Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and poor.

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

============================================================================================================================================================================================================================================================

Here is the face of austerity:

President Obama is now on track to reduce federal deficit to $0.00

By Tim Martyn | September 13, 2015 | 28President Obama has reduced the annual federal budget deficit by a full seventy percent since he inherited a $1.4 trillion annual shortfall from his successor George W Bush.

And with the race of reduction now accelerating, there is now every reason to believe that Obama can reduce the annual deficit all the way to zero for his final budget before leaving office.

This would make him the first U.S. President to eliminate the federal deficit since Bill Clinton.

Austerity: The federal government takes more dollars out of the economy than it puts in.

By some strange, magical logic, promulgated by the politicians, the media and the university economists — all owned by wealthy donors — taking dollars out of the economy is supposed to make the economy grow (!)

No one knows how that works, except perhaps in an upside-down world where the applying of leeches cures anemia and the starving of children makes them fat.

Not to say austerity accomplishes nothing. Here are some of austerity’s greatest accomplishments:

Medicare rates set to soar

By Stephanie Armour, Anne Tergesen, finance.yahoo.comCongressional lawmakers so far have failed to agree on a way to stave off an unprecedented premium increase for millions of Medicare recipients for 2016.

About 30% of the roughly 52 million people enrolled in Part B could see a 52% rise in those premiums if Congress and the Obama administration don’t find a way to freeze or reduce the increase.

Pressure on Congress is mounting because many state budgets also would be hard hit. The premium increase would affect about nine million lower-income Medicare beneficiaries whose premiums are paid by state Medicaid programs because they are eligible for both plans.

Rather than eliminating FICA and providing federally paid, comprehensive, no-deductions Medicare for all, our Monetarily Sovereign federal government pretends its finances are like yours and mine.

It pretends it can run short of its own sovereign currency, the dollar. It can’t.

It’s finances are not like yours and mine; it cannot run short of dollars. Austerity has one purpose and one purpose only: It widens the Gap between the rich and the rest.

Here is another austerity result:

Consumer Regulator Considers Student Loan Rules To Fix ‘Widespread Failures’

By Shahien Nasiripour, http://www.huffingtonpost.comView OriginalSeptember 29th, 2015

The federal Consumer Financial Protection Bureau said Tuesday it is weighing new rules governing the $1.3 trillion student loan market after releasing a stinging report documenting “widespread failures” in an industry largely overseen by the Obama administration.The consumer bureau’s report describes student loan servicing, or the business of collecting borrowers’ monthly payments and counseling them on their repayment options, as riddled with unfair and Kafkaesque practices.

Many borrowers are trapped at companies that don’t give them basic information, often mislead them, assess unexpected fees, make it hard for them to correct errors and frequently push them into default, the report says.

With delinquencies and defaults on the rise, the consumer bureau has said increasing levels of distress may hurt economic growth if households are forced to pare back spending and other borrowing, such as for home mortgages or new small businesses.

Many years ago, our leaders understood that educating our young people was necessary to help America grow and to be competitive among nations. So they mandated that every child should receive a free high school education.

In today’s far more technical and sophisticated world, a high school education is not sufficient. Growing America and keeping it competitive requires a much larger percentage of the population to be college educated and beyond.

To achieve that end, our Monetarily Sovereign federal government should provide a free college education to every child, just as our monetarily non-sovereign cities and states provide a free K-12 education.

Instead, in the name of austerity, we have created a Byzantine borrowing system, enslaving large swaths of our population in unpayable debt.

1.5 Million American Families Live on $2 a Day — How the Poorest Get By

By Yves Smith, September 28th, 2015 By Marcus Harrison Green.If she did not make plasma deposits twice a week at a donation center in Tennessee, Jessica Compton and her family would have no income.

If not for a carton of spoiled milk, Modonna and Brianna Harris’ refrigerator would be barren. The Harris and Compton families’ stories are just two accounts of devastating poverty documented in sociology professors Kathryn J. Edin and H. Luke Shaefer’s book, $2.00 a Day: Living on Almost Nothing in America.”

By Marcus Harrison Green. Originally published at Yes! Magazine. Cross posted from Alternet

Green: Your book documents a 70 percent increase in families living on $2 a day, per person. You talk about the welfare reform of the mid-90s, but what were the additional drivers of this development?

Shaefer: We point to changes in the government safety net, but a big driver of this is the state of the low-wage labor market. The parents of many of the families in our study think of themselves first and foremost as workers, but the jobs that they typically can get pay low wages, offer inadequate and unstable hours, and leave them exposed to unsafe work conditions.

Couple that with the instability in their family lives and it leads to what we see in the book.

There’s an affordable housing crisis in this country and it doesn’t just affect the $2-a-day poor. But housing instability seems to be both a cause and a consequence of extreme poverty.

Green: The poor are often demonized in this country, with politicians and others saying their problems are their own fault.

