Mitchell’s laws: The more budgets are cut and taxes inceased, the weaker an economy becomes. To survive long term, a monetarily non-sovereign government must have a positive balance of payments. Austerity = poverty and leads to civil disorder. Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

==========================================================================================================================================

While marchers here in Chicago, protest against major, multi-national, public and private organizations, it seems appropriate to mention the International Monetary Fund (IMF)

The (IMF) touts its mission this way: “The International Monetary Fund (IMF) is an organization of 188 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world.”

Mostly, it has done the exact opposite. The fundamental reason is the IMF’s ignorance of Monetary Sovereignty, the basis for all modern economics.

A Monetarily Sovereign government has the power to create unlimited quantities of its own sovereign currency. It is constrained neither by taxes nor by borrowing. Federal taxes and borrowing could fall to $0, and federal spending could double or triple or grow with no limit at all – constrained only by inflation.

So while the U.S. federal government never can be “broke,” as John Boehner famously lied, nor must it live within its “means,” (it has no “means”) as so many pundits falsely claim, there is but one limit to money creation, and that limit is inflation.

Yet, contrary to popular belief, reaching that limit is extremely rare, perhaps one of the rarest events in modern economics.

The International Monetary Fund maintains a website devoted to educating the public about economics. I cannot recommend this site. The IMF lives in a world of obsolete economics, while the rest of us work within the current realities of Monetary Sovereignty.

The sole reason to visit the site is to understand the popular (false) wisdom of the day, and in this way, to understand the failure of the IMF to reach its stated goals. For example, here are excerpts from their site, regarding inflation:

What creates inflation?

Long-lasting episodes of high inflation are often the result of lax monetary policy. If the money supply grows too big relative to the size of an economy, the unit value of the currency diminishes; in other words, its purchasing power falls and prices rise. This relationship between the money supply and the size of the economy is called the quantity theory of money, and is one of the oldest hypotheses in economics.

Yes, this is exactly what the public believes, i.e, when the government “prints” too much money, the U.S. has inflation.

First, the government doesn’t “print” money; money has no physical existence, so it can’t be printed, touched, mailed, smelled, burned, crumpled or stored. No one on earth, ever has seen money.

Money is nothing more than an accounting notation. A dollar bill is not money. It merely is an official statement that the holder owns money.

“Print” is yet another word used incorrectly in economics (along with “debt,” “deficit,” etc.) that misleads, because its popular meaning differs from its economic meaning. In economics, “print” really means “create.”

That said, the real question is: Does “printing” or creating money cause inflation? Is inflation really, as the common expression goes, “Too much money chasing too few goods and services?”

The answer is, “Yes and no.” Yes, if the U.S. federal government immediately created (by deficit spending) $900 trillion, I suspect there would be a world-wide inflation. But barring that extreme example, there simply has been no relationship between federal deficit spending and inflation.

The inflation fears of the debt hawks have no basis in reality. While “too much money / too few goods” may sound logical, it is not historically factual. It can exist only in some hypothetical, extreme, almost never-seen situation.

The reason has to do with the new, worldwide markets. “Too few goods” seldom can exist, today. If one nation runs short of something, buyers get it from another nation. The world has changed, while IMF economics has not changed with it.

The IMF’s “educational” site also says:

How policymakers deal with inflation

The right set of anti-inflation policies, those aimed at reducing inflation, depends on the causes of inflation. If the economy has overheated, central banks—if they are committed to ensuring price stability—can implement contractionary policies that rein in aggregate demand, usually by raising interest rates.

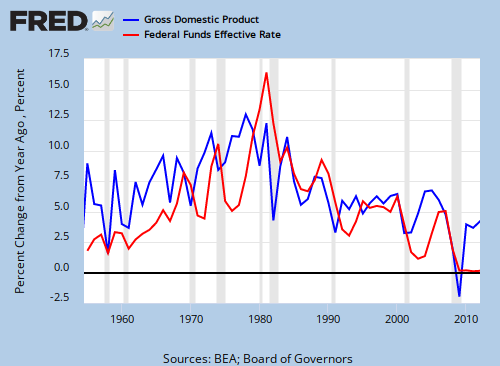

This too is a popular belief, that high interest rates reduce demand, and it too is false. If high rates did inhibit demand, we would expect to see a correspondence between high rates and reduced Gross Domestic Product (GDP).

Yet, we see no such thing. In fact, to a slight degree, we see the opposite: High rates actually stimulate demand:

The probable reason: High rates force the federal government to pay more interest, thereby pumping more money into the economy, which is stimulative.

The Fed does raise interest rates too fight inflation, not because they reduce the demand for goods and services but because high rates increase the reward for owning money, thereby increasing the demand for money. Making money more valuable fights inflation.

The bottom line: The IMF subscribes to obsolete bits of popular wisdom about economics, which explains why it tries to solve the indebtedness of monetarily non-sovereign nations by lending them even more money, when these nations cannot service the debt they already have, then demanding that these nations cease stimulative spending and increase anti-stimulative taxing.

The IMF, having learned little about economics during the past 40 years, prescribes leeches to cure anemia, much to the detriment of the world.

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

![]()

==========================================================================================================================================

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia. Two key equations in economics:

Federal Deficits – Net Imports = Net Private Savings

Gross Domestic Product = Federal Spending + Private Investment and Consumption + Net exports

#MONETARY SOVEREIGNTY

[1] The IMF has been a “failure” if we naively believe the IMF’s own mission statement. However, if we admit that the IMF, from its very beginnings at Bretton Woods, has always been designed to further enrich the global 1%, while reducing billions of people to poverty and debt slavery, then the IMF has been a success.

[2] I do not agree that the IMF is ignorant about monetary sovereignty, nor that the IMF “lives in a world of obsolete economics.” I say the IMF’s leaders (e.g. Christine Lagarde) are acutely aware of monetary sovereignty, and are dedicated to keeping it for themselves. The IMF, ECB, and World Bank all want big private banks, global corporations, and the FIRE sector to control the world economy. They do NOT want any nation to have monetary sovereignty. They do NOT want governments (i.e. the masses) to control the world economy. Their goal is a one-world super-bank in which 1% of mankind lives in splendor, and the other 99% of humanity remains forever in prison, or in permanent debt slavery, toiling in sweat-shops.

I say that anyone who thinks the IMF, ECB, or World Bank have honorable (albeit erroneous) motives is either a moron or a shill.

[3] I do not agree that the USA has monetary sovereignty. For true monetary sovereignty, we would need a genuinely public Fed that is not a private cartel with a monopoly. Monetary sovereignty is not held by the US government, but by the multi-national too-big-to-fail banks and bond marfkets, who form a separate meta-nation that rules all. As long as this meta-nation has monetary sovereignty, such that our currency and central banks remain privately owned and controlled, we will remain in this Depression.

Welcome to permanent austerity.

[4] I agree that the only limit to money creation is inflation.

[5] Roger has his inviolable “Mitchell’s laws” that are 100% valid. I have my own law, which says, “Never ascribe to ignorance that which is easily exposed as malice, or greed.”

The leaders of the IMF, ECB, and World Bank are not stupid. They are evil and greedy.

LikeLike

Too few produced goods might not exist in today’s modern world, but oil is in limited supply either by nature or by the dictates of the Cartel. Oil is priced in US dollars.

Would “too many dollars” cause a rise in oil prices, which you have stated is the cause of inflation?

LikeLike

Doesn’t seem to be the case.

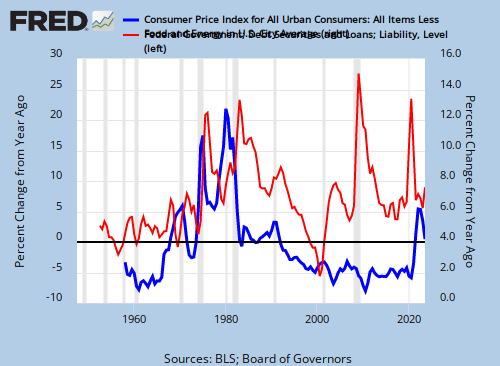

If it were, we would see a relationship between total money supply and inflation, which clearly we do not see:

and

LikeLike

I’m concerned with MMT’s condemnation of pump-priming because it partly aligns them with people who claim government spending causes inflation. Randy Wray wrote the following words about a month ago:

“OK, explain to me how pumping up the demand for higher skilled and educated workers—setting off a bidding war for them—will cause jobs to trickle down to the less skilled and less educated workers WITHOUT causing wages and prices to rise.”

This sounds like something that could have been written by the IMF.

LikeLike

As with all sciences, MMT does not present a united front. And Monetary Sovereignty disagrees with MMT on several questions. People see the same facts in different ways.

Not seeing the original comment, I’m not sure how one “pumps up the demand for higher skilled and educated workers.” Do you know how?

So far as I can guess, Randy seems to be talking about an inflation caused by a shortage of workers, an obsolete concept. I’m amazed Randy still believes that old chestnut, since it never happens, and to my knowledge, never has happened.

In answer to his request for an explanation, I would say, “Randy, if U.S. workers demand higher wages, companies simply will go overseas for goods and services, and/or there will be increased pressure for machines to do the work of people.”

LikeLike

I think one pumps up “demand for higher skilled and educated workers” by pumping up aggregate demand, which would force employers to seek skilled and educated workers.

Dr. Wray’s entire blog post can be found here: http://neweconomicperspectives.org/2012/04/mmp-blog-48-is-the-job-guarantee-necessary.html

In recent months, prominent members of MMT have been criticizing government stimulus as inflationary, which places them in agreement with Ron Paul.

LikeLike

Tyler,

If any MMTers have said stimulus is inflationary, where’s the inflation? How do they explain this graph?

LikeLike

Rodger,

MMT’s position on stimulus is more nuanced than I’ve stated. They believe pump-priming is inferior to JG because it will cause inflation when we near full employment. You told me this a week ago, and I’ve just taken some time to grasp it. I appreciate your patience.

Thanks,

Tyler

LikeLike

Yes, that is the MMT hypothesis, and they may be right — with one small caveat. We never have had a full employment inflation, and the likelihood of having an employment-driven inflation is remote.

In this world economy, a worldwide cause is required for a inflation effect. Currently, the only foreseeable worldwide cause is an oil shortage. A shortage of employees in America probably would not cause an inflation in America, simply because consumers could get goods and services from overseas.

I personally believe the notion of an employment-driven inflation not only is obsolete, but that full employment itself has become less likely in this technology-dominated economy, where one person can do what a dozen used to do.

Rodger Malcolm Mitchell

LikeLike