In the previous post (“They feed you garbage to improve your health), we addressed some of the usual false claims about the so-called “federal debt.” We showed why “federal debt”:

- Isn’t “federal,” and it isn’t “debt.” (It’s non-federal deposits.)

- Isn’t “unsustainable.” (It’s infinitely sustainable.)

- Isn’t a burden on the federal government or on taxpayers. (Neither are liable.)

- Doesn’t indicate financial irresponsibility. (It’s financially necessary for economic health.)

- Doesn’t put financial markets or federal credit ratings at risk. (There is zero market risk involved in “federal debt.”)

- Doesn’t indicate the federal government is borrowing or spending beyond its “means.” (The federal government never borrows and has infinite “means.”

- Doesn’t slow economic growth. (The lack of federal spending slows growth.)

- Doesn’t cause inflation, recession, or depression (the lack of federal deficit spending causes those events. Federal deficit spending cures them.)

- Doesn’t cause high interest rates.

Also, we showed that high interest rates:

- Are not a burden on the government.

- Are a burden on the public because they add to inflationary pricing, but.

- Add to GDP growth.

Finally, we showed that the Debt/Gross Domestic Product ratio:

- Doesn’t indicate a Monetarily Sovereign government’s solvency.

- Doesn’t consider the differences between a Monetarily Sovereign government vs. a monetarily non-sovereign government.

If you are unfamiliar with the above facts, you may wish to read the previous post and rid yourself of the nonsense that J.D. Tuccille spouts in the opening paragraphs of the following article.

First, his rehash of the old, familiar, wrongheaded, fact-free stuff:

With Rising Debt, the U.S. Federal Government Is in Bad Company. Governments worldwide have been on a borrowing spree, and prosperity has suffered. J.D. TUCCILLE | 4.3.2024 7:00 AM

Misery loves company, as they say. But does financial irresponsibility also enjoy spending a little quality time with friends? If so, it’s quite a party.

While the U.S. government is famously running up debt to stratospheric levels, governments worldwide have been spending beyond their means and borrowing to make ends meet.

The likely result: financial markets put at risk by over-extended governments and slow economic growth for pretty much everybody.

“Public debt as a fraction of gross domestic product has increased significantly in recent decades, across advanced, emerging, and middle-income economies,” write Tobias Adrian, Vitor Gaspar, and Pierre-Olivier Gourinchas for the International Monetary Fund (IMF).

“It is expected to reach 120 percent and 80 percent of output respectively by 2028.”

Public debt—money borrowed by governments—has steadily risen, they add, because years of very low interest rates “reduced the pressure for fiscal consolidation and allowed public deficits and public debt to drift upwards.” Then, COVID-19 disrupted the global economy, and governments responded by funding “large emergency support packages” on credit.

Now, with interest rates rising, the cost of servicing debt is going up, too. But governments continue to borrow as if nothing has changed. Of course, riskier governments have to pay higher interest rates.

“On average, African countries pay four times more for borrowing than the United States and eight times more than the wealthiest European economies,” United Nations Secretary-General António Guterres cautioned last summer with the release of A World of Debt: A Growing Burden to Global Prosperity. “A total of 52 countries – almost 40 percent of the developing world – are in serious debt trouble.”

As of 2022, that report revealed, global public debt stood at $92 trillion and rising. Interest payments displaced other expenditures in a growing number of nations, especially developing countries. High public debt crowds out financial room for everything else, including the ability of private parties to borrow to start or expand businesses that create jobs and build wealth.

Then we come to a criticism we didn’t remember to address in the previous post:

Public Debt Crowds Out Private Investment “Households who buy government debt reduce their savings in productive private investments,” Kent Smetters and Marcos Dinerstein wrote in 2021 for the Penn Wharton Budget Model. As the spending is unproductive, the economy is poorer, and total savings are lower due to capital crowding out.”

At first blush, that sounds reasonable. Putting your dollars into a T-security account seems to remove them (temporarily) from the economy.

If you had bought stock or private sector bonds, the dollars would have remained in the economy — except for three facts:

1. You still own those dollars. They are part of your wealth. You can sell them or use them as collateral for loans. Your ownership allows you to borrow more at lower rates than if you didn’t own them. This ability is economically stimulative.

2. They earn net additional dollars in interest. While stock dividends and private-sector bond interest increase your wealth, those dollars come from the private sector.

They do not earn net dollars. They are mere dollar transfers within the private sector. By contrast, federal interest comprises new dollars that add to the private sector’s money supply.

3. That so-called “reduction in savings” is offset by the federal government’s spending into the economy. The dollars you deposit into a T-bill, T-note, or T-bond were derived from the federal government’s deficit spending.

Federal total net deficit spending = Total T-security deposits.

Thus, Tuccille doesn’t realize he is taking both sides of the issue. He dislikes federal deficits, which add dollars to the economy, but criticizes deposits into T-security accounts for taking dollars from the economy.

“Government spending redirects real resources in the economy and can crowd out private capital formation,” they add. “An additional $1 trillion debt this year could decrease GDP by as much as 0.28 percent in 2050.”

How does federal spending crowd out capital formation? Does the government paying your Medical bills crowd out anything? No.

Does paying your Social Security crowd out anything? No.

Does paying private contractors to build a road, bridge, or dam crowd out anything? No.

Does even paying federal employees crowd out anything? No.

Every dollar the federal government spends is a newly created dollar that winds up in the U.S. economy or other nations’ economies. Nothing is crowded out. Capital formation is a result of federal deficit spending.

If you take that insight and apply it to a world of governments on a collective borrowing spree, you end up with a hobbled global economy where prosperity becomes increasingly elusive.

Except for a tiny reality. Prosperity has not become increasingly elusive for the Monetarily Sovereign nations and even for most of the monetarily non-sovereign nations.

The reason: U.S. deficit spending pumps new inflation-adjusted dollars into the world’s economies. We are net importers, meaning we export more dollars than we import. We help the world (and ourselves) become richer.

“Medium-term growth rates are projected to continue declining on the back of mediocre productivity growth, weaker demographics, feeble investment and continued scarring from the pandemic,” note IMF’s Adrian, Gaspar, and Gourinchas.

“Projections for growth five years ahead have fallen to the lowest level in decades.”

First, these are IMF projections, which notoriously are suspect. These folks don’t even say how or whether they include Monetary Sovereignty in their analyses.

Second, it is not reasonable to make a general statement about “medium-term growth rates” without specifying the term and the difference between Monetarily Sovereign nations and monetarily non-sovereign nations.

It is like predicting the growth rate of the world’s children, without specifying their diet and living conditions.

Heavy government borrowing also creates risk for the financial sector by putting banks at the mercy of massive debtors of uncertain creditworthiness.

“The more banks hold of their countries’ sovereign debt, the more exposed their balance sheet is to the sovereign’s fiscal fragility,” note the IMF analysts.

The article supposedly is about U.S. federal debt being too high. But Tuccille drifts off into non-sequiturs.

The U.S. government does not borrow. It creates every dollar it needs ad hoc. This is the process:

1. To pay a bill, the federal government creates instructions (checks, bank wires, currency), not dollars.

2. It sends those instructions (“Pay to the order of . . . ) to each creditor’s bank, instructing the bank to increase the balance in the creditor’s checking account.

3. At the instant the creditor’s bank does as instructed, dollars are created and added to the M2 money supply measure.

4. The bank then clears its action through the Federal Reserve, a federal agency. One branch of the federal government approves another branch’s instructions.

Thus, in a literal sense, banks create dollars. The notion that banks are “at the mercy of governments” is absolutely true because governments make all the rules by which banks must live.

And yes, banks are at the mercy of a government’s fiscal fragility.

But that begs the question, “Is the U.S. federal government fiscally fragile? The answer is a resounding “No”! (unless Congress, in a moment of MAGA insanity, insists on not paying bills.

Heavily indebted governments also reduce their ability to act as backstops in a financial crisis as they become the likeliest causes of future crises.

As they continue to borrow, they reduce the likelihood that productive private economic activity will grow them out of their financial problems.

Here, Tuccille demonstrates abject ignorance about the difference between Monetary Sovereignty and monetary non-sovereignty. The U.S. federal government is not “heavily indebted” because it could if it chose to, pay all its current and even future bills today.

It simply could send instructions to every creditor’s bank, instructing all those banks to increase the balances in the creditors’ checking accounts. Instantly, all debt, current and future, would disappear.

“Higher government debt implies more state interference in the economy and higher taxes in the future,” The Economist points out in its interactive overview of global government debt.

One would think that a publication titled “The Economist” would understand that while state/local taxes fund state/local spending, federal taxes do not fund federal spending. Even if the federal government didn’t collect a penny in taxes, it could continue spending forever.

The purpose of federal taxes is to:

- Control the economy by taxing what the government wishes to discourage and by giving tax breaks to what the government wishes to reward, and

- Assure demand for the U.S. dollar by requiring the dollar to be used for tax payments.

- To make the populace wrongly believe that federal benefits are unaffordable without tax increases, thus reducing the clamor for more benefits.

Also, add the editors, rising debt “creates a recurring popularity test for individual governments,” which often goes poorly regarding fiscal responsibility because paying outstanding bills isn’t popular with voters.

Paying outstand bills isn’t unpopular. It’s collecting taxes that ostensibly are necessary; that’s the unpopular part.

Higher Debt Leads to Lost Prosperity

Well, isn’t that cheerful? It’s also extraordinarily unfortunate. After thousands of years of grindingly slow progress, recent decades saw the human race escaping poverty.

According to the World Bank, even as populations increased, the number of people living below the poverty line, adjusted for inflation, plummeted from 2.01 billion in 1990 to 689 million in 2019.

In 2016, the economist Deirdre N. McCloskey attributed improving prospects for many of the world’s people to “liberalism, in the free-market European sense.”

But that progress reversed in recent years, with poverty blipping back up (712 million people in 2022) amidst slower economic growth and after drastic government interventions during the pandemic.

A future of stumbling economies hobbled by debt-ridden governments that crowd out private investment is one in which more people are poorer than they would have been if the world had stuck with free markets and implemented a modicum of financial responsibility.

Again, Tuccille was supposedly talking about the U.S. government, except he is mixing some monetarily nonsovereign governments into his comments.

The U.S. “federal debt” has grown from $40 billion in 1940 to $30 trillion in 2024. Where is the crowding out and the poverty he is wringing his hands about? Certainly, not in the U.S., the supposed subject of his article.

I can’t say whether Tuccille is incompetent or dishonest. You decide. Either way, he is wrong, wrong, wrong.

As concerned as the U.N. is about rising public debt, its proposed “solutions” are pretty much what you would expect from that organization. A lot of verbiage about a “more inclusive” system providing “increased liquidity” and “affordable long-term financing” boils down to letting the riskiest governments have a greater say in offering themselves cheap financing. What could possibly go wrong?

The IMF analysts, on the other hand, propose “durable fiscal consolidation” while “financial conditions remain relatively accommodative and labor markets robust.”

I take that as a gentle suggestion that governments need to start paying down their debt to sustainable levels before interest rates and economic conditions deprive them of any options in the matter.

There is only one way for the U.S. government to “pay down its debt.” It has to run surpluses, i.e., to take dollars out of the economy.

That is the worst idea since investing money with Bernie Madoff. Here is what happens every time the federal government pays down its “debt.”

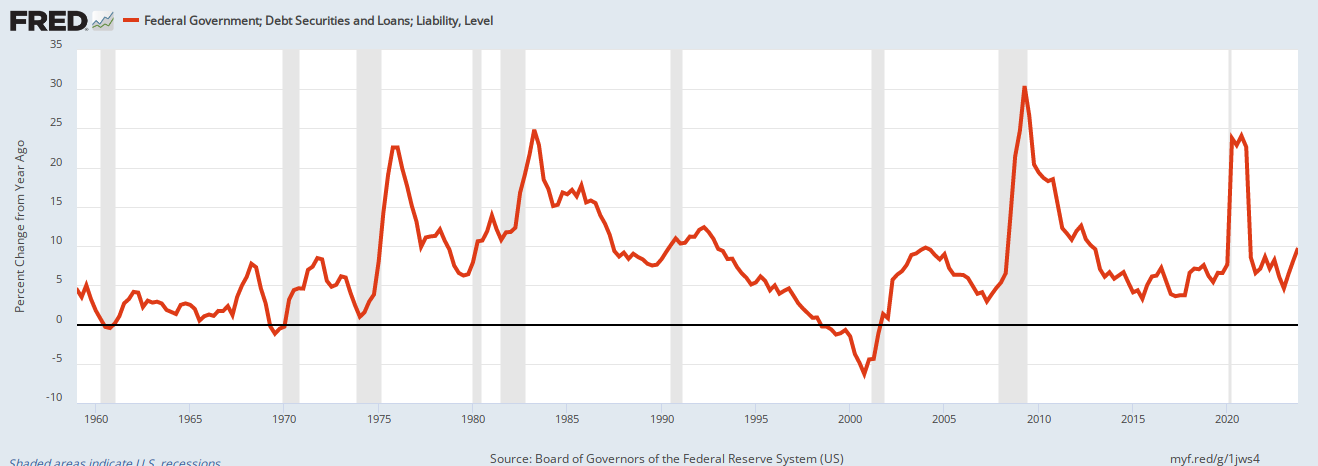

1804-1812: U. S. Federal Debt reduced 48%. Depression began 1807.

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.

1997-2001: U. S. Federal Debt reduced 15%. Recession began 2001.

It’s not just deficits, but deficit increases that are necessary for economic growth.

Would someone please tell Mr. Tuccille that taking money out of the economy causes recessions if we are lucky and depressions if we aren’t. Remind him that GDP = Federal Spending + Non-federal Spending + Net Exports.

Gentle suggestion or not, governments need to get their fiscal affairs in order before they take us all down with them.

Heavily indebted governments result in burdened economies, leading to a poorer world for everybody.

With its irresponsible borrow-and-spend ways, the U.S. government is, unfortunately, not alone. Most, if not all, world governments are hanging out in very bad company.

Wrong in every regard. Not just wrong but diametrically wrong, pitifully wrong, harmfully wrong.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY