1. Monetary sovereignty means the federal government has unlimited control over its own currency. It establishes all the laws that govern the creation and value of dollars.

At its discretion, the government can create, destroy, and revalue dollars. Therefore, it does not need to tax, borrow, or have any income to spend as it wishes. It can set inflation at any level it deems appropriate.

It makes all the decisions concerning dollars.

2. Gap psychology suggests that individuals tend to distance themselves from those with lower income, wealth, or power, while seeking proximity to those with higher income, wealth, or power.

Since “rich” is a relative term, increasing one’s wealth requires widening the income, wealth, and power gap below while narrowing the gap above.

(A person who has $10,000 is rich if everyone else has $2,000, but he is poor if everyone else has $50,000.)

This is accomplished by gaining more for oneself and/or by forcing others to have less. Thus, impoverishing those below or above makes one richer, while enriching those below and/or above makes one poorer.

Wealthy individuals in America, as well as in many other countries, influence the flow of information and the development of laws by financing various sectors. They support the media through advertising dollars and ownership, support economists through university funding and job offers, and fund politicians through campaign contributions and promises of future employment opportunities.The American voting public is subject to misinformation and disinformation regarding Monetary Sovereignty and the realities of Gap Psychology.

The public falsely is told that federal Monetary Sovereignty is the same as private sector monetary non-sovereignty, which would mean the federal government would not control the currency it creates out of thin air.

As a result of this misinformation/disinformation campaign, the public often unknowingly votes against their own interests.

People have been told that federal spending to narrow Gaps is unaffordable, unsustainable, and causes inflation. As an easily avoidable result, poverty, hunger, homelessness, lack of education, and gap-widening continue.

Here are examples of newspaper articles promulgating the myths that bind us to failure:

March 8, 2023 Biden plans new taxes on the rich to help save Medicare Justin Sink and Josh Wingrove, Bloomberg News

Federal taxes do not fund federal spending. Money creation does. Therefore, new taxes on the rich will not “save Medicare.”

The government already has the infinite power to fund a comprehensive, no-deductible Medicare for every man, woman, and child in America. No federal taxes are needed or used.

By positioning the plan as requiring increased taxes on the rich, Biden dooms it to pushback from the most powerful influencers in America.

WASHINGTON — President Joe Biden’s budget will propose hiking payroll taxes on Americans making over $400,000 per year and allowing the government new power to negotiate drug prices as part of an effort the White House says will extend the solvency of a key Medicare program for another quarter century.

Both “hiking payroll taxes” and “negotiating drug prices” would unnecessarily take dollars from the private sector (aka “the economy. Biden’s proposal, though perhaps well-meaning, is recessionary. It also is unlikely to pass Congress.

Because the US government is infinitely solvent, every agency is as solvent as Congress and the President want it to be.

Medicare, a government agency, is as solvent as Congress and the President want it to be, just as other agencies — the military, SCOTUS, Congress, and the White House — are as solvent as our leaders wish them to be.

Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency.”“The budget I am releasing this week will make the Medicare trust fund solvent beyond 2050 without cutting a penny in benefits,” Biden said Tuesday in an op-ed published in the New York Times shortly before the announcement. “

In fact, we can get better value, making sure Americans receive better care for the money they pay into Medicare.”

Every dollar paid into the Medicare “trust fund” is destroyed upon receipt.

All those dollars come from the M2 money supply measure, and when they reach the Treasury, they instantly disappear from any money supply measure. Thus, they functionally are destroyed.

The Medicare “trust fund” is not a real trust fund. A “trust fund” implies a secure source of funding. However, a federal trust fund is simply an accounting mechanism used to track inflows and outflows; it does not set aside receipts or invest them in private assets.

In private-sector trust funds, receipts are deposited and assets are held and invested by trustees on behalf of the stated beneficiaries. In federal trust funds, the federal government merely tracks receipts and disbursements. The receipts are recorded as accounting credits in the “trust funds,” and then combined with other receipts that the Treasury collects and spends.

Further, the federal government owns the accounts and can, by changing the law, unilaterally alter their purposes and raise or lower collections and expenditures.

At the touch of a computer key, the US federal government could double or triple the number of dollars in the Medicare “trust fund,” without collecting a penny more or less in taxes.

The crocodile tears for the impending “insolvency” of the trust fund are a stage performance for the uninformed voters.

At this point, it’s appropriate to mention that despite disinformation to the contrary, federal deficit spending is not “socialism.” Socialism is government ownership of production and distribution, not government spending.

The word “socialism” is used as an epithet to convince the naive public not to ask for federal benefits.

The president’s budget, which will be released Thursday, proposes raising Medicare taxes from 3.8% to 5% on annual income above $400,000, and eliminating a loophole business owners and higher-earners can exploit to avoid additional taxes, according to a White House fact sheet.

The sole benefit, if the dollars actually are collected, would be to narrow the Gap between the rich and the rest, while impoverishing the economy.

But the rich will find loopholes to exploit, so the whole proposal is a combination of misinformation and naivety.

To the extent the federal government successfully cuts prescription costs, fewer dollars will flow from the Monetarily Sovereign US government to the monetarily non-sovereign private sector, a recessionary effect.Biden’s plan would also help bolster Medicare reserves through some $200 billion in prescription drug reforms over the next decade by allowing the insurance program to negotiate costs on more medications and sooner after they come to market.

The moves are part of a concerted effort by the White House ahead of looming negotiations over the debt ceiling and government funding, where Republicans vow to seek deep cuts to federal spending.

The debt ceiling is an anachronism based on ignorance. It does nothing to eliminate future spending, but risks punishing legitimate creditors to the federal government, a potentially earth-shattering event.

Though Republicans claim to want spending cuts, they had been unable to identify significant areas for reductions. Now, they are aiming at previously “untouchable” defense, education, health care, welfare, pensions, and interest, which account for 93% of the budget.

The Republicans never wish to cut Defense because defense contractors are big, powerful providers of campaign cash.

Republicans would love to cut Education, Health Care, Welfare, or Pensions, but that might cost them votes, and they already have enough election problems with their stance on abortion.

With high inflation, it’s untouchable because of their legal commitments and the false narrative that high rates fight inflation. By subscribing to myths, the Republicans have backed themselves into a corner.

The only sensible and honest step would be to:

- Eliminate the debt ceiling.

- Acknowledge the fact that a Monetarily Sovereign government neither needs nor uses tax dollars or borrowing, because it pays all its dollar obligations by creating new dollars, ad hoc.

- Acknowledge the fact that inflations are caused not by federal spending but rather by scarcities of key goods and services (energy, food, construction materials, electronic parts, labor, etc.) and that these scarcities can be cured by federal deficit spending to obtain and distribute the scarce items.

Unfortunately, the government has devoted so much time and money to promulgating myths that it is now unable or unwilling to promulgate the facts.

House Speaker Kevin McCarthy has vowed the GOP won’t touch Medicare or Social Security, programs that share bipartisan support, particularly among elderly voters.

But Democrats, including Biden, have repeatedly highlighted past GOP efforts to overhaul the entitlement programs by reducing eligibility or benefits.

Ahead of the budget release, White House officials have challenged McCarthy to specify where he would pursue cuts.

The Republicans likely will settle for either or all of three demands:

- Demand cuts to Healthcare by cutting Obamacare and increasing deductibles and age requirements for Medicare and/or

- Demand cuts to poverty aids and/or

- Demand cuts to Social Security via increases in age requirements.

Democrats are hoping Biden’s budget, which would reduce the deficit by $2 trillion over the next 10 years, will provide a political advantage by keeping benefits intact, with higher taxes on the wealthy helping to offset rising costs.

Because federal taxes are destroyed upon receipt, they would offset nothing. But, in the unlikely event that taxes are appropriately administered, they would help narrow the Gap between the rich and the rest.

That is why the Republicans will not allow higher taxes, but instead might risk opting for the 1-3 (above) penalties against the “not-rich.”

Medicare’s Hospital Insurance Trust Fund, also known as Part A, pays for hospital stays, nursing facilities, and hospices.

It is currently projected to reach insolvency as soon as 2028, according to the most recent Medicare Trustees report.

“This modest increase in Medicare contributions from those with the highest incomes will help keep the Medicare program strong for decades to come.

My budget will make sure the money goes directly into the Medicare trust fund, protecting taxpayers’ investment and the future of the program,” Biden said in his op-ed.

Neither the federal government nor any federal agency can be insolvent unless Congress and the President so decide. Tax dollars do not go anywhere. They are destroyed. The “trust fund” is replenished at the whim of Congress through legislation.

It’s important to note that Medicare Part B, like military spending, is funded through federal spending rather than specific taxes. While all of Medicare could be financed in this manner, it is complicated by the existence of a misleading “trust fund.”

Proposed changes to Medicare’s ability to negotiate prescription drugs would also benefit seniors on Medicare by lowering their out-of-pocket costs, the White House says.

Biden’s budget will specifically propose capping the cost of certain generic drugs, like those used to treat hypertension and high cholesterol, to $2 per prescription per month.

The budget also eliminates the fee patients have to pay on up to three mental or behavioral health visits per year.

The negotiation of prescription drug prices accomplishes nothing for the government and impoverishes drug manufacturers and the private sector. The federal government has the infinite ability to pay for drugs, whatever their prices.

Sending fewer dollars to the health care industry will cut economic growth.

========================================Biden to offer deficit reduction plan Tax proposals are aimed at trimming $3T over 10 years By Jim Tankersley The New York Times

WASHINGTON — President Joe Biden on Thursday will propose policies aimed at trimming federal budget deficits by $3 trillion over the next 10 years as his administration embraces the politics of debt reduction amid a fight with Republicans over raising the nation’s borrowing

Trimming $3 trillion from the federal budget is identical to taking $3 trillion from the private sector, which unnecessarily will reduce Gross Domestic Product growth and usually causes a recession.

As always, ignorance about Monetary Sovereignty will lead to economic hardship. That is the usual effect of ignorance.

House Republicans have refused to raise the nation’s debt limit, which caps how much money the federal government can borrow, unless Biden agrees to steep cuts in federal spending.

To help increase federal revenues and reduce the nation’s reliance on borrowed money, Biden is expected to announce a new tax on American households worth more than $100 million that would apply to both their earned income and the unrealized gains in the value of their liquid assets, like stocks.

:max_bytes(150000):strip_icc()/oasis-with-palm-trees-in-the-middle-of-desert-157192238-bc7670d8152441aca329a8b94410ed2a.jpg)

Taking dollars from the private sector and sending them to the US Treasury is like pumping water from an oasis and pouring it into the sea.

The voting public does not understand that it makes no sense to take dollars from the economy, which relies on dollars for growth, and give them to the federal government, which can create dollars at will.

Taking federal taxes from the private sector is like pumping water from an oasis and pouring it into the sea.

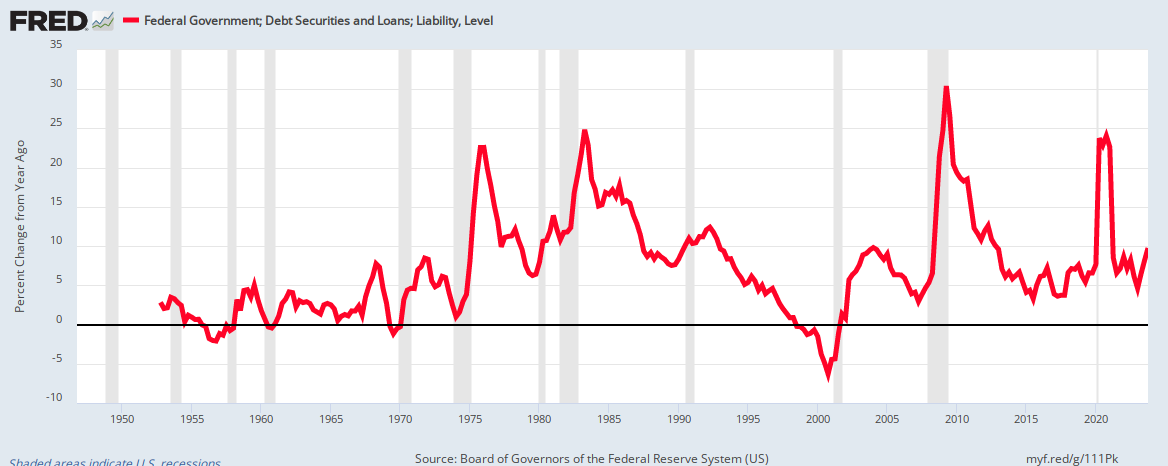

The federal government has run deficits every year since 2000, spending more money than it receives in tax revenue.

Translation: The economy has received more dollars from the government than it has sent to the government. This is necessary for economic growth.

The deficit ballooned under President Donald Trump after the onset of the pandemic recession, which spurred Congress to approve trillions of dollars in relief for individuals, businesses and state and local governments.

It remained elevated in 2021 under Biden, who signed a $1.9 trillion economic aid package he signed soon after taking office, but declined last year.

Deficit spending under Trump and Biden prevented recessions that otherwise would have been caused by COVID-related shortages.

Federal deficit spending grows the economy. The lack of federal deficit spending causes recessions. This lesson has not been acknowledged by Congress, the President, or the voting public.

The nonpartisan Congressional Budget Office projects the deficit will grow slightly this fiscal year, to $1.41 trillion from $1.375 trillion, then continue to rise for the course of the decade, topping $2 trillion in 2032.

Translation: The federal government is projected to pump 1.41 trillion to three trillion growth dollars into the economy.

From 2024 to 2033, the budget office projects, deficits will total more than $20 trillion, driving gross federal debt to nearly $52 trillion.

Translation: The budget office projects that the Monetarily Sovereign US government will have pumped a net total of 52 trillion growth dollars into the economy, at no cost to taxpayers (Taxes don’t fund spending).

Through laws he has signed and executive actions he has issued, Biden has approved policies that would add about $5 trillion to the national debt over a decade, according to estimates by the Committee for a Responsible Federal Budget in Washington.

Translation: The CRFB projects that $5 trillion will be added to Treasury Security deposits over the next 10 years.

Summary Monetary Sovereignty and Gap Psychology are two of the most essential realities of the US economy. Because the public has not been given the facts about these realities, voters have voted against their own best interests.

The current budget stalemate between the Republicans and Democrats is a manifestation of the misinformation/disinformation campaigns so detrimental to the US economy, and especially to Americans who are not rich.

Ignorance is expensive.

Rodger Malcolm Mitchell Monetary Sovereignty Twitter: @rodgermitchell Search #monetarysovereignty Facebook: Rodger Malcolm Mitchell……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY

We’re headed for the Big Showdown. Ultimately it’s Truth vs Lie, what works vs what doesn’t.

LikeLike

Mr. Mitchell, I just wanted to say that your tireless efforts over the years to combat the ignorance do not go unnoticed or unappreciated. We are forever grateful.

LikeLike

Thank you, Robin.

LikeLike

Hi Rodger,

I just got this message from a Jeff this is his message

“That’s why I have again joined forces with 50 senators to introduce the DISCLOSE Act. The DISCLOSE Act is a bicameral bill that would end the corrupting influence of dark money, shine a bright light of transparency on political spending, and make government more accountable to the will of voters.”

I think it would be good if you explained your position about Monetary Sovereignty including Federal Government spending!

Thanks Penny

LikeLike

Explained to whom, Penny?

LikeLike

No to Jeff a senator from Oregon he sends out newsletters like this one. I think he would listen and understand your ideas and use them to enlighten the 50 others. They can maybe include and talk to republican Senators that would listen and understand your ideas. Right?

“My colleagues and I are supposed to work for ‘We the People’ – for waitresses and truck drivers and home health aides and firefighters, not for the tiny fraction of the top one percent who have hoarded enough wealth to fund super PACs.

Abraham Lincoln said it best: The United States is a “government of the people, by the people, for the people.” The people elect us. The people are in charge. But this idea, this vision, this government by and for the people cannot survive if our elections are not open, fair, and free.

Dark money allows for donors with special interests to hide their identities, making it impossible for Americans to know who is behind the massive flow of money into our elections and what motivates them.

That’s why I have again joined forces with 50 senators to introduce the DISCLOSE Act. The DISCLOSE Act is a bicameral bill that would end the corrupting influence of dark money, shine a bright light of transparency on political spending, and make government more accountable to the will of voters.

I have spent years strongly supporting and advocating for the DISCLOSE Act, which was included in the For the People Act that I authored, and have worked tirelessly over the years to bring awareness to this bill to get it passed. There’s no place in our democratic republic for hidden expenditures by special interests to influence our elections. I call upon and urge all my colleagues to support this legislation, put the interests of the American people over those of powerful special interests, and stop billionaires from secretly buying our elections.

I won’t stop fighting to restore public trust in our elections and our government. You have my word.”

All my best,

Jeff

LikeLike

You wouldn’t have to go after “dark money” either. Just your idea about fed gov spending and how to make that spending better for those at the bottom on up without runaway debt and inflation

LikeLike