Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes..

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and poor.

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

============================================================================================================================================================================================================================================================

The President is both a window and a mirror.

Lately, I’ve been quite critical of the Republican Presidential candidates. I see an aggregation of men (and woman), whose primary qualification seems to be hatred: Hatred of the poor and middle classes, hatred of the gay, hatred of the immigrant, the non-Christian, the uneducated, the non-English speaking and ironically, hatred of the government.

Hatred is not an acceptable basis for governmental leadership, as hatred of others begets hatred of self. Such a divided nation cannot survive.

There are, to my thinking, three primary qualifications for being President.

1. Political experience and talent with which to drag an often reluctant Congress forward.

2. Experience with, and an understanding of, domestic and world economics.

3. The communication skills to educate the public and to gain public support.

1. Political experience and talent: If you wished to hire someone to do a difficult job, you would look for experience and talent. You wouldn’t hire someone having no experience to be a dentist, a dietician or a database administrator.

But among the Republican leaders are Donald Trump, Ben Carson and Carly Fiorina, each of whom has zero political experience.

Two have business experience, but business is not at all like the U.S. government.

The CEO of a business is a dictator, who issues commands and expects obedience. By contrast, we are a democracy. Our President (who has perhaps the world’s hardest job) must negotiate, cajole and promise, in order to move Congress and the public.

In my lifetime, Franklin Roosevelt and Lyndon Johnson probably were the most effective Presidents, because they knew how to work Congress. Their political experience and talent resulted in the passage of major forward advances of America.

Opting for a President with scant political experience is like opting for a doctor who never went to school.

2. Experience with, and an understanding of, domestic and world economics: Ultimately, the President is credited with a nation’s economic growth and faulted when growth lags.

He must understand what is needed to increase employment, reduce unemployment, narrow the Gap between the rich and the rest, feed the hungry, house the homeless, educate the uneducated and strengthen the nation’s economic and military competitiveness.

In today’s modern, technological world, we need a President who has, if not an understanding of, at least an appreciation for research, development and science.

Our President must support scientific achievements like atomic energy and other energy sources, spaceflight, medical advances and quantum mechanics and computing.

Scientific research and development ask our government to absorb the financial risks and long-term goals that are beyond the abilities and short-term views of financially constrained private organizations.

Yet, the vast majority of Republicans have voted to: Cut federal deficit spending, cut social benefits, starve the poor, impoverish the middle, deport immigrants and force America to default on its debts, all of which weaken America’s economy.

The likes of Carson, Santorum, Huckabee and the religious right deny science, and specifically economics, in favor of pious superstition. They offer Dark Ages thinking that will return us to 3rd world tribalism.

3. Communication skills: The President must communicate not only facts, not only ideas, but attitudes. As the leader, he helps us know who we are and who we wish to be.

Are Americans a people of love and tolerance or of hatred? Are we a people of courage or of fear? A people of joy or of melancholy? Of strength or weakness? A generous or a selfish people? A people of darkness or of light?

Who are we and who do we wish to be?

Our leader will help determine our national personality.

The Republican candidates received a few minutes of “hard” questions in the most recent debate. They haven’t stopped whining. Hillary Clinton endured 11 hours of hostile questioning, and she never flinched, cried or complained.

In the Republican candidates, I see weakness. I see intolerance and hatred. I see cowardice and the fear of an intolerant base. I see dark misery and selfishness. I see all the basest forms of the human psyche. With such leadership, I see an America that radiates no joy to the world nor back to itself.

Democrats Roosevelt and Kennedy and Republican Reagan gave us feelings of hope and optimism. But Democrat Carter gave us a dour “crisis of confidence.” And today’s Republicans give us anger.

The President is a window, who lets the world see us, and a mirror who helps us see ourselves.

Who are we and who shall we be?

In a year, we will choose.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually Click here

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

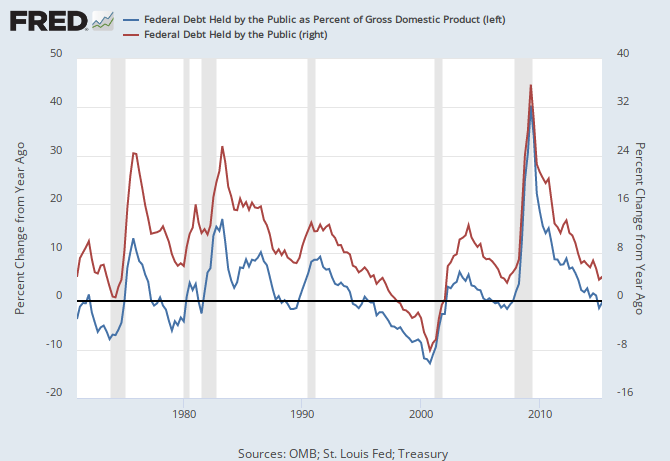

THE RECESSION CLOCK

Vertical gray bars mark recessions. Recessions come after the blue line drops below zero and when deficit growth declines.

As the federal deficit growth lines drop, we approach recessions, each of which has been cured only when the growth lines rose.

Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY