Who are the good guys? Who are the bad guys?

ASSAILANTS KILL 14 NEAR LOS ANGELES IN WORST MASS SHOOTING SINCE SANDY HOOK

Syed Rizwan Farook, 28, and Tashfeen Malik, 27, entered the Inland Regional Center in San Bernardino and opened fire using assault weapons and handguns, the police said.

Farook, a county employee, attended the holiday party before the shooting, according to the police. He then left in an “angry” manner and returned to open fire

“The only thing that stops a bad guy with a gun is a good guy with a gun,” NRA’s Executive Vice President Wayne LaPierre

Who are the good guys? Who are the bad guys?

Were Farook and Malik “good” guys and gals, or were they “bad” guys and gals?

The 2016 Gun-Violence Statistics Out of Chicago Are Horrific

Almost 3,000 Chicagoans were shot in 2015. In the first ten days of 2016, three times as many people were shot in Chicago as in the beginning of 2015, the Chicago Tribune reports.

Donald Trump: “We love the Second Amendment, folks. Nobody loves it more than us, so just remember that.”

Often, Trump shifts the conversation about gun control to mental health, which he says is an issue politicians have ignored for too long. A day after two journalists were killed on live TV in Virginia, he rejected calls to strengthen gun laws.

“This isn’t a gun problem, this is a mental problem,” he said.

Who are the sane guys? Who are the insane guys?

Everything You Need to Know About Federal Background Checks

In the United States, anybody who wishes to purchase a gun at a federally licensed firearms dealer (FFL) is subject to a background check.

Of course, if you think you can’t pass a background check, don’t buy your gun from an FFL. Simple.

The most common reason for a gun purchase denial is a criminal conviction. Nearly 150,000 fugitives, 120,729 domestic offenders, and 109,875 unlawful drug users have been denied in the 17 years NICS has been online.

For all the focus on mental health, the bar for denying someone on psychiatric grounds is very high, leading to relatively few rejections: Only 21,000 applicants have been denied because they were declared mentally unfit by a judge.

Somebody tell that to Donald Trump.

State and local police are not required to submit criminal-record data to the FBI. Reporting “varies widely based on the practices of the individual departments. The smaller the town, the worse the records.”

Federal law does not require states to forward mental health records to NICS, and some states are resistant, citing privacy laws.

The FBI has only three days to make a final determination on the buyer.

Why only 3 days? What’s the rush?

If a decision can’t be made in that time frame, the FFL is allowed by law to go ahead and sell the firearm. The dealer is also not required to notify the FBI when a sale has been made after a three-day delay.

Default-proceed sales are eight times more likely to involve a prohibited purchaser than sales with background checks that are resolved within 72 hours.

What could possibly go wrong with a system like that?

Study these people carefully. Take your time.

Some bought their guns at a federally licensed firearms dealer. Some bought their guns from a friend, or a neighbor, or a stranger on the street, or at a gun show, where no background checks at all were necessary.

Look again. With which of them are you trusting your life?

Who are the good guys? Who are the bad guys?

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. ELIMINATE FICA (Ten Reasons to Eliminate FICA )

Although the article lists 10 reasons to eliminate FICA, there are two fundamental reasons:

*FICA is the most regressive tax in American history, widening the Gap by punishing the low and middle-income groups, while leaving the rich untouched, and

*The federal government, being Monetarily Sovereign, neither needs nor uses FICA to support Social Security and Medicare.

2. FEDERALLY FUNDED MEDICARE — PARTS A, B & D, PLUS LONG TERM CARE — FOR EVERYONE (H.R. 676, Medicare for All )

This article addresses the questions:

*Does the economy benefit when the rich afford better health care than the rest of Americans?

*Aside from improved health care, what are the other economic effects of “Medicare for everyone?”

*How much would it cost taxpayers?

*Who opposes it?”

3. PROVIDE AN ECONOMIC BONUS TO EVERY MAN, WOMAN AND CHILD IN AMERICA, AND/OR EVERY STATE, A PER CAPITA ECONOMIC BONUS (The JG (Jobs Guarantee) vs the GI (Guaranteed Income) vs the EB) Or institute a reverse income tax.

This article is the fifth in a series about direct financial assistance to Americans:

Why Modern Monetary Theory’s Employer of Last Resort is a bad idea. Sunday, Jan 1 2012

MMT’s Job Guarantee (JG) — “Another crazy, rightwing, Austrian nutjob?” Thursday, Jan 12 2012

Why Modern Monetary Theory’s Jobs Guarantee is like the EU’s euro: A beloved solution to the wrong problem. Tuesday, May 29 2012

“You can’t fire me. I’m on JG” Saturday, Jun 2 2012

Economic growth should include the “bottom” 99.9%, not just the .1%, the only question being, how best to accomplish that. Modern Monetary Theory (MMT) favors giving everyone a job. Monetary Sovereignty (MS) favors giving everyone money. The five articles describe the pros and cons of each approach.

4. FREE EDUCATION (INCLUDING POST-GRAD) FOR EVERYONEFive reasons why we should eliminate school loans

Monetarily non-sovereign State and local governments, despite their limited finances, support grades K-12. That level of education may have been sufficient for a largely agrarian economy, but not for our currently more technical economy that demands greater numbers of highly educated workers.

Because state and local funding is so limited, grades K-12 receive short shrift, especially those schools whose populations come from the lowest economic groups. And college is too costly for most families.

An educated populace benefits a nation, and benefiting the nation is the purpose of the federal government, which has the unlimited ability to pay for K-16 and beyond.

5. SALARY FOR ATTENDING SCHOOL

Even were schooling to be completely free, many young people cannot attend, because they and their families cannot afford to support non-workers. In a foundering boat, everyone needs to bail, and no one can take time off for study.

If a young person’s “job” is to learn and be productive, he/she should be paid to do that job, especially since that job is one of America’s most important.

6. ELIMINATE CORPORATE TAXES

Corporations themselves exist only as legalities. They don’t pay taxes or pay for anything else. They are dollar-tranferring machines. They transfer dollars from customers to employees, suppliers, shareholders and the government (the later having no use for those dollars).

Any tax on corporations reduces the amount going to employees, suppliers and shareholders, which diminishes the economy. Ultimately, all corporate taxes come around and reappear as deductions from your personal income.

7. INCREASE THE STANDARD INCOME TAX DEDUCTION, ANNUALLY. (Refer to this.)

Federal taxes punish taxpayers and harm the economy. The federal government has no need for those punishing and harmful tax dollars. There are several ways to reduce taxes, and we should evaluate and choose the most progressive approaches.

Cutting FICA and corporate taxes would be an good early step, as both dramatically affect the 99%. Annual increases in the standard income tax deduction, and a reverse income tax also would provide benefits from the bottom up. Both would narrow the Gap.

8. TAX THE VERY RICH (THE “.1%) MORE, WITH HIGHER PROGRESSIVE TAX RATES ON ALL FORMS OF INCOME. (TROPHIC CASCADE)

There was a time when I argued against increasing anyone’s federal taxes. After all, the federal government has no need for tax dollars, and all taxes reduce Gross Domestic Product, thereby negatively affecting the entire economy, including the 99.9%.

But I have come to realize that narrowing the Gap requires trimming the top. It simply would not be possible to provide the 99.9% with enough benefits to narrow the Gap in any meaningful way. Bill Gates reportedly owns $70 billion. To get to that level, he must have been earning $10 billion a year. Pick any acceptable Gap (1000 to 1?), and the lowest paid American would have to receive $10 million a year. Unreasonable.

9. FEDERAL OWNERSHIP OF ALL BANKS (Click The end of private banking and How should America decide “who-gets-money”?)

Banks have created all the dollars that exist. Even dollars created at the direction of the federal government, actually come into being when banks increase the numbers in checking accounts. This gives the banks enormous financial power, and as we all know, power corrupts — especially when multiplied by a profit motive.

Although the federal government also is powerful and corrupted, it does not suffer from a profit motive, the world’s most corrupting influence.

10. INCREASE FEDERAL SPENDING ON THE MYRIAD INITIATIVES THAT BENEFIT AMERICA’S 99.9% (Federal agencies)Browse the agencies. See how many agencies benefit the lower- and middle-income/wealth/ power groups, by adding dollars to the economy and/or by actions more beneficial to the 99.9% than to the .1%.

Save this reference as your primer to current economics. Sadly, much of the material is not being taught in American schools, which is all the more reason for you to use it.

The Ten Steps will grow the economy, and narrow the income/wealth/power Gap between the rich and you.

========================================================================================================================================================================================================================================================================================================

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

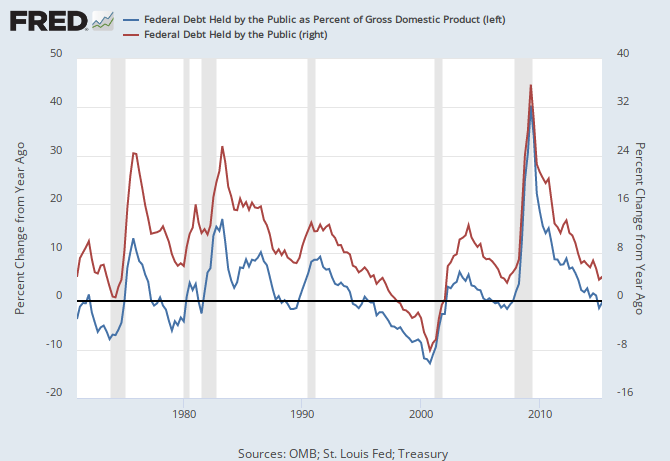

THE RECESSION CLOCK

Recessions begin an average of 2 years after the blue line first dips below zero. A common phenomenon is for the line briefly to dip below zero, then rise above zero, before falling dramatically below zero. There was a brief dip below zero in 2015, followed by another dip – the familiar pre-recession pattern.

Recessions are cured by a rising red line.

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

————————————————————————————————————————————————————————————————————————————————————————————————-

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes..

•No nation can tax itself into prosperity, nor grow without money growth.

•Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

•A growing economy requires a growing supply of money (GDP = Federal Spending + Non-federal Spending + Net Exports)

•Deficit spending grows the supply of money

•The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

•The limit to non-federal deficit spending is the ability to borrow.

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and the rest..

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

MONETARY SOVEREIGNTY