It takes only two things to keep people in chains: The ignorance of the oppressed and the treachery of their leaders.

………………………………………………………………………………………………………………………………………………………………………………

Humans lie. Even animals lie.

Lies have many advantages. The so-called “white lie” is a social method that is welcome and considered courteous. On many occasions, it would be rude to tell someone the truth. (“Your plastic surgery makes you look ugly.” “Your child is stupid.”)

Lying can build relationships, and even when the recipient of a lie knows it’s a lie, the lie and the liar are appreciated. The harm of a social lie is minimal compared to the benefit.

Lying, in of itself, is part of the normal human experience. Humans tend to accept and believe lies. Otherwise, humans wouldn’t lie, as acceptance and belief are the purpose.

Some political lies are beneficial to humanity.

Ozone in the atmosphere helps protect us from solar radiation. You’ve heard of the “ozone hole.” It’s a hole in the air above the north and south pole, that lets in dangerous radiation — except, there is no “hole.” There is some depletion, much of it natural and cyclical, but the notion of a “hole” is a lie.

The value of the ozone “hole,” or more specifically the value of calling it a “hole,” is that it creates a picture in our minds.

This picture makes us amenable to paying the cost and suffering inconvenience of eliminating chlorofluorocarbons(CFCs), halons, and other ozone-depleting chemicals, which are used in air conditioning and spray propellants.

So the hole is a lie, but it’s a “good lie.” The harm is minimal compared to the benefit.

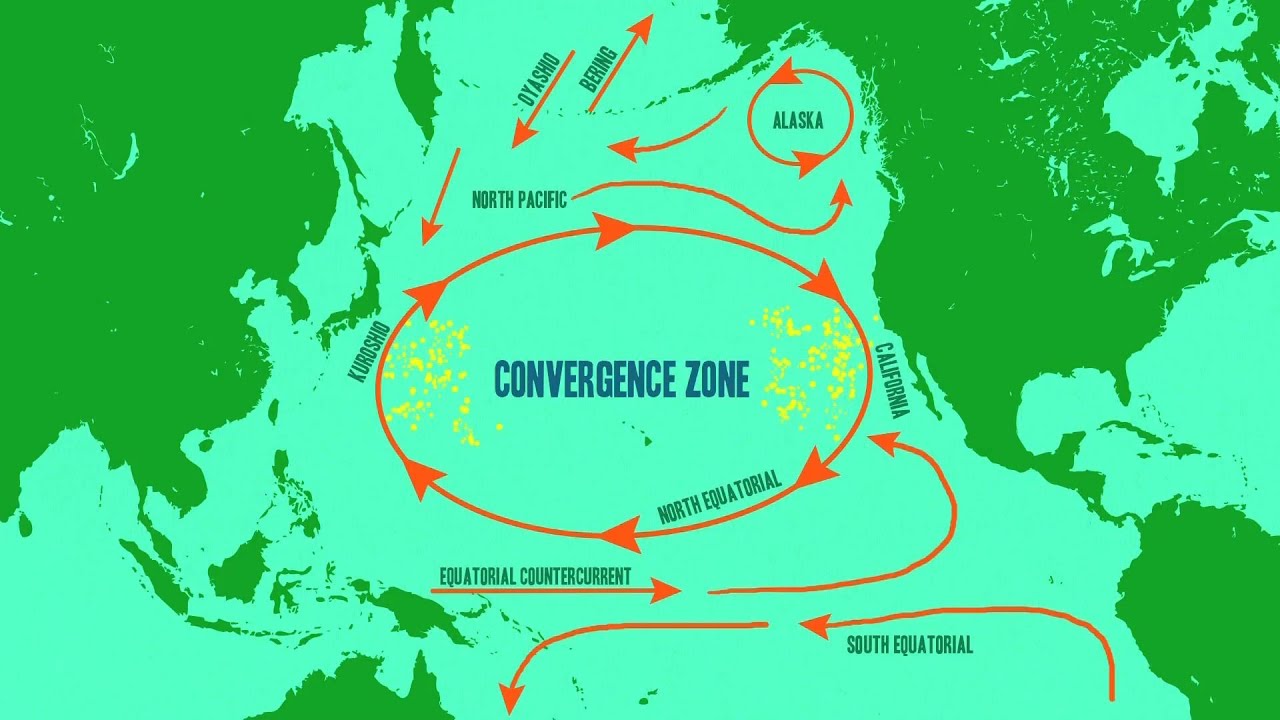

The Pacific Garbage Patch

In the same vein, you may have heard of the “Great Pacific Garbage Patch.” It’s an area of the Pacific Ocean where the natural currents create a swirl that entraps all floating trash, which builds up into piles of plastic, wood, bottles, sludge, chemicals, and other floatables.

