Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive, and the motive is the gap.

===================================================================================

One part of the Big Lie is the myth that we federal taxpayers pay for federal spending. We don’t.

The U.S. government, being Monetarily Sovereign has the unlimited ability to create its sovereign currency, the dollar. So it can pay any bill of any size, without tax dollars.

If all federal taxes fell to $0 or rose to $999 trillion, neither event would affect the federal government’s ability to pay all its bills.

Both political parties, and especially the right-wing, use the myth to justify increasing taxes on, and reducing benefits for, the lower 99.9% income/wealth/power group. (FICA increases and Social Security cuts are examples.)

Even children are fair game for the “compassionate right-wing” Washington Times:

Washington Times

Illegal immigrant children get first-class treatment at taxpayers’ expense

Special care for border surge youths at shelters stretches federal budget

Oh woe! Treating children with kindness stretches a non-existent “limit” to federal spending.

From culturally sensitive music to special meals for the lactose intolerant, the organizations the federal government is paying to house and care for the children who have surged across the border illegally are taking pains to make sure they are as comfortable as possible.

What!? Special meals for lactose intolerant children? Outrageous! Next thing you know, we’ll give them special medicines for their illnesses!

Dietitians scrutinize the menus each day to make sure they include enough whole grains but not whole milk. Counselors offer life skills classes in Spanish, and intensive English language training, including use of the Rosetta Stone program. Doctors and dentists treat the children at taxpayers’ expense — often the first medical care of the children’s lives.

Well this certainly is ridiculous: Making sure the children receive a healthful diet! And how are we expected to persecute them for not knowing English, if we teach them English??

And giving them medical treatment? Oh, what will those “libs” think of next?

Children are guaranteed the right to wear their own clothes, to have a private place to store belongings, to have guests, to send and receive uncensored mail, and to have phone privileges.

This is the last straw. Yes, we know these children seek asylum from horrifying, often deadly circumstances, but actually treating them like human beings? That’s going too far.

Documents from the program give a glimpse of the breadth and scope of the effort, which is eating up an ever-larger portion of the Health and Human Services Department’s budget, jumping from $305.9 million last year to $671.3 million so far in fiscal year 2014.

Do you wonder where that extra $366 million came from? Not from taxes or from taxpayers. The federal government simply created it, exactly the same way it creates every other federal dollar — the same way it created the first dollar in 1792.

(No one could pay taxes without the federal government first creating dollars, and to get to the point we are today, trillions more dollars needed to be created than taxes paid.)

And where do those dollars go?

Federal contracting records show that the David and Margaret Youth and Family Services, of La Verne, California, collected more than $3 million this year from HHS to care for the unaccompanied alien children.

Yes, the money goes to private businesses, that provide jobs to people in the communities in which the children are housed.

So bottom line, all the fake outrage about giving these homeless immigrant children “special care” merely is an extension of the Big Lie — the ongoing effort to widen the gap between the rich and the rest. The rich simply don’t want dollars going to the not rich.

It’s disgraceful that the rich continue to oppress the rest of us, with unnecessary taxes and cuts in social programs. But to extend that persecution all the way down to helpless children, really is beyond the pale.

Is this the America of which we are so proud? Is this what we will elect next year?

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

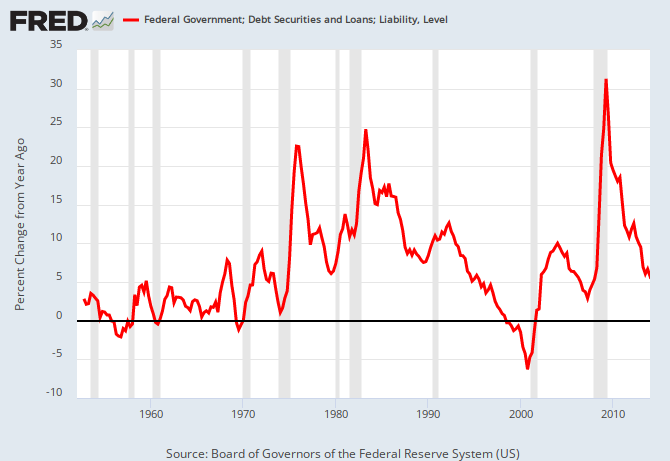

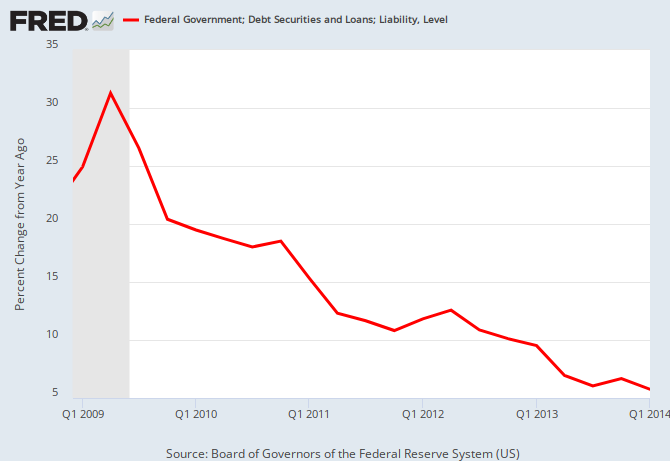

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY