Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and poor.

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

===================================================================================================================================================================================================================================================================================

Why do Americans want guns, and not just “want,” but passionately and angrily crave them, like an addiction to drugs?

From an article in today’s Chicago Tribune:

Commentary: Does owning a gun make you safer?

By David Hemenway, a professor at the Harvard School of Public Health and director of the Harvard Injury Control Research Center.The United States has the most heavily armed civilian population in the First World; our homes contain enough firearms for every man, woman and child.

Why do so many Americans own guns? The main reason, according to surveys, is protection.

Advocates argue that guns in the home both deter crime (criminals refrain from even trying to break in because they fear being shot by an armed citizen) and thwart it (an armed citizen can stop a crime in progress, preventing injury or theft).

The scientific evidence, however, provides little support for these arguments. Quite the opposite.

In terms of deterrence, a recent study found that states with higher levels of household gun ownership have higher levels of firearm crime and do not have lower levels of other types of crime.

Another study, in 2003, found that counties with higher levels of household gun ownership have higher rates of household burglary, not lower. Burglars like to steal not only cash and jewelry but also guns.

Along with Sara Solnick, a professor of economics at the University of Vermont, I analyzed the data for the five-year period from 2007 to 2011, looking at more than 14,000 crimes in which there was some degree of personal contact between the victim and perpetrator — incidents in which a self-protective action by the victim was theoretically possible (for example, assaults and robberies).

Victims used a gun in less than 1 percent of the incidents (127/14,145). In other words, actual self-defense gun use, even in our gun-rich country, is rare.

Of the more than 300 sexual assaults reported in the surveys, the number of times women were able to use a gun to protect themselves was zero.

Indeed, a study of 10 previous years of crime survey data found that of more than 1,100 sexual assaults, in only one did the victim use a gun in self-defense.

Slightly more than 4 percent of victims were injured during or after a self-defense gun use — the same percentage as were injured during or after taking other protective actions.

Using some other weapon — Mace, for instance — appeared equally effective as using a gun.

The evidence is overwhelming that a gun in the home increases the likelihood not only that a household member will be shot accidentally, but also that someone in the home will die in a suicide or homicide.

The statistics are clear. Owning guns does not make you safer. Owning guns increases your life risks. So why the fervor for gun ownership?

Several reasons:

1. People do not understand probability.

Statistically, driving a car is much more dangerous than being a passenger in a commercial airplane. Vaccinations protect against mortal diseases. Buying a lottery ticket almost guarantees you will lose money.

Yet intuition causes many people to be more afraid to fly than to drive, more afraid of vaccination than of disease, and to overestimate the likelihood of winning a lottery.

Gun facts are ignored by intuition, and not just ignored, but strongly denied.

2. People wish to have control.

Driving a car provides the illusion of control, vs. being a passenger in an airplane. And though robotic cars undoubtedly will be safer than human-driven cars, they probably will come with some human control.

Guns provide the illusion of control.

3. Fear and anger are our most powerful emotions. They are our prime survival emotions.

Guns are our perfect angry response to our fear of criminals. Not only are guns seen to protect us, but they punish the “bad guys,” satisfying our anger.

4. Humans have an innate desire for power.

Guns are the traditional “great equalizer.” They are felt to compensate for perceived personal weakness in the face of perceived danger.

In short, the desire for guns, while often justified by the pseudo-logic of 2nd Amendment interpretations, is not logical at all. It is wholly emotional, based on fear, anger, intuition, and the desires for control and power.

Thus facts, as conclusive as they may be, have little effect on discussions of gun control. The emotional impact of “They want to take my guns away,” trumps all facts.

There simply is no use to presenting ever more facts about the dangers of gun ownership. They will have zero effect on gun owners and lawmakers.

So what can be done?

What cannot be done is to threaten gun owners with the loss of their guns. That simply will not work. We long ago have passed the point of no return on that issue.

Instead, we need to “go with the flow,” and pass laws that will have the effect of gun control, without threatening the self-proclaimed “good guys.”

Here are my thoughts:

1. Allow anyone to own a gun except two groups:

A. Young people. We are accustomed to denying young people certain rights: Driving, voting, drinking, marriage, military service, etc.

B. Mentally incompetent people, those convicted of a felony, and non-citizens. There is scant advocacy for any of these groups.

2. Then pass two laws, neither of which threaten gun ownership, but could reduce gun violence and the the desire to own guns.

A. Any person who commits a felony while carrying a gun, shall be sentenced to a prison term of 20 years to life, in addition to the term for the felony itself.

B. Any provider of a gun that is used in a felony shall have the same criminal and civil liability as the actual perpetrator of the felony. (This latter is similar to the “dram shop” laws for liquor.)

In short, are you of the required age (21?), and are you neither a criminal, nor mentally incompetent, nor a non-citizen nor committed a crime while carrying a gun, nor sell guns to criminals?

If you meet those very easy criteria (the vast majority of Americans do), no one will take your guns away.

You can keep guns in every room of your house and on your person, when you’re not at home.

All society asks is that you be a “good guy,” the guy the National Rifle Association says will stop a “bad guy.”

Or we can do nothing.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

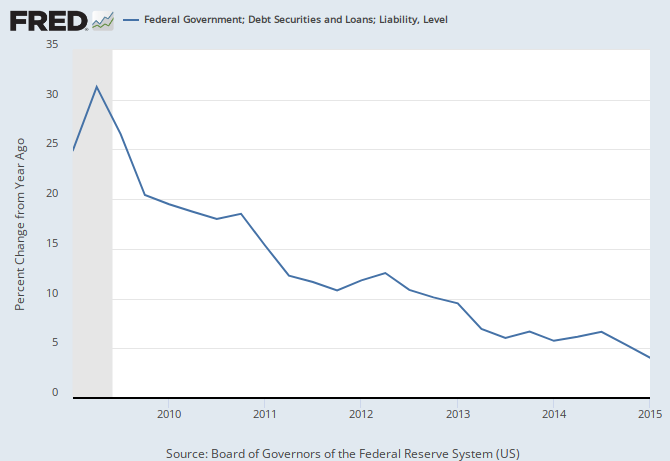

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY