Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

A new Fed chairman, a new myth is born.

Fed Chairman Ben Bernanke gave us the myth of quantitative easing (QE) as an economic stimulus. QE, very simply, is the Federal Reserve’s purchasing of Treasury bonds, which supposedly stimulates the economy by adding dollars to the economy and reducing long term interest rates.

It is true that adding dollars to the economy does stimulate, but the purchase of Treasury bonds doesn’t do it. In fact, these monthly, $85 billion purchases subtract dollars from the economy.

The myth is based on the wrong-headed belief that when the Fed buys T-bonds, it creates dollars, which then go into the private sector. In actual fact, no dollars are created, and although the process does increase liquidity somewhat (cash is more liquid than bonds), QE has been reducing the total dollar supply.

Here is how that works:

When you, or China or anyone else buys a T-bond, you instruct your bank to debit your checking account and to credit your T-bond account at the Federal Reserve Bank (FRB).

So you, China and anyone still own the dollars. You simply have transferred them from one of your bank accounts to another of your bank accounts. Since a T-bond account essentially is a bank savings account, visualize that you have transferred dollars from your checking account to your savings account.

Now, visualize that the Fed decides to buy your savings account. What will happen? Your savings account will be debited and your checking account will be credited. Will this stimulate the economy? Of course not.

In the case of T-bonds, however, there actually will be a negative effect. With the Fed owning more T-bonds, the Treasury will pay less interest into the private sector – which is recessive. On balance, QE is a stimulative myth.

And now comes Janet Yellen. No QE for her. She has a new idea. It’s called “Optimal Control (OC). Here is how Business Insider explains it:

Everyone On Wall Street Is Buzzing About ‘Optimal Control’ — The Janet Yellen Approach To Monetary Policy

Matthew Boesler, Nov. 4, 2013,Michael Feroli, chief U.S. economist at JPMorgan: “This approach starts with a forecast for the economy, and then solves a large-scale macroeconomic model to find the path of the funds rate that minimizes the deviation of inflation and unemployment from their respective targets.”

The Federal Open Market Committee (FOMC) targets an annual inflation rate of 2% over the long run and an unemployment rate of 6% (the latter number an estimate of the economy’s “natural” unemployment rate).

Under the optimal control approach, the central bank would then use a model to calculate the optimal path of short-term interest rates in order to hit these targets. As long as unemployment is further away from the target level than inflation, then monetary policymakers would keep interest rates low in an attempt to correct this, even if it means inflation runs slightly above target for a while.

The upshot of a Yellen Fed employing an optimal control strategy is simply the notion that the central bank would take a more aggressive stance toward fighting above-target unemployment, implying lower short-term rates for longer.

The Yellen Optimal Control approach requires four beliefs to be correct:

1. Raising interest rates fights inflation

2. Lowering interest rates fights unemployment

3. Excessive inflation and excessive unemployment do not occur simulatiously.

4. Interest rate control is a more powerful inflation and unemployment fighter than other economic factors, so that the Fed actually has significant control.

1. RAISING INTEREST RATES FIGHTS INFLATION

This is correct, and in fact, is the method the Fed successfully has used to fight inflation.

Inflation is the loss in value of the dollar. But the dollar is a commodity, the value of which is determined by Supply and Demand. And Demand is determined by Risk and Reward. All other factors held constant, increasing the Reward for owning a dollar, increases the value of the dollar, thereby fighting inflation.

Interest is the Reward for owning a dollar.

There are two counter effects: Higher interest rates increase business costs (inflationary), but for most businesses, interest is a very small part of their costs, so the effect is slight. And higher interest rates require the Treasury to pay more interest into the private sector, which adds dollars, which in turn increases Supply – also inflationary.

So there are opposing Supply and Demand forces, but the Demand force is stronger, which is why raising interest rates has fought inflation:

The following graph shows how the Fed anticipates and fights inflation by raising interest rates, after which inflation falls.

The relationship would be clearer, but for one important factor: The prime cause of inflation for the past 40 years has been oil prices, not low interest rates. (This is one example of the falsity of belief #4, above).

Count #1 as True.

2. LOWERING INTEREST RATES FIGHTS UNEMPLOYMENT

High interest rates fight inflation (i.e. high rates are deflationary), so low rates must be inflationary. But for low rates to fight unemployment, inflation also must correspond with unemployment. This is nonsensical on its face.

The belief is based on the myth that low rates stimulate the economy by encouraging business borrowing. But as described in more detail in the post, The low interest rate/GDP growth fallacy, there is no positive relationship between low interest rates and economic growth.

An excerpt from the post:

What seems to be ignored is the lending side of the equation. When interest rates are low, lenders receive less money. And who are the lenders? Businesses and consumers.

You are a lender when you buy a CD or a bond, or put money into your savings account. When interest rates are low, you receive less money, which means you have less money to spend on goods and service — which means less stimulus for the economy.

Also, when rates are low, the Treasury sends less interest money into the private sector, and banks are less encouraged to lend.

Count #2. as False.

3. EXCESSIVE INFLATION AND EXCESSIVE UNEMPLOYMENT DO NOT OCCUR SIMULTANEOUSLY

The problem with having one tool (interest rates) for solving two different problems is, what does one do when both problems are in opposition. If your only available food is sugar, and you are suffering from both diabetes and starvation, what do you do?

In fact, excessive inflation and excessive unemployment do occur together, and this is known as “stagflation.”

Count #3 as False.

4. INTEREST RATE CONTROL IS A MORE POWERFUL INFLATION AND UNEMPLOYMENT FIGHTER THAN OTHER ECONOMIC FACTORS, SO THAT THE FED ACTUALLY HAS SIGNIFICANT CONTROL.

We already have seen that low interest rates do not stimulate the economy, so do not fight unemployment. On that basis alone, #4 is False.

The most powerful unemployment fighter in America is Congress, which through its spending, creates demand for goods and services. Additionally, the federal government directly employs a great many civilian and military personnel – and none of this is under the Fed’s control.

In summary, the Fed has some control over inflation but has very little effect on unemployment. Janet Yellen’s OC is as big a myth as Ben Bernanke’s QE.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

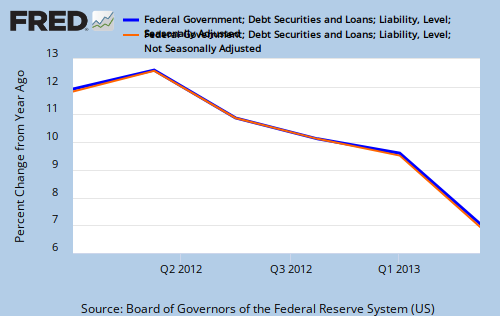

THE RECESSION CLOCK

As the federal deficit growth lines drop, we approach recession, which will be cured only when the lines rise.

#MONETARY SOVEREIGNTY