Shaefer: People make the assumption that low-income families don’t work or don’t want to work. And that’s just not true.

The norm among families with children is a parent who works or has worked recently. But I don’t think people fully grasp the conditions of jobs in the bottom rungs of the labor market.

Green: Your research showed that about half of families living on $2 a day are white. This may come as a surprise to some readers who remember the image of a “welfare queen” bandied about to vilify poverty programs in the 80s and 90s.

Poverty hurts America. It hurts not only the poor, but the entire nation. Poverty creates crime. Poverty creates illiteracy. Poverty creates disease. Poverty reduces a nation’s economic growth.

Being part of America, you are affected by poverty, whether or not you yourself are poor.

For reasons discussed in an earlier post, I do not suggest providing jobs to the poor. I propose we simply give a monthly Economic Bonus (EB) to every man, woman and child in America, regardless of any other income or wealth they may have. You would receive the same EB as I receive and as Bill Gates receives.

No need to go through the convoluted steps our gigantic tax code demands, to determine what is income, and what kind of income it is, and when you received it and how you received it, etc., etc. If you live in America, and you’re alive, you receive your monthly EB.

Remember, the federal government can afford it, and it costs you nothing.

But the austerity beat goes on, with penalties for the nation:

After S.C. floods, Lindsey Graham reverses course on disaster aid

10/06/15 By Steve BenenWhen Congress considered federal disaster assistance in the wake of Hurricane Sandy, Sen. Tom Cotton (R-Ark.) voted against it.

Two years later, when it was his state that was hammered by flooding, Cotton reversed course, requesting and receiving emergency aid.

Sen. Ted Cruz (R-Texas) also voted against the Sandy-relief bill, though three years later, the Republican senator fought for federal funding for Texas in the wake of flooding.

Sen. Lindsey Graham (R-SC) “is asking for federal aid for his home state of South Carolina as it battles raging floods, but he voted to oppose similar help for New Jersey in the aftermath of Hurricane Sandy in 2013,” CNN reports.

In each case, the austerity lie was the reason for not spending money where it would have been helpful to the American economy (though when disaster is close to home, minds change.)

Bottom line: Austerity (i.e. deficit reduction) is the single worst economic plan history. Austerity never has worked for any Monetarily Sovereign nation. Austerity always leads to recessions and depressions.

Austerity has but one result: It impoverishes the 99% while widening the Gap between the rich and the rest.

So why is Obama laughing? Because when he retires he will be part of the wealthy 1%.

He and his wife will make millions by giving speeches. His daughters will receive lucrative jobs from rich companies. They all will travel the world, and hobnob with the rich and the powerful, while a library extols their virtues.

Meanwhile, America will fall into the recession or depression his austerity will create, as austeries invariably do.

Actually, this is these are the faces of austerity:

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually Click here

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

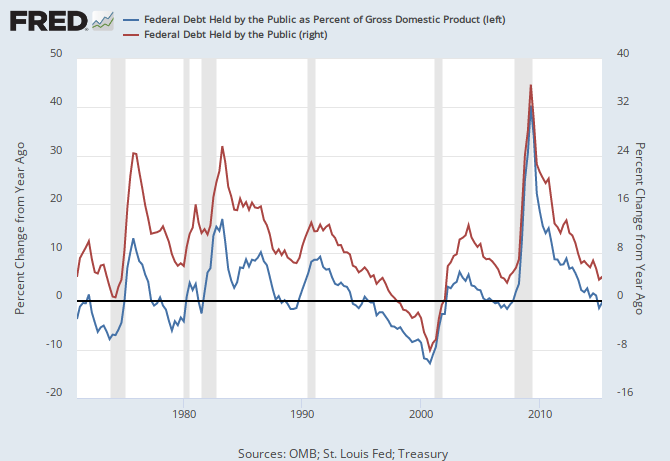

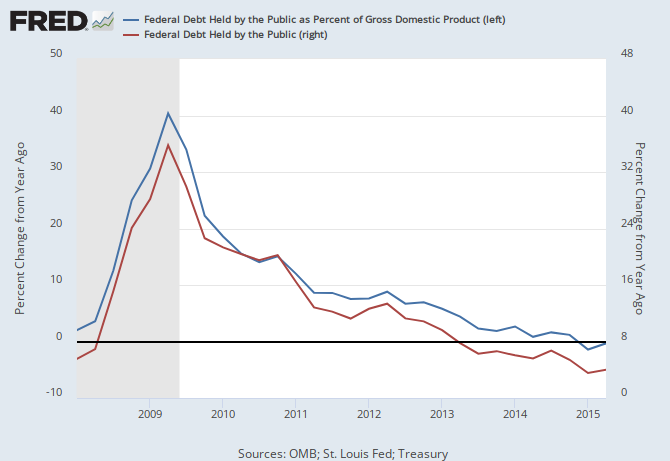

THE RECESSION CLOCK

Recessions come after the blue line drops below zero.

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY