Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive, and the motive is the gap.

===================================================================================

If you don’t already understand the differences between Monetary Sovereignty and monetary non-sovereignty, please click the above link before continuing.

Last year, we published “Why Detroit and Jonathan Tobin both are bankrupt.” A few key sentences from that post are:

Detroit et al are not sovereign over the dollar. Greece is not sovereign over the euro. In essence, the dollar and the euro are “alien” currencies, used courtesy of the Monetarily Sovereign U.S. government and the Monetarily Sovereign European Union.

It is an absolute rule of economics that a monetarily non-sovereign entity cannot survive long-term without money coming in from outside its borders. You and I are monetarily non-sovereign. To survive long term, we must have income. We could not survive by paying taxes to ourselves.

Similarly, no city, county or state in America can survive long term by taxing itself. Nor can Greece.

What happens when a monetarily non-sovereign entity has insufficient money coming in from outside? It must borrow. And if the situation persists, it must borrow again. And again. And again. And one day, when it no longer can borrow, it goes bankrupt or defaults on its loans.

This is true even if the entity is bare-bones frugal. Even if you were to live in a tent and eat garbage, you, being monetarily non-sovereign, eventually would run out of money, unless you had an income.

In this regard, the Chicago Tribune published an interesting 9/8/14 article by Reihan Salam, titled: “How the suburbs trap the poor.”

The suburbs have long been a welcome refuge for families looking for a safe, affordable place to live.

But for many Americans, the suburbs have become a trap. Towns too small or too starved of sales tax revenue to sustain their local governments stay afloat by having local law enforcement go trawling for trumped-up traffic violations, the fines for which can be cripplingly expensive, and which only grow more onerous as low-income residents fail to pay them.

Before we can understand what makes some suburbs so miserable, we first have to understand what makes others succeed. The most successful suburban neighborhoods fall into two categories. First, there are the dense and walkable ones that, like the most successful urban neighborhoods, have town centers that give local residents easy access to retail and employment opportunities.

These neighborhoods generally include a mix of single-family homes and apartment buildings, which allows for different kinds of families and adults at different stages of life to share in the same local amenities.

The problem with these urban suburbs is that there are so few of them, and this scarcity fuels the same kind of gentrification that is driving poor people out of successful cities.

The other model for success can be found in sprawling suburban neighborhoods dominated by households with either the time or the resources to maintain single-family homes and to engage in civic life.

As a general rule, the neighborhoods in this latter category don’t allow for apartment buildings or town homes on small lots. They implement stringent local land-use regulations that keep them exclusive, and they attract families that tenaciously defend the character of their neighborhoods.

Last year, Slate contributor Matt Feeney argued that Detroit, his hometown, had declined so dramatically because it was “a virtual monoculture, residentially speaking a city of detached, owner-occupied, single-family homes.”

Since the initial rise of the suburbs, families have changed. The most dramatic change has been the steep increase in one-person households, from 7.8 percent of all households in 1940 to 26.7 percent as of 2010.

To summarize Mr. Salan’s thesis, Detroit and indeed many cities and especially suburbs, struggle because they are loaded with single-family, owner-occupied homes. These homes take up land and city services. Their owners can’t afford the upkeep, the taxes and the risk of property depreciation. In the event poorer people move into the neighborhood, the resident home-owners, fearing home depreciation, rush out, only to be replaced by additional poor people.

As poor owners replace wealthier owners, property prices fall; then tax collections fall; then suburban services fall in a downward helix to poverty. And all this could be prevented if the suburb or city had more of multi-story, affordable rentals, requiring less service per person and less risk of property devaluation to chase people away.

The problem, according to Mr. Salam, is Detroit’s mono-culture of single family homes.

There may be some logic to this, but it ignores the fundamental problem: A monetarily non-sovereign entity cannot survive long term without money coming in from outside its borders.

Visualize Village “A.” It is entirely self-contained, being surrounded by a high wall. Nothing comes in; nothing goes out. Every dollar spent remains in the village, so total dollars do not change. If the total population remains static, then the average dollars per person remains static.

Only if the Gap between the rich and the rest shrinks or grows, will the economy of Village “A” become unstable. Otherwise, nothing changes.

Now visualize Village “B.” It has the same wall as Village “A,” but this wall has a door, which allows for imports but not exports. So goods and services flow in, while dollars flow out. Eventually, Village “B” runs out of dollars and goes bankrupt.

Clearly, it makes no difference whether or not Village “B” contains single-family housing, high-rise apartments or pup tents all in a row. And, no matter how much taxing or benefit cutting the village does, a monetarily non-sovereign village that has a negative balance of payments, will run out of money. To survive long-term, a monetarily non-sovereign entity must have more money coming in across its borders than going out.

From where can the village acquire enough dollars to balance or exceed its outflow? One source would be neighboring villages. For instance, some people who receive a paycheck in Chicago, live in the suburbs, so among these people there is a net flow of dollars from Chicago to its suburbs.

That helps the monetarily non-sovereign suburbs, but punishes the monetarily non-sovereign Chicago. The dollar-shortage has not been solved; it merely has been moved from one village to another.

In any closed system, where the total supply of dollars neither grows nor shrinks, the overall net balance of payments = $0. If the system is comprised of states, counties, cities, businesses and people (all of whom are monetarily non-sovereign), on average half will gain dollars and half will lose dollars, and the losers will be threatened with bankruptcy.

Chicago might be able to obtain dollars from Cook County, which in turn might be able to obtain dollars from Illinois, but what then?

A tax increase temporarily may help Illinois, but it would impoverish Illinois tax payers, who in turn, will pay less taxes, eventually impoverishing the Illinois government. For long term survival, additional net dollars are needed.

From where will these additional dollars come? Fortunately, our federal government is Monetarily Sovereign. It alone has the unlimited ability to create its sovereign currency.

When the states, counties, cities, businesses and people run short of dollars, the federal government has the unlimited ability to replenish the shortfall via deficit spending.

Monetarily Sovereign government deficit spending is the only long-term method by which dollars are created. Were it not for federal deficit spending, the supply of dollars would remain static. Net importing and population growth would reduce the number of dollars per person.

Yes, banks create dollars by lending. In fact, banks create most of the dollars. But these all are temporary dollars. When the loans are repaid, those bank dollars disappear. The only permanent dollars result from federal deficit spending.

Bottom line: A Monetarily non-sovereign government may look for short term solutions to its dollar shortage. It can borrow. It can do as Mr. Salam suggests and build more high rise rental apartments along with fewer stand-alone, single-family homes. It can raise taxes and cut spending. It can try to increase exports and reduce imports.

But all this accomplishes is to move the same dollars from one monetarily non-sovereign entity to another, which over time results in, on average, half being short of dollars.

If the states are to help support their counties, and the counties are to help support their cities, and the cities are to help support their suburbs — all of which is necessary to prevent the impoverishment of these governments and their residents — the U.S. federal government must deficit spend. It is basic arithmetic.

This not true only for the U.S. The same concept is true for the euro nations and indeed for every nation. The euro nations, for instance, have tried to deny that 1 – 1 = 0, by instituting a wide variety of “Band Aid” solutions to their monetary non-sovereignty. Most of the solutions involve loans, the repayment of which is impossible, together with higher taxes and lower social benefits, this impoverishing the citizenry.

The one entity capable of permanently increasing each nation’s euro supply, is the Monetarily Sovereign European Union. But it refuses, perhaps for fear the populace will learn that all these years of back-breaking austerity were unnecessary.

Similarly, the U.S. state & local U.S. governments force austerity by repeatedly raising taxes and cutting services, while the federal government does the same.

The only solution to a money shortage is to create money. There are no clever “work-arounds.” Monetarily Sovereign governments must create the money to feed their monetarily non-sovereign citizens.

Governments excuse austerity with the bogeyman of hyperinflation. It is the BIG LIE.

The trapped people, emaciated and dying of starvation, are refused food for fear of morbid obesity.

Cruelly, the governments will not send food into the box.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

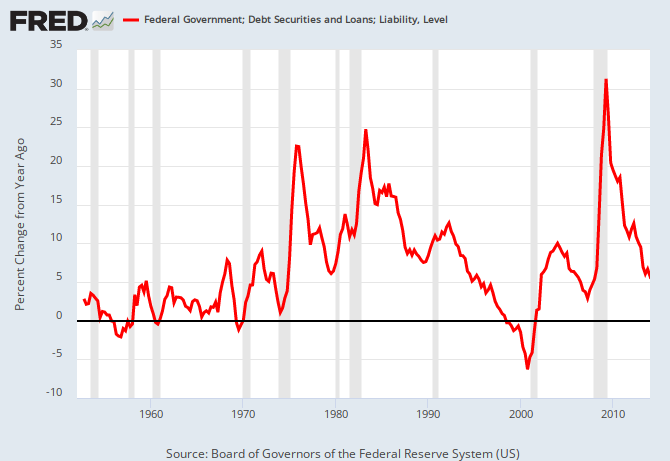

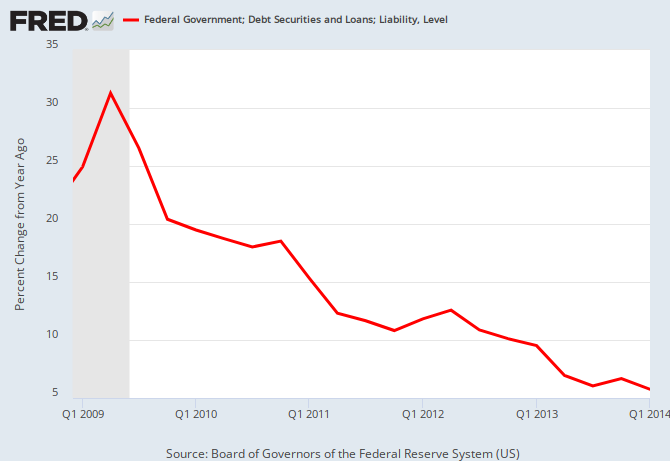

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY