale and to approach those “above.”

If you understand the above four simplicities, you understand the Ten Steps to Prosperity (below).

You understand why the federal government can eliminate FICA, increase Social Security and Medicare, fund advanced education for all who want it, and reduce poverty, while preventing and curing recessions, depressions, and inflations.

And you also understand why the government doesn’t do these things that would benefit the middle and lower-income/wealth/power groups.

In short, you will know more economics than your favorite politician, news source, or friend.

And you won’t even have to learn to calculate “cross elasticity of demand.”

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell

Search #monetarysovereignty Facebook: Rodger Malcolm Mitchell

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

The most important problems in economics involve:

- Monetary Sovereignty describes money creation and destruction.

- Gap Psychology describes the common desire to distance oneself from those “below” in any socio-economic ranking, and to come nearer those “above.” The socio-economic distance is referred to as “The Gap.”

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Implementation of Monetary Sovereignty and The Ten Steps To Prosperity can grow the economy and narrow the Gaps:

Ten Steps To Prosperity:

2. Federally funded Medicare — parts a, b & d, plus long-term care — for everyone

3. Provide a monthly economic bonus to every man, woman and child in America (similar to social security for all)

4. Free education (including post-grad) for everyone

5. Salary for attending school

6. Eliminate federal taxes on business

7. Increase the standard income tax deduction, annually.

8. Tax the very rich (the “.1%”) more, with higher progressive tax rates on all forms of income.

9. Federal ownership of all banks

10. Increase federal spending on the myriad initiatives that benefit America’s 99.9%

The Ten Steps will grow the economy and narrow the income/wealth/power Gap between the rich and the rest.

MONETARY SOVEREIGNTY