It is a disgusting example of how mankind is polluting even our largest ocean, and is a good reason why we should exert every effort to reduce pollution — except the Great Pacific Garbage Patch is a lie. It doesn’t exist, at least not the way you might visualize it.

The words probably draw to your mind a picture of a huge floating island of garbage, but in fact, the “Great Pacific Garbage Patch” is invisible. It merely is an area of the ocean that has a slightly higher concentration of particulate matter, especially plastic particles. You could boat or even swim right through it and not realize it.

The problem is that when fish swim through it, a few of those tiny plastic particles might be ingested and enter their flesh, and when we eat those fish, the plastic enters our bodies, with potentially harmful physical effects.

The value of the “Great Pacific Garbage Patch” lie is that by drawing a vivid pollution picture, it might encourage stricter anti-pollution laws (except under the current American political administration, which seems not to worry about pollution).

So it’s a lie, but a “good” lie. The harm is minimal compared to the benefit.

Because lying is such a common part of our daily experience, we have evolved ways to deal with lies. To survive in our society, we must know which lies to accept as courteousness, which to believe as fact, and which to disbelieve.

And it isn’t easy.

There are several aspects to lies that help make them seem believable, among which are:.

- Source: Do we trust the source delivering the lie?

- Logic: Does the lie sound reasonable?

- Desire: Do we have a personal motive to believe the lie?

- Repetition: Does the lie square with what we previously have heard?

On this site, we often discuss “The Big Lie,“ a group of lies that deny Monetary Sovereignty. Within that group of lie are such statements as:

*Federal finances are like your personal finances (They aren’t.)

*Federal taxes fund federal spending. (They don’t.)

*The federal deficit and debt are unsustainable (They aren’t.)

*Federal spending causes inflation (It doesn’t.)

*And the federal government can run short of its own sovereign dollars. (It can’t.)

Though this blog discusses, in detail, why each of these statements is false, many people resist the facts. That is, despite proof showing otherwise, they continue to believe the lie, because.

- Trusted sources like the media, the politicians, and many economists promulgate The Big Lie.

- Because The Big Lie equates federal financing with people’s own personal financial experience, the lie sounds reasonable.

- People want to believe The Big Lie because it justifies their desire to cut benefits to those who are poorer.

- The incessant, unrelenting repetition of the lie.

The Big Lie is harmful because it vindicates widening the Gap between the rich and the poor. It justifies reductions in federal spending for such social programs as Medicare, Medicaid, Social Security, poverty aids, education aids and other benefits for the “not-rich.”

It condones the easing of federal regulations meant to stop criminal bankers. It rationalizes the reduction in budgets for food, drug, and environmental protections. It reduces federal spending that grows the economy.

The Big Lie clearly is harmful, but does it have any redeeming qualities?

Some would say, “Yes.” They would say The Big Lie discourages Americans from constantly asking the federal government for benefits and it lessens the likelihood Congress will provide an endless succession of those benefits.

They would say that without The Big Lie, federal politicians, hoping to please constituents with gifts and tax cuts, would be helpless to prevent the massive growth of federal spending.

Said as briefly as possible, The Big Lie prevents “excessive” deficit spending. And that leaves us with a question: What is “excessive” deficit spending?

There are those of a Libertarian bent, who believe the federal government is too big and powerful (to use their favorite word a “Leviathan”), and most or even any deficit spending is too much.

That belief cannot be argued. There is no proof possible that the federal government is “too big.” It is an emotional, not a factual, judgment.

We can observe however that in 1940, the federal “debt” was $40 billion, and some called it a “ticking time bomb.” Today, it is $14 trillion, and that time bomb still is ticking.

We also can observe that every recession and nearly every depression has been introduced by reduced deficit growth, and every recession and depression has been cured by increased deficit growth.

Then, there are those who believe “excessive” federal deficit spending causes inflations, even Zimbabwe-style hyperinflations.

However, we can observe that despite periods of massive deficit spending, the U.S. never in its history has had a hyperinflation.

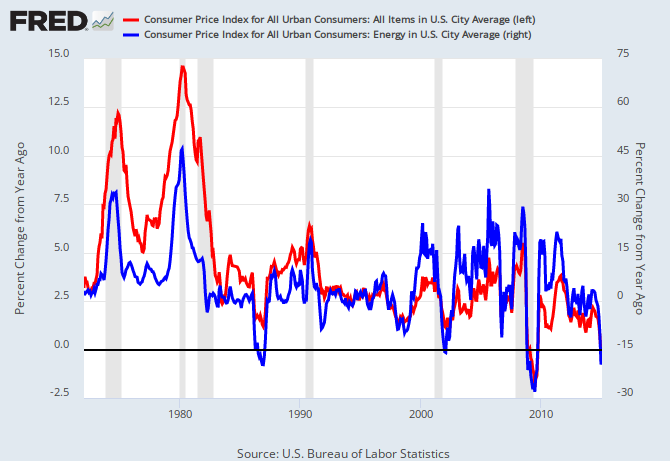

And we can observe that even with the massive deficit spending that brought us out of the “Great Recession” of 2008, and which has continued to this day, our rate of inflation is somewhat lower than the Fed’s target of about 2.5%. The reasons:

- World inflation is caused by oil prices.

- The Fed controls U.S. inflation by increasing the Demand for the dollar, via interest rate control.

Finally, what about the theoretical helplessness of politicians to resist demands for deficit spending, if the public realized the federal government cannot run short of dollars, and does not use tax dollars?

- Politicians already yield to demands for gifts and tax cuts — but from their biggest contributors, the rich. Public understanding of Monetary Sovereignty would put the 99.9% on a par with the richest .1%.

- Deficit spending and tax cuts stimulate economic growth and enrich the populace, especially the 99.9% who benefit from social spending, the largest part of the federal budget. Cuts to regressive taxes — FICA, sales taxes, and remarkably even net income taxes (after special deductions for the rich) also would benefit the 99.9%.

And would the politicians really be “helpless”? Today’s politicians already resist deficit spending. They do it by telling a lie, The Big Lie: “Taxpayers and the government can’t afford it.”

They just as well could resist deficit spending by telling the truth:

Deficit spending is limited only by an inflation the Fed cannot control via interest rates.

The Fed already determines current and future inflation. It adjusts interest rates upward when it believes inflation will rise above its target rate of about 2.5%. It lowers rates when it believes inflation will fall below its target rate.

The Fed alrady acts not only as a control but as a barometer.

If the Fed ever merely were to announce, “We predict inflation will be too high and we will not be able to control it reasonably close to our 2.5% target,” the politicians could use that announcement, not The Big Lie, as their excuse to resist further federal spending, or even to cut federal spending.

In summary, there are no excuses for The Big Lie. There is no value to The Big Lie. The harm is enormous compared to the non-existent benefit.

How about telling The Big Truth: Monetary Sovereignty.

Rodger Malcolm Mitchell

Monetary Sovereignty

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

The single most important problems in economics involve the excessive income/wealth/power Gaps between the have-mores and the have-less.

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Implementation of The Ten Steps To Prosperity can narrow the Gaps:

Ten Steps To Prosperity:

1. ELIMINATE FICA (Ten Reasons to Eliminate FICA )

Although the article lists 10 reasons to eliminate FICA, there are two fundamental reasons:

*FICA is the most regressive tax in American history, widening the Gap by punishing the low and middle-income groups, while leaving the rich untouched, and

*The federal government, being Monetarily Sovereign, neither needs nor uses FICA to support Social Security and Medicare.

2. FEDERALLY FUNDED MEDICARE — PARTS A, B & D, PLUS LONG TERM CARE — FOR EVERYONE (H.R. 676, Medicare for All )

This article addresses the questions:

*Does the economy benefit when the rich can afford better health care than can the rest of Americans?

*Aside from improved health care, what are the other economic effects of “Medicare for everyone?”

*How much would it cost taxpayers?

*Who opposes it?”

3. PROVIDE A MONTHLY ECONOMIC BONUS TO EVERY MAN, WOMAN AND CHILD IN AMERICA (similar to Social Security for All) (The JG (Jobs Guarantee) vs the GI (Guaranteed Income) vs the EB (Economic Bonus)) Or institute a reverse income tax.

This article is the fifth in a series about direct financial assistance to Americans:

Why Modern Monetary Theory’s Employer of Last Resort is a bad idea.Sunday, Jan 1 2012

MMT’s Job Guarantee (JG) — “Another crazy, rightwing, Austrian nutjob?”Thursday, Jan 12 2012

Why Modern Monetary Theory’s Jobs Guarantee is like the EU’s euro: A beloved solution to the wrong problem. Tuesday, May 29 2012

“You can’t fire me. I’m on JG” Saturday, Jun 2 2012

Economic growth should include the “bottom” 99.9%, not just the .1%, the only question being, how best to accomplish that. Modern Monetary Theory (MMT) favors giving everyone a job. Monetary Sovereignty (MS) favors giving everyone money. The five articles describe the pros and cons of each approach.

4. FREE EDUCATION (INCLUDING POST-GRAD) FOR EVERYONE Five reasons why we should eliminate school loans

Monetarily non-sovereign State and local governments, despite their limited finances, support grades K-12. That level of education may have been sufficient for a largely agrarian economy, but not for our currently more technical economy that demands greater numbers of highly educated workers.

Because state and local funding is so limited, grades K-12 receive short shrift, especially those schools whose populations come from the lowest economic groups. And college is too costly for most families.

An educated populace benefits a nation, and benefitting the nation is the purpose of the federal government, which has the unlimited ability to pay for K-16 and beyond.

5. SALARY FOR ATTENDING SCHOOL

Even were schooling to be completely free, many young people cannot attend, because they and their families cannot afford to support non-workers. In a foundering boat, everyone needs to bail, and no one can take time off for study.

If a young person’s “job” is to learn and be productive, he/she should be paid to do that job, especially since that job is one of America’s most important.

6. ELIMINATE FEDERAL TAXES ON BUSINESS

Businesses are dollar-transferring machines. They transfer dollars from customers to employees, suppliers, shareholders and the federal government (the later having no use for those dollars). Any tax on businesses reduces the amount going to employees, suppliers and shareholders, which diminishes the economy. Ultimately, all business taxes reduce your personal income.

7. INCREASE THE STANDARD INCOME TAX DEDUCTION, ANNUALLY. (Refer to this.) Federal taxes punish taxpayers and harm the economy. The federal government has no need for those punishing and harmful tax dollars. There are several ways to reduce taxes, and we should evaluate and choose the most progressive approaches.

Cutting FICA and business taxes would be a good early step, as both dramatically affect the 99%. Annual increases in the standard income tax deduction, and a reverse income tax also would provide benefits from the bottom up. Both would narrow the Gap.

8. TAX THE VERY RICH (THE “.1%) MORE, WITH HIGHER PROGRESSIVE TAX RATES ON ALL FORMS OF INCOME. (TROPHIC CASCADE)

There was a time when I argued against increasing anyone’s federal taxes. After all, the federal government has no need for tax dollars, and all taxes reduce Gross Domestic Product, thereby negatively affecting the entire economy, including the 99.9%.

But I have come to realize that narrowing the Gap requires trimming the top. It simply would not be possible to provide the 99.9% with enough benefits to narrow the Gap in any meaningful way. Bill Gates reportedly owns $70 billion. To get to that level, he must have been earning $10 billion a year. Pick any acceptable Gap (1000 to 1?), and the lowest paid American would have to receive $10 million a year. Unreasonable.

9. FEDERAL OWNERSHIP OF ALL BANKS (Click The end of private banking and How should America decide “who-gets-money”?)

Banks have created all the dollars that exist. Even dollars created at the direction of the federal government, actually come into being when banks increase the numbers in checking accounts. This gives the banks enormous financial power, and as we all know, power corrupts — especially when multiplied by a profit motive.

Although the federal government also is powerful and corrupted, it does not suffer from a profit motive, the world’s most corrupting influence.

10. INCREASE FEDERAL SPENDING ON THE MYRIAD INITIATIVES THAT BENEFIT AMERICA’S 99.9% (Federal agencies)Browse the agencies. See how many agencies benefit the lower- and middle-income/wealth/ power groups, by adding dollars to the economy and/or by actions more beneficial to the 99.9% than to the .1%.

Save this reference as your primer to current economics. Sadly, much of the material is not being taught in American schools, which is all the more reason for you to use it.

The Ten Steps will grow the economy, and narrow the income/wealth/power Gap between the rich and you.

MONETARY SOVEREIGNTY