Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

=========================================================================================================================================================================

Unfortunately, this blog never will run short of material. With the vast majority of writers, politicians and even old-time economists, not understanding Monetary Sovereignty, and instead parroting today’s popular wisdom that federal government finances resemble personal finances, I have a huge selection of ignorant comments from which to choose.

This time, the myths come to us courtesy of Robert J. Samuelson:

Social Security, Medicare, Medicaid and other retiree programs constitute roughly half of non-interest federal spending.

These transfers have become so huge that, unless checked, they will sabotage America’s future. The facts are known: By 2035, the 65-and-over population will nearly double, and health costs remain uncontrolled; the combination automatically expands federal spending (as a share of the economy) by about one-third from 2005 levels. This tidal wave of spending means one or all of the following: (a) much higher taxes; (b) the gutting of other government services, from the Weather Service to medical research; (c) a partial and dangerous disarmament; (d) large and unstable deficits.

No Mr. Samuelson, it doesn’t mean any of those things. Let me address each:

(a)”. . . much higher taxes. . .”

Federal taxes have nothing whatsoever to do with federal spending. The U.S. is Monetarily Sovereign. It pays its bills by instructing banks to credit bank accounts. Whether taxes fall to $0 or rise to $100 trillion, neither event would change by even $1 the federal government’s ability to instruct banks to credit bank accounts.

In federal financing, there is no functional connection between taxing (or borrowing) and spending. When you and I spend, we transfer money. When the federal government spends, it creates money. Huge difference, that Mr. Samuelson does not understand.

(b)” . . . the gutting of other government services, from the Weather Service to medical research. . . “

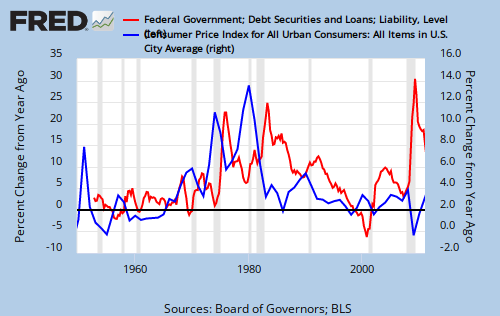

This is based on the myth that federal spending is limited. It is, but not by what Mr. Samuelson thinks. It’s not limited by taxes. It’s not limited by borrowing. It’s limited only by Congress and inflation, which today is nowhere near. Remember, we’re in a recession, where the nation is starved for money. Federal spending adds needed money to the economy.

(c)” . . . a partial and dangerous disarmament. . . “

Same as (b)

(d)” . . . large and unstable deficits.”

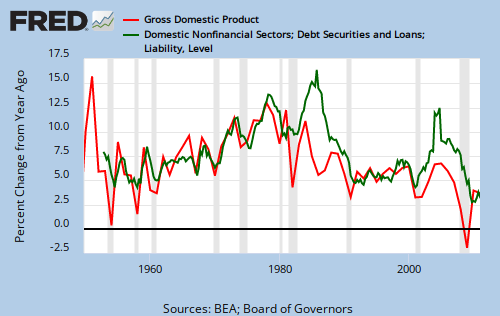

Yes the deficits will be large. They need to be. This is a large country with large money needs. Deficits are the federal government’s method for adding money to this large country. Without large and growing federal deficits we will not be a large and growing country. And what the heck are “unstable” deficits? Or is “unstable” just a more erudite-sounding word you toss in as a synonym for “bad”?

Like most opinion writers, you do not understand the differences between Monetary Sovereignty and monetary non-sovereignty. Let me summarize our current situation:

Our economy languishes. Unemployment is far too high. We need to stimulate businesses so they will hire more people. You, Mr. Samuelson, are suggesting that the federal government pay less money to Social Security, Medicare, Medicaid and other retiree programs, because you erroneously believe the government does not have the unlimited ability to pay its bills.

If the federal government increases its payments to these programs, the recipients of this money will spend it, which will stimulate business and help reduce the unemployment problem.

Mr. Samuelson has joined the crowd who feels that funding ”. . . other government services, from the Weather Service to medical research” along with the military must be accomplished by reduced funding to our seniors and to our poor. If we follow Mr. Samuelson, America will decline to a mean, harsh, wretched nation, indeed.

Readers of Mr. Samuelson’s columns should drop him a note and suggest he acquaint himself with Monetary Sovereignty, before he spreads any more incorrect and harmful myths.

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

![]()

==========================================================================================================================================

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

MONETARY SOVEREIGNTY